February 2026

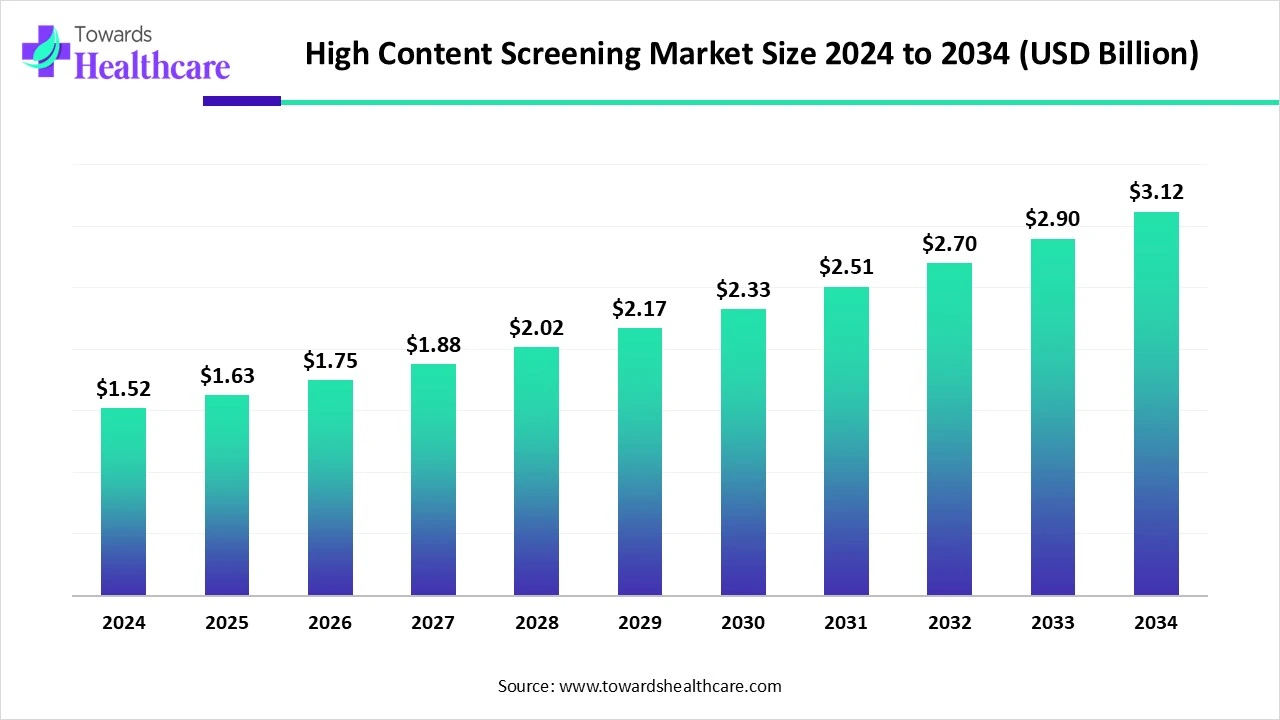

The global high content screening market size is calculated at USD 1.52 billion in 2024, grew to USD 1.63 billion in 2025, and is projected to reach around USD 3.12 billion by 2034. The market is expanding at a CAGR of 7.54% between 2025 and 2034.

The high content screening market is experiencing robust growth, driven by the demand for personalized medicines and growing research and development activities. Government organizations launch initiatives to promote the development of novel drugs and provide funding. The increasing collaborations among key players favor market growth. Integrating artificial intelligence (AI) into high content screening leads to faster and more accurate results. The future looks promising, with advancements in cell culture technology.

| Metric | Details |

| Market Size in 2025 | USD 1.63 Billion |

| Projected Market Size in 2034 | USD 3.12 Billion |

| CAGR (2025 - 2034) | 7.54% |

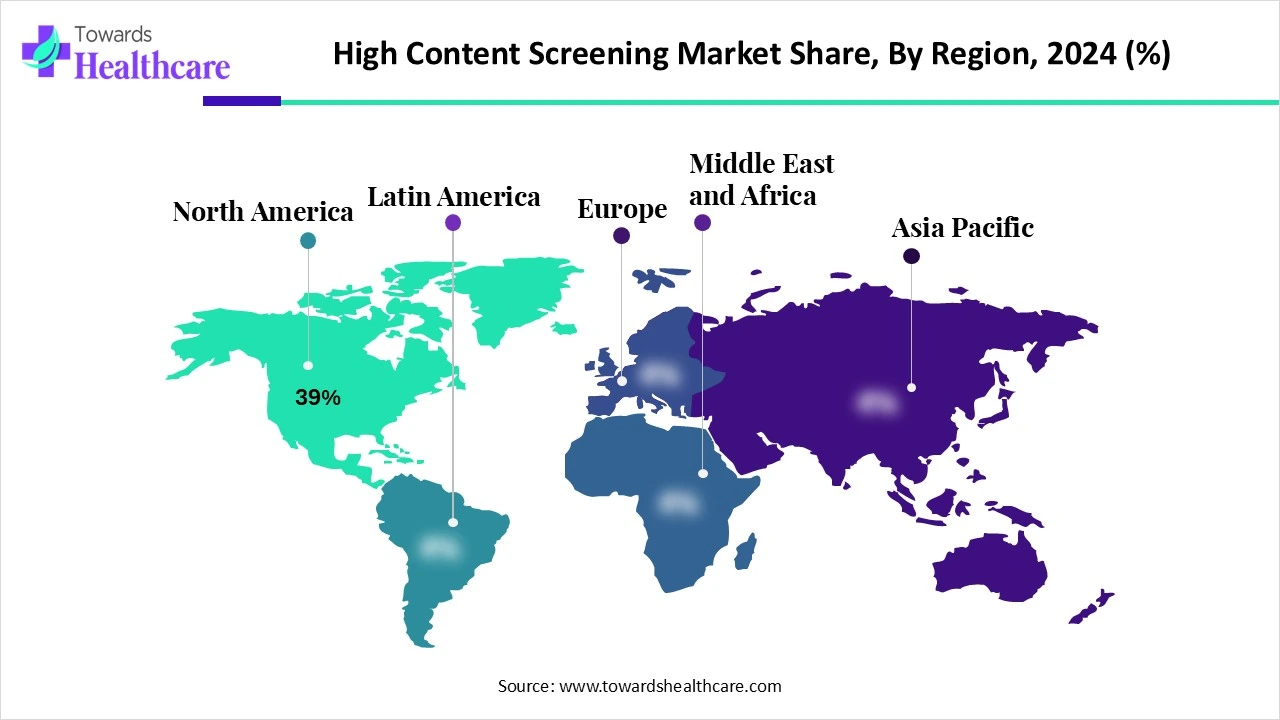

| Leading Region | North America Share 39% |

| Market Segmentation | By Product, By Application, By Technology, By End-User, By Region |

| Top Key Players | Thermo Fisher Scientific, PerkinElmer, GE HealthCare, Molecular Devices (Danaher), Yokogawa Electric Corporation, BD Biosciences, BioTek Instruments, Cell Signaling Technology, Merck KGaA (Sigma-Aldrich), Tecan Group Ltd, IntelliCyt (Sartorius) ,Essen BioScience, Genedata AG, Bioimaging Solutions Inc., CytoSMART Technologies, BioStatus Limited, Core Life Analytics, Araceli Biosciences, MetaSystems, Thermo Genesis Holdings |

High content screening (HCS), also known as high content analysis (HCA), is a powerful technique combining high-throughput screening methods with automated microscopy, image analysis, and multiparametric data analysis. It is primarily used for analyzing cellular events, phenotypic changes, and biomolecular interactions within live or fixed cells. HCS enables drug discovery, toxicity studies, and systems biology by offering quantitative data on cellular functions from multiplexed assays.

Numerous factors influence market growth, including the increasing prevalence of chronic disorders and the growing need for novel drugs. The rising investments by government and private organizations contribute to market growth. Favorable government support and regulatory policies favor the market. Technological advancements drive the latest innovations in high content screening. The burgeoning molecular biology and cellular biology sectors promote market growth.

AI plays a vital role in HCS by streamlining data analysis of complex datasets, enhancing efficiency and accuracy. AI and machine learning (ML) algorithms facilitate image segmentation and measurements, reducing the time and cost associated with conventional methods. Deep learning models enhance the resolution and quality of images obtained from lower-quality inputs. AI and ML facilitate the extraction of accurate quantitative data from biological images, supporting high-throughput analysis and the identification of phenotypic changes in response to drug treatments.

New Drug Discovery

The major growth factor for the high content screening market is the new drug discovery. Researchers focus on the development of novel drugs due to the increasing prevalence of chronic disorders. Drug discovery is essential to enhance existing therapies, reduce the burden of disease, and improve the quality of life of individuals. Personalized medicines are developed based on individual patients’ conditions. Researchers focus on repurposing existing drugs for additional applications, requiring HCS. HCS is essential in the early stages of drug discovery for target validation and candidate optimization.

Time Consuming

The HCS process is time-consuming as it requires time for throughput, storage, and data analysis. Complex data needs to be analyzed for hundreds of drug candidates. This requires the use of innovative approaches to analyze large datasets.

What is the Future of the High Content Screening Market?

The market future is promising, driven by advancements in cellular technology. 3D cell culture is an emerging technology that involves the growth of cells in all three dimensions, unlike 2D cell culture. It is more physiologically relevant as it replicates an in vivo environment. 3D cell culture has the potential to replace animal testing. It is widely used for drug screening of small molecules or genetically manipulated to understand disease pathways. It is more accurate in predicting the efficacy and toxicity of drug candidates.

By product, the instruments segment held a dominant presence in the market in 2024. This is due to the need for sophisticated and specialized instruments for different applications. Instruments play a vital role in data analysis and interpretation. The integration of AI and ML introduces automation in instruments, enhancing their efficiency. Instruments enable researchers to analyze multiple cellular parameters simultaneously, saving time and costs.

The cell imaging & analysis systems sub-segment dominated the market. Cell imaging and analysis refers to a system used for imaging applications and delivers publication-quality images and data. Scientists are developing microscopes that offer high-resolution images, automated controls, and easy routine maintenance.

By product, the software segment is expected to grow at the fastest CAGR in the market during the forecast period. Software simplifies the task of researchers and significantly reduces experimental time. The availability of user-friendly software enhances accessibility to researchers and eliminates the need for certain laborious tasks. Data can be accessed and stored from anywhere and at any time through software.

The AI/ML-based analysis tools sub-segment is expected to expand rapidly. AI and ML revolutionize the analysis of HCS. They can accelerate drug discovery workflows and automate image analysis. They can interpret data easily that is difficult for researchers to interpret manually.

By application, the toxicity studies segment contributed the biggest revenue share of the market in 2024. This is due to stringent regulations for assessing the toxicity of drug candidates at an early stage. Assessing toxicity allows researchers to screen out compounds that have potential toxicity or may be harmful to humans. High content screening involves using automated microscopy with image analysis methods to study the effect of toxic compounds on cells.

The in vitro toxicology sub-segment held the largest revenue share. In vitro toxicology assays assess the potential toxicity of a drug candidate. They enable researchers to identify adverse effects early in the drug development process.

By application, the phenotypic screening segment is expected to grow with the highest CAGR in the market during the studied years. Phenotypic screening refers to identifying substances, such as small molecules, peptides, or RNAi, that alter the phenotype of a cell or an organism in a desired manner. High content screening allows researchers to monitor the expression of several proteins simultaneously.

By technology, the 2D cell culture-based HCS segment accounted for the highest revenue share of the market in 2024. The segmental growth is attributed to simple procedures and lower reagent cost. 2D cell culture can analyze drug candidates on a flat surface or in petri dishes. It is a more conventional method that enables fast proliferation and colony formation. It is suitable for high-throughput and aids in excellent reproducibility. 2D cell culture has diverse applications, including drug screening and understanding disease pathophysiology.

By technology, the 3D cell culture-based HCS segment is expected to witness the fastest growth in the market over the forecast period. The 3D cell culture technique offers superior benefits over conventional 2D cell culture. It mimics tissue and organ structures outside the body, representing in vivo conditions. It helps researchers to study complex cell-cell and cell-environment interactions. Some studies have demonstrated the use of the 3D cell culture technique in tumorigenesis.

By end-user, the pharmaceutical & biotechnology companies segment led the global market in 2024. Pharmaceutical and biotech companies have favorable research infrastructure and suitable capital investment to adopt advanced technologies. The increasing competition among pharma and biotech companies facilitates them to develop novel drugs to strengthen their market position.

By end-user, the contract research organizations (CROs) segment is expected to show the fastest growth over the forecast period. CROs have specialized equipment and skilled professionals to perform complex experiments. They provide relevant expertise and customized solutions for research problems. The increasing number of pharma and biotech startups potentiates the demand for CRO services.

North America dominated the market share by 39% in 2024. The presence of key players, availability of state-of-the-art research and development facilities, and favorable government support are the factors that govern market growth in North America. Suitable regulatory frameworks lead to increasing new drug launches. The increasing collaborations among key players enhance access to advanced tools and techniques, facilitating market growth.

Key players, such as Charles River Laboratories, Thermo Fisher Scientific, and Revvity, Inc., are the major contributors to the market in the U.S. The U.S. Food and Drug Administration (FDA) approved a total of 50 novel drugs in 2024 and 22 novel drugs as of 4th August 2025.

In November 2024, the Government of Canada announced an investment of $4 million in funding to McMaster University to upgrade and future-proof its drug discovery infrastructure. The funds will enable the University to establish the Center for Collaborative Chemistry (C3) on campus.

Asia-Pacific is expected to host the fastest-growing high content screening market in the coming years. The rapidly expanding pharma and biotech sectors and increasing investments by government and private organizations foster market growth. The rising number of pharma and biotech startups and growing venture capital investments contribute to market growth. Countries like China, India, Japan, and South Korea are becoming prominent sites for clinical trials to assess novel drugs.

The National Medical Products Administration (NMPA) approved the highest number of novel drugs in 2024, accounting for 46 novel drugs, including 23 chemical drugs and 20 biological drugs. As of 5 August 2025, a total of 15,336 not yet recruiting, recruiting, and active, not recruiting clinical trials have been registered in China.

The Central Drug Standard Control Organization (CDSCO) approved 17 drugs in 2024. The Indian government supported the establishment of 7 Centres of Excellence (CoEs) at each National Institute of Pharmaceutical Education and Research (NIPERs). These CoEs have so far approved 104 research projects under the PRIP scheme and filed two patents.

Europe is considered to be a significantly growing area in the high content screening market in the upcoming years. The rising adoption of advanced technologies and growing research and development activities bolster market growth. Government organizations support the development of personalized medicines through initiatives and funding. Numerous European research institutions and companies have advanced research infrastructure.

Prominent institutes like Fraunhofer ITMP, Helmholtz Institute for Pharmaceutical Research Saarland, and Max Planck Institute conduct new drug discovery research in Germany. Germany’s Medical Research Act aims to strengthen Germany’s position as an attractive environment for medical innovation and pharmaceutical development.

The UK government announced an investment of £22.5 billion per year for R&D of new drug treatments, longer-lasting batteries, and developing AI, over the next four years (2025-2028), including up to £500 million for regional authorities.

Sachin Mahale, Research Leader, Discovery Sciences at Charles River Laboratories, commented that the most widely used HTS technologies for the identification of small-molecule API candidates include fluorescence-based and absorbance-based assays. Different attributes, such as binding affinities, reaction kinetics, enzymatic activity, functional activity, target engagement, selectivity, and specificity, are analyzed. They are essential as they provide early insights into the potential efficacy and selectivity of drug candidates.

By Product

By Application

By Technology

By End-User

By Region

February 2026

January 2026

October 2025

November 2025