February 2026

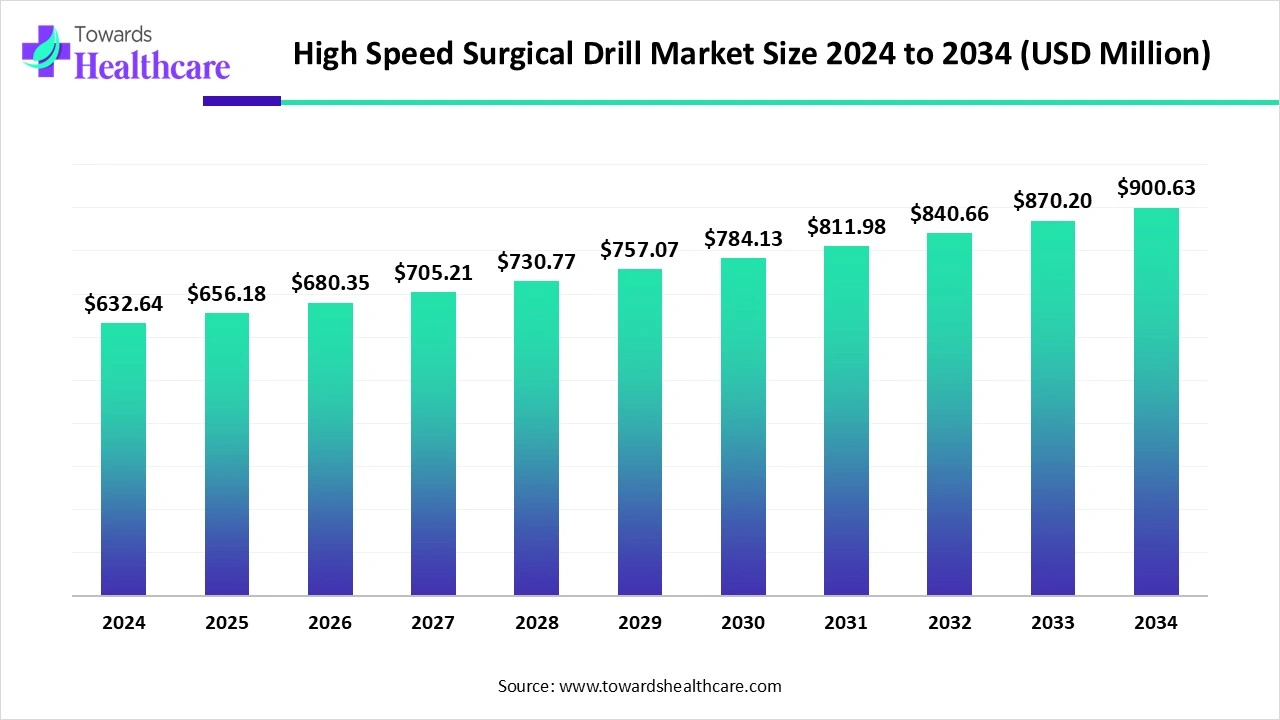

The global high speed surgical drill market size is calculated at US$ 632.64 million in 2024, grew to US$ 656.18 million in 2025, and is projected to reach around US$ 900.63 million by 2034. The market is expanding at a CAGR of 3.89% between 2025 and 2034.

The globe is facing a huge burden of surgical volumes associated with the growing geriatric population, as well as the presence of diverse musculoskeletal concerns are fueling the transformation of the high speed surgical drill market. Additionally, the latest developments in cordless handpieces, robotic surgeries are supporting the improvements in various surgical procedures. The accelerating orthopedic and dental concerns, with the expansion of ambulatory surgery centers, are boosting support for surgeons and patients. Furthermore, technological advances are assisting in the emergence of telesurgery solutions in healthcare facilities.

| Table | Scope |

| Market Size in 2025 | USD 632.64 Million |

| Projected Market Size in 2034 | USD 900.63 Million |

| CAGR (2025 - 2034) | 3.89% |

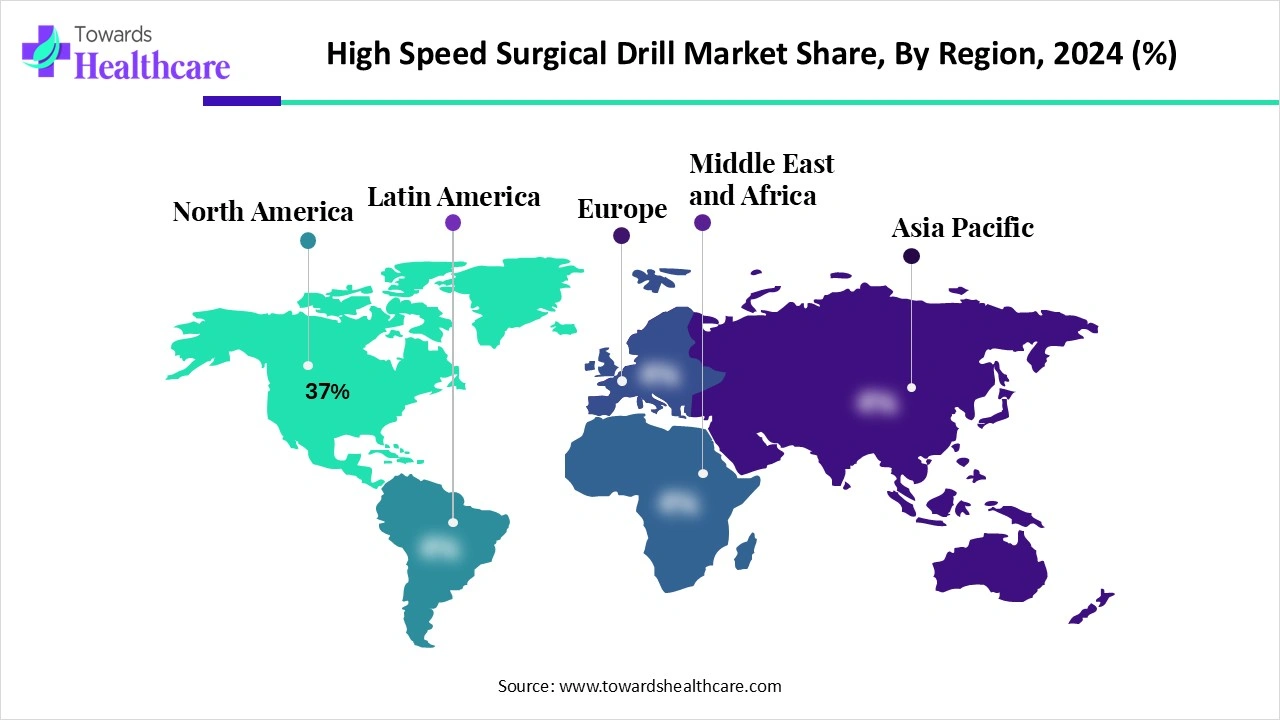

| Leading Region | North America by 37% |

| Market Segmentation | By Product/Device Type, By Technology/Power Source, By Specialty / Application, By End-User/Purchasing Channel, By Distribution Mode, By Region |

| Top Key Players | Stryker, DePuy Synthes, Zimmer Biomet, Smith & Nephew, Medtronic, Arthrex, CONMED, Aesculap/B. Braun, Karl Storz, NSK, Bien-Air, W&H, Dentsply Sirona, Integra LifeSciences, Surgicraft/Sutter Med, Implantmed/Anthogyr/Straumann, Steris, KLS Martin, Ace Medical/Shanghai & regional Chinese manufacturers, Specialized consumable/burr manufacturers & aftermarket suppliers |

High-speed surgical drills are used across specialties, orthopedics, neurosurgery/craniomaxillofacial, ENT, spinal surgery, dental implantology and oral surgery, trauma, and many minimally invasive procedures. The high speed surgical drill market covers powered handpieces, motors, and complete drill systems used by surgeons to cut, bore, ream, or abrade bone and hard tissue during operative procedures.

Systems include the motor/handpiece, foot controls, a range of burrs/reamers/osteotomes, irrigation & suction interfaces, and disposables; sub-segments also include battery/cordless systems, pneumatic/electric consoles, and single-use sterile handpiece options. Demand is driven by rising surgical volumes (arthroplasty, spinal fusion, craniotomies), growth of ambulatory surgery centers (ASCs), innovation in cordless systems and ergonomics, and infection-control preferences that favor single-use burrs and sterilizable components.

A major role of AI in the respective market is offering real-time feedback and guidance, with increased precision in procedures, especially in orthopedic and spinal surgery. In the case of the orthopedic device domain, researchers have designed AI-driven hand-held bone-cutting tools that help in the autonomous identification when they have penetrated bone. Moreover, AI algorithms are assisting in the reconstruction of 3D anatomical models of the spine from restricted fluoroscopy images.

For instance,

A Rise in Chronic Issues & Healthcare Infrastructure

Eventual expansion in chronic and age-related concerns, like musculoskeletal conditions, as well as the growing cases of sports-related injuries and road traffic accidents, are fostering the demand and transformation of the high speed surgical drill market. Alongside, developing economies, mainly China and India, are accelerating huge investments in healthcare infrastructure and the modernization of medical facilities, which further boost accessibility to sophisticated surgical solutions.

Need for Maintenance and Replacement Expenses

Primarily, this market is demanding is higher initial investment, which is a prominent limitation to market growth. At the same time, these surgical technologies are further bolstering the need for regular maintenance, sterilization, and replacement of drill components, which merges the comprehensive financial burden for the healthcare providers.

Transformation in Drill Technology and Telesurgery

During the prospective period, the global high speed surgical drill market will shift towards innovations, advances in drill technology. This will support the development of compact, lightweight drills to optimize maneuverability, especially for ENT and neurosurgical procedures in tight anatomical spaces. Along with this, the growing demand for tele-health services, the market will put efforts into the revolution of haptic interfaces, like in spine surgery research, which can result in forecast applications in telesurgery. This further enables surgeons to perform procedures remotely with expanded tactile feedback.

In 2024, the high-speed drill systems segment accounted for nearly 40% share of the market. The segment is fueled by the accelerating instances of musculoskeletal, neurological, and dental concerns. Additionally, current developments in micro-vent channels and ceramic bearings in high-speed drills are supporting the dissipation of heat, protecting bone viability during surgery. The market is further pushing an integration with navigation systems for improved accuracy, enhanced ergonomics, and wireless controls, innovations in motor technology.

Whereas the battery/cordless handpieces segment is expected to expand at the highest CAGR. The emergence of cordless designs, which facilitate surgeons with unlimited movement, omits the constraints of cords. Also, they are lightweight, ergonomic designs that are important in lowering hand and arm fatigue, mainly during long surgeries. In the orthopedics sector, battery-powered saws and drills are employed, whereas in dentistry, cordless handpieces are employed in implants and endodontic (root canal) treatments. Neurosurgeons and spine surgeons are using these solutions for accurate bone removal and spinal surgeries.

The electric (AC) high-speed motors segment led with an approximate 50% share of the high speed surgical drill market. The segment is emphasizing the accelerating speed and torque for enhancing precision, minimizing vibration and noise, and improving ergonomics with lighter-weight designs. Inclusion of the widespread adoption of brushless DC motors, sophisticated bearing technologies, such as ceramic for durability, and smart features like wireless foot controls and digital displays are leveraging higher user flexibility and safety in the operating room.

However, the battery/cordless segment will grow rapidly during 2025-2034. Day by day, a rise in demand for portability and maneuverability in confined surgical spaces, and the requirement for escalated convenience in field and emergency settings are supporting the overall segmental development. Also, this is boosting surgeon experience and patient safety, emerging innovations in smart auto-stop technology, real-time depth measurement, cable-free operation for lowered OR clutter, and integrated robotic guidance.

The orthopedics segment captured approximately 35% share of the high speed surgical drill market in 2024. A major factor is the increasing aging population possessing arthritis, fractures, and other musculoskeletal concerns. Additionally, the globe is immensely demanding joint replacements and fracture stabilization, which need accurate and specialized drills for robust bone preparation and fixation. The incorporation of cooling systems helps to minimize friction and mitigate heat buildup, which can damage bone and surrounding tissues during high-speed procedures.

The dental & oral surgery segment is expected to grow at the highest CAGR in the high speed surgical drill market in the coming era. Accelerating dental issues and demand for cosmetic and aesthetic dentistry are impacting the segmental progress. Ongoing advancements in robotic-assisted surgery for precise implant placement and tooth extraction, in combination with advanced digital imaging, are fostering solutions in these conditions. New approaches are offering surgeons greater precision, adjustable torque, and pace settings that are crucial for diverse bone densities and surgical requirements, like drilling for implants.

By capturing nearly 65% share, the hospitals & tertiary care centres segment dominated the market in 2024. The worldwide growing burden of surgical procedures, and a wider preference for minimally invasive procedures boosting the demand for specialized, high-speed drills in both hospital and ambulatory settings. Continuous advances in super-slim shaft diameters, universal cutter systems, and variable cutter exposure support the management of complex micro-surgical procedures. The contribution of heavy investment in health infrastructure is expanding the adoption of novel and sophisticated surgical tools in the developing hospitals and tertiary care centres.

The ambulatory surgery centers segment will register rapid growth in the high speed surgical drill market during 2025-2034. A prominent catalyst is its feasibility and affordability in the migration of procedures, eventually in total knee replacements, into outpatient settings. ASCs are increasingly fueling demand for cordless, high-speed surgical drills for faster charging and easy movement between operating rooms, with expanded effectiveness and flexibility. The emergence of groundbreaking electric and battery-powered systems, such as the Stryker CD NXT, is enabling improvements in efficiency and longer operation times.

In 2024, the direct sales segment held a major share of the high speed surgical drill market. Cost-effectiveness and direct communication with end-users and decision-makers regarding the fruitful effects of the innovative techniques are fueling the expansion of direct sales. Also, direct sales teams offer specialized product training and application support to surgeons and operating room staff. Ongoing progression and modernization of healthcare facilities are boosting the demand for direct sales facilities.

The service contracts & consumable recurring revenue segment will expand rapidly. Encouraging maintenance and support to expand equipment uptime, while consumable recurring revenue stems from the regular purchase of disposable accessories, including burrs and blades, required for procedures. Service contracts allow agreements with hospitals and surgical centers for regular maintenance, calibration, and repair services to confirm the high-speed surgical drills remain operational and effective. The exploration of platform ecosystems, like drills, accessories, and support services, is assisting the entire and locked-in solutions for hospitals and clinics.

In 2024, North America accounted for approximately 37% revenue share of the high speed surgical drill market. Due to the high surgical volumes, fast ASC growth, and strong purchasing power for high-end consoles and service contracts, fostering the regional development. North America is bolstering the adoption of the latest solutions, such as Stryker's CD NXT System with real-time digital depth measurement, Hubly Surgical's cranial access drill for enhanced neurosurgery. Also, this region is stepping into the trend of integrating AI and robotics for facilitating higher accuracy, navigation, and tissue avoidance.

In September 2025, Biotia, a health technology company, and Hospital for Special Surgery (HSS) collaborated to advance diagnostics for detecting prosthetic joint infection.

In March 2025, William Osler Health System (Osler) introduced a major milestone in surgical innovation, performing the 1,000th robot-assisted total knee replacement using the ROSA® Knee System at Brampton Civic Hospital.

Asia Pacific’s high speed surgical drill market is anticipated to expand at a rapid CAGR in the studied years. This expansion will be driven by the growth of hospital capacity, elective surgeries (orthopedics & dental implants), and local manufacturing, mainly in China, India, South Korea, and Japan. These countries are allowing manufacturers to establish specialized drills, like the Right-Angle Drill for ankle replacement, and neurosurgical drills for precise bone work in the brain.

In March 2025, Brain Navi Biotechnology, a leading innovator in neurosurgical robotics, entered into a strategic partnership with BenQ Medical Technology to launch and commercialize the NaoTrac neurosurgical navigation robot in the Chinese market.

In March 2025, Medicover Hospital in Navi Mumbai introduced an innovation in orthopedic care with the launch of the MISSO high-tech robotic knee and hip replacement system, to revolutionize knee and hip replacement procedures.

The global market encompasses stages from concept generation and design to material selection, mechanical and electrical engineering, and robust testing for safety and efficacy, such as biomechanical evaluations in bone tissue and pre-clinical trials.

Key Players: Medtronic, Stryker Corporation, Zimmer Biomet, etc.

The high speed surgical drill market includes pre-clinical studies (on cadavers or bone specimens) to examine functionality and safety, then clinical trials in humans to study efficacy, and finally, regulatory approval for post-market surveillance for long-term safety and efficacy.

Key Players: Royal United Hospitals Bath NHS Foundation Trust, KU Leuven, University of Trieste, etc.

Companies are providing continuous irrigation, specialized drill bit design, careful speed control, and proper application of protective materials like cottonoids.

Key Players: DePuy Synthes, Aesculap, Adeor Medical AG, etc.

By Product/Device Type

By Technology/Power Source

By Specialty / Application

By End-User/Purchasing Channel

By Distribution Mode

By Region

February 2026

October 2025

October 2025

November 2025