February 2026

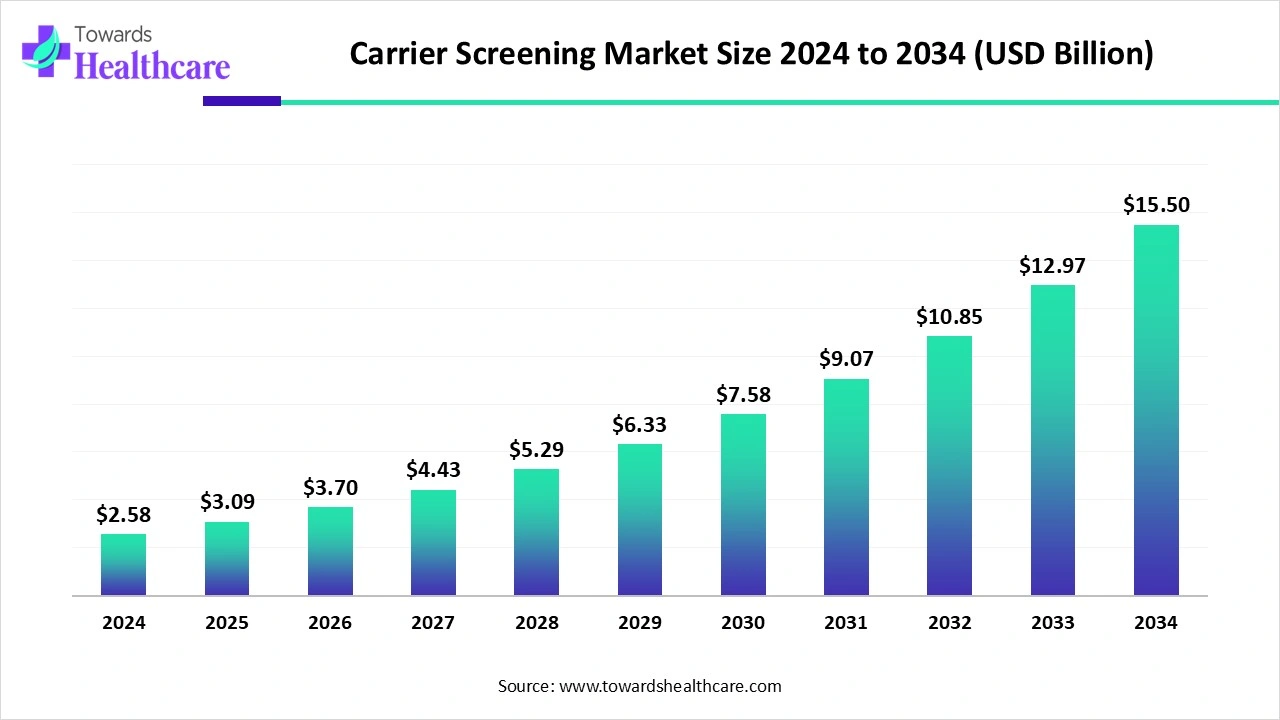

The global carrier screening market size is calculated at US$ 3.09 billion in 2025, grew to US$ 3.70 billion in 2026, and is projected to reach around US$ 18.58 billion by 2035. The market is expanding at a CAGR of 19.65% between 2026 and 2035.

In 2025, ongoing advancements in genetic techniques, especially next-generation sequencing, expanded carrier screening, PGT, and other major techniques, are boosting the expansion of the global carrier screening market. Along with this, the increasing awareness regarding genetic disorders and preconceptions is assisting in the widespread application of these groundbreaking approaches for early disease detection and further risk assessment. Alongside, the globe is experiencing a huge growth in vitro fertilization (IVF), with preimplantation genetic testing (PGT) or using donor gametes is fueling a broader adoption of sophisticated screening techniques.

The carrier screening market refers to genetic testing solutions designed to identify individuals or couples who carry one or more mutations in their genes that could be passed on to offspring, leading to inherited genetic disorders. Carrier screening is widely used in family planning, preconception, and prenatal care to assess the risk of conditions such as cystic fibrosis, spinal muscular atrophy, thalassemia, sickle cell disease, and other rare autosomal recessive or X-linked disorders. These tests are increasingly performed using next-generation sequencing (NGS), microarrays, and polymerase chain reaction (PCR) technologies, allowing for high accuracy and broad panel testing. Growth is supported by rising awareness of genetic health, advancements in precision medicine, integration into routine obstetric practice, and government recommendations for population-based screening. The market is expanding globally with strong adoption in North America, Europe, and rapidly in the Asia Pacific.

Ongoing advancements in innovative genetic testing technologies are fostering the application of AI algorithms to boost risk assessment, optimize the precision of genetic analysis, and simplify the testing process. Whereas, in 2025, AI-driven platforms have immense significance in personalized genetic counselling, explaining test results and consent processes digitally, particularly fruitful in the lack of genetic counsellors. In the identification of carriers of genetic mutations, AI assists in making informed decisions about family planning and minimizes the risk of having a child with a genetic disorder.

Progressing Prenatal Screening Programs and Early Disease Detection

The global carrier screening market is experiencing major development in the present era, due to a rise in prenatal screening programs. In these programs, carrier screening is coupled with routine prenatal care for the prior detection of genetic abnormalities. Nowadays, widespread adoption of carrier screening allows informed decision-making about their reproductive health and managing potential health risks. Recent developments in the respective market encompass expanded carrier screening (ECS), which is employed in different genetic conditions at a lower cost.

Challenges in Data Interpretation

In 2025, along with advancements in different areas, certain challenges are widely impacting the overall market development, such as a lack of well-trained and skilled professionals. This ultimately results in improper counselling, which potentially leads to misinterpretation of complex genomic data and undue anxiety for patients.

Widespread Developments in Preconception and PGD

During 2025-2034, consistent developments will expand the carrier screening market by exploring these screening approaches in in vitro fertilization (IVF) with preimplantation genetic testing (PGT) or using donor gametes. Along with this, carrier screening is further experiencing a groundbreaking approach, like ESC, which is further coupled with preimplantation genetic diagnosis (PGD). This effort is incorporated into the detection of embryos that are unaffected by genetic diseases before implantation, and supports family planning.

| Table | Scope |

| Market Size in 2026 | USD 3.7 Billion |

| Projected Market Size in 2035 | USD 18.58 Billion |

| CAGR (2026 - 2035) | 19.65% |

| Leading Region | North America by 42% |

| Historical Data | 2020 - 2023 |

| Base Year | 2025 |

| Forecast Period | 2026 - 2035 |

| Measurable Values | USD Millions/Units/Volume |

| Market Segmentation | By Test Type, By Technology, By Indication, By End Use, By Patient Group, By Region |

| Top Key Players | Illumina Inc., Thermo Fisher Scientific Inc., Natera Inc., Myriad Genetics Inc., Invitae Corporation, Fulgent Genetics, Eurofins Scientific, Centogene N.V., OPKO Health (GeneDx), Laboratory Corporation of America Holdings (Labcorp), Quest Diagnostics Incorporated, 23andMe, Inc., BGI Genomics Co., Ltd., Color Health, Inc., Sema4, Ambry Genetics, Baylor Genetics, MedGenome Inc., Dante Labs, PerkinElmer Inc. |

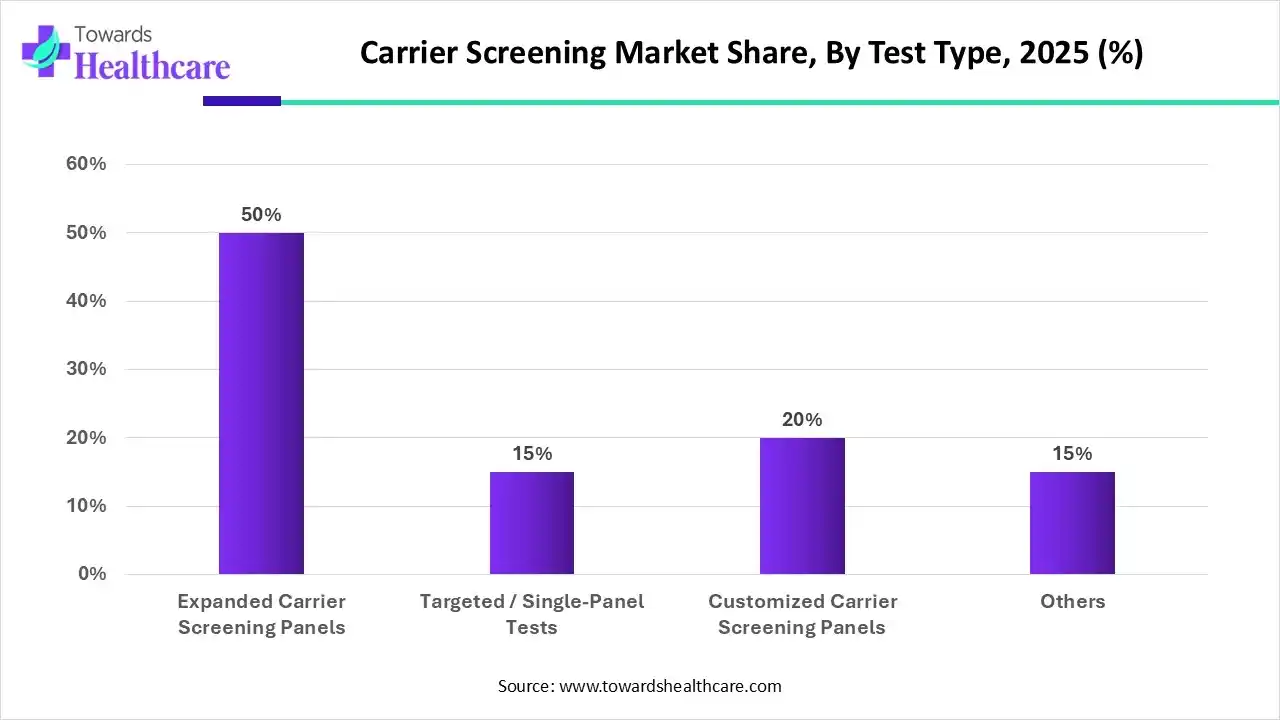

Which Test Type Held the Largest Share of the Carrier Screening Market in 2025?

The expanded carrier screening panels segment was dominant in the market with a major revenue share by 50% in 2025. This kind of test gives several benefits, such as empowerment of autonomous reproductive choices, encouraging equitable access to genetic testing by being pan-ethnic, and potentially growing inexpensiveness by detecting more conditions in a single test. Nowadays, numerous companies are providing different ECS panels, each possessing a diverse list of genes and conditions, with some panels covering over 100 or even up to 1000 genes.

Whereas, the customized carrier screening panels segment is anticipated to expand at the fastest CAGR during 2025-2034. This is a major kind of test, which encompasses widespread adoption of genetic testing for family planning and prevention. Furthermore, this approach can be utilized by couples in making informed decisions regarding family planning, coupled with the application of IVF with PGD to avoid affected pregnancies, pursuing adoption, or using donor sperm or eggs. In conjunction with next-generation sequencing (NGS), this segment is fueled by identifying carriers of autosomal recessive and X-linked genetic disorders.

How did the Next-Generation Sequencing (NGS) Segment Lead the Market in 2025?

By technology, the next-generation sequencing (NGS) segment captured the biggest revenue share of the carrier screening market by 55% in 2025. A wider detection of genetic variants linked to various hereditary diseases is mainly impacting the segment's progress. Alongside, NGS offers a wide range of views of the genome by allowing the discovery of new genetic variations, gene fusions, and other genomic features. Ultimately, this helps in the future for the development of personalized medicine, reproductive health, pathogen identification, and population genetics.

However, the DNA microarrays segment is predicted to expand rapidly in the predicted timeframe. Highly influential growth factors in the segment development are its specific benefits, like speed, which results in faster outcomes than some other techniques. As well as its sensitivity and specificity for precise measurements, the ability to miniaturize complex experiments onto small chips is also driving the comprehensive transformation of the market. Currently, researchers are working on the study of integration of higher-density arrays with other omics (like proteomics and metabolomics), which further assist in infectious diseases and gene expression profiling.

Why did the Cystic Fibrosis (CF) Segment Dominate the Market in 2025?

In the carrier screening market, the cystic fibrosis (CF) segment registered dominance by 35% in 2025. Mainly, the segment is driven by its allowance for informed reproductive choices, supporting couples to consider options, such as prenatal diagnosis or preimplantation genetic testing to minimize cases of CF births, and further offering information that can be employed in cascade screening to find other at-risk family members. Additionally, a negative carrier screening facilitates reassurance to individuals and couples who were concerned about having a child with CF.

Although the spinal muscular atrophy (SMA) segment will witness rapid growth during 2025-2034, the segment’s expansion will be impacted due to a rise in cases of SMA as a fatal, genetic disease, as well as the accelerating availability of accurate and affordable tests. Moreover, advanced screening tests enable individuals to access genetic counselors who can convey the implications of the results, the inheritance pattern of SMA, and reproductive risks. Across the globe, numerous organizations, including the American College of Medical Genetics, have suggested population-wide screening for SMA carrier status due to the rising prevalence.

What Made the Reference Laboratories Segment Dominant in the Market in 2025?

Primarily, the reference laboratories segment accounted for the dominating share of the carrier screening market by 40% in 2025. A huge population of the globe is trying to detect a variety of genetic disorders, which are widely utilizing advanced techniques, like Next-Generation Sequencing (NGS) and Multiplex PCR, enabling rapid, more accurate, and more comprehensive genetic analysis, with enhanced accessibility and affordability. The segment is further propelled by its proactive options, especially preimplantation genetic diagnosis (PGD), utilizing donor gametes, or prenatal testing, instead of only reactive responses during pregnancy.

Besides this, the specialty clinics segment is estimated to register the fastest growth in the upcoming era. The possession of specialized genetic counselors and experts provides thorough explanations of complex genetic results and helps navigate choices in these specialty clinics. In addition, they also offer easy access to advanced technologies, like state-of-the-art expanded carrier screening (ECS) panels, which are increasingly used in a broader range of conditions over the conventional methods. Now that many couples are choosing IVF, in which specialty clinics can unite carrier screening results into the PGD process, boosting the chance of a healthy pregnancy.

| Segment | Share 2025 (%) |

| Prenatal & Preconception Couples | 48% |

| High-Risk Ethnic Groups | 15% |

| General Population | 20% |

| Others | 17% |

Which Patient Group Led the Global Carrier Screening Market in 2025?

In 2025, the prenatal & preconception couples segment captured the biggest revenue share of the market by 48%. In the case of prenatal group, highly sophisticated tests are allowing couples to anticipate prenatal diagnostic tests and strategies for the management of an affected fetus. Whereas, preconception screenings provide the wider options, particularly assisted reproductive technologies, such as preimplantation genetic diagnosis (PGT) or selecting sperm or egg donors. Alongside, the application of universal expanded carrier screening minimizes dependence on ancestry-based testing, coupled with equitable access to critical information for all couples.

And, the general population segment is predicted to grow rapidly in the studied years. Greater contribution of public and healthcare professionals in the escalating genetic disorders, and supportive initiatives by governments and non-governmental organizations are highly fueling the overall segment and market expansion. As well as developing screening tests to assist the entire population in normalizing carrier status, it is also supporting the general population's adoption. Besides this, the usage of screening for multiple conditions in a single panel (ECS) can be more affordable than testing for single, high-risk disorders.

In the carrier screening market, North America held a major revenue share in 2025. North America’s well-established healthcare policies and healthcare infrastructure are widely adopting sophisticated diagnostic tests. Apart from this, many American organizations are incorporating these screening approaches by integrating them more broadly into clinical practice. These organizations are greatly focusing on the early detection of carriers of recessive genetic conditions like Cystic Fibrosis, Spinal Muscular Atrophy (SMA), and Hemoglobinopathies (such as Sickle Cell Disease), and ethnicity-specific screening for hemoglobinopathies and Ashkenazi Jewish disorders.

The US market is impacted by a pan-ethnic approach that is more equitable, also facilitating similar advantages to all populations, unlike prior methods that were restricted by ethnicity.

For this market,

Canada’s huge efforts in innovations in self-sampling kits, like those employed in a Quebec-based program, are being created to assist with home-based collection and mail-in analysis, enhancing convenience.

For instance,

During 2025-2034, the Asia Pacific is anticipated to grow at a rapid CAGR in the carrier screening market. Across the ASAP countries, like China and India, there is a rise in instances of certain genetic issues, particularly sickle cell anemia and thalassemia, which fuels the demand for carrier screening. Along with this, these countries' healthcare systems are widely aiming at the progression of personalized medicine and consumer demand for proactive health management.

For this market,

The carrier screening market usually consists of the designing of novel genetic tests by first reviewing and refining evolved scientific knowledge, establishing new methods for sample collection and analysis, validating test precision and reliability, and ultimately developing accessible reporting systems with genetic counseling to interpret results for patients.

Key Players: Natera, Myriad Genetics, LabCorp, Invitae, and Fulgent Genetics

It involves confirmation of accuracy and safety, as well as other laboratory processes like analytical validation, regulatory submission to bodies such as the FDA, and consistent quality control, with post-market surveillance to monitor performance.

Key Players: American College of Medical Genetics and Genomics (ACMG), US FDA, Merck, Ferring Pharmaceuticals, etc.

The carrier screening market gives genetic counseling to assess results and guide decision-making, pre-test education on inheritance patterns and possible risks, and post-test support for handling psychological aspects and informing family members.

Key Players: MedGenome, Medicover Genetics, BGI Genomics, Medicover Genetics, etc.

By Test Type

By Technology

By Indication

By End Use

By Patient Group

By Region

February 2026

February 2026

February 2026

February 2026