January 2026

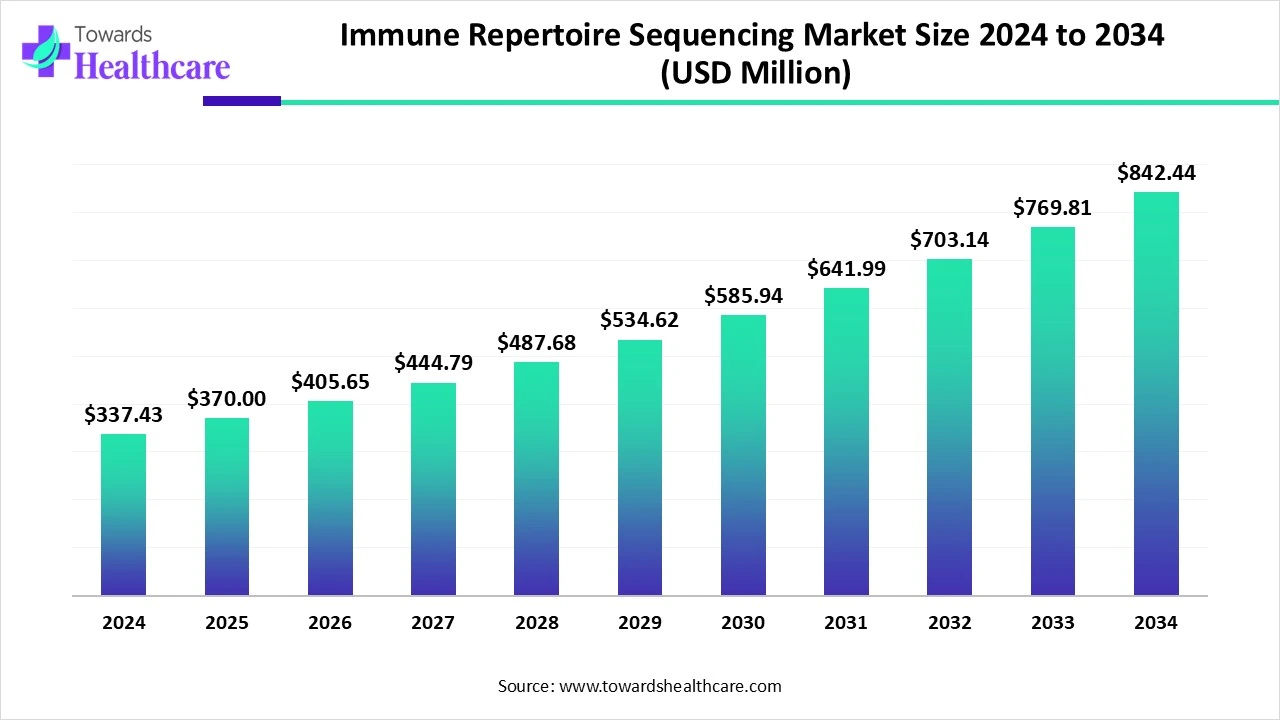

The global immune repertoire sequencing market size touched US$ 337.43 million in 2024, with expectations of climbing to US$ 370 million in 2025 and hitting US$ 842.44 million by 2034, driven by a CAGR of 9.64% over the forecast period.

In 2025, the global immune repertoire sequencing market encompasses several kinds of sequencing technology, like next-generation sequencing, single-cell RNA sequencing, etc. These technologies are widely applied in the rising prevalence of cancer, autoimmune diseases, and other infectious conditions. Moreover, to overcome organ transplant rejection, vaccine development and immunotherapies, different types of sequencing are adopted. As well as, wide-range IRS software and services have played a major role in various biopharmaceutical companies.

| Metric | Details |

| Market Size in 2025 | USD 370 Million |

| Projected Market Size in 2034 | USD 842.44 Million |

| CAGR (2025 - 2034) | 9.64% |

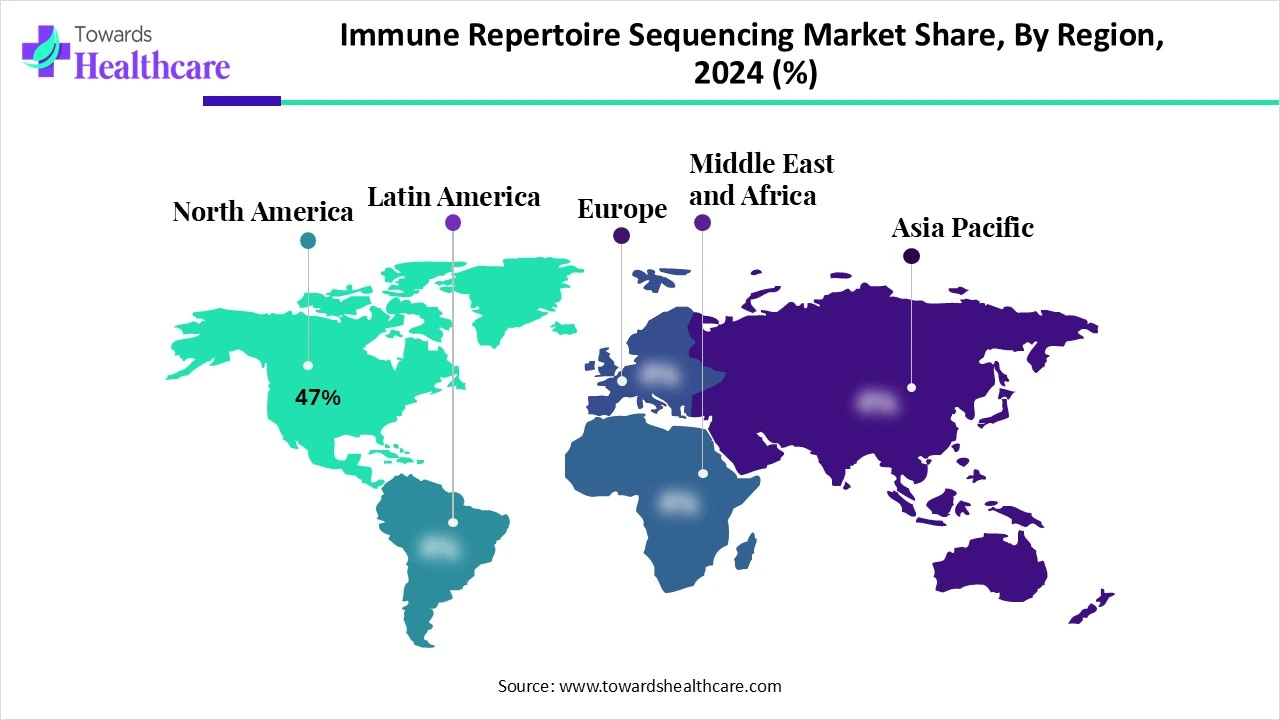

| Leading Region | North America Share 47% |

| Market Segmentation | By Product Type, By Application, By Sequencing Type, By End User, By Technology, By Region |

| Top Key Players | Adaptive Biotechnologies, Illumina, Inc., 10x Genomics, BGI Genomics, Takara Bio, Thermo Fisher Scientific, F. Hoffmann-La Roche Ltd, Bio-Rad Laboratories, CD Genomics, Eurofins Genomics, iRepertoire Inc., ArcherDX, Genentech, GENEWIZ, QIAGEN, Mission Bio, ImmunoSEQ Analyzer, Oncomine Immune Response Assay, ImmuSoft, ImmunID |

Immune repertoire sequencing refers to high-throughput sequencing technologies used to analyze the diversity and clonal composition of B-cell and T-cell receptors (BCR and TCR) in the immune system. This technique enables the deep profiling of immune cells at a molecular level to understand immune responses in diseases, vaccine development, cancer immunotherapy, autoimmune disorders, infectious diseases, and transplant rejection. The immune repertoire reflects the unique antigen-specific receptors present in individual patients and thus serves as a biomarker for diagnostics, therapy monitoring, and personalized medicine applications.

Majorly impacting the development of the market are the factors like the accelerating demand for single-cell IRS is transforming the market by allowing more reliable analysis of immune cell dynamics and function.

Around this market, AI possesses a major role by assisting in data analysis, boosting drug discovery, and allowing precision medicine. The usage of AI algorithms in the analysis of complex datasets provided by IRS results in a more accurate and effective interpretation of immune responses.

For instance,

Growing Demand for Diverse Therapeutics and Expansion of R&D

Currently, the global immune repertoire sequencing market is driven by numerous factors, including the increasing demand for precision medicine and targeted therapies. In these cases, immune repertoire sequencing gives meaningful information about each patient’s immune profile and response to treatment. Moreover, for cancer patients, they assist in selecting the most efficient immunotherapies or improving vaccine responses. Besides this, major investments in the R&D sector by both public and private sectors are boosting the overall progress of novel technologies, diagnostics, and therapies.

Challenges Regarding data Analysis and Accuracy

Primarily, the market is facing certain restrictions regarding data analysis, as large volume datasets generated by the IRS need advanced and specific bioinformatics tools and personnel, which leads to enhanced expenditure and difficulties in the process. Alongside, usual and novel bioinformatics possess few challenges in measurability, sensitivity, and supplying trustworthy data, which probably result in inappropriate results.

Fostering Vaccine Development and Other Monitoring Areas

In the future, the global immune repertoire sequencing market will encompass a variety of opportunities, mainly in vaccine development. In this domain, the IRS used to study immune response to various types of vaccines, like mRNA vaccines and viral vector vaccines. As well as against cancer, IRS is employed to detect tumor-specific antigens, which further accelerates the development of novel cancer vaccines. Whereas, in organ transplantation monitoring, IRS supports tracking immune reconstitution after stem cell transplantation to find and handle possible rejection episodes.

In 2024, the reagents & kits segment was dominant in the global immune repertoire sequencing market. The segment is driven by its wide range of advantages in streamlining complex procedures, minimizing variations, and escalating movement towards specialized kits. Different types are kits are used, such as NEBNext Immune Sequencing Kit (Human) for complete characterization of somatic mutations in full-length immune gene repertoires of B and T cells. Also, the QIAseq Immune Repertoire RNA Library Kit, SMART-Seq Human TCR/BCR (with UMIs), and BD Rhapsody TCR/BCR Multiomic Assay Kit are widely used.

Whereas, the software & services segment is anticipated to grow at the fastest CAGR. Accelerating the adoption of many software, like VDJtools, VIDJI, IRProfiler, VDJServer, and VisTCR, etc., is assisting in the analysis of vast, complex datasets, with a major role in data processing, QC, repertoire analysis, and visualization. Although other service providers, including BGI (BGI Genomics), Illumina, and other significant players, are allowing library preparation, sequencing, and data analysis with end-to-end sequencing workflows.

The cancer immunotherapy segment led the market by accounting for a major share in 2024. Broad utilization of the IRS in cancer research to recognize the difficulties in immune responses during cancer progression, with the detection of novel neoantigens, is fueling the ultimate segment expansion. Moreover, this leads to enhanced analysis of tumor microenvironments and the development of new therapeutic strategies. Additionally, the IRS has a vital role in clinical trials to examine the efficacy of immunotherapies, identification of adverse effects, and monitor the fate of infused lymphocytes in adoptive cell therapy.

On the other hand, the vaccine development segment will witness rapid expansion. This will be demonstrated by the significant advances in NGS technologies, like optimized speed, accuracy, and affordability of immune repertoire sequencing, making it highly accessible for research and clinical applications. Furthermore, in the prospects for designing newer vaccines, IRS will be incorporated to determine novel targets for this development. This ultimately expands more efficient vaccines against wider pathogens, particularly for those that are difficult to target with conventional vaccine methods.

The T-cell receptor (TCR) sequencing segment led the global immune repertoire sequencing market. As this type of sequencing is important in cancer immunotherapy, infectious diseases, autoimmune conditions, and monitoring immune responses. Besides this, key factors of this sequencing are the data analysis of data developed by TCR sequencing using an advanced computational tool. As well as factors, such as sequencing depth, library preparation methods, and data analysis pipelines, that impact the accuracy and reliability of TCR sequencing results.

However, the single-cell immune profiling segment will grow fastest during 2025-2034. Due to the emergence of its importance in various transplantation research, autoimmunity, like helps in introducing the variance within immune cell subsets, is propelling the adoption of this kind of approach. Along with this, it assists in understanding disease pathways, tracking clonal expansion, and the linkage between phenotype and genotype. This approach usually integrates the ability to sequence T cell receptors (TCRs) and B cell receptors (BCRs) at the single-cell level with transcriptional profiling, which offers a comprehensive view of individual immune cells.

In the global immune repertoire sequencing market, the pharmaceutical & biotechnology companies segment registered dominance in 2024. Across the world, the growing funding in the research and development area by numerous companies is driving the widespread adoption of IRS in different pharmaceutical and biotechnology companies. Also, the use of IRS in biomarker discovery, new target identification, and immunotherapy enhancements is boosting this company's development and complete turnover in the development of novel therapies for the arising severe health issues.

The contract research organizations (CROs) segment is predicted to expand rapidly. Several benefits of this segment are fueling the ultimate market development, including having broad access to specialized personnel and technologies, and also outsourcing IRS to a CRO will be an affordable one. Reduced time consumption and greater navigation of regulatory frameworks are supporting compliance with related rules. Also, CROs provide services like sample preparation, sequencing, data analysis, and interpretation. This leads pharmaceutical and biotechnology companies to outsource these complex tasks and focus on core research and development.

In 2024, the next-generation sequencing (NGS) segment was dominant in the immune repertoire sequencing market, with the biggest share. This kind of technology allows high throughput by adopting the simultaneous sequencing of millions of DNA or RNA molecules. Alongside, it also gives rise to high resolution at the nucleotide level with the detection of individual receptor sequences and subtle diversity within them. It can identify clonal expansion and study numerous sample types, with scaling up or down based on research needs.

On the other hand, the single-cell RNA sequencing segment is estimated to grow rapidly. The emergence of this technology in cancer studies and treatment by analyzing the tumor microenvironment, detecting cancer stem cells, and tracking treatment results boosts its adoption. Furthermore, different computational tools and pipelines have contributed to the analysis of scRNA-seq data, especially those for clonotype calling, network generation, and visualization of gene usage. Likewise, the SiCR web application offers tools for single-cell repertoire analysis and visualization.

By capturing a major share of the immune repertoire sequencing market, North America led the market share by 47% in 2024. Due to the increasing number of immunotherapy studies, a robust pool of biopharmaceutical industries is impacting this region’s market expansion. Along with this, growing understanding of the immune system, novel progressions in sequencing technologies, and developing applications in areas like oncology, infectious diseases, and vaccine development have also contributed to the market growth.

The U.S. is increasingly using the IRS to study the immune response in different diseases, such as infectious diseases (e.g., COVID-19), autoimmune diseases (like rheumatoid arthritis), and cancers. As well as crucial incorporation in transplant monitoring of ongoing widespread organ transplantation in the U.S.

For instance,

The market is expanding due to Canadian researchers greatly promoting the development and application of immune repertoire sequencing technologies, such as the AIRR Community was introduced in Canada to set guidelines for the analysis, management, and sharing of immune repertoire data.

For this market,

During 2025-2034, the Asia Pacific will register the fastest growth in the immune repertoire sequencing market. By broadly fostering the development of customization in various diseases by adopting IRS in tailoring therapies, it is assisting in its enhancement across the ASAP market. Furthermore, major investments and funding in research and development of several domains, like oncology, immunotherapies, and other severe conditions, are encouraging the rise in usage of IRS approaches in ASAP’s companies.

For instance,

In China, the IRS has been widely employed in the analysis of the immune area of several glioma subtypes in Chinese patients, revealing heterogeneity in the immune response within these tumors. Also, China’s research boosted the impact of COVID-19 on the immune repertoire, finding abnormal T and B cell responses in survivors and investigating the persistence of antibodies.

For this market,

The market is driven by numerous Indian research institutions that actively participate in immune repertoire sequencing research, such as the Indian Institute of Science (IISc), National Centre for Biological Sciences (NCBS), and others.

For this market,

A surge in the adoption of highly sophisticated sequencing technologies in Europe is mainly influencing the immune repertoire sequencing market. Primarily, the broad application of whole-genome sequencing in research and precision medicine, as well as nanopore sequencing, is gaining traction for their ability to develop longer reads, supporting complex genomic areas. Apart from this, the active presence of major market players, Illumina Inc., Thermo Fisher Scientific Inc., Agilent Technologies Inc., Roche Holding AG, Oxford Nanopore Technologies, and Qiagen, is highly supporting of comprehensive market progression.

In Germany, the development of advanced data analysis tools and algorithms allows researchers to the analysis of huge datasets generated by immune repertoire sequencing, resulting in an excellent understanding of the immune system. Also, initiatives like the National NGS Competence Center (NGS-CC) focused on modernization and harmonization of NGS infrastructure in German universities.

The UK is experiencing significant expansion with the emergence of combination factors, like demand for customized treatments, developing participation in cancer and other diseases R&D. The UK has advanced healthcare systems and widespread investments in innovation of sequencing technologies.

For instance,

By Product Type

By Application

By Sequencing Type

By End User

By Technology

By Region

January 2026

November 2025

November 2025

November 2025