February 2026

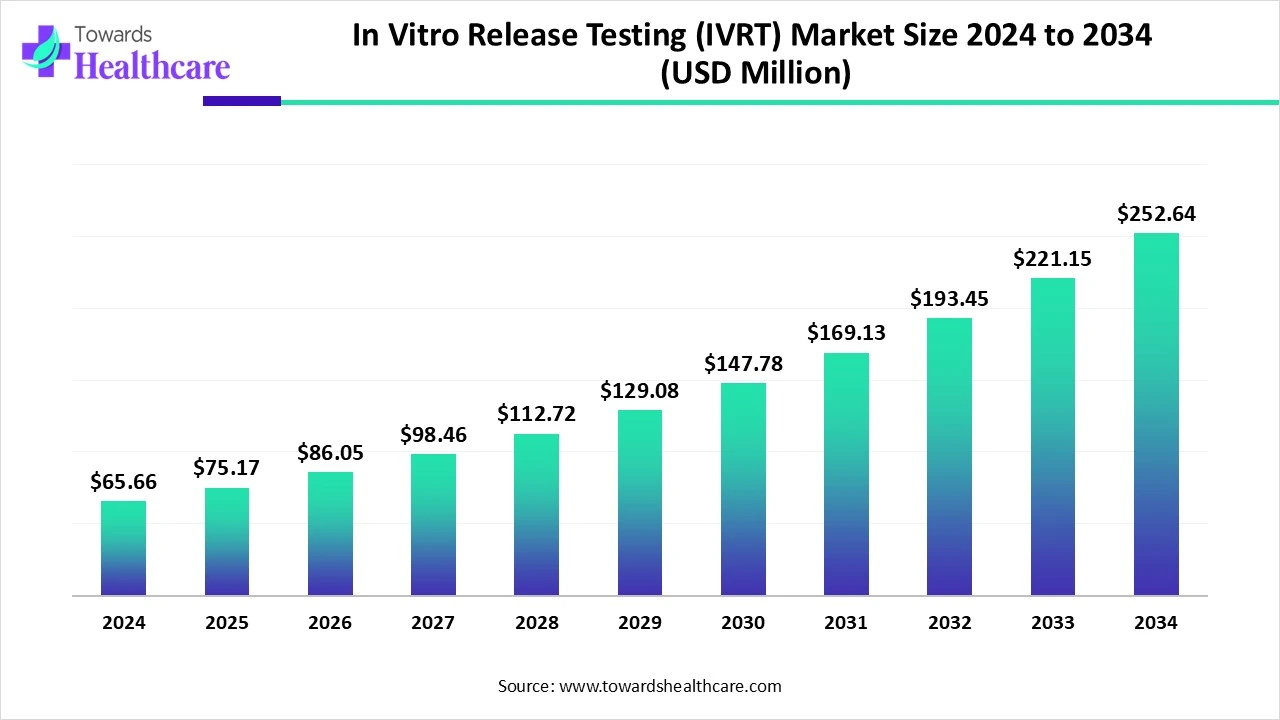

The global in vitro release testing (IVRT) market size is calculated at USD 65.66 million in 2024, grow to USD 75.17 million in 2025, and is projected to reach around USD 252.64 million by 2034. The market is expanding at a CAGR of 14.47% between 2025 and 2034.

The in vitro release testing (IVRT) market is witnessing steady growth due to the rising need for efficient drug evaluation methods, especially for topical and transdermal formulations. Increased focus on bioequivalence studies and regulatory compliance is boosting demand for IVRT. Additionally, advancements in drug delivery technologies and the shift toward non-invasive testing are driving its wider adoption across the pharmaceutical and research sectors.

| Metric | Details |

| Market Size in 2025 | USD 75.17 Million |

| Projected Market Size in 2034 | USD 252.64 Million |

| CAGR (2025 - 2034) | 14.47% |

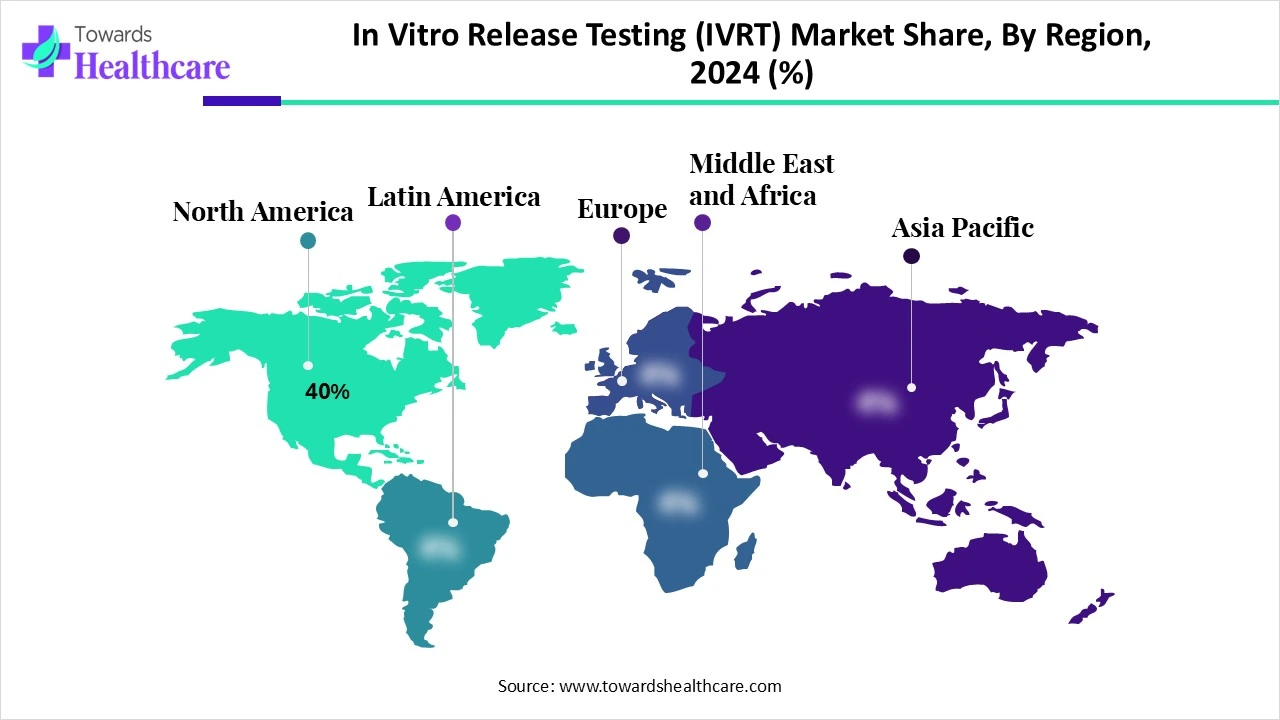

| Leading Region | North America share by 40% |

| Market Segmentation | By Product Type, By Application, By End User, By Technology, By Membrane Type, By Region |

| Top Key Players | Copley Scientific Ltd, Logan Instruments Corporation, PermeGear Inc., Anow Microfiltration Co., Ltd., IKA Werke GmbH & Co. KG, Sotax AG, Varian Inc. (Agilent Technologies), Thermo Fisher Scientific Inc., Waters Corporation, Agilent Technologies Inc., Shimadzu Corporation, Analytical Technologies Ltd, Distek Inc., Erweka GmbH, Mettler-Toledo International Inc., Metrohm AG, Metrohm AG, Bioanalytical Systems Inc., Sun Pharm Industries Ltd., Buchi Labortechnik AG |

In Vitro Release Testing (IVRT) is a laboratory technique used to evaluate the release profile of a drug from its topical or transdermal dosage forms, such as creams, gels, ointments, and patches, under controlled laboratory conditions. IVRT helps in assessing the rate and extent of drug release, ensuring quality, efficacy, and consistency of topical formulations during product development and quality control phases. It acts as a surrogate for in vivo studies and supports regulatory approval by demonstrating product equivalence and batch-to-batch consistency.

The IVRT market comprises instruments, software, and services used by pharmaceutical companies, contract research organizations (CROs), and academic institutions involved in topical drug formulation development and testing. Innovation is enhancing the IVRT market by improving test accuracy, reducing analysis time, and enabling automated, high-throughput systems. These advancements support complex formulation testing and help meet evolving regulatory and industry demand more efficiently.

AI is transforming the in-vitro release testing (IVRT) market by enhancing data analysis, improving test accuracy, and accelerating formulation development. Machine learning algorithms can predict drug release profiles, identify formulation issues early, and optimize testing conditions. This reduces time, cost, and human error in the testing process. AI integration also supports regulatory compliance by ensuring consistent, high-quality data interpretation across complex pharmaceutical products.

Increasing Demand for Generic and Topical Drug Products

The surge in generic and topical drug development has made in vitro release testing essential for ensuring consistent product performance. IVRT enables manufacturers to assess how a drug is released from its formulation, which is critical for meeting regulatory expectations. As more companies aim to deliver affordable and effective alternatives to branded medications, the reliance on IVRT increases, supporting quality assurance and streamlined approval processes.

The Lack of Standardized Testing Protocols

The absence of standardized protocols in IVRT presents challenges in ensuring reproducibility and consistency across different laboratories. This variation can lead to discrepancies in drug release data, complicating regulatory submissions and delaying approvals. Developers may need to invest additional time and resources to validate custom methods, increasing development costs. This lack of uniformity ultimately slows the widespread adoption of IVRT, especially for complex or novel drug formulations.

Advancements in Automation

Automation in in vitro release testing (IVRT) market presents a promising opportunity by transforming how drug release studies are conducted. These technologies enable intelligent data processing, reduce reliance on manual procedures, and support real-time monitoring of test results. As pharmaceutical development becomes more complex, automated systems help optimize formulation assessments, enhance reproducibility, and accelerate timelines, making IVRT more adaptable, efficient, and valuable for future innovations in drug delivery and regulatory compliance.

In 2024, the instruments segment led the in vitro release testing (IVRT) market due to the increasing adoption of advanced analytics tools like Franz diffusion cells and automated dissolution systems. These instruments offer precise, reproducible measurements essential for evaluating drug release profiles, especially in complex formulations. Their integration into quality control and formulation development processes has streamlined workflows and enhanced data accuracy, solidifying their dominance in the market.

The Franz diffusion cells subsegment held the largest revenue share in the IVRT market due to its widespread use in testing topical and transdermal drug formulations. It provides accurate, reproducible results for drug permeation studies and is favored for its simplicity, regulatory acceptance, and effectiveness in evaluating drug release across semi-permeable membranes.

In 2024, the topical formulations segment dominated the in vitro release testing (IVRT) market as the popularity of creams, gels, and transdermal patches continued to grow in both the pharmaceutical and cosmetics industries. These products require thorough testing to confirm consistent drug release and skin absorption. IVRT methods are ideally suited for evaluating these characteristics, making them crucial for ensuring product performance, patient safety, and meeting regulatory expectations.

The novel drug delivery systems segment is expected to grow rapidly in the IVRT market as pharmaceutical companies develop advanced formulations like liposomes, nanoparticles, and transdermal systems to improve drug targeting and absorption. These complex systems require detailed release testing to ensure proper function and therapeutic effectiveness. This need for precise evaluation tools to support innovation and regulatory compliance is driving the increasing reliance on the IVRT market.

In 2024, the static diffusion systems (Franz cell-based) segment, especially the Franz cell-based setup, led the in vitro release testing (IVRT) market due to their widespread use in analyzing drug release from semi-solid and transdermal formulations. These systems offer a simple yet effective way to measure permeation through membranes, making them highly valuable in both R&D and regulatory testing. Their reliability, ease of use, and adaptability to various formulations contributed to their dominant position in the market.

The automated IVRT systems segment is projected to grow rapidly as pharmaceutical companies seek faster, more precise testing solutions. These systems reduce human error, streamline complex workflows, and deliver consistent, high-quality data. Their ability to handle multiple samples simultaneously and integrate with digital reporting tools makes them ideal for modern labs aiming to boost productivity and meet evolving regulatory expectations, driving strong adoption in both R&D and routine quality assurance environments.

In 2024, the synthetic membranes segment dominated the in vitro release testing (IVRT) market as it provided a practical and reliable alternative for assessing drug release. These membranes are widely favored for their uniform structure, compatibility with various formulations, and minimal batch-to-batch variability. Their ability to deliver consistent data, along with reduced preparation time and broader acceptance in laboratory protocols, made them the top choice across both research and regulatory environments.

The biological membranes segment is projected to experience the fastest growth in the IVRT market during the forecast period, driven by the growing demand for physiologically relevant testing models. Biological membranes, such as human or animal skin, provide more accurate stimulation of in vivo conditions, enhancing the predictive value of drug release studies. This increased realism is crucial for evaluating complex formulations and supporting regulatory expectations for bioequivalence in topical and transdermal drug development.

In 2024, the pharmaceutical companies segment led the in vitro release testing (IVRT) market due to their growing need for reliable drug release evaluation during formulation development and regulatory submission. Their focus on expanding generic, topical, and innovative drug products has increased the use of IVRT for assessing product performance. With well-established infrastructure and strong regulatory obligations, these companies rely heavily on in vitro methods to streamline development and ensure consistent product quality, supporting their dominant market share.

The contract research organizations (CROs) segment is expected to grow at the fastest rate in the IVRT market as pharmaceutical companies increasingly turn to external partners to manage testing demands and reduce internal burdens. CROs offer cost-efficient, specialized services with access to advanced instrumentation and skilled professionals. Their flexibility in handling diverse project sizes and tight timelines makes them ideal for supporting complex formulation studies and accelerated product development cycles.

North America dominated the market share by 40% in 2024, due to its well-established pharmaceutical industry, advanced research infrastructure, and strong regulatory framework supporting in vitro testing methods. The presence of major drug manufacturers and growing demand for topical and transdermal products further fueled regional adoption. Additionally, increased investment in R&D, availability of skilled professionals, and early adoption of automated and AI-integrated testing technologies have solidified North America’s leadership in driving innovation and regulatory compliance in IVRT applications.

The U.S. market is expanding due to the increasing demand for bioequivalence studies, particularly for generic drug approvals, which is driving the need for IVRT. Stringent regulatory requirements for drug approvals necessitate precise and reliable testing methods, further boosting the market. Additionally, the adoption of advanced analytical techniques enhances the accuracy and efficiency of IVRT, making it a preferred choice for pharmaceutical companies aiming to ensure product quality and compliance.

Canada's market is expanding due to the country's robust pharmaceutical and biotechnology sectors are increasingly adopting IVRT methods to ensure product quality and regulatory compliance. Additionally, Canada's supportive regulatory framework and emphasis on research and development foster innovation in drug formulation and testing. The growing demand for generic and topical drug products further drives the need for efficient and reliable IVRT methodologies, contributing to market growth.

Asia-Pacific is driving growth in the market due to increasing clinical research activities and rising awareness about advanced drug evaluation methods. The region’s expanding generic drug industry and collaborations between local manufacturers and global pharma companies are also contributing to demand. As regulatory bodies tighten quality standards, more companies are adopting IVRT to meet compliance requirements, fueling further investment in modern lab infrastructure and skilled workforce across the region.

China's market is growing rapidly due to the rise in local drug manufacturing and increased focus on quality assurance in generics and topical drugs. The government’s push for pharmaceutical innovation and international regulatory alignment is encouraging advanced testing adoption, while partnerships with global firms are enhancing technical capabilities and expanding market reach.

India's market is expanding due to the country's robust pharmaceutical industry, which is the world's largest provider of generic medicines by volume. The increasing prevalence of chronic diseases and a growing emphasis on early and accurate diagnosis are driving demand for advanced diagnostic tools. Government initiatives to improve healthcare infrastructure and accessibility, especially in rural areas, further support this growth by promoting the adoption of IVRT solutions.

In 2024, Europe is advancing the market by emphasizing personalized medicine and enhancing laboratory automation. This progression is supported by a robust pharmaceutical sector and a strong regulatory framework that encourages innovation. The increasing prevalence of chronic diseases and the demand for precise drug delivery systems are driving the adoption of IVRT methodologies. Additionally, investments in research and development are fostering the integration of advanced technologies, further propelling market growth across the region.

The UK's market is expanding due to its strong pharmaceutical and biotechnology sectors, which are increasingly adopting IVRT methods to ensure product quality and regulatory compliance. The growing demand for generic and topical drug products further drives the need for efficient and reliable IVRT methodologies, contributing to market growth. Additionally, the UK's supportive regulatory framework and emphasis on research and development foster innovation in drug formulation and testing.

Germany's market is expanding due to its advanced healthcare infrastructure and high medical care standards. The increasing demand for diagnostic tests among the aging population is a significant driver. Technological innovations in IVD technologies, such as molecular diagnostics and digital health solutions, further contribute to market growth. Additionally, government initiatives, including reimbursement policies and adherence to European Union standards, support the development and adoption of IVRT methodologies.

Analytical services continue to be a cornerstone of pharmaceutical development, ensuring drug quality, safety, and efficacy through advanced testing methods. These services include method development, validation, impurity profiling, and stability studies, supported by technologies like NMR, XRD, and spectroscopy. Emphasizing Quality by Design and risk-based strategies, they align with global standards from ICH, FDA, and EMA. Additionally, specialized testing such as IVRT/IVPT, sterility, and endotoxin analysis supports effective drug delivery and microbiological safety, said Ramesh Jagadeesan, vice president. (Source - Pharmaceutical Manufacturer)

By Product Type

By Application

By End User

By Technology

By Membrane Type

By Region

February 2026

January 2026

January 2026

January 2026