February 2026

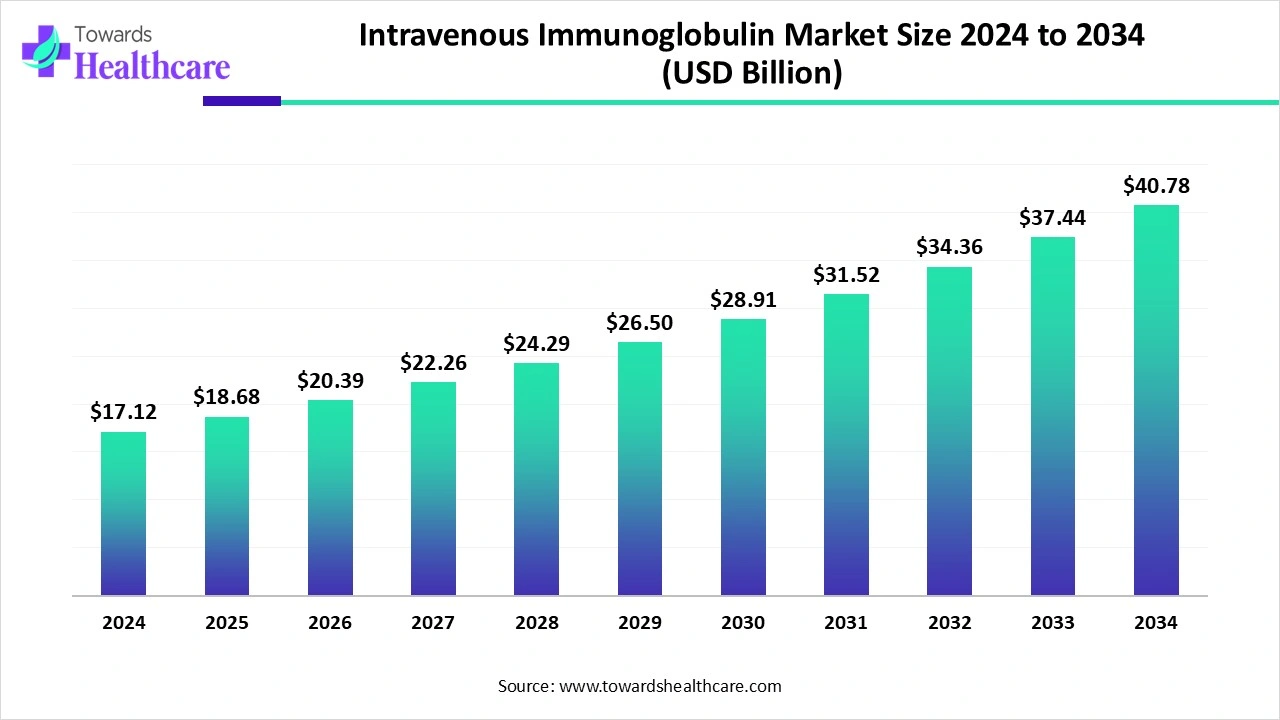

The global intravenous immunoglobulin market size is calculated at USD 17.12 billion in 2024, grew to USD 18.68 billion in 2025, and is projected to reach around USD 40.78 billion by 2034. The market is expanding at a CAGR of 9.14% between 2025 and 2034.

The intravenous immunoglobulin market is rapidly expanding due to the widespread adoption of intravenous immunoglobulin (IVIG) for the treatment of various immunological and rare disorders. People are becoming more aware of blood donations, increasing the accessibility to IVIGs. Prominent players collaborate to access advanced technologies and design customized IVIGs based on patients’ needs. Artificial intelligence (AI) facilitates the production of IVIGs. Advances in plasma fractionation techniques present future opportunities for the market.

| Table | Scope |

| Market Size in 2025 | USD 18.68 Billion |

| Projected Market Size in 2034 | USD 40.78 Billion |

| CAGR (2025 - 2034) | 9.14% |

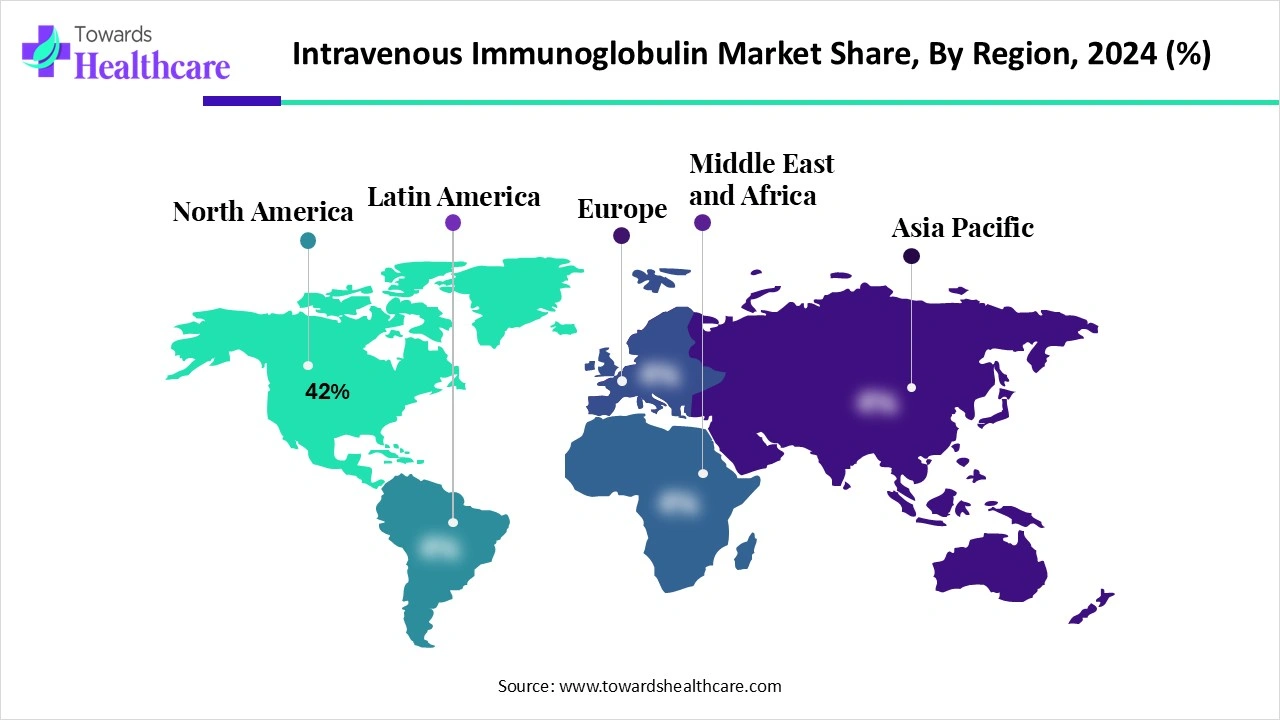

| Leading Region | North America 42% |

| Market Segmentation | By Indication, By Concentration, By Formulation, By End-User, By Distribution Channel, By Region |

| Top Key Players | Takeda Pharmaceutical Company Limited, CSL Behring, Grifols, S.A., Octapharma AG, Kedrion Biopharma, Biotest AG, Sanquin Plasma Products, ADMA Biologics, Inc., LFB S.A., Green Cross Corporation (GC Pharma), China Biologic Products Holdings, Inc., Shanghai RAAS Blood Products Co., Ltd., Bharat Serums and Vaccines Ltd., Kamada Ltd., Emergent BioSolutions, SK Plasma Co., Ltd., Intas Pharmaceuticals Ltd., Corning Life Sciences, Hualan Biological Engineering Inc., Bio Products Laboratory (BPL) |

The intravenous immunoglobulin market refers to the segment of immunotherapy products derived from human plasma containing pooled immunoglobulin G (IgG) antibodies. IVIG is administered intravenously to treat a wide range of autoimmune, infectious, and idiopathic diseases by modulating immune responses. Its demand is driven by the rising prevalence of primary immunodeficiency diseases (PID), chronic inflammatory demyelinating polyneuropathy (CIDP), immune thrombocytopenia (ITP), Kawasaki disease, and neurological disorders, as well as its off-label use in multiple inflammatory conditions. The growing plasma collection capacity, expansion of specialty infusion clinics, and technological improvements in fractionation are shaping the market.

Increasing Collaboration: Collaborations are made to access advanced technologies and expand their product portfolio, along with geographical presence.

FDA Approval: Regulatory agencies like the U.S. Food and Drug Administration (FDA) approve IVIG therapeutics for various disorders.

AI revolutionizes the design and development of IVIG by introducing automation. It enables the prediction and design of antibody sequences, 3D structures, and complementarity-determining regions of IVIGs. It enhances the accuracy and precision of large-scale IVIG manufacturing. AI and machine learning (ML) algorithms can analyze vast amounts of data and predict potential outcomes of therapeutic antibodies. This enables healthcare professionals to make proactive clinical decisions and tackle adverse effects caused by IVIGs.

Rising Prevalence of Immunological Disorders

The major growth factor for the intravenous immunoglobulin market is the rising prevalence of immunological and rare disorders. These disorders need to be treated at their root cause. Therapeutic antibodies, such as IVIGs, alter the immune response of patients by secreting cytokines and chemokines, regulating the adhesion and mobility of various immune cells. Several disorders that can be treated with IVIG include severe combined immunodeficiency disorders (SCID), multiple sclerosis, myasthenia gravis, Guillain-Barré syndrome, and Kawasaki disease. The prevalence rate of multiple sclerosis is 23.9 cases per 100,000 population. Sweden, Canada, Norway, and Ireland report the highest number of cases.

Adverse Reactions

IVIGs have potential adverse reactions, including mild, moderate, and severe. These reactions are observed in approximately 5% of patients receiving IVIGs. Some common adverse effects are headache, fatigue, chills, and fever. This restricts the use of IVIGs.

What is the Future of the Intravenous Immunoglobulin Market?

The market future is promising, driven by advances in plasma fractionation techniques. Scientists are developing novel plasma fractionators to enhance product yield, purity, and safety. Advanced technologies, such as ion exchange and affinity chromatography, are increasingly integrated into purification systems. Another strategy includes the proposed use of magnetic separations to improve the initial isolation, capture, or purification. The adsorbent is magnetic, and the product is recovered from the feedstock. Additionally, advancements in genetic engineering techniques facilitate the development of recombinant IVIGs.

By indication, the primary immunodeficiency diseases (PID) segment held a dominant presence in the market in 2024. This is because of the use of IVIGs in diagnosing and treating several PIDs. IVIGs boost the immune system’s natural defenses. PIDs are immunological disorders that are present at birth. There are more than 400 PIDs, including common variable immunodeficiency (CVD), DiGeorge syndrome, and Wiskott-Aldrich syndrome. It is estimated that about 1 in 1200 live births are affected by PIDs.

By indication, the myasthenia gravis segment is expected to grow at the fastest CAGR in the market during the forecast period. Myasthenia gravis is an autoimmune condition that affects the communication between nerves and muscles. This significantly impacts the daily life activities, including blinking of eyes, making facial expressions, and lifting objects. Different types of myasthenia gravis include autoimmune myasthenia, neonatal myasthenia, and congenital myasthenia.

By concentration, the 5% concentration segment held the largest revenue share of the market in 2024. This segment dominated because 5% concentration is the most widely delivered amount of IVIG. Healthcare professionals start from low-dose concentrations, or standard dosing, to treat a particular disease and gradually increase the dose if the disease is untreated. 5% IVIGs are usually administered at least once per month. They also have a lower risk of adverse reactions.

By concentration, the 10% concentration segment is expected to grow with the highest CAGR in the market during the studied years. A 10% concentration dose of IVIGs is increasingly used due to its enhanced therapeutic benefits. The latest multicenter retrospective study demonstrated that 10% IVIG products facilitate faster IVIG administration and increase non-response rates in patients with Kawasaki disease.

By formulation, the liquid segment contributed the biggest revenue share of the market in 2024. This is due to the ease of use of liquid IVIGs. Liquid formulations are ready-made solutions that eliminate the need for a trained professional to measure a dose accurately. In addition, they are more convenient to handle. Liquid formulations are prepared using cold ethanol fractionation, yielding a typical purity of >98% of IVIG.

By formulation, the lyophilized/frozen-dried powder segment is expected to expand rapidly in the market in the coming years. Lyophilized IVIG is prepared by dissolving solid IVIGs in a solvent, which is then further lyophilized. They are comparatively more stable than liquid IVIG. Lyophilized IVIG is reported to have high stability for a longer period of up to 36 months at room temperature. It reduces the chances of denaturation, degradation, and aggregation as it does not involve an aqueous solution.

By end-user, the hospitals segment led the global market in 2024. The segmental growth is attributed to the availability of favorable infrastructure and suitable capital investment. This enables hospitals to adopt advanced and innovative IVIGs. The increasing number of patients with complex immunological disorders boosts the segment’s growth. Favorable reimbursement policies and the presence of multidisciplinary experts potentiate the need for hospitals. Some hospitals are also part of IVIG clinical trials, benefiting patients before market approval of a product.

By end-user, the specialty clinics & infusion centers segment is expected to witness the fastest growth in the market over the forecast period. Specialty clinics and infusion centers have specialized equipment to deliver IVIG. They provide a safe, comfortable, and supportive environment for delivering IVIG therapy. Specialty clinics contain skilled professionals who offer personalized treatment to patients with immunological disorders. These clinics have access to all available IVIG infusion therapies for customized, uninterrupted treatment.

By distribution channel, the hospital pharmacies segment accounted for the highest revenue share of the market in 2024. This segment dominated because hospital pharmacies have relevant infrastructure to store liquid and lyophilized IVIGs and administer them based on patients’ conditions. They have trained professionals and favorable capital inflow. It becomes convenient for a patient to purchase IVIG from a hospital pharmacy and administer it with the help of a nurse or doctor within the hospital. This saves travel time and exorbitant costs.

By distribution channel, the online pharmacies segment is expected to show the fastest growth over the forecast period. The demand for online pharmacies is increasing as they enable patients to purchase high-quality IVIG in the comfort of their home. Online pharmacies also allow patients to choose from a wide range of options at affordable prices. They provide numerous benefits, such as free home delivery and virtual consultations.

North America dominated the global market share 42% in 2024. The availability of a robust healthcare infrastructure, the rising prevalence of autoimmune disorders, and favorable reimbursement policies are the major growth factors for the market in North America. North American countries have an advanced plasma collection network. Favorable regulatory policies and increasing investments by government and private organizations augment market growth. The rising number of clinical trials also facilitates market growth.

It is estimated that approximately 6.8 million people in the U.S. donate blood annually. About 5,000 units of platelets and 6,500 units of plasma are needed daily in the U.S. As of September 15, 2025, a total of 2,007 clinical trials have been reported on the clinicaltrials.gov website related to intravenous immunoglobulin.

Canadian Blood Services (CBS) has set a goal of adding 1 million new blood donors in the next five years, owing to the increasing need for blood, plasma, stem cells, and organ donors. It is estimated that the demand for immunoglobulins will increase by 50% or more over the next five years.

Asia-Pacific is expected to grow at the fastest CAGR in the intravenous immunoglobulin market during the forecast period. The rapidly expanding healthcare infrastructure and the increasing diagnosis rates of immunological and rare disorders foster market growth. Countries like China, India, and South Korea have an expanding local plasma collection capacity. These countries have a favorable manufacturing infrastructure, encouraging foreign players to set up their manufacturing facilities. Government organizations support the development of innovative therapeutics through funding and initiatives.

The National Medical Products Administration (NMPA) reported that more than 20 million people are suffering from rare medical conditions. A systematic review and meta-analysis study also found that around 2.7-3.0% of the total adult population in China has one or more autoimmune diseases, accounting for >31 million people.

Bharat Serums and Vaccines, one of the largest and oldest IVIG makers in India, manufactures more than 500 million doses of IVIG and other plasma products annually. Another manufacturer, Biological E, has a capacity of manufacturing over 1 million doses of IVIG annually. The Indian government initiatives, like the Mahatma Phule Yojana, cover IVIG for children of up to Rs 1 lakh.

Research activities for IVIG include the development of innovative IVIG for a plethora of immunological and rare disorders.

Key Players: CSL Behring, Octapharma, and Grifols.

IVIGs are usually manufactured to prepare final liquid or lyophilized formulations to maintain sterility, integrity, and stability.

Key Players: Kedrion Biopharma, ADMA Biologics, and Takeda Pharmaceutical Company.

IVIG undergoes clinical trials after final preparation to assess its safety and efficacy against numerous disorders. Regulatory agencies approve an IVIG based on its human trials.

Key Players: Bio Products Laboratory, Grifols Therapeutics LLC, Octapharma

After an IVIG is approved for market use, it is distributed to hospitals and pharmacies in the respective countries where it is approved.

Patient support & services refer to providing clinical support, administration services, and care coordination for patients receiving IVIG treatment.

Kristina Allikmets, Senior Vice President and Head of R&D for Takeda’s Plasma-Derived Therapies Business Unit, commented that the approval of Gammagard Liquid ERC reinforces the company’s commitment to supporting individualized treatment approaches for people with primary immunodeficiency. The company aims to prioritize reliable supply while offering a broad range of IVIG therapies to address varied patient needs.

By Indication

By Concentration

By Formulation

By End-User

By Distribution Channel

By Region

February 2026

February 2026

February 2026

February 2026