January 2026

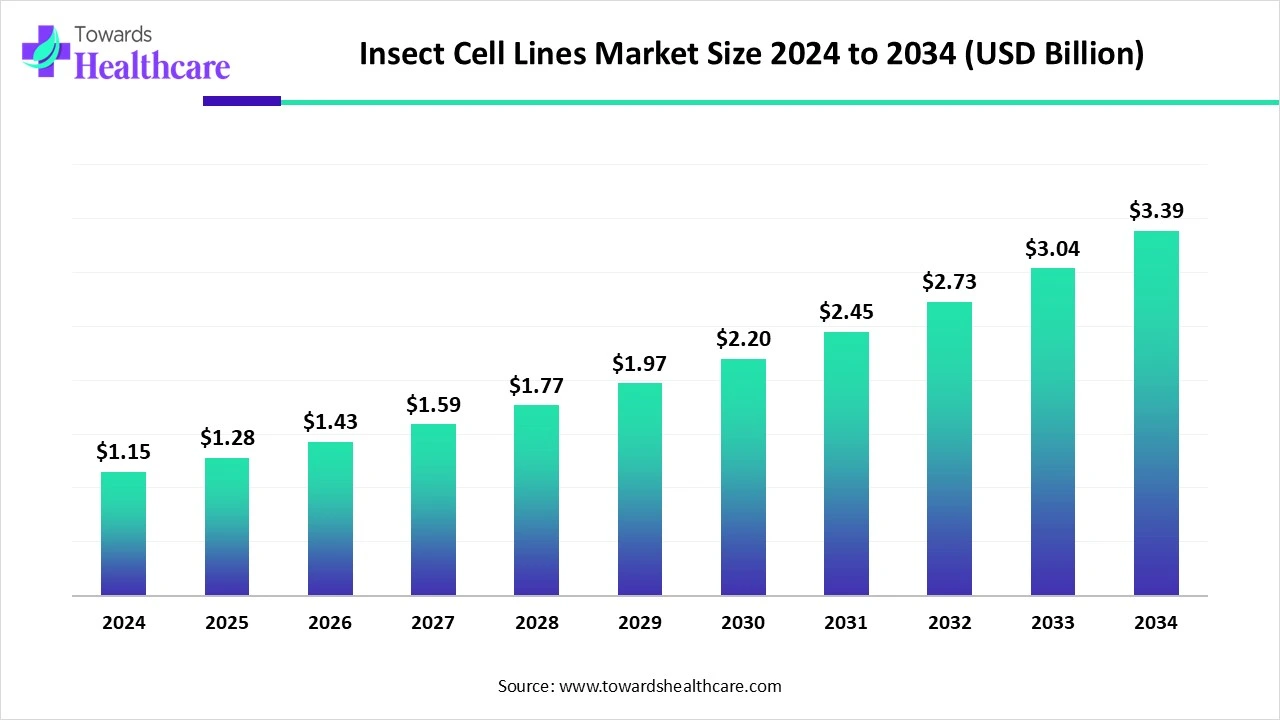

The global Insect Cell Lines Market size is calculated at US$ 1.15 in 2024, grew to US$ 1.28 billion in 2025, and is projected to reach around US$ 3.39 billion by 2034. The market is expanding at a CAGR of 11.44% between 2025 and 2034.

The Insect cell lines market is rapidly expanding because of its increasing applications in recombinant protein expression, vaccine manufacturing, and research of gene and cell therapy. Also increasing demand for personalized medicine and biologics. North America is dominated in the market by the strong presence of healthcare infrastructure and increasing government funding for biotech research. Asia Pacific is fastest fastest-growing due to advancements in biotechnology and innovation in cell culture technology.

| Metric | Details |

| Market Size in 2025 | USD 1.28 Billion |

| Projected Market Size in 2034 | USD 3.39 Billion |

| CAGR (2025 - 2034) | 11.44% |

| Leading Region | North America |

| Market Segmentation | By Product, By Application, By End User, By Region |

| Top Key Players | Thermo Fisher Scientific Inc., Merck KGaA (Sigma-Aldrich), Sartorius AG, Expression Systems LLC, Lonza Group AG, GE Healthcare, HiMedia Laboratories, CellGenix GmbH, Atlanta Biologicals Inc., PromoCell GmbH, Becton, Dickinson & Company, Corning (Cellgro), Takara Bio, Life Technologies |

The insect cell lines market is rapidly growing because it provides high levels of protein expression with posttranslational alteration approaching that of mammalian cells, ease of scale-up, and simplified cell growth, which readily adapted to high-density suspension culture for expression of large-scale. The insect cell lines generally used as expression systems are derived from the cabbage looper Trichoplusia ni (High Five), fall armyworm Spodoptera frugiperda (Sf9, Sf21), and the fruit fly Drosophila melanogaster (S2). Insect cell lines are prominent for their strong growth and adaptability. They thrive in simple and affordable culture media, which significantly lowers the cost of large-scale manufacturing. Insect cell lines gained popularity in research and biotechnology because of their unique properties.

AI integration in the insect cell lines is driving the growth of the market as artificial intelligence and computational technologies advance, involving the manufacturing of complex protein structures with potential folding risk, baculovirus insect cell expression systems, which remain significant in facilitating the production and development of advanced medicines to meet unmet patient requirements. Various advances in AI-driven technology are enhancing the performance of insect cell-culture systems and improving their attractiveness for the large-scale production of biotherapeutics and vaccines. AI-driven insect cell lines emerged as significant platforms for the manufacturing of vaccines, recombinant proteins, and other biopharmaceuticals.

Advancements in Recombinant Protein Production

Advancements in recombinant protein production have significantly increased yields and reduced costs, enabling large-scale manufacturing and broadening treatment options for various diseases and disorders. Recombinant protein technology facilitates the expression of biopharmaceuticals based on recombinant proteins. Insect cell lines are widely employed for the efficient production of these proteins, especially for vaccines and research purposes, driving the growth of the insect cell line market.

High Cost Challenges

Compared to E. coli and yeast expression systems, it is relatively costly. It cannot produce proteins with complex N-linked glycan structures, and its production is typically discontinuous because of the death of host insect cells. This limitation hampers the growth of the insect cell lines market.

Recent Advancements in the Baculovirus Expression Vector System

The baculovirus expression vector system (BEVS) has become a well-established platform for manufacturing viral vaccines and gene therapy vectors. BEVS introduces foreign genes into insect cells via insect-specific baculoviruses, enabling high-level production of recombinant proteins with correct folding in eukaryotic environments. This versatile system supports the production of a wide variety of proteins and offers several advantages over other expression methods. Additionally, the baculovirus insect cell system provides an inherent safety benefit because baculoviruses have a limited host range, restricted to infecting only certain insects, opening opportunities in the insect cell line market.

By product type, the Sf9 segment dominated in the insect cell lines market in 2024, as it shows a rapid growth rate and advanced cell density than Sf21 cells, and is preferred mostly. Insect Sf9 cells are well suited for extensive and high-density serum-free suspension culture than HEK293 cells. The use of Sf9 cells in vaccine production provides various advantages, including high yield, low expenses, and enhanced safety as compared to outdated vaccine production processes. Sf9 cells serve as a model system for reviewing cellular processes, like cell signaling, gene regulation, and apoptosis.

The Sf21 segment is expected to grow at the fastest CAGR over the forecast period, 2025 to 2035, as the use of Sf-21 cells provides major advantages, including flexibility in scale-up, low production expenses, and the capability to produce proteins with intricate structures. Sf-21 cells are capable of expressing advanced levels of recombinant proteins, making them ideal for large-scale production. These cells easily cultured in serum-free media, which lowers the risk of contamination.

By application, the biopharmaceutical manufacturing segment is dominant in the insect cell lines market in 2024, as insect cell lines are a significant factor for the production of recombinant protein; they offer a multipurpose platform for applications in the biopharmaceutical and research sectors. Explore their implications in pharmaceutical production, predominantly on Nuvaxovid/Covovax, which is the recently approved vaccine manufactured using insect cell BEVSs for protection against SARS-CoV-2. It is also used to manufacture biologicals for human and veterinary medicine.

The tissue culture & engineering segment is expected to fastest-growing over the forecast period 2025 to 2035 as insect cells cultured without a CO2 incubator, and are accepting of the change in pH, temperature, and osmotic pressure. Recombinant insect cell culture serves as an excellent platform for the effective production of influenza VLPs for use as effective and safe vaccines and diagnostic antigens.

By end user, the pharmaceutical industry segment is dominant in the insect cell lines market in 2024, as recombinant proteins remove the challenges of contamination from pathogens which present in natural sources of biomaterial. This safety aspect is significant for the pharmaceutical industry for large-scale manufacturing. Cell line advancement starts at small-scale suspension cultures, finally transitioning to industrial-scale bioreactors at the manufacturing stage. Its huge strength is to accommodate large DNA molecules in the vector, which allows the production of high-molecular-weight proteins in the pharmaceutical industry.

The research laboratories segment is estimated to fastest-growing over the forecast period 2025 to 2035, as these laboratories are significant for researching insect cell lines and are also used for testing the damage caused by environmental contaminants and evaluating the malignant effects of various chemicals on the endocrine system of vertebrates. It is produced with a high degree of research to reduce the challenges of contamination or impurities in experimental applications.

North America is dominant in the insect cell lines market with the largest revenue share, as major cities of North America are emerging biotech hubs, goal of becoming the next epicenters of health tech advance and growth. For Instance, Boston and San Francisco continue to dominate in biomanufacturing. Strong presence of large biopharmaceutical companies, with the skilful expertise and resources to help clinical trials, get government approval, all factors are major drivers of the market in North America.

For Instance,

In the U.S., strong startup environment, containing a vibrant venture capital sector which offers early-stage funding to small and medium organizations that require further development of novel healthcare technologies and a system of specialized vendors and service providers. Government-funded R&D policies rise healthcare innovation, which helps advanced research in gene therapy and recombinant protein using the insect cell platform, which contributes to the growth of the market.

In Canada, advanced healthcare technologies have an important role to play in making efficiencies and increasing the resilience of the medical care system, while steadily contributing to improving Canadian population patient results on an ongoing basis, containing insect cell lines research. Fast advancement in evolving technologies is creating novel opportunities for revolution and disruption of outdated healthcare processes and models, which contributes to the growth of the market.

The Asia Pacific region is projected to experience the fastest growth in the insect cell lines market during the forecast period, due to the Asia-Pacific region emerging as a centre in vaccine manufacturing and development, growing innovation with advance technologies, strong pipelines, and strategic partnership to fight challenging diseases, insect cell line is widely used in evolving vaccines against various infectious disease. Asia Pacific has modernised its regulatory environment to align with international standards, predominantly improving its demand for biopharma investments, which encourages the advanced research of insect cell lines.

Recently Chinese government has made novel policies for biotech innovation and advancement. A novel national strategy has been significant to the biotech sector growth, this strategy accelerating the commercialization of insect cell lines. Chinese biomedical manufacturing organizations have easier access to raw materials in the region, which further strengthens China's supply chains and China’s biopharmaceutical engagement in the region, which contributes to the growth of the market.

India's bioeconomy field has grown from $10 billion in 2014 to $165.7 billion in 2024, with a target of $300 billion by 2030. Increasing regulatory support and government aims to make India a global bio-manufacturing home driven by inclusive development, sustainability, and innovation. Growing various biotech initiatives, such as the National Biopharma Mission, co-funded with the World Bank ($250 million), help the more than 100 projects and 30 MSMEs, which also drive the growth of the market.

Europe is expected to grow significantly in the insect cell lines market during the forecast period as the EU is leader in vaccine research, manufacturing, and development, EU host around 22% of global vaccine clinical trials over the past two decades and this advance research facilities associated with the world’s largest vaccine organization, which increases the demand of insect cell line for vaccines manufacturing. Rapid adoption of modern bioprocessing automation and advanced technology, which makes it simple to produce bio products using insect cells.

Germany has an appropriate environment for biotech innovation and research, containing world-class central research in several future-oriented sectors. Increasing healthcare spending and government funding drive the growth of the market. For instance, in 2024, the financing of German biotechnology organizations increased significantly by 78% as compared to the previous year, which boosted the demand for advanced cell culture systems like insect cell lines.

In January 2025, Dr. Hans Huber, CEO of Biomay, stated, “The addition of Cas9 to Biomay’s off-the-shelf portfolio aligns with our mission to offer good quality and scalable services for emerging therapeutic modalities.” (Source - Biomay)

By Product

By Application

By End User

By Region

January 2026

January 2026

January 2026

January 2026