February 2026

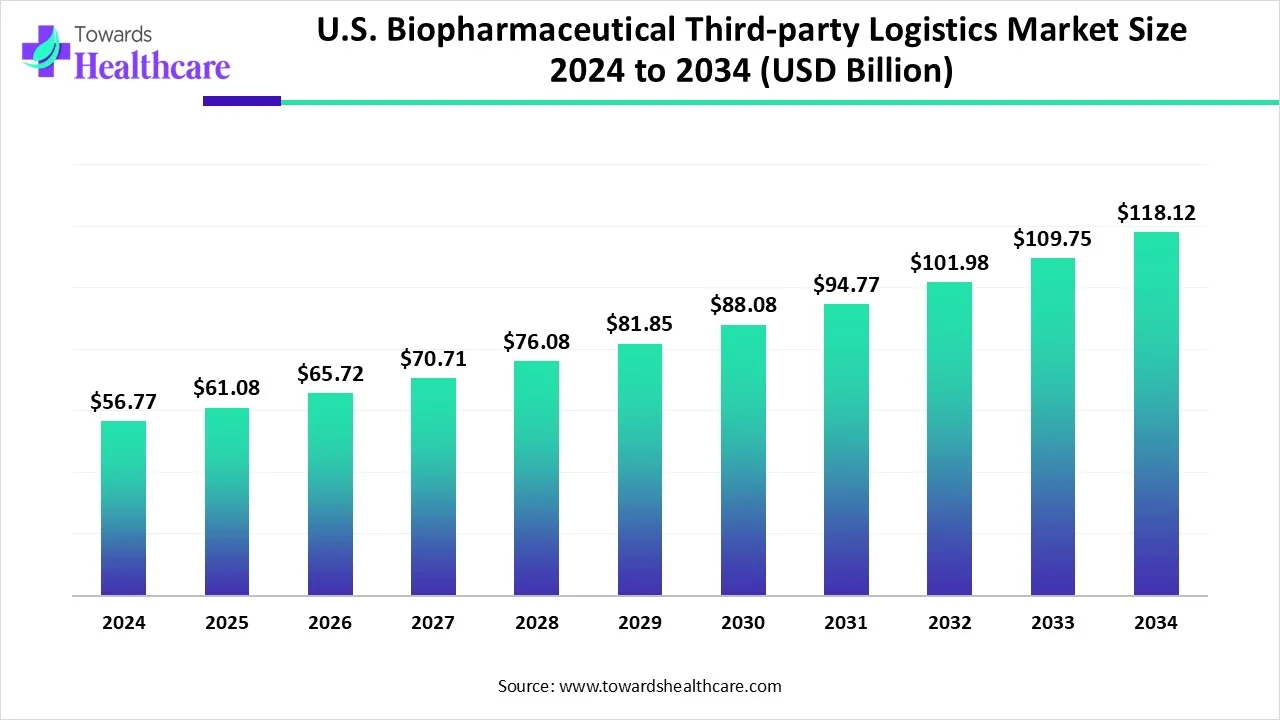

The U.S. biopharmaceutical third-party logistics market size is calculated at USD 61.08 billion in 2025, grew to USD 65.72 billion in 2026, and is projected to reach around USD 127.06 billion by 2035. The market is expanding at a CAGR of 7.6% between 2026 and 2035.

| Metric | Details |

| Market Size in 2025 | USD 61.08 Billion |

| Projected Market Size in 2035 | USD 127.06 Billion |

| CAGR (2026 - 2035) | 7.6% |

| Market Segmentation | By Supply Chain, By Service Type |

| Top Key Players | UPS Healthcare, Cardinal Health, KUEHNE + NAGEL, AmerisourceBergen Corp., McKesson Corporation, Thermo Fisher Scientific, DHL International GmbH, DB Schenker, Kerry Logistics Network Ltd., CEVA Logistics, Agility Logistics, SF Express, XPO Logistics, Cencora, Inc., EVERSANA |

Biopharmaceutical third-party logistics (3PL) entailed the outsourcing of logistic services such as warehousing, transportation, and distribution for pharmaceutical and biopharmaceutical products. These 3PL contributors assist companies in overcoming the difficulties of dispensing conscious products, generally involving specialized infrastructure, including cold chain logistics and real-time tracking to assure compliance with regulations. Mainly, the growth of the market is impelled by outsourcing logistics, in which the target would be a robust distribution network, and an increase in biosimilar launches. Moreover, the rising demand for biosimilar and specialty drugs, which need certain conditions like temperature control, has raised the demand for advanced cold-chain logistics solutions.

AI has a major role in biopharmaceutical third-party logistics (3PL), as it supports in enhancement of efficiency, minimization of risk, and accelerates compliance all over the supply chain. It improves the shipping routing, minimizes the transit frequency, and also reduces the transportation expenses. Furthermore, AI-powered predictive analytics can forecast possible disturbances, like weather events or supply chain congestions. AI can guide in the precise tracking of temperature and other conditions to confirm the product's efficiency and integrity.

Escalating Complexities and Yield of Biopharmaceutical Products

The U.S. biopharmaceutical third-party logistics market is particularly influenced by rising complexities and yield of biopharmaceuticals such as monoclonal antibodies and gene therapies, and branded drugs need particular storage, handling, and transportation requirements, oftentimes comprising temperature-sensitive cold chain logistics. However, 3PL provides the validated logistics, including data loggers, 24/7 tracking, and firm transit services.

Accelerated Capital Expenditure and Regulatory Conformity

The primary challenges for the U.S. biopharmaceutical third-party logistics market that are being experienced are increasing capital expenditure, including developing and controlling GDP-compliant facilities, temperature-controlled fleets, validated IT systems, and securing mandatory certifications require significant capital investment and compliance with regulations such as Drug Supply Chain Security Act (DSCSA) and Good Distribution Practice (GDP).

Rising Advances for Temperature-Sensitive Products and Demand for Biologics and Specialty Drugs

In the U.S. biopharmaceutical third-party logistics market, growing demand for biologics and specialty drugs, and boosting advancements for temperature-sensitive products, such as advanced cold-chain solutions, which provide temperature-controlled storage, transportation, and real-time operating, are necessary for regulating the integrity of biopharmaceutical products. Also, the AI-aided and IoT are modifying logistics processes with automation, resulting in more effective and reasonable solutions.

Which Supply Chain Segment Led the Market?

By supply chain, the non-cold logistics segment led the market in 2024. The growing significant demand for biopharmaceutical products, such as various generics and over-the-counter drugs (OTC), can be stored and transported at room temperature, which enables to use of non-cold logistics, a more reasonable and accessible solution. As well as, it raises the expansion of distribution networks of numerous pharmaceutical companies.

The Cold Chain Logistics Segment: Fastest Growing Rate

By supply chain, the cold chain logistics segment is predicted to grow at the fastest rate in the market during the projected timeframe. In the U.S. biopharmaceutical third-party logistics market, biopharmaceutical companies ' demanding for precise temperature control, particularly for vaccines, monoclonal antibodies, and other biologics, is impacting the cold chain logistics solution. Moreover, the vital portion is global vaccine distribution, which is leading to the growth of this segment.

How the Warehousing & Storage Segment Dominated the Market?

By service type, the warehousing and storage segment dominated the market in 2024. Regulatory authorities like the FDA in the U.S. and the EMA in Europe possess rigorous guidelines for the storage and distribution of biologics and vaccines. Basically, these products require stringent temperature control systems and specific storage conditions to maintain their efficacy and safety. This segment is highly influenced by advancements in drug development, specifically in oncology, immunology, and infectious diseases.

The Transportation Segment: Fastest Growing

By service type, the transportation segment is anticipated to grow at the fastest rate during the forecast period. Pharmaceutical industries are accelerating the outsourcing of logistics to improve their distribution networks and targets on elemental competencies like research and development. However, the expansion of the biopharmaceutical market and increasing biosimilar launches require efficient transportation and storage conditions as well.

The U.S. biopharmaceutical third-party logistics market, significantly impacted by the rising development of biologics and specialty drugs, which oftentimes need firm, temperature-controlled systems, which demand advanced cold-chain logistic solutions. Also, the automation, AI integration, and IoT programming are leading factors for the growth of the market. Technologies such as blockchain are widely employed to ensure data accuracy and discoverability over the chain, particularly in temperature-sensitive products like biologics.

For instance,

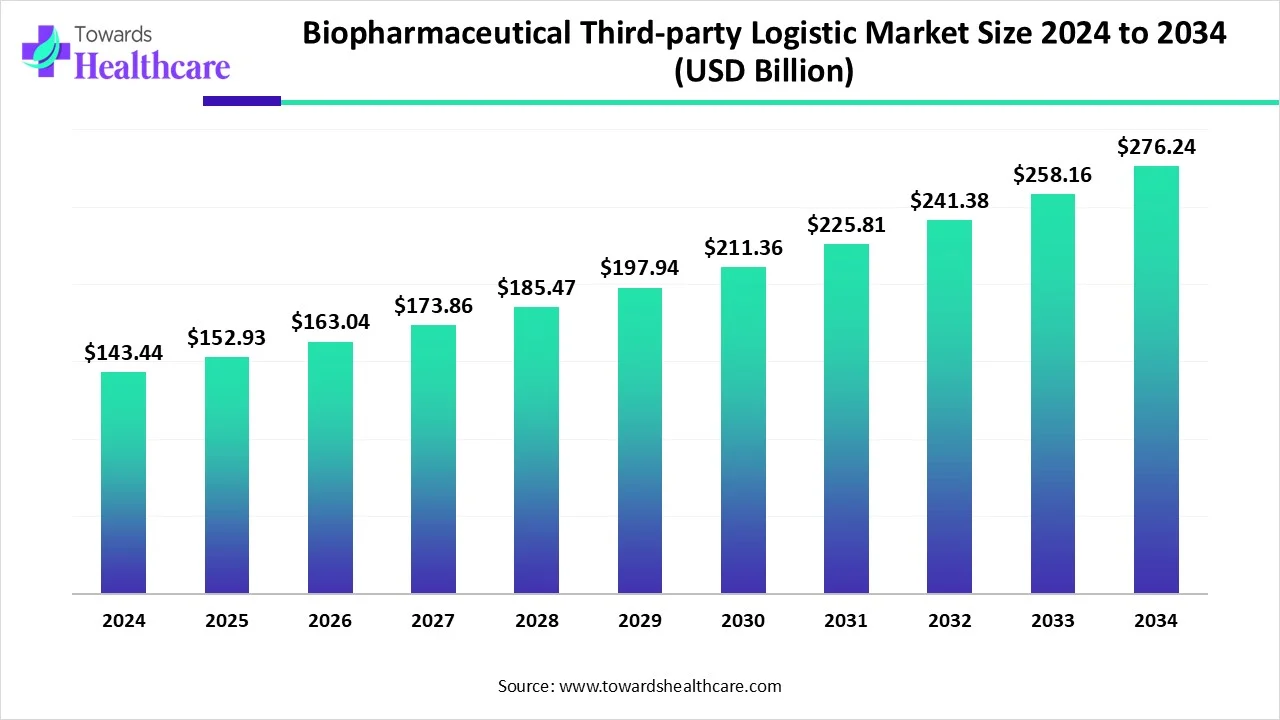

The global biopharmaceutical third-party logistics (3PL) market is on a growth path, valued at $143.44 billion in 2024, expected to rise to $152.93 billion in 2025, and projected to reach approximately $276.24 billion by 2034.

By Supply Chain

By Service Type

February 2026

February 2026

February 2026

February 2026