January 2026

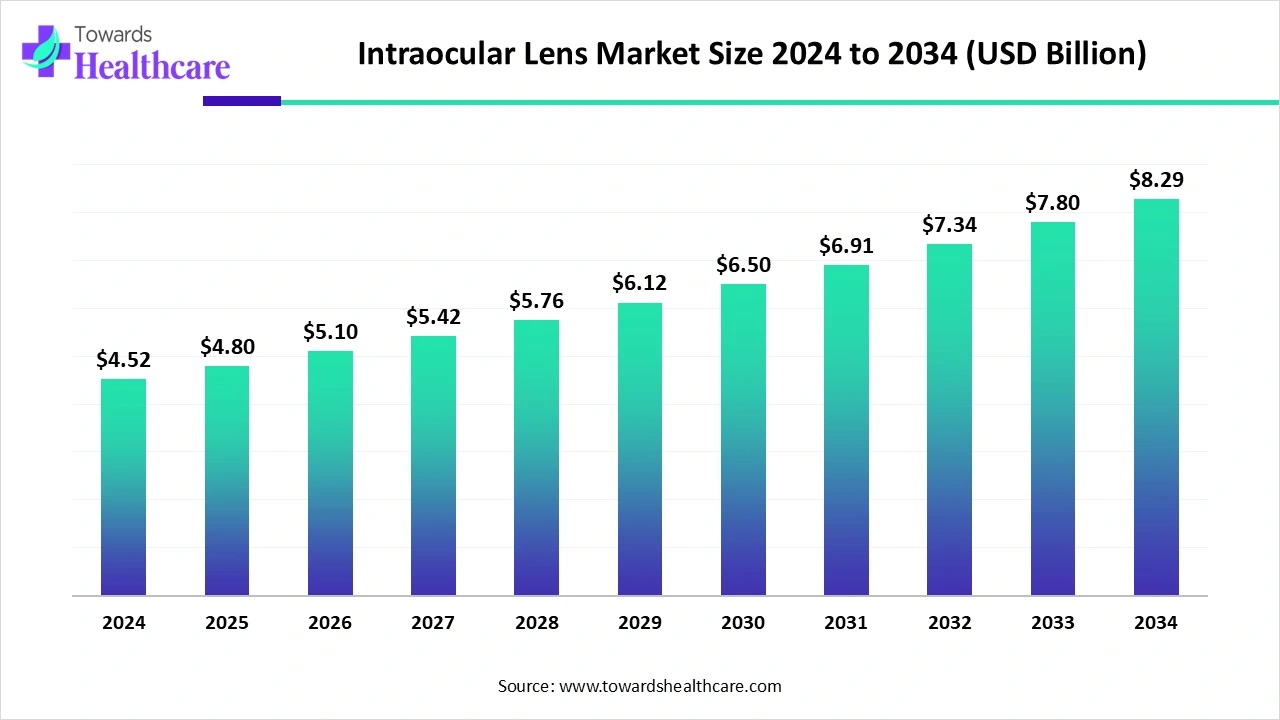

The global intraocular lens market size marked US$ 4.80 billion in 2025 and is forecast to experience consistent growth, reaching US$ 5.10 billion in 2026 and US$ 8.81 billion by 2035 at a CAGR of 6.26% from 2026 to 2035.

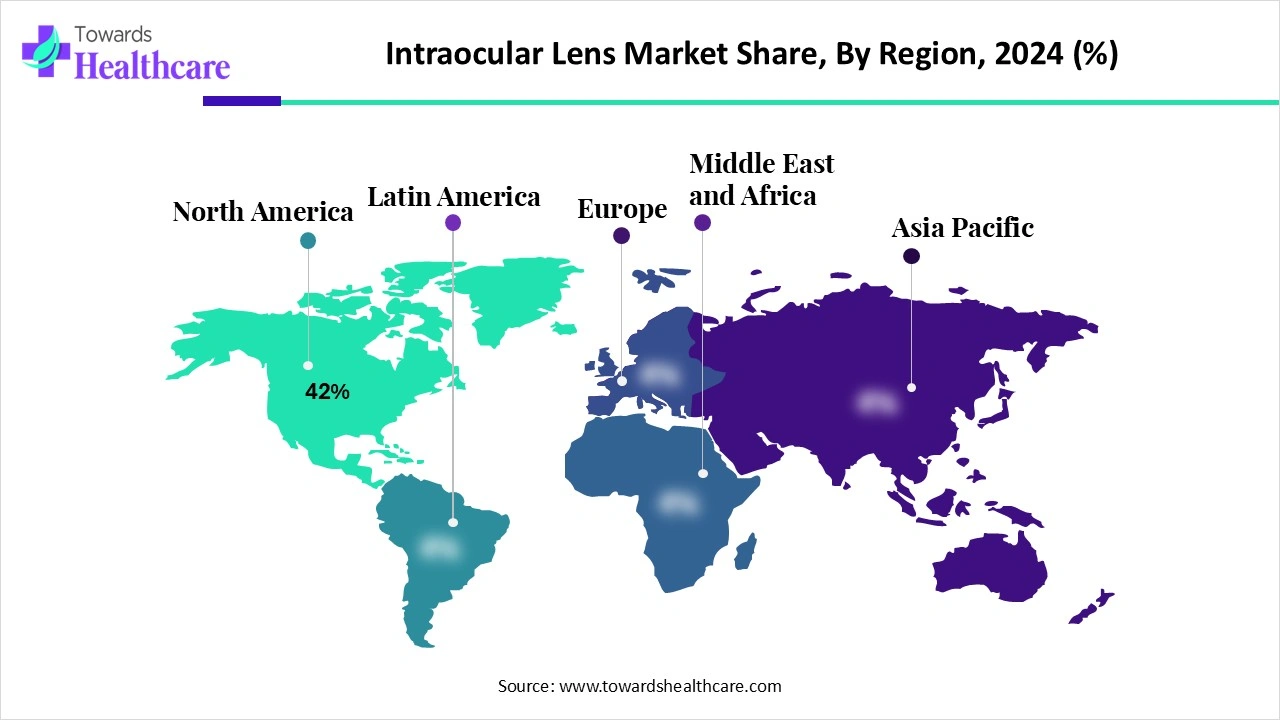

The intraocular lens market is growing rapidly, driven by the rising prevalence of cataracts, an aging population, and increasing demand for advanced vision correction. Technological innovations such as multifocal, toric, accommodative, and light-adjustable IOLs are enhancing patient outcomes and reducing dependence on glasses. North America dominates due to advanced healthcare infrastructure, high surgical volumes, and a strong presence of key manufacturers, while Asia-Pacific is the fastest-growing region, supported by a large patient pool, improved access, and rising awareness.

| Table | Scope |

| Market Size in 2026 | USD 4.8 Billion |

| Projected Market Size in 2035 | USD 8.29 Billion |

| CAGR (2026 - 2035) | 6.26% |

| Leading Region | North America |

| Market Segmentation | By Type (Optical Design), By Material, By Indication/Procedure, By End User/Channel, By Distribution Channel, By Region |

| Top Key Players | Alcon (Novartis spinout), Johnson & Johnson Vision (J&J Vision / Johnson & Johnson), Bausch + Lomb (Bausch Health), Carl Zeiss Meditec, Hoya Surgical Optics (Hoya Corporation), Rayner Intraocular Lenses, STAAR Surgical, PhysIOL, Lenstec, Oculentis, HumanOptics, SIFI S.p.A. (Italy), Medicontur, PowerVision, AcuFocus, Aaren Scientific, Care Group / Care IOLs, Rayner, BVI / Surgidev, Multiple regional & OEM contract manufacturers (India, China, Turkey) — active in generic/volume |

An intraocular lens (IOL) is a surgically implanted artificial lens placed inside the eye, typically to replace the natural lens removed during cataract surgery. It helps restore clear vision by focusing light onto the retina and can also correct refractive errors such as myopia, hyperopia, or astigmatism. The intraocular lens market covers implantable lenses used to replace the eye’s natural lens that has been removed, most commonly during cataract surgery, and also for refractive lens exchange and phakic applications.

IOLs restore focused vision and can correct refractive errors (myopia, hyperopia, astigmatism, presbyopia) using different optical designs (monofocal, toric, multifocal, extended depth-of-focus, accommodating, small-aperture). Market growth is driven by aging populations, expanding cataract surgery rates, rising demand for premium IOLs (astigmatism & presbyopia-correcting), improving surgical access in emerging markets, and technological innovation in materials and optics.

As the global population ages, cataracts, an age-related condition, are becoming more widespread, prompting a surge in cataract surgeries and consequently boosting intraocular lens demand.

For instance, the WHO estimates that over 2.1 billion people will be aged 60 or older by 2050, doubling the number from 2020. Cataracts affect 65 million people worldwide, causing vision loss in over 80% of cases. According to World Population Prospects 2024, the world's population is predicted to continue increasing for another 50 or 60 years, reaching a peak of about 10.3 billion in the mid-2080s, up from 8.2 billion in 2024, before progressively decreasing to 10.2 billion in 2100. The number of people 65 and older worldwide is expected to surpass the number of children under the age of 18 and reach 2.2 billion. By the 265 million people will be 80 years of age or older by the middle of the 1930s surpassing infants. Even countries with fast economic growth will see an increase in the senior citizenry during the ensuing three decades.

There's a growing preference for multifocal and extended depth-of-focus (EDOF) lenses, driven by patient demand for reduced dependence on glasses. For instance, in February 2024, Johnson & Johnson's TECNIS PureSee Intraocular Lenscombines clarity with low-light performance, reflecting this trend. Johnson & Johnson MedTech revealed that its TECNIS PureSee purely refractive presbyopia-EMEA offers correcting lenses. Comparable to a monofocal IOL, the TECNIS PureSee Intraocular Lens boasts a proprietary, purely refractive design that provides continuous, high-quality vision with best-in-class contrast and low-light performance.

Advancements include light-adjustable lenses (LALs), such as RxSight's LAL+, which allow for post-surgical vision refinement using UV light, offering personalized visual outcomes.

Light-Adjustable Lenses (LALs): RxSight's LAL+ lenses, introduced in 2024, allow post-surgical vision refinement using UV light, offering personalized visual outcomes.

Market expansion drives the growth of the intraocular lens market by increasing the reach and accessibility of IOL products to new regions and patient populations. Expanding into emerging markets allows manufacturers to tap into countries with rising cataract prevalence and growing awareness of vision correction procedures.

AI integration is transforming the market by enhancing precision, personalization, and surgical outcomes. Advanced AI-powered formulas, such as Hill-RBF and Ladas Super Formula, enable highly accurate Intraocular Lenspower calculations, reducing post-surgical refractive errors and improving patient satisfaction. Machine learning algorithms analyze individual patient parameters, including corneal curvature, axial length, and visual requirements, to recommend the most suitable lens type, supporting personalized vision correction.

AI also assists surgeons in preoperative planning and simulation, optimizing lens placement and alignment for toric, multifocal, and accommodative IOLs. Furthermore, AI-enabled imaging tools enhance the detection of ocular conditions, allowing timely intervention and reducing complications like posterior capsule opacification. By improving surgical efficiency, outcomes, and adoption of premium IOLs, AI is driving significant growth and innovation in the market.

Rising Cataract Prevalence & Growth in Cataract Surgeries

Cataract surgery is one of the most commonly performed surgeries globally 28 million procedures each year. With improvements in surgical techniques, such as phacoemulsification and femtosecond laser-assisted surgery, procedures have become safer, faster, and more accessible, further driving Intraocular Lens adoption.

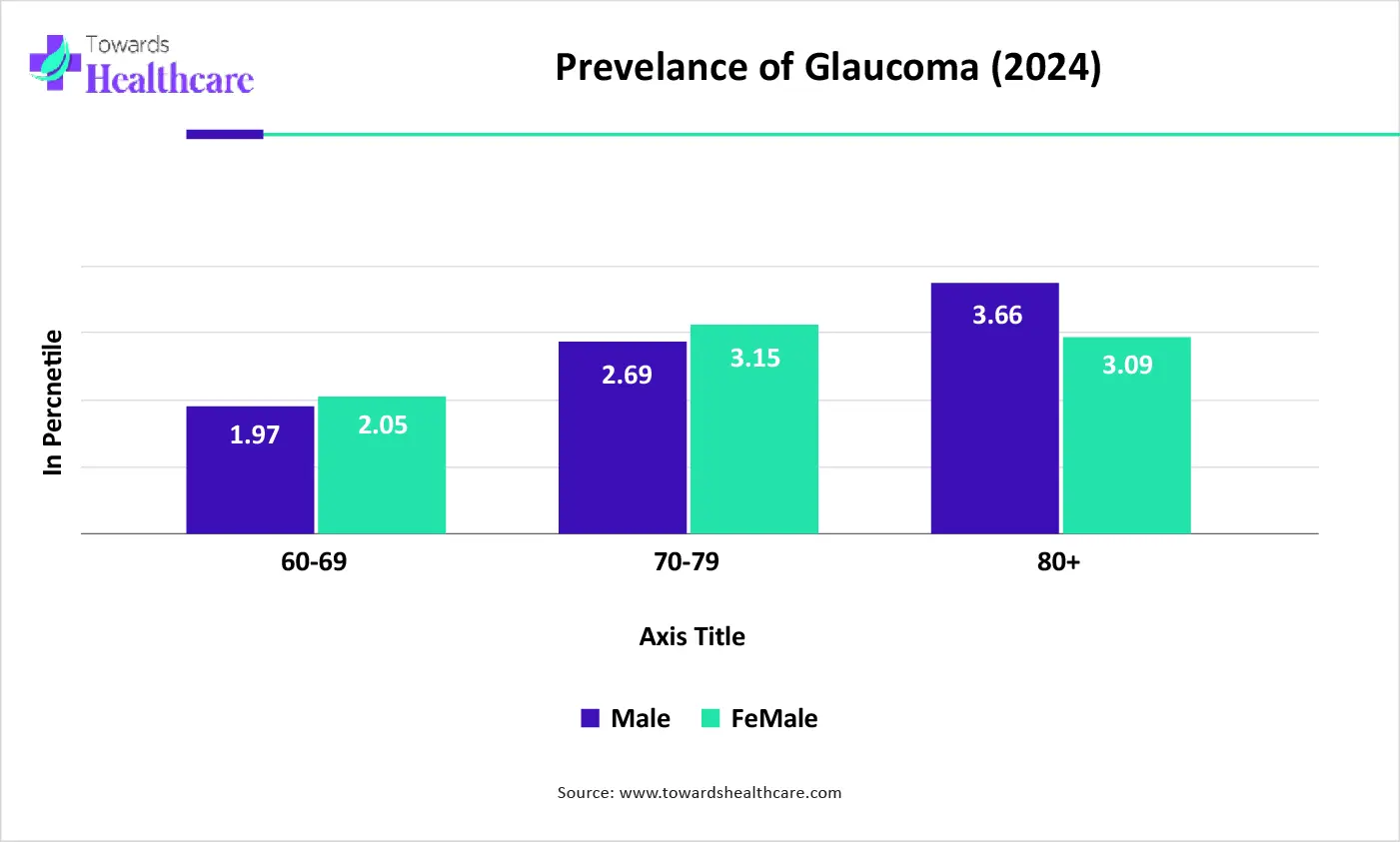

The above statistics underscore the growing global burden of glaucoma and highlight the need for enhanced awareness, early detection, and access to treatment, especially among high-risk populations. Hence, the rising prevalence of cataract has driven the growth of the intraocular lens market in the near future.

Regulatory Hurdles & Surgical Risks, and Complications

The key players operating in the intraocular lens market are facing issues due to regulatory hurdles and surgical risks. IOLs are medical devices that require strict approvals from regulatory bodies like the FDA and EMA, which can delay product launches and increase development costs. Although rare, risks like infection, lens dislocation, or posterior capsule opacification may discourage some patients from opting for surgery.

Government Initiatives & Subsidy Programs

Public initiatives and government-funded cataract elimination programs (including subsidized surgeries and insurance support) help reduce financial barriers and boost uptake of IOLs in underserved areas.

For instance,

The monofocal IOLs segment is dominant in the market due to its widespread use, proven safety, and cost-effectiveness. Monofocal IOLs are designed to provide clear vision at a single distance, typically for distance vision, making them the standard choice in cataract surgeries. Their simplicity and reliability, along with high adoption among ophthalmologists and patients, contribute to their market dominance. Additionally, insurance coverage and affordability compared to premium IOLs, such as multifocal or toric lenses, make monofocal IOLs the preferred option in both developed and developing regions, sustaining their leading position in the market.

The toric IOLs segment is estimated to be the fastest-growing in the intraocular lens market due to the rising prevalence of astigmatism among cataract patients and increasing demand for vision correction beyond standard distance focus. Toric IOLs correct both cataracts and corneal astigmatism, offering patients reduced dependence on glasses post-surgery. Advancements in lens design, improved surgical techniques, and growing awareness among ophthalmologists and patients about premium lens options are further driving adoption. Additionally, expanding healthcare infrastructure and higher disposable incomes in emerging markets are accelerating the growth of toric IOLs compared to traditional monofocal lenses.

The hydrophobic acrylic segment is dominant in the market and is anticipated to be the fastest-growing during the forecast period due to its excellent biocompatibility, low incidence of posterior capsule opacification (PCO), and superior optical clarity. Hydrophobic acrylic materials provide stable lens implantation, minimizing lens movement and reducing post-surgical complications. Their ability to resist water absorption and maintain long-term visual performance makes them highly preferred by ophthalmologists. Additionally, hydrophobic acrylic IOLs are widely available, compatible with various surgical techniques, and supported by strong clinical evidence, which ensures high adoption rates in cataract surgeries across both developed and emerging regions.

The hydrophilic acrylic segment is anticipated to grow significantly in the intraocular lens market due to its high water content, flexibility, and ease of insertion, which reduces surgical trauma and enhances patient comfort. Hydrophilic IOLs allow for smaller incisions and faster recovery, making them increasingly popular among ophthalmic surgeons. Additionally, advancements in hydrogel materials have improved optical clarity, biocompatibility, and resistance to calcification. Rising patient awareness of minimally invasive procedures, growing demand for premium lens options, and expanding cataract surgery volumes in emerging markets are further driving the rapid adoption of hydrophilic hydrogel IOLs.

The cataract surgery segment is the dominant end-use in the market due to the high prevalence of cataracts globally, particularly among the aging population. Cataract removal is the most common ophthalmic procedure, and IOL implantation is essential to restore vision after lens extraction. The procedure’s established safety, effectiveness, and accessibility drive widespread adoption of IOLs. Additionally, growing awareness of cataract treatment options, advancements in surgical techniques, and increasing healthcare infrastructure in both developed and emerging markets further reinforce the dominance of cataract surgery as the primary application segment in the IOL market.

The refractive lens exchange (RLE)/presbyopia correction segment is estimated to be the fastest-growing in the intraocular lens market due to increasing demand for vision correction among aging populations who seek freedom from glasses or contact lenses. RLE addresses presbyopia and other refractive errors by replacing the natural lens with a premium IOL, improving near, intermediate, and distance vision. Rising awareness of advanced surgical options, growing adoption of multifocal and toric lenses, and increasing disposable incomes in developed and emerging markets are driving rapid growth. Additionally, technological advancements and improved surgical outcomes are encouraging more patients to opt for presbyopia-correcting IOLs.

The hospitals & eye clinics segment is dominant in the market due to their well-established infrastructure, availability of skilled ophthalmic surgeons, and access to advanced surgical equipment required for cataract and refractive lens procedures. These facilities handle the majority of cataract surgeries, which are the primary applications for IOLs, ensuring consistent demand. Hospitals and eye clinics also offer post-operative care, patient counseling, and follow-up services, enhancing patient confidence in IOL procedures. Additionally, strong partnerships with IOL manufacturers and bulk procurement capabilities further consolidate their position as the leading end-user segment in the market.

The specialty refractive clinics segment is anticipated to be the fastest-growing segment in the intraocular lens market due to increasing demand for premium vision correction procedures, such as multifocal, toric, and presbyopia-correcting IOLs. These clinics focus on elective, high-precision surgeries and cater to patients seeking freedom from glasses or contact lenses. Advanced surgical technologies, personalized treatment plans, and targeted marketing enhance patient adoption in these settings. Additionally, rising awareness of refractive lens exchange, growing disposable incomes, and expanding urban populations in emerging markets are driving the rapid growth of specialty refractive clinics as a preferred channel for premium IOL procedures.

The direct OEM sales to hospitals & large chains segment are dominant in the market due to streamlined procurement, cost efficiency, and consistent supply. Hospitals and large eye-care chains prefer direct purchases from manufacturers to secure bulk orders, reduce intermediary costs, and ensure the timely availability of high-quality IOLs. This model supports long-term partnerships, volume discounts, and customization options. Additionally, direct OEM relationships enable better training, technical support, and product updates for surgeons, enhancing adoption rates and reinforcing the dominance of this distribution channel in the IOL market.

The online/e-procurement segment is anticipated to be the fastest-growing segment in the intraocular lens market due to increasing digitization and the convenience of purchasing directly from verified manufacturers or distributors. It enables hospitals, eye clinics, and smaller surgical centers to compare products, access competitive pricing, and place orders quickly without intermediaries. The segment benefits from growing adoption of cloud-based procurement platforms, easier inventory management, and faster delivery logistics. Additionally, rising awareness of online medical sourcing, coupled with expanding internet penetration and e-commerce infrastructure in emerging markets, is driving the rapid growth of online IOL procurement.

North America is the dominant region in the market share 42% due to a high prevalence of cataracts and other age-related ocular conditions, particularly among the aging population. The region benefits from well-established healthcare infrastructure, widespread availability of advanced ophthalmic surgical facilities, and a large base of skilled ophthalmologists. Strong awareness of eye care, high adoption of premium IOLs, and robust insurance coverage further support market growth. Additionally, ongoing technological advancements in lens design, favorable reimbursement policies, and active participation of key manufacturers in product launches and clinical studies contribute to North America’s leadership position in the global IOL market.

The U.S. dominates the North American intraocular lens market due to a high prevalence of cataracts, an aging population, and a well-established healthcare infrastructure. For instance, in the United States, a study published in JAMA Ophthalmology in 2024 found that 4.22 million adults have glaucoma, representing 1.62% of the adult population. Among individuals aged 40 and older, the prevalence rises to 2.56%, with 0.91% experiencing vision-affecting glaucoma. Notably, non-Hispanic Black adults exhibit the highest prevalence rates, at 3.15%, compared to 1.42% in non-Hispanic white adults. Advanced ophthalmic facilities, widespread insurance coverage, and high patient awareness support extensive adoption of both standard and premium IOLs. Leading IOL manufacturers frequently launch new technologies and conduct clinical studies in the U.S., further strengthening market growth.

Canada shows strong growth driven by government-supported healthcare programs, increasing cataract surgery volumes, and rising patient demand for premium IOLs. Advanced surgical centers, high physician expertise, and growing awareness of presbyopia-correcting and toric lenses contribute to market expansion.

The Asia-Pacific region is the fastest-growing in the intraocular lens market due to a rapidly aging population and the increasing prevalence of cataracts and other vision-related disorders. Expanding healthcare infrastructure, rising disposable incomes, and improving access to advanced ophthalmic surgeries in countries like China, India, and Japan are driving demand. Growing awareness of vision correction procedures, increasing adoption of premium IOLs such as multifocal and toric lenses, and government initiatives to support eye care programs further accelerate market growth. Additionally, emerging urban markets and the expansion of private eye care clinics contribute to the region’s rapid IOL market expansion.

China holds a significant share in the Asia-Pacific IOL market due to a large aging population and rising cataract prevalence. Expanding healthcare infrastructure, increasing government initiatives for eye care, and growing adoption of premium IOLs are key growth drivers. Urban areas see high demand for advanced multifocal and toric lenses.

India’s IOL market is rapidly growing due to rising cataract surgeries, increasing healthcare accessibility, and expanding private ophthalmic clinics. Growing awareness among patients about vision correction options and the affordability of modern IOLs are driving adoption, particularly in urban centers.

Japan shows steady growth, driven by a highly aging population and advanced ophthalmic surgical facilities. High adoption of premium and technologically advanced IOLs supports market expansion, along with strong insurance coverage for cataract surgeries.

Intraocular Lens (IOL) Research and Development (R&D) in-

Organizations: Alcon, Johnson & Johnson Vision, Bausch + Lomb, HOYA Surgical Optics, PhysIOL SA, Carl Zeiss Meditec, Rayner Intraocular Lenses Ltd, Hanita Lenses, Santen Pharmaceutical Co.

Companies conduct extensive clinical trials to ensure the safety and efficacy of their Intraocular Lenses products. Bausch + Lomb has a robust pipeline of Intraocular Lenses undergoing clinical evaluation. Regulatory approvals are obtained from agencies like the U.S. FDA and the European Medicines Agency (EMA).

Organizations Conducting Clinical Trials: Johnson & Johnson Vision, Alcon, Bausch + Lomb, HOYA Surgical Optics, PhysIOL SA, Carl Zeiss Meditec, Rayner Intraocular Lenses Ltd, Hanita Lenses, Santen Pharmaceutical Co.

Regulatory Bodies Approving Intraocular Lenses: U.S. Food and Drug Administration (FDA), European Medicines Agency (EMA), Pharmaceuticals and Medical Devices Agency (PMDA, Japan), Central Drugs Standard Control Organization (CDSCO, India), Health Canada, Therapeutic Goods Administration (TGA, Australia), China National Medical Products Administration (NMPA).

This stage involves the manufacturing of Intraocular Lenses using materials such as hydrophobic acrylic, silicone, and PMMA. HOYA Surgical Optics is known for its advanced manufacturing capabilities. Companies ensure that the lenses meet stringent quality standards before moving to the next stage.

After manufacturing, Intraocular Lenses are packaged in sterile conditions to maintain their integrity. Carl Zeiss Meditec employs advanced sterilization techniques to ensure product safety. Packaging is designed to protect the lenses during transportation and handling.

Post-surgical care and patient support are crucial for successful Intraocular Lenses implantation. Bausch + Lomb offers educational resources and support services to patients and healthcare providers. Companies also provide training to surgeons to ensure optimal surgical outcomes.

Tim Clover, Rayner CEO, stated that the company has read about Al's potential to change people's lives, but this is an actual instance of how technology can affect patient outcomes. The RayOne Galaxy is a cutting-edge intraocular lens technology that allows patients to see without the need for glasses. Introducing the first spiral optic lens in history. The CEO was honored that Rayner continues to lead the way in technology, working with cutting-edge surgeons from around the globe to improve the lives of millions of patients annually.

By Type (Optical Design)

By Material

By Indication/Procedure

By End User/Channel

By Distribution Channel

By Region

January 2026

January 2026

January 2026

January 2026