November 2025

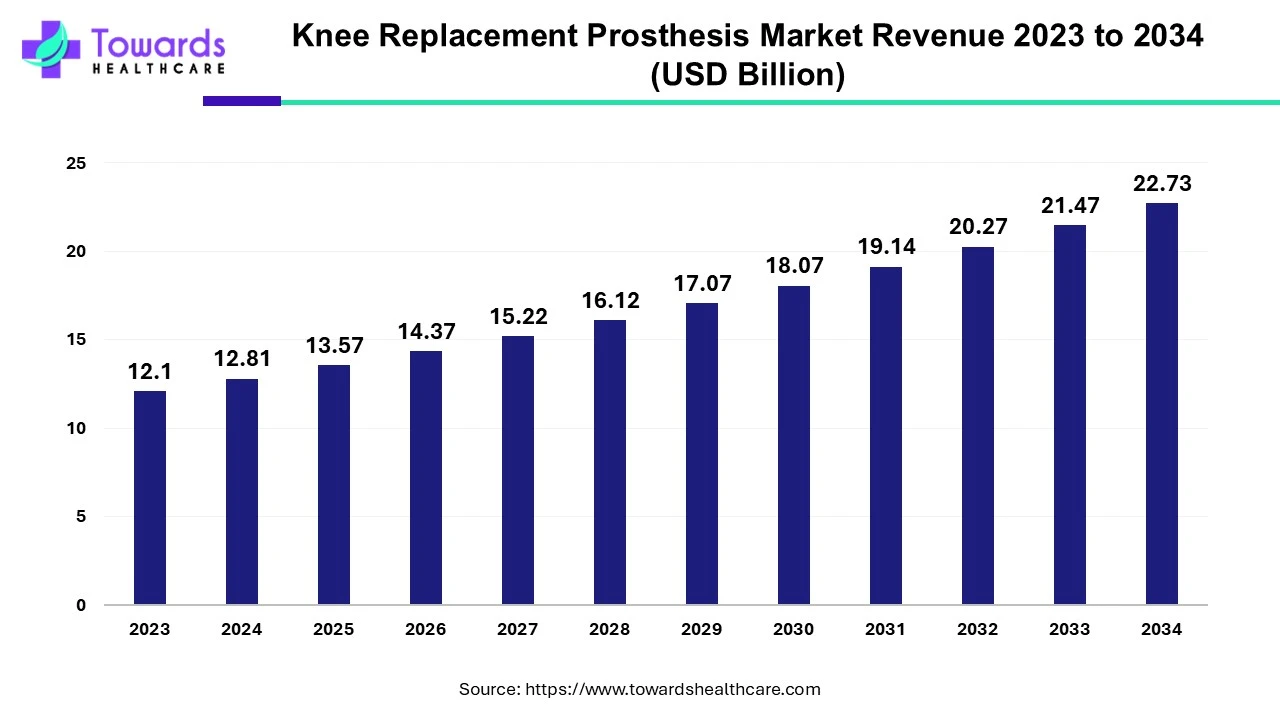

The global knee replacement prosthesis market was estimated at US$ 12.1 billion in 2023 and is projected to grow to US$ 22.73 billion by 2034, rising at a compound annual growth rate (CAGR) of 5.9% from 2024 to 2034.

Knee-replacement prostheses are artificial implants used to replace a part of the knee joint or the entire knee joint with a new replacement surgery. The purpose of doing so is to relieve knee pain or enhance mobility in patients who have arthritis or have suffered knee injuries in accidents or sports. The knee replacement prosthesis market is growing due to growing knee injuries during accidents and various sports activities. Apart from this, people who lack calcium due to improper diet are getting more prone to reduced bone density, leading to arthritis and joint pain. They may need knee replacement surgery in the future.

| Company Name | Funding Got in 2024 |

| Osteal Therapeutics | US$ 50 million |

| restor3D | US$ 70 million |

| SLAM Orthopedic | US$ 2.15 million |

| Miach Orthopedics | US$ 20 million |

| Nanochon | US$ 40 million |

The table provides a list of different start-ups that received funding for various products. The funding will promote the development of knee replacement prostheses or surgeries, which will, in turn, promote the growth of the knee replacement prosthesis market.

Technological advancement is a continuous procedure, and it is also happening in the knee replacement prosthesis market. Various technologies are being used in the market, such as sensor technology, artificial intelligence, minimally invasive surgeries, robotic surgeries, and remote monitoring. Applications like ‘mymobility’ are being developed to track the recovery process, increasing patient satisfaction. Artificial intelligence helps analyze knee conditions and develop personalized prosthetics. All these advancements are improving patient satisfaction by reducing recovery time and better surgery results. People in the future, with these advancements, are going to opt for knee replacement surges, which will help the market to grow.

For instance,

Knee replacements are highly useful for mobility, but the cost associated with the surgery is high, which is why not everyone can afford them. In the U.S., the average cost of knee replacement can range between US$ 15,000 to US$ 75,000 depending on the type of surgery, complications, and the material used. From diagnosis, analysis, treatment, and monitoring to the recovery process, a lot of effort and various professionals are involved in providing multidisciplinary care.

The future is driven by the use of 3D printing technology to develop state-of-the-art knee replacement prostheses. The 3D printing technology has emerged as an effective technique in several fields, including dentistry, neurosurgery, orthopedics, and traumatology. It enables researchers to design and manufacture custom prostheses tailored to a person’s anatomy. It is a cost-effective technique and reduces wastage, saving the time of researchers. It eliminates the need for bulk manufacturing, requiring fewer raw materials. The development of cost-effective 3D printing machines enhances their widespread utilization.

For instance,

North America dominated the knee replacement prosthesis market in 2023. Growing healthcare expenditure, technological advancements, innovation, and initiatives by key market players and government organizations drive the market in North America. Organizations are integrating AI and machine learning in research and development to make better and more affordable knee implants. The region also has a lot of skilled professionals, which is why a lot of people work in the region for surgeries.

The U.S. makes a major contribution to the knee replacement prosthesis market. The U.S. has advanced healthcare infrastructure and skilled professionals who provide quality care to patients. According to data from the 2023 Annual Report, 3,149,042 primary and revision hip and knee arthroplasty surgeries were carried out between 2012 and 2022; primary knee arthroplasty accounted for the bulk of these procedures (51.0%), and primary hip arthroplasty (33.4%). Women made up the majority of the procedures recorded (58.5%). Additionally, as outpatient arthroplasty operations have become more prevalent, the number of cases conducted in ambulatory surgical centers (ASCs) has continued to rise. The number of arthroplasty operations recorded by ASCs increased by 84% this year, reaching almost 42,000 treatments in 2022.

Asia Pacific is expected to grow at the fastest rate during the forecast period. The knee replacement prosthesis market in the Asia Pacific is growing due to the growing geriatric population in the region. Some of the countries with the largest population are in the Asia Pacific. The oldest population in the world is found in China. The number of individuals over 65 in 2023 was 216.76 million, which is more than 15.4% of the entire population and significantly higher than the global average of 10%. The United Nations Population Fund's 2023 India Ageing Report predicted that between 2022 and 2050, the number of individuals over 80 will increase at a pace of about 279%, with widowed and heavily dependent elderly women making up the majority. Government statistics indicated that the number of senior persons in Japan increased by 20,000 between September 2023 and 36.25 million, making up a record-high 29.3 percent of the population.

For instance,

Europe is expected to grow at a considerable CAGR in the knee replacement prosthesis market in the upcoming period. The rising prevalence of orthopedic disorders and the increasing adoption of advanced technologies drive the market. Government organizations launch initiatives to create awareness about early detection and effective treatment of orthopedic disorders among the general public. The increasing investments and collaborations also contribute to market growth.

According to a recent study report, the incidence of knee dislocations accounts for 0.44 to 0.54 per 100,000 inhabitants in Germany. The increasing number of knee replacements augments market growth. In the UK, approximately 74,082 knee replacement procedures were conducted, amongst whom 97.8% were beyond 50 years. 54.9% of knee replacements were carried out on females and 45.1% were carried out on males. The European Action Towards Better Musculoskeletal Health by the European Union has developed strategies to prevent musculoskeletal problems and aims to reduce the future burden in Europe.

Latin America is expected to grow significantly in the knee replacement prosthesis market during the forecast period. The growing incidence of osteoarthritis and joint degradation in Latin America is increasing the demand for knee replacement prosthesis. Moreover, the aging population is also contributing to the same. At the same time, the increasing medical tourism is increasing the demand for affordable and high-quality knee prosthetics. These are being supported by the government investments and other policies. Thus, this is promoting the market growth.

By type, the tibial component segment held the largest share of the market and is estimated to grow at a significant rate during the forecast period. This segment dominated because tibial component is essential for knee replacement prosthesis. One surgical technique for realigning the knee joint is a high tibial osteotomy. This operation preserves damaged joint tissue, which may help some patients with knee arthritis avoid or postpone the need for a partial or total knee replacement.

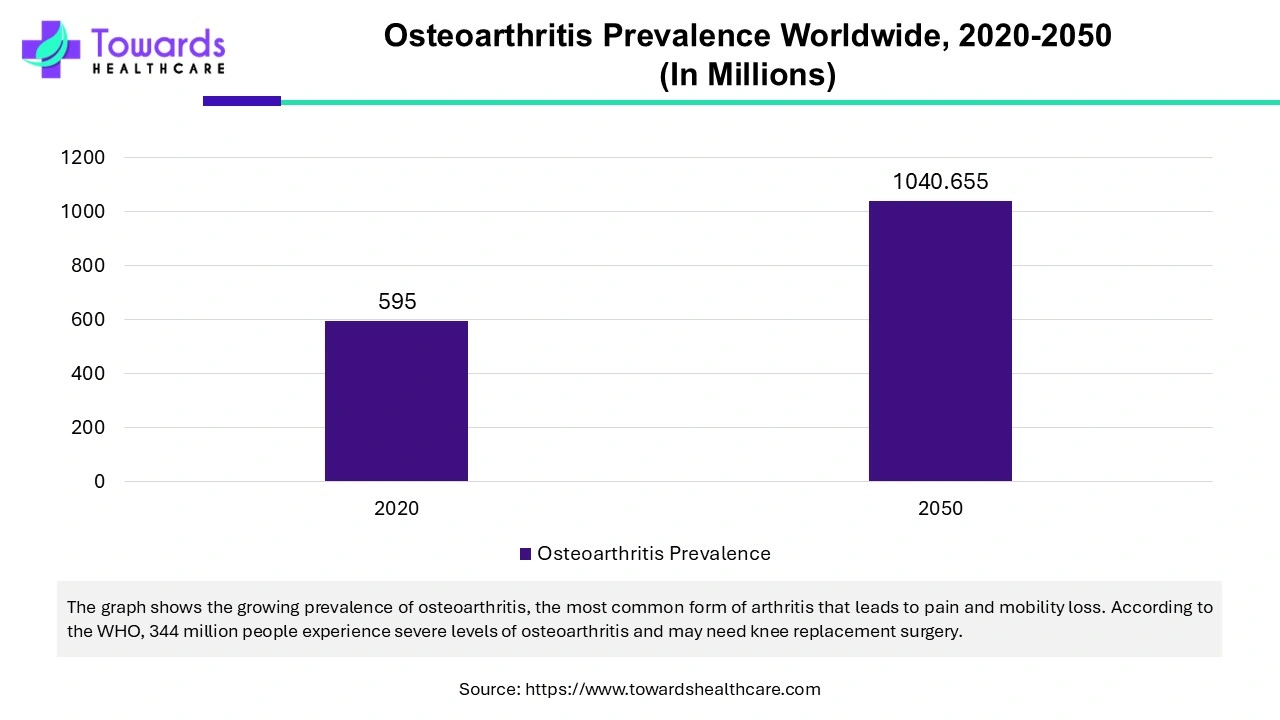

By application, the osteoarthritis segment led the market. This segment dominated as the most prevalent kind of arthritis in adults is osteoarthritis, which is characterized by persistent pain and decreased mobility. Osteoarthritis is most common after the age of forty, and its frequency rises sharply with age. Osteoarthritis is the most prevalent reason for knee replacement surgery, and as the number of cases rises, so will the need.

The sports injuries segment is anticipated to grow at a significant rate during the forecast period. Knee injury is very common in sports, especially when the sport requires a lot of jumping and running. Many athletes end up getting knee replacements due to these injuries.

For instance,

Corey Perine, Chief Operating Officer at Maxx Orthopedics, commented that the IDE application approval for the Freedom Total Knee System with PEEK Optima Femoral Component is a monumental achievement and the culmination of more than a decade of collaboration between Maxx Orthopedics and Invibio. He is satisfied to see the next step in the development of this innovation reach fruition. (Source: Cision PR Web)

In July 2025, Chief of the Sports Medicine Institute at the Hospital for Special Surgery in New York City, MD, Riley J. Williams III, said that their osteochondral allografts defined their career. In certain cases, the biology fails and is no longer a good choice for a patient, and it's too early for any kind of joint replacement. Thus, an implant that resurfaces the joint, offering a lasting, durable, and predictable solution, adhering to the joint preservation principles, will be provided by them for bridging the gap between the joint replacement and biologic options.

Read further to see how top players are transforming the Knee Replacement Prosthesis Market at: https://www.towardshealthcare.com/companies/knee-replacement-prosthesis-companies

In March 2025, full-year financial results were announced by Medacta Group SA. The adjusted EBITDA margin showed constant currency of 28.0%, reflecting an excellent performance by the company. Moreover, the 19.4% to Euro 160.2 million growth was reported for adjusted EBITDA. Euro 590.6 million, up 16.2% in c.c.2, was noted for FY 2024 revenue. Additionally, a distribution of CHF 0.69 per share with a rise of 25.5% yoy was proposed by the board of directors. Furthermore, for 2025, the company is expecting a revenue growth between the range of 13% to 15% in c.c. and a 27% rise in the adjusted EBITDA margin, where the Parcus acquisition will be included.

In February 2025, the Q4 2024 Earnings Call was released by Zimmer Biomet Holdings Inc. (ZBH). A 4.3% revenue growth, that is $2.23 billion, was observed along with a constant currency of 4.9%. 5% growth, which was reported for constant currency revenue for the fourth quarter of 2024. The prior year showed the adjusted earnings per share (EPS) $2.20, where this year showed a growth upto $2.31. The free cash flow and adjusted operating margin for this year were reported to be $1.055 billion and 30.8%, respectively. Moreover, the knees, hips, and S.E.T. net sales reported a growth of 5.6%, 4%, and 8.4%. Additionally, for the fourth quarter of 2024, the adjusted tax rate was noted to be 17.5%.

Moreover, as per the 2025 financial guidance, 3% to 5% constant currency revenue growth, along with $8.15 to $8.35 adjusted EPS, was observed. $526 million was reported to be cash and cash equivalents at the end of the quarter.

By Type

By Application

By Region

November 2025

November 2025

November 2025

November 2025