March 2026

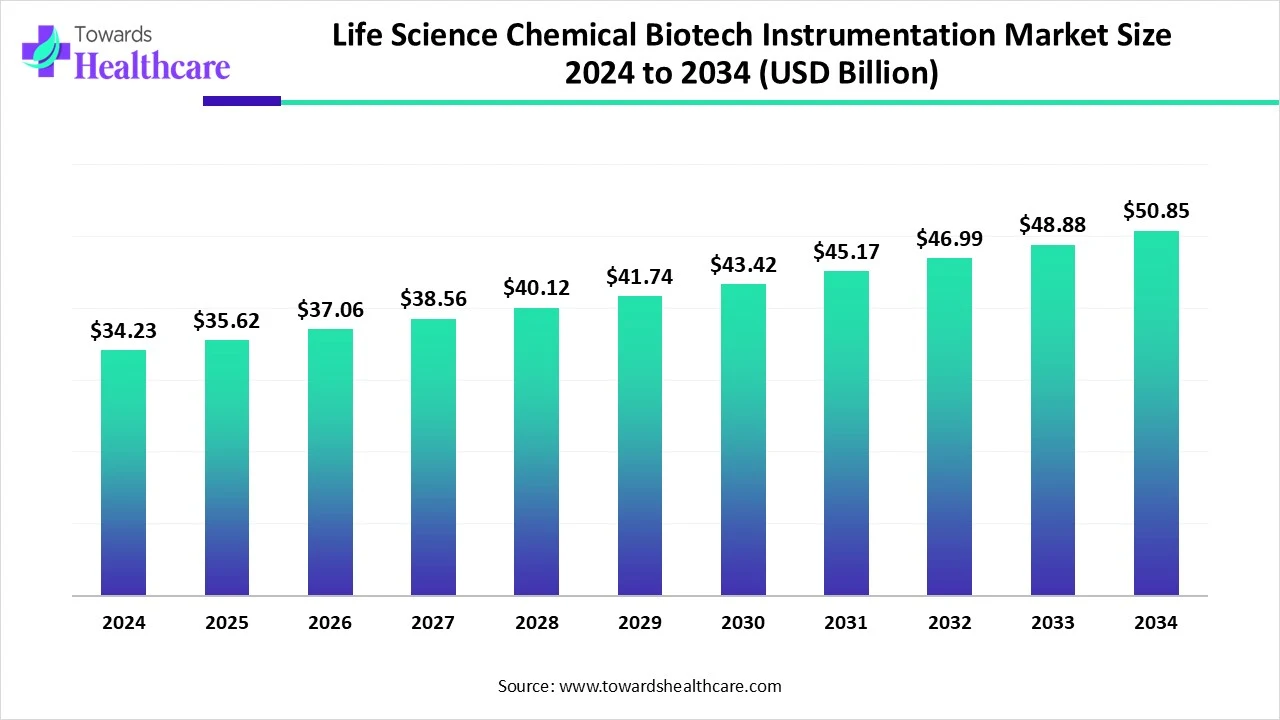

The global life science chemical biotech instrumentation market size is calculated at USD 34.23 billion in 2024, grew to USD 35.62 billion in 2025, and is projected to reach around USD 50.85 billion by 2034. The market is expanding at a CAGR of 4.05% between 2025 and 2034.

The life science chemical biotech instrumentation market is primarily driven by the growing research and development activities. Numerous companies invest heavily in their R&D activities to yield novel products and strengthen their market position. Prominent players collaborate to access advanced technologies and specialized infrastructure. AI and ML in instruments improve the efficiency and accuracy of data analysis and enable real-time monitoring. The future looks promising, with advancements in technology including lab-on-chip, modular automation, and miniaturization.

| Metric | Details |

| Market Size in 2025 | USD 35.62 Billion |

| Projected Market Size in 2034 | USD 50.85 Billion |

| CAGR (2025 - 2034) | 4.05% |

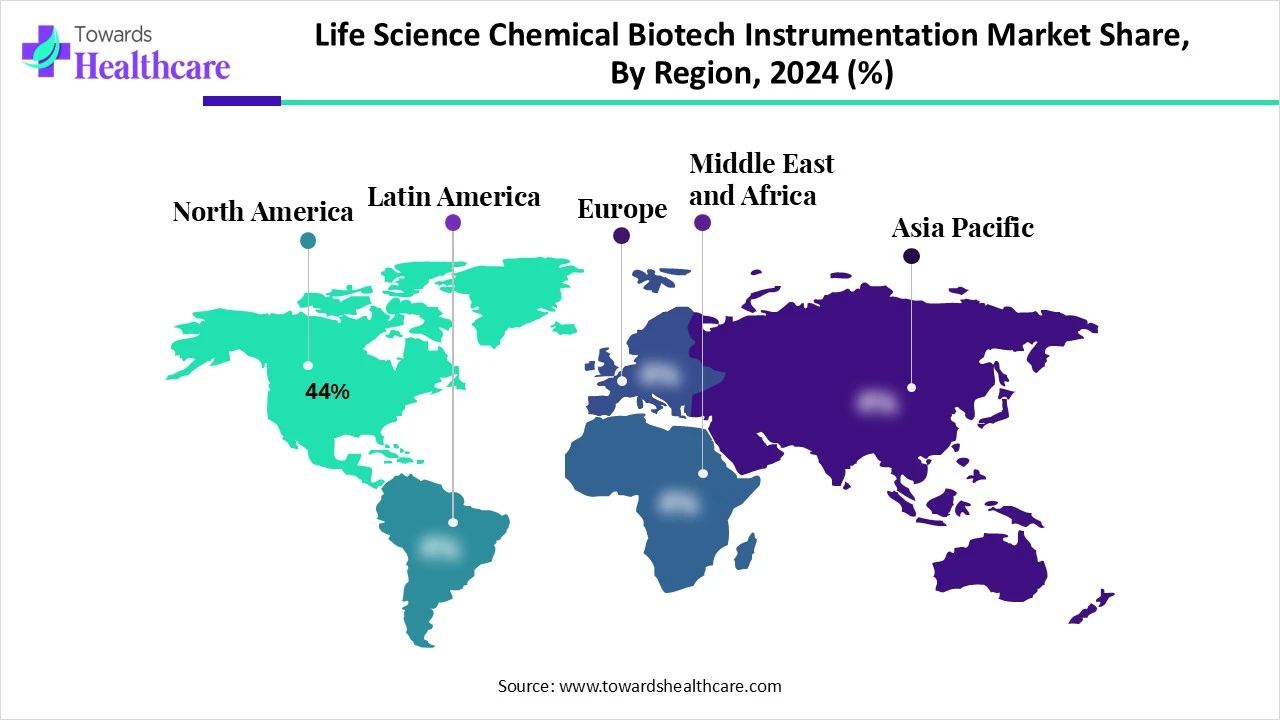

| Leading Region | North America share by 44% |

| Market Segmentation | By Product Type, By Technology, By Application, By End-User, By Region |

| Top Key Players | Thermo Fisher Scientific Inc., Agilent Technologies Inc., Danaher Corporation (Beckman Coulter, SCIEX, Cytiva), Waters Corporation, Shimadzu Corporation, PerkinElmer, Inc. (Revvity), Bruker Corporation, Merck KGaA (MilliporeSigma), Bio-Rad Laboratories, Inc., Illumina, Inc., QIAGEN N.V., GE HealthCare (Cytiva), Sartorius AG, Eppendorf SE, Oxford Instruments, HORIBA Scientific, JEOL Ltd., Tecan Group Ltd., Analytik Jena AG, Malvern Panalytical (Spectris Group) |

The market refers to a broad range of high-precision instruments and systems used in chemical analysis, biotechnology, molecular biology, and pharmaceutical R&D processes. These instruments facilitate compound identification, structural elucidation, purity analysis, process monitoring, and quality control in life sciences. Applications span across drug discovery, proteomics, genomics, metabolic profiling, cell biology, and bioprocess development. Demand is driven by biopharma innovation, personalized medicine, chemical biology convergence, and the need for regulatory-compliant analytical workflows.

Numerous factors influence market growth, including growing research and development (R&D) activities and stringent regulatory policies. The increasing investments by government and private organizations and the rising collaborations among key players boost the market. Technological advancements drive the latest innovations in instruments, potentiating their demand. The rapidly expanding life sciences sector and the increasing number of startups promote market growth.

Integrating artificial intelligence (AI) into life science instrumentation transforms different functionalities of the instrument. It can enhance the efficiency, accuracy, and reproducibility of instruments. It can automate and simplify various tasks of researchers, including sample preparation and data analysis. AI can improve data analysis, automate repetitive tasks, and optimize instrument performance. AI and machine learning (ML) algorithms can analyze vast amounts of data and identify patterns that are not visible to humans. They reduce human intervention, reducing manual errors.

Growing Research Activities

The major growth factor of the life science chemical biotech instrumentation market is the growing R&D activities in various research institutions and life science companies. The rising prevalence of chronic disorders necessitates researchers to develop novel products for their prevention, diagnosis, and treatment. The increasing market competitiveness among life science companies facilitates them to conduct research activities and expand their product portfolio, thereby strengthening their market position. In 2023, major pharmaceutical companies invested heavily in R&D, with expenditure ranging from around 14% to 50% of their revenues.

High Cost

Life science instruments for analysis and other purposes are very expensive. This limits the affordability of several companies and research institutions from low- and middle-income countries. The reduced installation of laboratory equipment restricts the market.

What is the Future of the Life Science Chemical Biotech Instrumentation Market?

The market will experience robust growth in the future, driven by the development of lab-on-chip technology, modular automation, and miniaturization. Ongoing efforts are made to scale down laboratory procedures to a chip format. This helps researchers decrease the amount of solvents and chemicals, thereby reducing wastage and overall costs. These technologies reduce the time needed to obtain test results and boost throughput. The integration of the Internet of Things (IoT) in devices enables professionals to achieve greater value and service by exchanging data with the manufacturer.

By product type, the analytical instruments segment held a dominant presence in the market in 2024. This segment dominated due to the increasing research activities and the ability to perform multiple functions. Some common examples of analytical instruments are spectrophotometers, pH meters, density meters, melting point apparatus, and chromatography instruments. These instruments are used to analyze products, including raw materials, intermediates, and finished products. They are essential for different fields, including pharmaceutical, biotechnology, food, and agriculture.

By product type, the bioprocess & fermentation monitoring instruments segment is expected to grow at the fastest CAGR in the market during the forecast period. The growing demand for biologics and microbiological research boosts the segment’s growth. Bioreactors, online analyzers, and pH probes are used for manufacturing biologics. These instruments assess the real-time conditions of manufacturing biologics, enabling manufacturers to make proactive decisions. They are available in various sizes, making them suitable for small-scale and large-scale production.

By technology, the chromatography segment held the largest revenue share of the market in 2024. This is due to the ability to isolate compounds based on their properties. Chromatography is a widely used tool due to its affordability and diverse applications. It is used to detect impurities in samples and characterize active pharmaceutical ingredients (API). It enables precise separation, analysis, and purification of a wide range of compounds and requires minimal sample volumes. The growing new drug discovery research and the development of fixed-dose formulations augment the segment’s growth.

By technology, the real-time bioprocess monitoring & PAT tools segment is expected to grow with the highest CAGR in the market during the studied years. The increasing development of biologics as therapeutics, such as cell and gene therapies, monoclonal antibodies, and vaccines, promotes the use of real-time bioprocess monitoring & PAT tools. The integration of AI and ML in instruments enables real-time monitoring of the process from remote locations. This allows researchers or manufacturers to make appropriate decisions.

By application, the drug discovery & development segment held a major revenue share of the market in 2024. This is due to the need for novel drugs with enhanced efficacy and lower side effects. The rapidly changing demographics and the growing geriatric population facilitate researchers to develop personalized medicines based on patients’ genetic profiles. Analytical instruments are integral parts of drug discovery research. They play a crucial role in identifying, characterizing, and quantifying drug molecules, as well as assessing their pharmacokinetic properties.

By application, the bioprocessing & biomanufacturing segment is expected to expand rapidly in the market in the coming years. The demand for bioprocessing is increasing with the growing development of biologics. The burgeoning biotech sector and the rising need for targeted treatments favor the segment’s growth. Bioprocessing & biomanufacturing require advanced instruments, including in-line and at-line monitoring tools, for efficient manufacturing of biologics. They are used to reduce sample error and increase throughput.

By end-user, the pharmaceutical & biotechnology companies segment led the global market in 2024. The segmental growth is attributed to favorable infrastructure and suitable capital investments. This enables companies to install advanced instruments for various applications. Pharma & biotech companies have skilled professionals to conduct research activities and operate complex instruments. The growing demand for developing novel products propels the segment’s growth.

By end-user, the industrial R&D segment is expected to witness the fastest growth in the market over the forecast period. Industrial R&D focuses on advancing technologies, products, and processes to optimize performance, improve safety, and boost efficiency. Life science instruments are used for various applications, including bio-catalysis and synthetic biology. The advent of real-time sensors and data analytics revolutionizes industrial R&D processes.

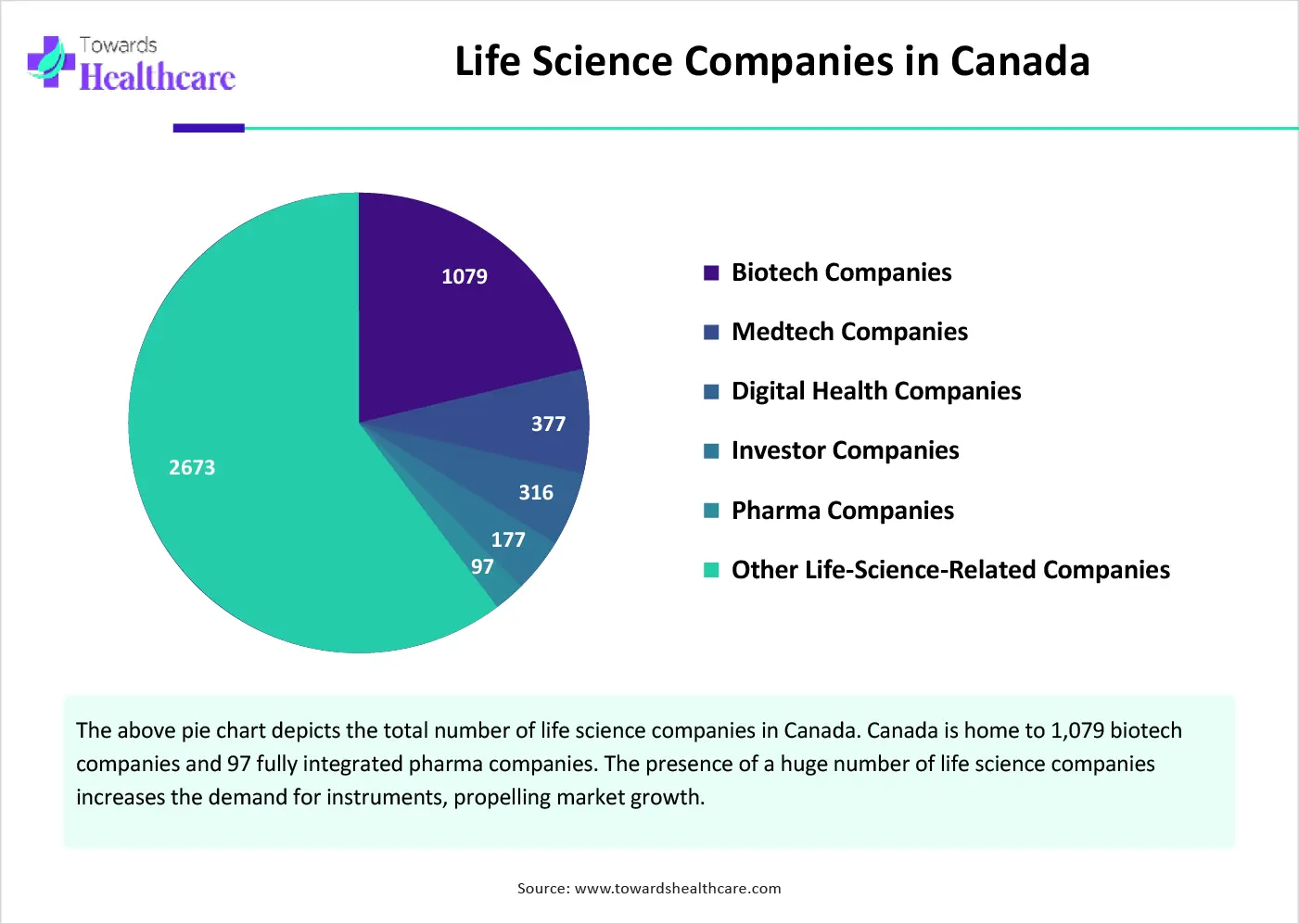

North America dominated the global market share by 44% in 2024. The availability of state-of-the-art research and development facilities, robust biopharma infrastructure, and increasing R&D investments are the major growth factors of the market in North America. Research institutions and companies in North America adopt cutting-edge technologies to deliver advanced tools and products. Countries like the U.S. and Canada have high regulatory compliance standards, necessitating the use of life science instruments.

Key players, such as Bruker Corporation, Thermo Fisher Scientific, and Bio-Rad Laboratories, are the major contributors to the market in the U.S. It is estimated that 40% of new biotech companies originate from NIH-funded academic research. The U.S. Commission recommended that the federal government invest $15 billion to bolster the country’s leadership in the biotech sector and to prevent China from taking the lead. (Source - First Word Pharma)

The Canadian life sciences sector is an important contributor to Canada’s innovation economy, creating medical innovations. The Ontario government is building a strong, competitive, and resilient life sciences sector for the long term. This strategy will establish Ontario as a global manufacturing and life sciences hub. (Source - Ontario)

Asia-Pacific is expected to grow at the fastest CAGR in the life science chemical biotech instrumentation market during the forecast period. The growing research and development activities, along with the increasing number of clinical trials, potentiate the demand for life science, chemical, and biotech instruments. Countries such as India, China, South Korea, and Singapore are focusing on pharma manufacturing and biotech innovation, thereby fostering market growth. The burgeoning life sciences sector and the increasing number of life science startups favor market growth.

India is emerging as a global leader in laboratory and analytical instruments through innovation, entrepreneurship, and strategic partnerships. According to Volza data, India is the top exporter of scientific instruments globally. It exported around 1,180 shipments of scientific instruments from October 2023 to September 2024, mainly to the U.S., South Korea, and Belgium. (Source - Volza)

Singapore is home to around 464 life science companies. The Singapore government invested about S$25 billion in research, innovation, and enterprise (RIE) under the RIE2025 plan. An additional S$3 billion was planned to be invested in 2024 to deepen capabilities in new growth areas. (Source - Agency for Science Technology and Research)

Europe is expected to grow at a notable CAGR in the life science chemical biotech instrumentation market in the foreseeable future. The rising adoption of advanced technologies and the growing emphasis on positioning Europe as a global leader in the life sciences sector boost the market. Government organizations launch initiatives and provide funding for developing novel therapeutics. The increasing collaborations and mergers & acquisitions among key players bolster market growth. The presence of key players also contributes to market growth.

Germany has the highest number of pharmaceutical production sites in Europe and the second-highest in the world after the U.S. The Germany Trade & Invest report states that the life science sector accounts for 2.9% of the country’s total GDP. This is in accordance with significant investment from domestic and foreign investors.

The French government and the pharmaceutical industry have pledged to increase spending on medical R&D by 10% over the next three years. Currently, the pharma industry in France spends about 12% of its turnover on R&D. (Source - European Commission)

The global life science market size is calculated at US$ 88.2 billion in 2024, grew to US$ 98.63 billion in 2025, and is projected to reach around US$ 269.56 billion by 2034. The market is expanding at a CAGR of 11.82% between 2025 and 2034.

Renato Giacobbo Scavo, CEO of CrestOptics, commented on collaboration with Leica Microsystems that Leica provides a wide array of unique and powerful solutions for the imaging market, including the THUNDER platform, Adaptive immersion, and many more. By partnering with Leica, the company brings solutions to the spinning disk microscopy market, allowing customers to leverage the benefits of these technologies in parallel with CICERO’s confocal imaging capabilities. (Source - News Medical Life Science)

By Product Type

By Technology

By Application

By End-User

By Region

March 2026

January 2026

January 2026

January 2026