January 2026

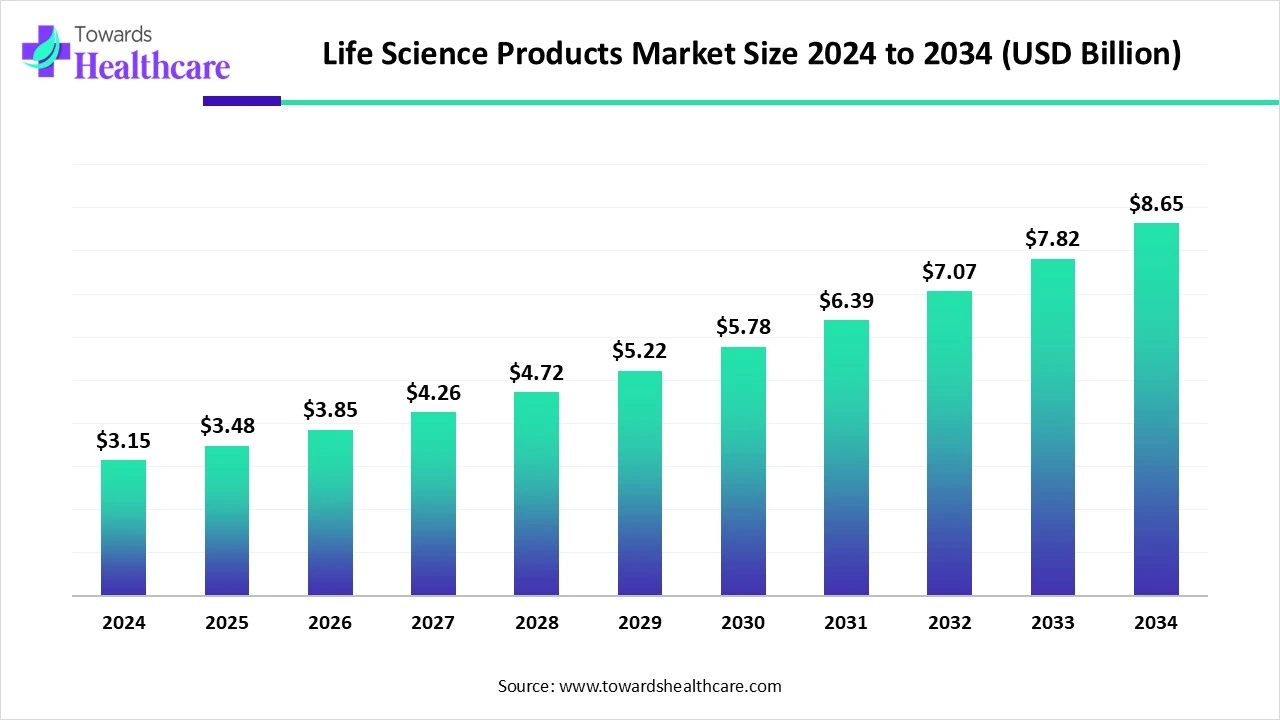

The global life science products market size is calculated at US$ 3.15 billion in 2024, grew to US$ 3.48 billion in 2025, and is projected to reach around US$ 8.65 billion by 2034. The market is expanding at a CAGR of 10.56% between 2025 and 2034.

The demand for life science products is increasing globally, due to growing innovations in the healthcare sector, as well as due to increasing research. At the same time, to reduce errors and enhance the workflow, the use of AI is also increasing, leading to the development of new solutions. New collaborations among the companies are enhancing research and development, as well as their launches. This, in turn, is growing the demand for life science products in different regions. Thus, this is promoting the market growth.

| Metric | Details |

| Market Size in 2025 | USD 3.48 Billion |

| Projected Market Size in 2034 | USD 8.65 Billion |

| CAGR (2025 - 2034) | 10.56% |

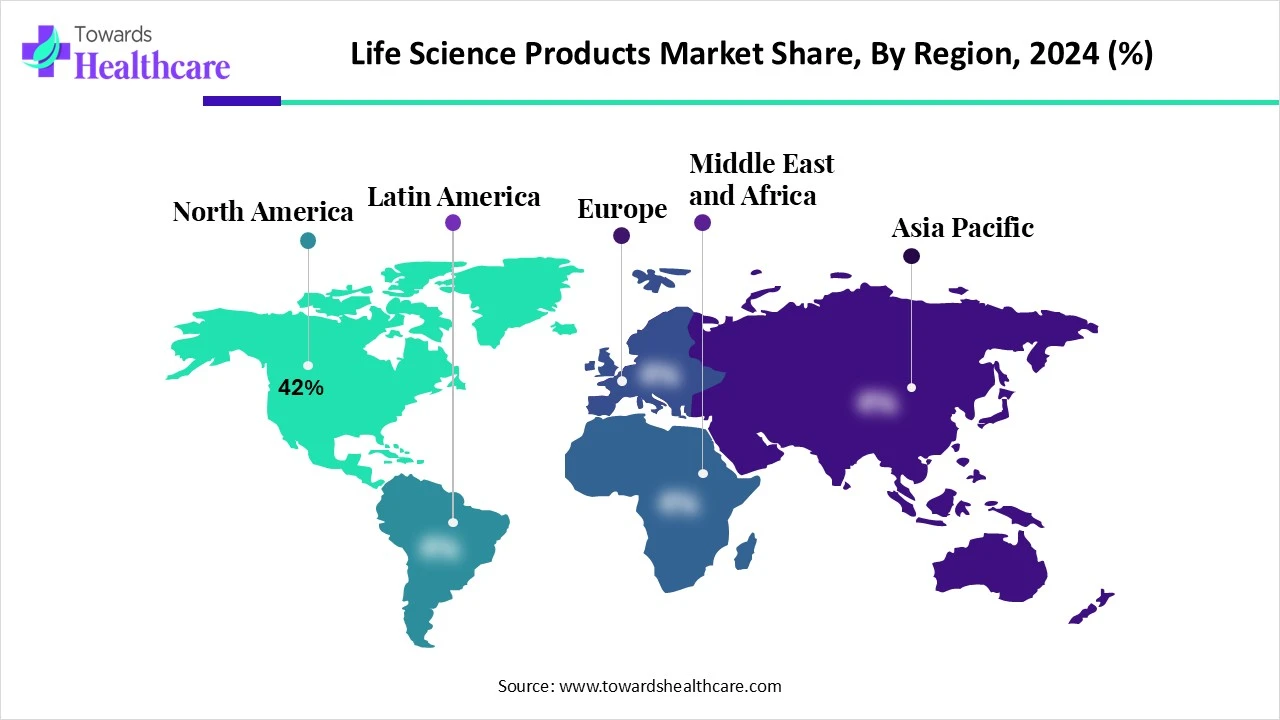

| Leading Region | North America share by 42% |

| Market Segmentation | By Product Type, By Technology, By Application, By End User, By Region |

| Top Key Players | Thermo Fisher Scientific, Merck KGaA, Danaher Corporation, Cytiva, IDT, Agilent Technologies, Bio-Rad Laboratories, Western blotting, and cell biology products, Qiagen – Sample prep, PCR, NGS, and bioinformatics, PerkinElmer (Revvity) – Omics, imaging, and automation platforms, BD Biosciences – Flow cytometry and cell analysis solutions, Eppendorf AG – Lab instruments and consumables, Promega Corporation – Genomics and molecular biology kits, Bruker Corporation – Proteomics and structural biology instruments, GE Healthcare Life Sciences (Cytiva) – Bioprocessing tools, Waters Corporation – LC-MS and analytical chemistry tools, Illumina Inc. – Genomics instruments and sequencing kits, 10x Genomics – Single-cell and spatial biology products, Takara Bio – Molecular biology and cell therapy tools, Lonza Group AG – Cell culture, bioprocessing, bioscience tools, Avantor/VWR – Lab reagents, equipment, and supply chain services, Sigma-Aldrich (MilliporeSigma) – Chemicals, reagents, assay kits, Oxford Nanopore Technologies – Real-time sequencing devices |

The Life Science Products Market comprises a wide range of consumables, instruments, reagents, and analytical tools used in biological research, drug development, diagnostics, and biomanufacturing. It supports end-to-end workflows across molecular biology, cell biology, microbiology, genomics, proteomics, as well as bioproduction.

The market is driven by increasing R&D investments in biotech and pharma, growing adoption of precision medicine, and demand for next-gen analytical and automation platforms. Moreover, the strategic expansion of CROs/CDMOs and academic research funding globally is further accelerating demand.

The use of AI is increasing in the life science products market. It is used in the identification of various disease targets. At the same time, it helps in minimizing the toxic effects by identifying the side effects of the drugs being developed. For accurate diagnosis and monitoring, they are being used in various diagnostic tools. It detects the genetic mutations and their risk, thus are used in genomic sequencing platform development. It also helps in providing accurate insights, promoting research and development.

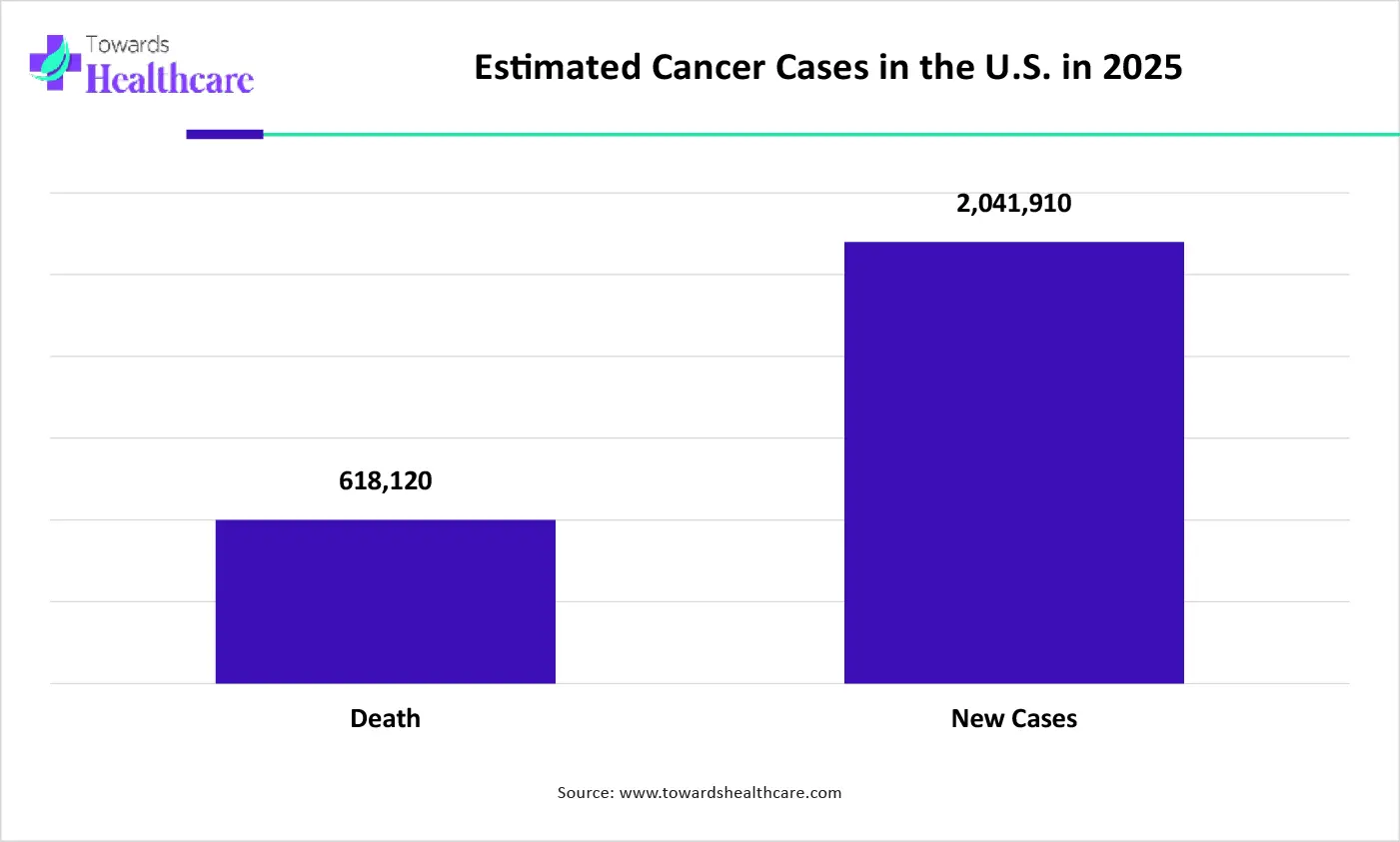

Increasing Chronic Diseases

The growing incidence of chronic diseases is increasing the demand for early diagnosis and effective treatment options. This, in turn, increases the demand for life science products. The development of cell and gene therapies, as well as personalized next-generation therapies, is also contributing to the same. Similarly, for early diagnosis and monitoring of disease conditions, various kits are also being developed. Moreover, the increasing research also contributes to the same. Thus, all the factors drive the life science products market growth.

Regulatory Barriers

The companies developing life science products have to compile all the data and prepare for submission, making the process time-consuming. Additionally, the time period of the clinical trial may also be lengthy. Moreover, the products developed may not always be approved. Thus, all these factors discourage the development of life science products and other innovations.

Growing Prenatal Diagnostics

The increasing occurrences of diseases and growing awareness are increasing the demand for prenatal and children's diagnostics. It helps in detecting the presence of any genetic disorders, due to which effective treatment options can be provided at an early stage. Moreover, the risk of complications can also be avoided. Therefore, various next-generation sequencing platforms are being developed with the help of advanced technologies. This is enhancing the diagnosis of the infants, providing accurate insights. Thus, this promotes the life science products market growth.

For instance,

By product type, the reagents & consumables segment led the market with approximately 40% share in 2024. The demand for the reagents & consumables was high as they were required repeatedly. They were important in genomics and drug discovery. Thus, they were used by industries, which contributed to the market growth.

By product type, the software & services segment is expected to show the fastest growth rate at a notable CAGR during the forecast period. The use of software & services is increasing in genomics and proteomics for data interpretation. Similarly, they are used in clinical trials. Hence, their use is increasing to enhance productivity.

By technology type, the cell biology products segment held the dominant share in the market in 2024. The cell biology products were crucial in the research and development process. Moreover, they were increasingly used in the development of cell therapies. At the same time, the growth in the development of single-cell analysis also promoted their use.

By technology type, the bioprocessing & biomanufacturing inputs segment is expected to show the highest growth during the forecast period. The growing development of recombinant proteins and monoclonal antibodies is increasing their demand. Similarly, the growth in cell and gene therapies and vaccines is also driving the same. They are also used to enhance the purity and yield of the products.

By application type, the drug discovery & development segment held the largest share of approximately 35% in the market in 2024. There was a growth in the use of life science products due to rising drug discovery & development. Moreover, the growth in the precision and personalized treatment options and the development of diagnostic tools also contributed to the same. This enhanced the market growth.

By application type, the biopharmaceutical manufacturing segment is expected to show the fastest growth rate during the forecast period. Due to the growing use of vaccines and monoclonal antibodies, the biopharmaceutical manufacturing are increasing the use of life science products. Furthermore, the growing collaborations with CROs are also increasing their use.

By end user, the pharmaceutical & biotechnology companies segment led the global market in 2024. The life science products were mainly used by these companies. The growth in the development of treatment and diagnostic approaches increased their demand. Thus, this promoted the market growth.

By end user, the contract research organizations (CROs) segment is expected to show the highest growth during the forecast period. The growing research and development, along with outsourcing, is increasing the use of life science products by CROs. The growing clinical trials is also increasing their use. Moreover, the growing collaboration with companies is also contributing to the same.

North America dominated the life science products market share by 42% in 2024. The research universities present in North America are well-developed. Moreover, the presence of advanced equipment and technologies encouraged the research, resulting in the growth of life science products use. Thus, this contributed to the market growth.

The pharmaceutical as well as biotechnology industries in the U.S. are developing various diagnostic approaches for different diseases. Thus, with the help of advanced technologies, their development is enhanced. Moreover, the growing approval for the next-generation therapies is also promoting their development.

The institutes and the industries of Canada are focusing on research and development, which in turn is increasing the demand for life science products. These developments are supported by the NIH funding. Additionally, the growing use of diagnostic and treatment approaches is also increasing their use.

Asia Pacific is expected to host the fastest-growing life science products market during the forecast period. Asia Pacific is experiencing a rise in investment in biotech R&D. This is increasing the demand and the use of life science products. Thus, this enhances the market growth.

China has a large population, due to which the risk of chronic disease incidence increases. This, in turn, drives the development of new diagnostic and treatment approaches. Thus, the use of life science products is increased. Additionally, the growing research for the same is also increasing its demand.

The healthcare sector in India is expanding, which is increasing the investment in the biotech R&D. This, in turn, increases the production of generic medications as well as medical devices. Hence, the growing innovations in healthcare are increasing the use of life science products.

Europe is expected to grow significantly in the life science products market during the forecast period. The industries present in Europe are well-developed, along with a robust research and development infrastructure. Thus, the growing innovations are driving the demand for life science products. This is promoting the market growth.

The industries, as well as the startups in Germany, are developing cutting-edge innovations. At the same time, the growing chronic diseases in the adult population are increasing the demand for early screening and effective treatment options. Thus, these factors are increasing the use of life science products.

The industries in the UK are contributing to various research and development on chronic diseases. This is increasing the clinical trials and production. Additionally, they are engaging in eco-friendly manufacturing practices. Thus, these developments are increasing the demand for life science products.

The global life science market size is calculated at US$ 88.2 billion in 2024, grew to US$ 98.63 billion in 2025, and is projected to reach around US$ 269.56 billion by 2034. The market is expanding at a CAGR of 11.82% between 2025 and 2034.

By Product Type

By Technology

By Application

By End User

By Region

January 2026

December 2025

November 2025

December 2025