December 2025

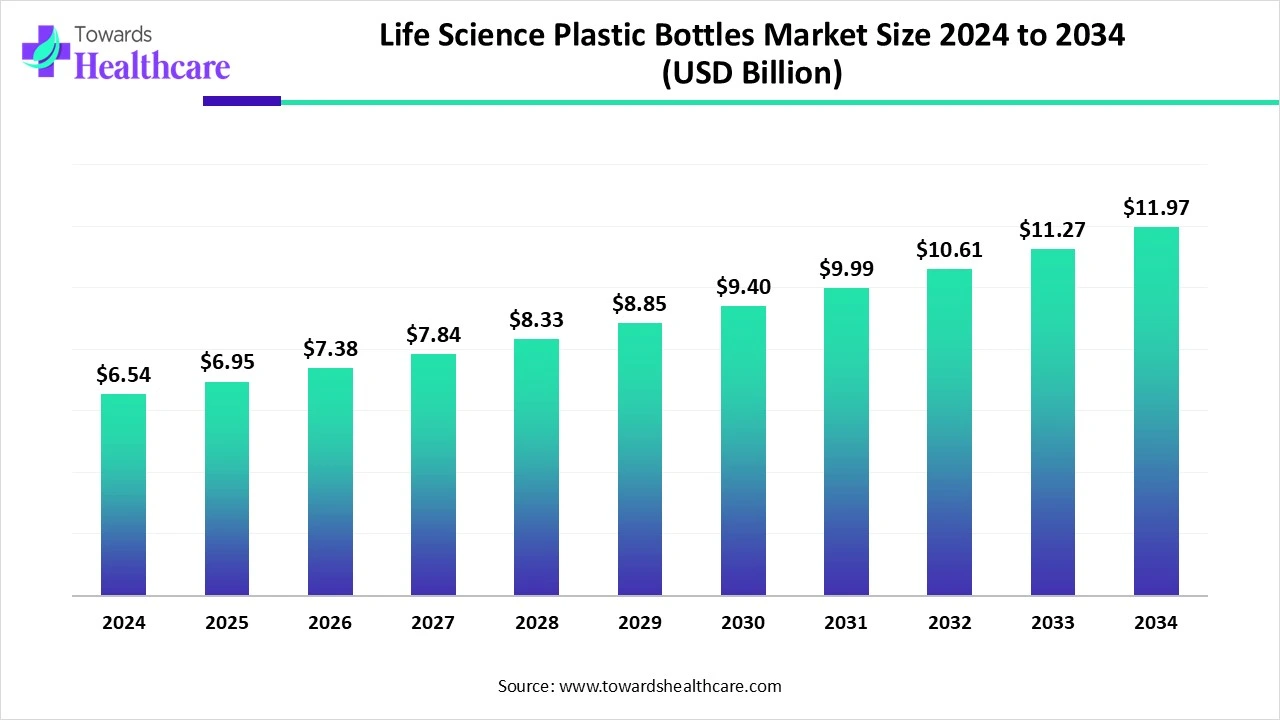

The global life science plastic bottles market size is calculated at USD 6.54 billion in 2024, grew to USD 6.95 billion in 2025, and is projected to reach around USD 11.97 billion by 2034. The market is expanding at a CAGR of 6.24% between 2025 and 2034.

The life science plastic bottles market is primarily driven by growing research and development activities. Research activities are supported by funding from the government and private organizations. Plastic bottles in life science are used for sample storage, chemical storage, and transportation. The growing need for environmental sustainability promotes market growth. The future looks promising, with advancements in manufacturing technology through the integration of AI/ML.

| Metric | Details |

| Market Size in 2025 | USD 6.95 Billion |

| Projected Market Size in 2034 | USD 11.97 Billion |

| CAGR (2025 - 2034) | 6.24% |

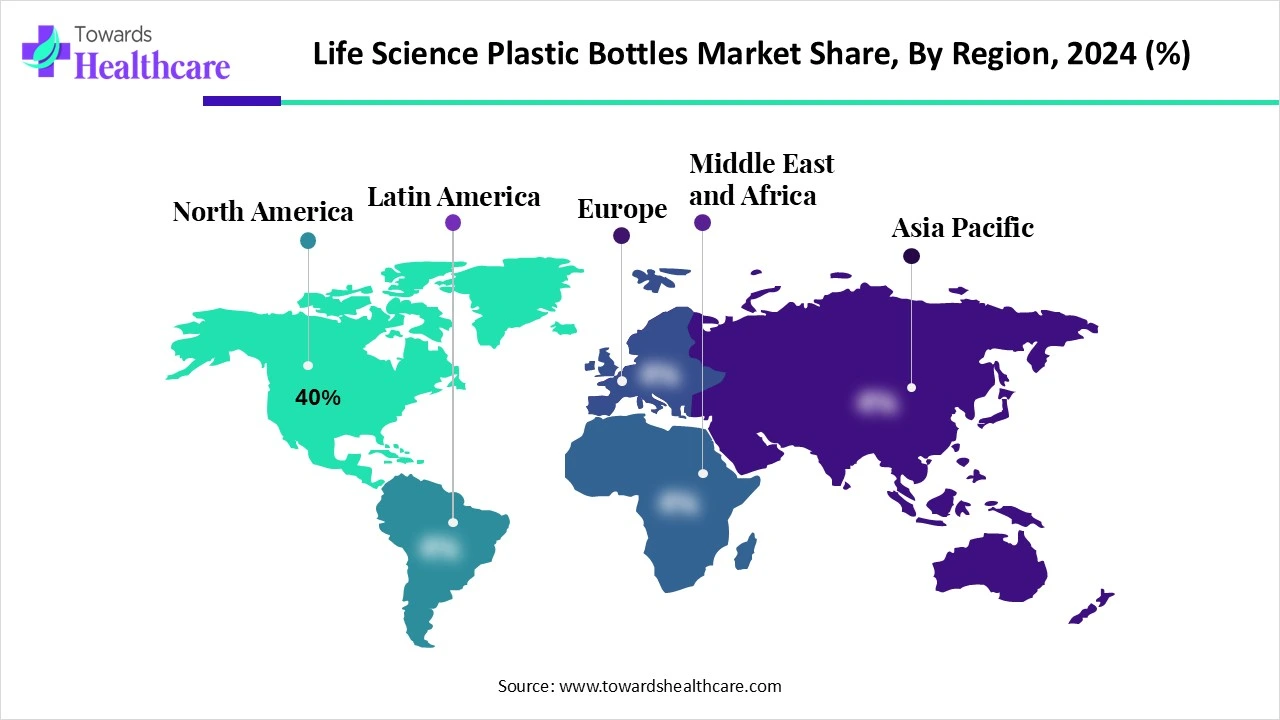

| Leading Region | North America share by 40% |

| Market Segmentation | By Material Type, By Capacity, By Application, By End-User, By Distribution Channel, By Region |

| Top Key Players | Thermo Fisher Scientific – Nalgene™ lab bottles, Corning Inc. – PYREX® and Axygen® bottles, DWK Life Sciences, Eppendorf AG, Sartorius AG, Merck KGaA (MilliporeSigma), VWR International (Avantor Inc.), Greiner Bio-One, Nalgene (brand under Thermo), Cytiva (Danaher Corporation) – ReadyMate™ container, Saint-Gobain Life Sciences, BrandTech Scientific, SciLabware Ltd. – Azlon plasticware, Kautex Textron GmbH, Beckton, Dickinson and Company (BD Life Sciences), Cole-Parmer (part of Antylia Scientific), Foxx Life Sciences – EZBio® single-use bottles, NEST Scientific USA, Tarsons Products Ltd. (India), JET BIOFIL |

The market refers to the segment of laboratory consumables used in pharmaceutical, biotechnology, academic, and clinical research settings for the safe storage, transport, and dispensing of liquids, buffers, reagents, and samples. These bottles are made of high-grade polymers such as polyethylene (PE), polypropylene (PP), polyethylene terephthalate (PET), and fluoropolymers and offer characteristics like chemical resistance, sterility, transparency, autoclavability, and leak-proof handling.

The market is driven by increasing R&D investments, bioproduction scale-up, and the shift to single-use labware. The growing demand for environmental sustainability potentiates the use of eco-friendly plastics. Government and private organizations support R&D activities through funding. Technological advancements drive the latest innovations in manufacturing technology. Stringent regulatory policies necessitate researchers to use bottles that are safe and free from contamination.

Artificial intelligence (AI) can transform the manufacturing of plastic bottles by automating the process, enhancing efficiency and reproducibility. It can facilitate the large-scale production of plastic bottles, saving costs and time. AI and machine learning (ML) algorithms can monitor bottle transport and identify drug dosage. AI enhances the precision in sorting and identifying plastic types, reducing contamination rates and improving process efficiency. It can also streamline the supply chain of plastic bottles across different geographical locations for life science institutions and companies.

Demand for Safe Containers

The major growth factor of the life science plastic bottles market is the need for safer containers. Bottles made from plastic have a minimum risk of material leakage into the product, thereby preventing cross-contamination. Researchers must follow the regulatory compliance developed by regulatory agencies of their respective nations regarding the use of safer containers. Plastics protect pharmaceutical products from moisture, oxygen, and other environmental factors that could degrade their quality and efficacy. They are more cost-effective, offering advantages in transportation, storage, and handling.

Disposal of Laboratory Wastage

In the life science sector, plastic waste is a major concern among researchers and regulators. Laboratories generate a significant amount of waste, including single-use bottles. Plastics are harmful to health and pose safety risks.

What is the Future of the Life Science Plastic Bottles Market?

The market future is promising, driven by the growing need for environmental sustainability. Government organizations launch initiatives to promote sustainable practices in the life science sector. The World Health Organization (WHO) has launched the “UN 2020-2030 Strategy for Sustainability Management” to encourage environmentally friendly practices. This necessitates researchers to use eco-friendly and biodegradable plastic materials. Bio-based plastics, including PLA and PHA, are renewable to decrease fossil fuels. Researchers are developing novel plastic materials or a combination of plastics with high recyclability and lower energy consumption.

By material type, the polyethylene (PE) segment held a dominant presence in the market in 2024. This segment dominated due to their chemical inertness and high strength. High-density polyethylene (HDPE) and low-density polyethylene (LDPE) are the most common types of PE materials. They offer greater chemical resistance and are cost-effective. HDPE bottles are used in laboratories where the risk of breakage or chemical spills needs to be minimized. LDPE bottles are used for dispensing liquids. Due to their greater strength, they are widely used for buffers and bulk reagents.

By material type, the polyethylene terephthalate (PET/PETG) segment is expected to grow at the fastest CAGR in the market during the forecast period. PET has gained significance over few years as an ideal packaging material for healthcare products. It offers enhanced transparency and visibility. Plastic bottles made from PET are lightweight and durable, ensuring medications are well-protected. It saves the cost of transportation and handling plastic bottles. They are highly flexible and can be molded into various shapes and sizes.

By capacity, the 250-500 mL segment held the largest revenue share of the market in 2024. This is due to the increasing research activities at a small scale in laboratories. Plastic bottles with a capacity of 250-500 mL are mainly used for storing buffers, reagents, and media. They are used for storing cell cultures and solvents. These bottles can be easily transported and withstand temperatures of all ranges.

By capacity, the 1000 mL segment is expected to grow with the highest CAGR in the market during the studied years. The increasing manufacturing of healthcare products at an industrial scale favors the use of plastic bottles with a 1000 mL capacity. The growing demand for large quantities of reagents at pilot and industrial levels boosts the segment’s growth. These bottles provide complete sterility for a large quantity of chemical and biological samples.

By application, the reagent storage & dispensing segment contributed the biggest revenue share of the market in 2024. This segment dominated because plastic bottles offer chemical resistance and easy dispensing. Reagent bottles are required to store blood tests, ELISA, and urinalysis. They hold solvents and active ingredients for drug formulation and testing, and are used in quality control tests. The increasing use of reagents in genomics and proteomics research, such as PCR, protein purification, and immunoassays, promotes the segment’s growth.

By application, the bioproduction & bioprocessing segment is expected to expand rapidly in the market in the coming years. The growing demand for biologics and the increasing manufacturing of biologics augment the segment’s growth. Manufacturers focus on the development of cell and gene therapy, monoclonal antibodies, and vaccines. They require proteins, DNA/RNA, and other reagents. The increasing demand to store biological samples in regulatory-compliant containers and a sterile environment facilitates the use of plastic bottles for bioprocessing.

By end-user, the pharmaceutical & biotechnology companies segment held a major revenue share of the market in 2024. The segmental growth is attributed to favorable research infrastructure and suitable capital investments. The increasing competition among key players encourages them to develop novel products and conduct advanced research activities, potentiating the demand for plastic bottles. The rising number of startups also contributes to the segment’s growth.

By end-user, the life science packaging distributors segment is expected to witness the fastest growth in the market over the forecast period. Life science packaging distributors ensure product integrity, sterility, and compliance. The burgeoning e-commerce sector enables distributors to deliver high-quality plastic bottles to different companies and institutions. They offer benefits regarding leak-proof closures and tamper-evident properties.

By distribution channel, the direct sales segment led the global market in 2024. Direct sales of plastic bottles to manufacturers and researchers bypass the traditional wholesaler chain. Direct sales offer benefits by providing cost-effective bottles to consumers. It leads to enhanced interaction with customers directly, building personal relationships, and understanding the specific needs of consumers.

By distribution channel, the online platforms segment is expected to show the fastest growth over the forecast period. The increasing use of smartphones and the rapidly expanding e-commerce sector propel the segment’s growth. Consumers can directly order plastic bottles of different sizes from online platforms. Distributors can also benefit by delivering bottles directly to consumers across various geographical locations.

North America dominated the global market share by 40% in 2024. The presence of key players, increasing R&D investments, and the availability of state-of-the-art research and development facilities are the major growth factors of the market in North America. Research institutions and companies have increased demand for lab consumables. Government organizations launch initiatives to develop novel pharmaceuticals and biologics favors market growth.

As of 2023, there were 2,655 pharmaceutical companies in the U.S. Additionally, there were 2,435 biotechnology companies as of 2024. Key players, such as Thermo Fisher Scientific, Cytiva, and Becton, Dickinson and Company, are the major contributors to the market in the U.S.

Canada has the 8th largest world market in the pharmaceutical sector. It contributes to 2.2% of the global share in pharmaceutical sales. Canada is home to more than 2,000 biotech companies. The Canadian Government announced an investment of $89.5 million over five years (2023-2027) to establish Canada’s Drug Agency (CDA) and an additional $34.2 million annually to support the Canadian Agency for Drugs and Technologies in Health (CADTH). (Source - Canada’s Drug Agency)

Asia-Pacific is expected to grow at the fastest CAGR in the life science plastic bottles market during the forecast period. The presence of a suitable manufacturing infrastructure potentiates biopharma manufacturing in Asia-Pacific countries. This allows foreign investors to set up their manufacturing infrastructure in countries like China, India, and South Korea. The Asia-Pacific region is emerging as a center for clinical research due to its affordability and favorable infrastructure.

The biopharmaceutical sector in China is expanding at a faster rate. It has become the largest supplier of APIs to Southeast Asian countries like Indonesia, Thailand, and Vietnam. The National Medical Products Administration (NMPA) offers incentives, including accelerated regulatory approvals for locally produced drugs and potential subsidies to help companies expand in China.

The Indian government actively supports the indigenous manufacturing of pharmaceuticals and biologics through the “Make in India” policy. India is the third-largest destination for biotechnology in Asia-Pacific. India has the highest number of pharmaceutical manufacturing facilities globally. Major companies like Bharat Biotech, Merck, and Biocon have their manufacturing facilities in India.

Europe is expected to grow at a notable CAGR in the life science plastic bottles market in the foreseeable future. The growing research and development activities and favorable government support drive the market. Government agencies have launched initiatives to encourage environmental sustainability in the healthcare sector. The burgeoning life sciences sector and the increasing number of startups also foster market growth. The rising collaborations among key players enable excellence in scientific research and laboratory management.

Germany has around 721 companies related to pharmaceuticals, biotech, and medtech & digital health. These healthcare industries accounted for approximately EUR 34 billion in revenue in 2024-25. According to the EY Startup Barometer Germany report, the biotech sector recorded the highest venture capital investment within the health sector. (Source - EY Startup)

The UK is home to more than 3,500 life science startups. According to the BioIndustry Association, UK biotech attracted £2.24 billion in venture capital funding in 2024, an increase of 337% from 2017. (Source - Bio Industry) Life science companies significantly contributed to the UK economy by attracting £3.7 billion in investment in 2024. (Source - Bio Industry)

The global life science market size is calculated at US$ 88.2 billion in 2024, grew to US$ 98.63 billion in 2025, and is projected to reach around US$ 269.56 billion by 2034. The market is expanding at a CAGR of 11.82% between 2025 and 2034.

Rafael Auras, Professor at the Michigan State University School of Packaging, commented that plastics offer lower assessed potential environmental impacts in terms of global warming potential, mineral resource use, fossil energy consumption, and water scarcity. As new and better data emerge, stakeholders and policymakers can make decisions that help deliver more sustainable outcomes across different stages of a product’s lifecycle. (Source - MSU Today)

By Material Type

By Capacity

By Application

By End-User

By Distribution Channel

By Region

December 2025

December 2025

November 2025

October 2025