October 2025

The multiple AAV serotypes market is experiencing significant expansion, with projections indicating a revenue increase reaching several hundred million dollars by the end of the forecast period, spanning 2025 to 2034. This growth is driven by emerging trends and strong demand across key sectors.

The growth of instances of cancer, hemophilia, muscular dystrophy, and other rare genetic disorders, along with huge investments in biotechnology and advanced techniques used in the AAV process by China, Japan, and South Korea, is impacting the overall global multiple AAV serotypes market. Moreover, the market is stepping into engineered/hybrid serotypes, particularly the leading CDMOs are fostering these approaches. The widespread adoption of diverse AAV serotypes in the development of innovative and more effective therapies, specifically gene therapies, is fueling the broader demand for AAV serotypes.

The multiple AAV (Adeno-Associated Virus) serotypes market refers to the development, production, and application of various AAV serotypes used in gene therapy and research. The availability of multiple AAV serotypes enhances therapeutic precision, drives innovation in capsid engineering, and expands the range of clinical applications in genetic diseases, rare disorders, and regenerative medicine.

AAV vectors are among the most widely used delivery vehicles due to their low pathogenicity, ability to transduce both dividing and non-dividing cells, and their ability to induce long-term gene expression. Different AAV serotypes (e.g., AAV1–AAV9, AAVrh10, engineered capsids) exhibit unique tissue tropisms, enabling targeted gene delivery for diseases affecting muscles, liver, CNS, retina, and more.

Global Expansion: Emerging advancements in AAV vector engineering, alongside escalated clinical trial activity and regulatory approvals for gene therapies, are supporting the global growth. In 2025, VectorBuilder established a 500,000 sq ft Gene Delivery campus in Guangzhou to boost its capacity for viral vectors production, including different AAV serotypes.

Major Investors: The Government of India invested ₹20,000 crore to support private sector research under the Research, Development, and Innovation (RDI) Scheme, including AAV vector production.

Startup Ecosystem: Fuse Vectors is a Danish startup that secured €4.9 million in pre-seed funding in February 2025 to highlight manufacturing bottlenecks for AAV vector production.

A prominent use of AI models is emphasized, their trained on vast datasets from deep sequencing and directed evolution experiments to anticipate the functional properties of new capsid sequences. This further allows quicker detection of capsids with expanded tissue tropism, lowered immunogenicity, and optimized transduction effectiveness.

For instance,

Advancements in Vector Engine Engineering & Broader Applications

Primarily, the global multiple AAV serotypes market is fueled by its widespread applications due to the adoption of diverse serotypes, like AAV9. This type of serotype assists in crossing the blood-brain barrier, whereas AAV2/5/8 are employed in ophthalmic and liver diseases, which further escalate the therapeutic applications of AAV vectors. Also, another driver is crucial advances in vector engineering, which comprises computational design and capsid shuffling, that enable evolution of newer, highly specific, and engineered capsids that resolve challenges of natural serotypes, like pre-existing immunity.

Limitations in Scaling Up Production

There is a major challenge in scaling up production, during which it is difficult to control the therapeutic requirement. Also, the growing demand for high-quality needs and the requirement for complex production platforms pose barriers, especially for smaller research institutions.

Tailored Gene Therapies & Hybrid Vector Design

In the coming era, the global multiple AAV serotypes market will faster developments in personalized gene therapies, emphasizing their specific pre-existing immunity or genetic makeup. This further expands an important opportunity for more tailored and efficient treatments. Moreover, the transformation of hybrid AAV vectors by integrating genetic elements from various natural serotypes. This is a step into the enhancement of gene transfer efficiency and targeting new cell types, accelerating the overall utility of AAV as a gene delivery platform.

The AAV2 segment accounted for nearly 31% share of the market in 2024. The broader benefits of this serotype encompass its greater non-pathogenic nature and mild immune response, are contribute to the segmental growth. Alongside, it is the most well-described AAV serotype, with a long history of research and clinical application. In recent years, AAV2 has found its wider usage, mainly in ocular and neurological therapies, such as Luxturna. Also, the developed new re-engineered variants, including AAV2i8, omit AAV2's risks by facilitating better targeting and an altered antigenic profile.

Whereas the AAV9 segment is expected to expand at the fastest CAGR during 2025-2034. The emergence of the latest clinical success of AAV9-based therapies, including Zolgensma, and the growing demand for gene therapies are propelling the AAV9 revolution. Recently, designed AAV9.HR by researchers includes the incorporation of specific amino acid mutations from a chimpanzee-derived capsid (CLv-D8). This innovative approach minimizes liver transduction and retains enhanced gene delivery to the central nervous system (CNS) in a mouse model of Canavan disease. Putting efforts into the application of chromatography methods supports improvements in AAV9 purification yields and transduction rates.

By capturing nearly 39% share, the neurology segment led the multiple AAV serotypes market in 2024. A combination of factors, like a rise in clinical trials, the wider applications of AAV in Alzheimer's, Parkinson's, and Huntington's disease, and technological advances in AAV variants, is bolstering the neurological expansion. A current development is an AAV-DJ, which integrates capsid components from multiple serotypes to develop a hybrid that enhances CNS targeting and expression while lowering peripheral exposure.

Moreover, the infectious diseases segment is expected to expand at the fastest CAGR during 2025-2034. A groundbreaking in vector technology, the rising instances of targeted infectious diseases, and the growth of gene therapy applications are supporting the AAV solutions in these cases. The market is shifting towards engineering of AAV capsids for accelerated targeting, innovative approaches for the quantification of vector binding to the AAV receptor (AAVR), and the development of AAV-based vaccines.

In 2024, the self-complementary AAV (scAAV) segment captured nearly 44% revenue share of the multiple AAV serotypes market. A prominent driver is improvements in scAAV’s transduction effectiveness, which allows rapid and more potent gene expression for treating a diverse range of genetic disorders. Nowadays, the segment incorporates cceAAV, a new vector class that resolves the need for omitting mutant inverted terminal repeats (mITRs) during production.

Whereas, the engineered/hybrid serotypes segment is expected to expand at the fastest CAGR during 2025-2034. These serotypes highlight the creation of vectors with improved tissue tropism for certain clinical applications, including expanded delivery to the central nervous system (CNS), muscle, or retina. Recently, researchers have developed the Rec2 vector, with its superior transduction efficiency in risky tissues like brown adipose tissue and the spinal cord as compared to natural serotypes. An emphasis on capsid engineering, mosaic/chimeric vector generation, and combinatorial library creation is also boosting the comprehensive progression.

In 2024, the biotechnology & pharmaceutical companies segment accounted for nearly 48% of the multiple AAV serotypes market. A rise in demand for gene therapies, breakthroughs in vector engineering, and accelerated research and development (R&D) investments are driving the segmental growth. In 2025, companies are aiming at boosting manufacturing processes employing pooled screening and AI to expand yield, and tailored medicine approaches that match serotypes to patient immune profiles. As well as they are also bolstering better analytical tools to demonstrate and control the quality of AAV vectors for clinical use.

Although the contract development & manufacturing organizations (CDMOs) segment is expected to expand at the fastest CAGR during 2025-2034, various small and mid-sized biotech firms are facing a shortage of the specialized in-house expertise and infrastructure that are essential for complex AAV vector manufacturing. For this, outsourcing to CDMOs is a cost-effective solution, allowing companies to focus on research and clinical development. CDMOs are emphasizing improvements in upstream processes with intensified, high-cell-density cultures and downstream purification to gain greater yields, purity, and the removal of empty capsids.

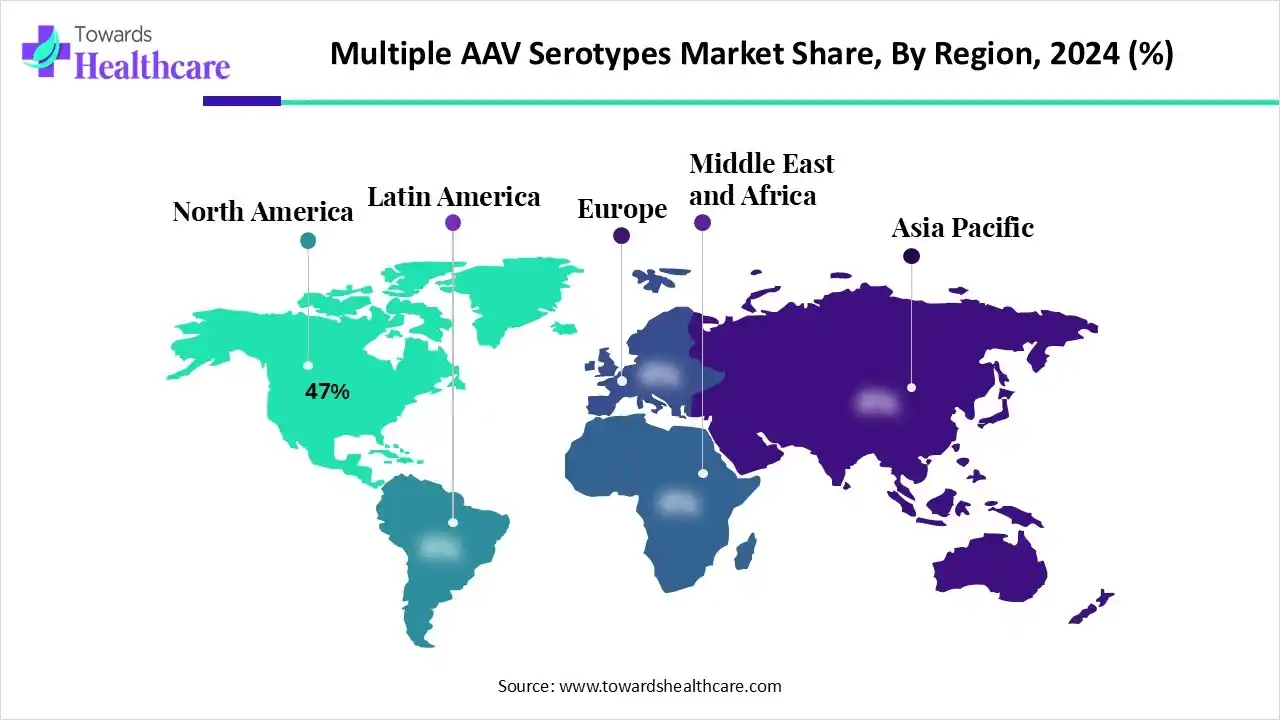

In 2024, North America held an approximate 47% revenue share of the multiple AAV serotypes market. Along with the ongoing technological advances, diverse researchers and biopharmaceutical companies are looking for robust gene therapy solutions in North America. Also, this region encompasses a wide range of AAV serotypes, such as human (AAV2, AAV3, AAV5, AAV6) and non-human origins (AAV1, AAV4, AAV7-12), which differ in tissue tropism, or their ability to target specific organs.

For instance,

In May 2024, Siren Biotechnology, pioneers of Universal AAV Immuno-Gene Therapy for Cancer, and Catalent Inc., collaborated to support the development and manufacturing of Siren Biotechnology’s AAV immuno-gene therapies.

In October 2024, eXmoor Pharma, the full-service cell and gene therapy (CGT) manufacturing partner, and Virica Biotech Inc., a leading pioneer of enhancers for scaling of viral vectors, leveraged a new project funded in part through a joint Canada-UK government biomanufacturing collaboration, focused on optimizing the manufacture of adeno-associated vector (AAVs).

During 2025-2034, the Asia Pacific is expected to expand at the fastest CAGR 2025 2034. The growing cases of chronic issues, like cancer, hemophilia, muscular dystrophy, and other rare genetic disorders, are fostering the transformations in the AAV-based therapies. Additionally, China, Japan, and South Korea are increasingly investing in biotechnology and advanced therapies. Also, the progressing contract development and manufacturing organizations (CDMOs) are widely involved in viral vector facilities.

In April 2025, Belief BioMed and its commercialisation partner with Takeda China domestically designed haemophilia B gene therapy dalnacogene ponparvovec (BBM-H901) was approved in China.

In September 2025, Thermo Fisher Scientific Inc., the world player in serving science, and Dr. Park, a developing viral vector contract development and manufacturing organization (CDMO) based in South Korea, partnered to deliver sophisticated bioprocessing solutions for large-scale cell and gene therapy production.

The multiple AAV serotypes market comprises the generation of a variety of capsid libraries, followed by in vivo selection and amplification in animal models, and, at the end, characterization and purification are used.

Key Players: Viralgen, Sartorius Xell, Weill Cornell Medical College, etc.

This encompasses preclinical studies, clinical trial designing, patient selection and informed consent, vector administration, and post-administration monitoring for therapeutic effect and adverse events. The Institutional Review Board (IRB) and Institutional Biosafety Committee (IBC) are involved in the overall approval processes.

Key Players: IRB, IBC, US FDA, and EMA.

The multiple AAV serotypes market includes the selection of the most adequate AAV serotype for a patient's gene therapy and the specific tissue tropism required for the disease, and administering the therapy to a targeted patient group.

Key Players: 3PBIOVIAN, Spark Therapeutics, Novartis, etc.

By Serotype

By Application

By Technology/Vector Design

By End User

By Region

October 2025

November 2025

October 2025

November 2025