February 2026

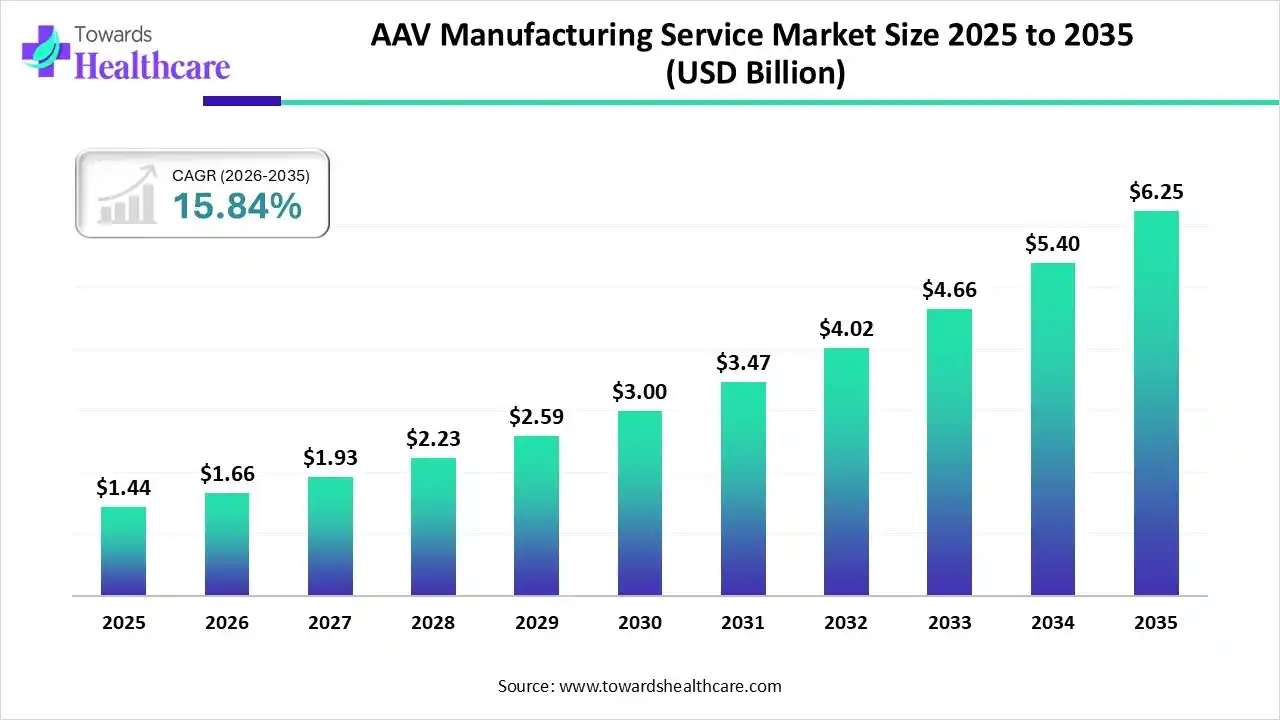

The AAV manufacturing service market size touched US$ 1.44 billion in 2025, with expectations of climbing to US$ 1.66 billion in 2026 and hitting US$ 6.25 billion by 2035, driven by a CAGR of 15.84% over the forecast period.

The manufacturing of adeno-associated viruses (AAVs) for gene therapies involves various stages in a complex process, which ensure the stringent quality and safety requirements of the final products. The AAV manufacturing service market is driven by AAVs that are used for in vivo gene therapy applications by the leading industries like Genentech. The major companies like the Roche Group, BioNTech, and Sangamo work in collaboration to launch innovations in medicinal products for advanced therapies. The manufacturing ensures identity, safety, quantity, purity, and potency of high-quality products.

| Key Elements | Scope |

| Market Size in 2026 | USD 1.66 Billion |

| Projected Market Size in 2035 | USD 6.25 Billion |

| CAGR (2025 - 2035) | 15.84% |

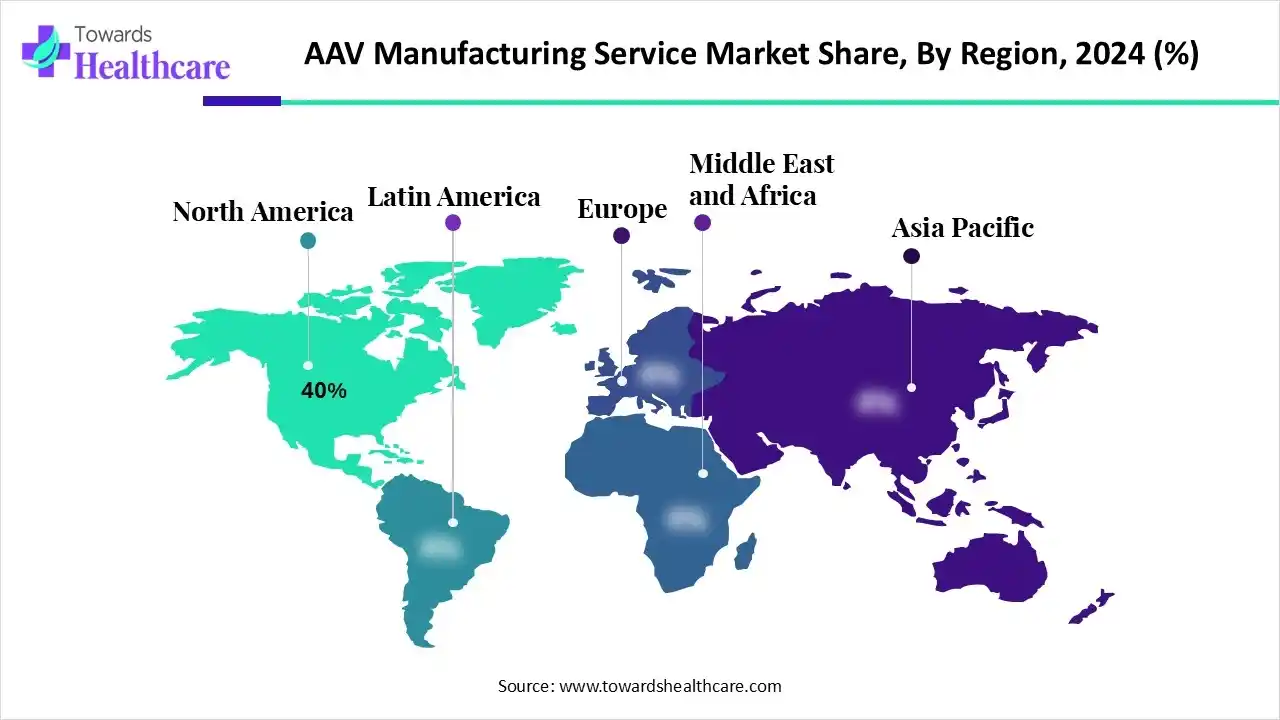

| Leading Region | North America by 40% |

| Market Segmentation | By Service Type, By Vector Type, By Therapeutic Area, By End-User, By Region |

| Top Key Players | Lonza Group, Catalent Inc., WuXi AppTec, Curia (formerly AMRI), Vigene Biosciences, Brammer Bio (Thermo Fisher), AskBio (Asklepios BioPharmaceuticals), REGENXBIO, Oxford Biomedica, Paragon Bioservices, GenScript Biotech, MeiraGTx, Astellas Gene Therapy, Sarepta Therapeutics, BioVectra, Fujifilm Diosynth Biotechnologies, Spark Therapeutics, Cobra Biologics, AGC Biologics, CleanCap Technologies |

The therapeutic development and rapid shift towards commercialization expanded the AAV production processes. The AAV manufacturing service market refers to contract manufacturing services focused on the production of adeno-associated virus (AAV) vectors used in gene therapy applications. These services encompass upstream and downstream processes, including vector design, cell line development, plasmid production, transfection, purification, formulation, and quality testing. The market is driven by the rapid expansion of gene therapy pipelines, growing demand for scalable and high-quality viral vectors, and increasing outsourcing of vector manufacturing to specialized CDMOs.

Key end-users include pharmaceutical and biotechnology companies, research institutions, and clinical trial sponsors. The market spans multiple regions, including North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, with applications in inherited disorders, oncology, CNS, ophthalmology, and other therapeutic areas.

The AI-assisted biological experiments can be conducted to accelerate AAV gene therapy research. AI-assisted experiments are conducted in drug development areas and regular laboratory assays. They offer a promising approach to overcome emerging challenges in R&D and improve data reliability. AI has enabled more efficient genomic investigation and insightful imaging. AI is implemented across diverse fields such as epigenomics, proteomics, metabolomics, and drug discovery.

The strategic investment of Regeneron will enable efficient production of its biologic medicines that will also support high-paying jobs in this region. For instance, in April 2025, Regeneron Pharmaceuticals, Inc. signed a new agreement with FUJIFILM Diosynth Biotechnologies with an expected total investment of $3 billion to expand its manufacturing capacity and deliver industry-leading biologic medicines.

The leading companies like Ultragenyx Pharmaceutical Inc. aim to provide a first-ever treatment for Sanfilippo syndrome type A. For instance, in February 2025, Ultragenyx Pharmaceutical Inc. announced that the U.S. FDA had accepted its Biologics License Application (BLA) for review and approval of UX111 (ABO-102) AAV gene therapy as a potential treatment for patients dealing with Sanfilippo syndrome type A (MPS IIIA).

| Sr. No. | Name of the Regulatory Organization | Role |

| 1 | U.S. Food and Drug Administration (FDA) | The Center for Biologics Evaluation and Research (CBER) of the U.S. FDA provides specific guidance for cellular and gene therapy products. |

| 2 | European Medicines Agency (EMA) | To regulate Advanced Therapy Medicinal Products (ATMPs), which include AAV-based gene therapies. |

| 3 | International Council for Harmonization (ICH) | To develop harmonized technical guidelines for pharmaceutical registration across regions like Europe, the U.S., and Japan. |

| 4 | U.S. Pharmacopeia (USP) | To set quality standards for medicines. |

The upstream manufacturing segment dominated the market in 2024, with a revenue of approximately 45% owing to the impact on the final product and process with a maximum vector yield, improved vector quality, improved scalability, and consistency. It reduces overall manufacturing costs through better development of cell lines. The optimization leads to a better production process and improved quality of the final product.

The downstream manufacturing segment is expected to grow at the fastest CAGR in the AAV manufacturing service market during the forecast period due to the benefits such as high purity, safety, potency, yield, and scalability. The most widely used techniques, like chromatography, are vital for large-scale production due to their efficiency and scalability. The downstream processing meets the rigorous regulatory standards to ensure the safety of final products.

The AAV9 segment dominated the market in 2024, with a revenue of approximately 30% owing to its primary role in targeting specific tissues and determining purification strategy. AAV9 is mostly used to encode the capsid and inform quality control to verify the presence of the AAV9 capsid in the final product. The AAV9 manufacturing is essential to developing gene therapies for treating central nervous system disorders.

The genetic/rare disorders segment dominated the market in 2024, with a revenue of approximately 35% owing to the scalability for clinical and commercial supply offered by AAV manufacturing services. These services address challenges in rare disease therapy or rare genetic disorders. The services can reduce the overall cost of goods and make the final therapies more accessible and affordable.

The oncology segment is anticipated to grow at a notable rate in the AAV manufacturing service market during the upcoming period due to the crucial role of AAV manufacturing services in therapeutic development and vector engineering for targeted delivery. They result in large-scale and high-quality production by offering scalability, purification, consistency, and quality control. AAV manufacturing services produce special vectors that can overcome barriers in difficult-to-treat cancers.

The pharmaceutical companies segment dominated the market in 2024, with a revenue of approximately 45% owing to the major stages of industrial manufacturing, such as process development, optimization, etc., which are strategic for pharmaceutical companies. They leverage advanced expertise that helps to lower costs and investment. They also improve speed to market, mitigate risks, and focus on core competencies.

The biotechnology companies segment is predicted to grow at a rapid rate in the AAV manufacturing service market during the studied period due to the production of high-quality viral vectors for clinical trials, research, and commercial gene therapies. The contract development and manufacturing organizations (CDMOs) provide various services that overcome challenges associated with technical and logistical aspects that are faced by biotechnology companies while developing gene therapies. They focus on cost savings, reduced capital investment, and access to expertise and advanced technology.

North America dominated the market share by 40% in 2024, owing to the rising trend of outsourcing manufacturing to CDMOs and strong investments in developing gene therapies. The increased number of clinical trials, supportive regulatory environment, and technological advancements are the major growth drivers for the North American market. The strategic mergers and acquisitions help to expand industrial capabilities and secure expertise. The commercial launches of various health products are driven by notable market players like Pfizer through its gene therapy for treating hemophilia B. Significant venture capital funding is provided for biotechnology startups that develop gene therapies for rare diseases.

In September 2025, the National Institutes of Health (NIH) launched the $87 million plan to advance an alternative to animal testing, aiming to utilize small laboratory-grown 3D tissue models to test fewer laboratory rats and drugs.

The U.S. government activities related to AAV manufacturing include the National Science Foundation (NSF) funding, the Biomedical Advanced Research and Development Authority (BARDA), and the U.S. FDA guidance. These programs support advanced biomanufacturing and the development of gene therapy. The number of gene therapies entering clinical trials and receiving regulatory approvals is increasing.

The Government of Canada announced its plan to advance the Canadian biomanufacturing sector. The Canada-UK collaboration specifically aims at viral vector production through selective research projects and funding. The gene therapy treatments are made more accessible to Canadians.

Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast period due to the expanded cell and gene therapy clinical trials, the rise of CDMOs and outsourcing, and increased investments in R&D. The various government programs supported advanced biomanufacturing, including AAV and other viral vector services. Various government initiatives support the rapidly expanding cell and gene therapy sector in this region. There is an increasing demand for viral vector and plasmid DNA manufacturing across Asia Pacific countries like South Korea, Australia, and Southeast Asia. The establishment of the first GMP-certified cell therapy manufacturing facility in Thailand was driven through a collaboration between Genepeutic Bio and Cytiva.

In August 2025, ProBio announced the launch of an end-to-end AAV production facility to support scalable manufacturing at its production site in New Jersey.

The R&D process for the AAV manufacturing service includes upstream process development, downstream process development, analytical development, quality control, and further R&D stages.

Key Players: Abbott Laboratories, Medtronic plc, Boston Scientific Corporation, Danaher Corporation, Stryker Corporation, Thermo Fisher Scientific Inc., GE HealthCare Technologies Inc., Becton, Dickinson and Company.

The distribution chain for AAV therapies involves AAV manufacturing facilities, specialized logistics providers, ultra-low temperature storage, transport to treatment centers, hospital infusion centers, and direct administration to patients.

Key Players: Thermo Fisher Scientific, Catalent, Lonza, Charles River Laboratories, FUJIFILM Diosynth Biotechnologies, WuXi AppTec, Aldevron, etc.

The crucial parameters for AAV gene therapy patient support include access and reimbursement navigation, financial assistance, patient and caregiver education, logistical coordination, long-term follow-up and monitoring, and emotional and psychological support.

Key Players: AskBio, Novartis, ProPharma, Genethon, and Samabriva.

By Service Type

By Vector Type

By Therapeutic Area

By End-User

By Region

February 2026

February 2026

February 2026

February 2026