January 2026

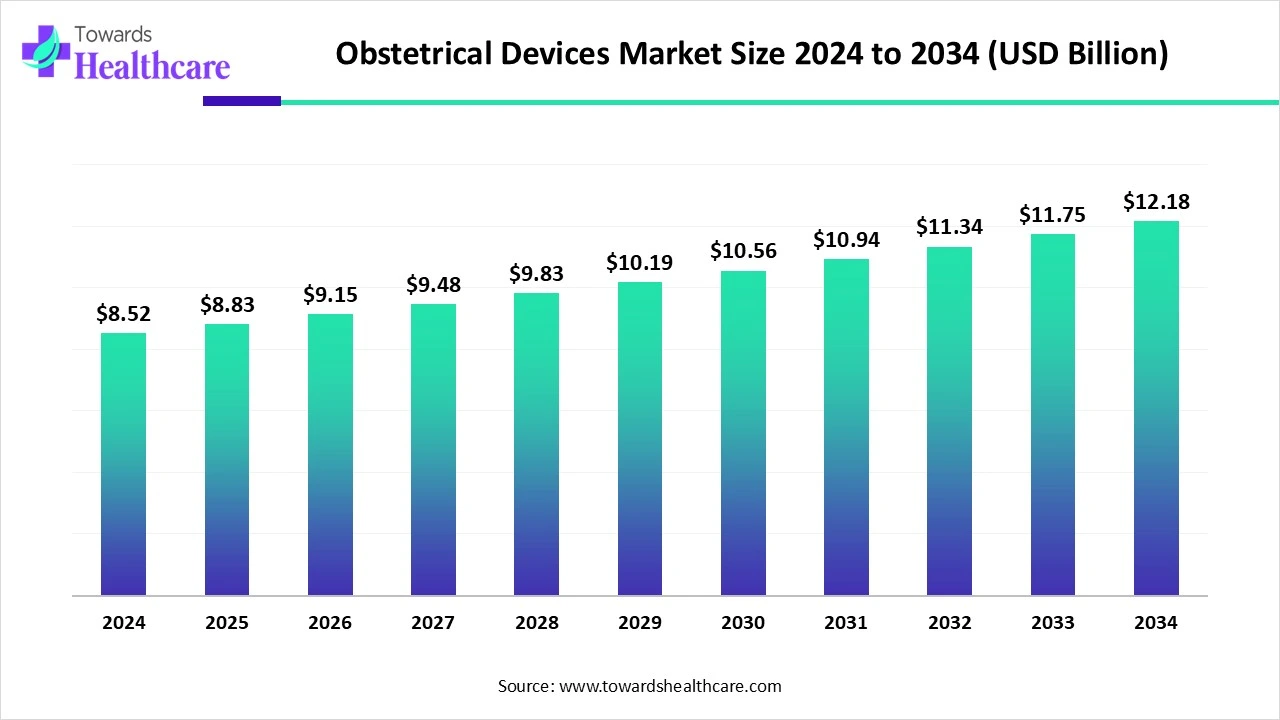

The global obstetrical devices market size is calculated at USD 8.52 billion in 2024, grow to USD 8.83 billion in 2025, and is projected to reach around USD 12.18 billion by 2034.The market is expanding at a CAGR of 3.64% between 2025 and 2034.

The obstetrical devices market is witnessing steady growth driven by increasing global birth rates, rising awareness of maternal health, and technological advancements in labor and delivery tools. Growing demand for minimally invasive procedures and improved prenatal care are further boosting adoption. Additionally, supportive government initiatives, better access to healthcare facilities, and the rising number of high-risk pregnancies are contributing to the expanding use of obstetrical devices worldwide.

| Metric | Details |

| Market Size in 2025 | USD 8.83 Billion |

| Projected Market Size in 2034 | USD 12.18 Billion |

| CAGR (2025 - 2034) | 3.64% |

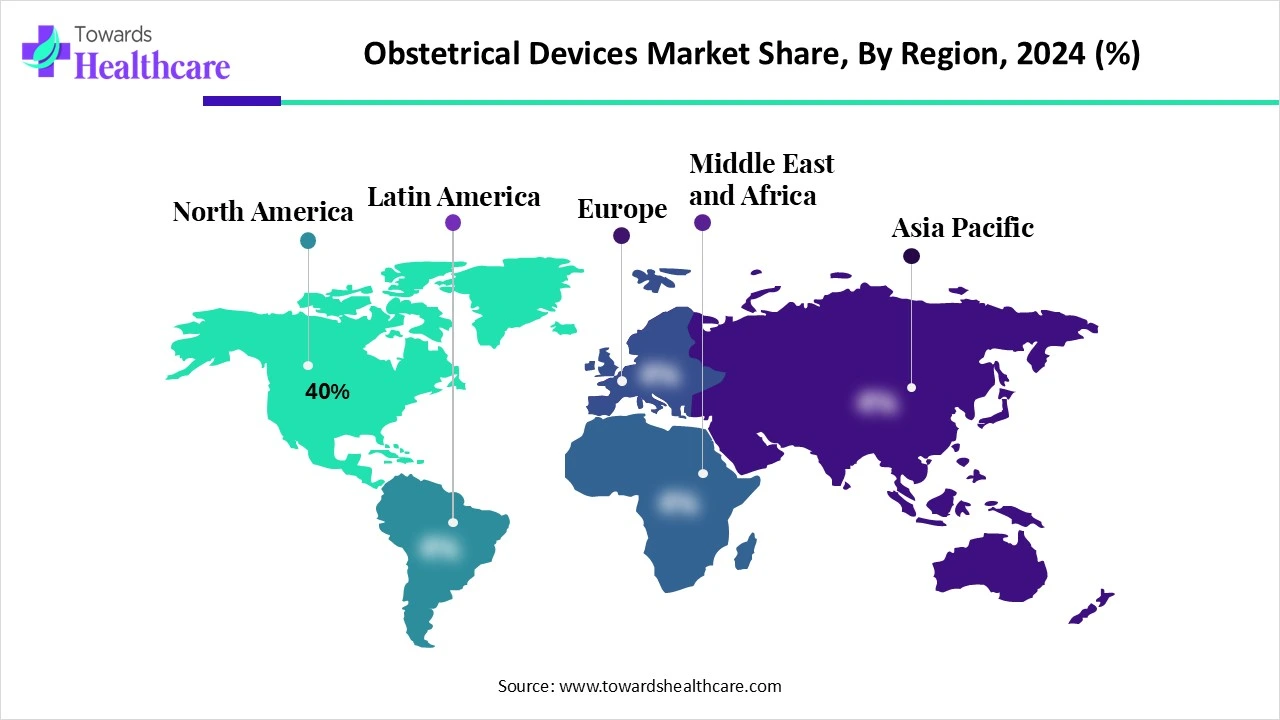

| Leading Region | North America Share by 40% |

| Market Segmentation | By Product Type, By Application, By End User, By Technology, By Region |

| Top Key Players | GE HealthCare, Philips Healthcare, Medtronic plc, Stryker Corporation, CooperSurgical, Inc., Becton, Dickinson and Company (BD), Dixion Vertrieb medizinischer Geräte GmbH, Drägerwerk AG & Co. KGaA, Natus Medical Incorporated, Fisher & Paykel Healthcare, Nonin Medical, Inc., Neoventa Medical AB, Atom Medical Corporation, Cardinal Health, Inc., Utah Medical Products, Inc., Olympus Corporation, Bionet Co., Ltd., Wallach Surgical Devices, Edan Instruments, Inc., Mindray Medical International Limited |

The obstetrical devices market consists of medical instruments and equipment used for monitoring, assisting, and managing pregnancy, labor, delivery, and postpartum care. These devices include fetal monitors, vacuum extractors, forceps, cervical dilators, and obstetric surgical tools. With rising global birth rates in some regions, increasing rates of high-risk pregnancies, growing demand for technologically advanced fetal monitoring, and higher access to maternal healthcare services, the market continues to grow. Minimally invasive procedures and tele-obstetrics are emerging as notable trends. The market is evolving with the integration of advanced technologies like AI-based monitoring, portable imaging, and wearable health-risk pregnancies, and improved prenatal diagnostics are reshaping care standards. Expanding access in developing regions and ongoing innovation continue to drive the market's transformation and global reach.

For Instance,

AI is set to significantly impact the obstetrical devices market by enhancing diagnostic accuracy, improving fetal and maternal monitoring, and enabling healthcare predictive analytics for high-risk pregnancies. AI-powered tools can assist in the early detection of complications, automate routine procedures, and support clinical decision-making. This leads to more personalized care, reduced intervention rates, and better outcomes, ultimately driving demand for smart obstetrical technologies in modern healthcare settings.

For Instance,

Rising Demand for Safer Childbirth Procedures

Improved focus on maternal and infant safety has led to greater reliance on advanced obstetrical tools during labor and delivery. With rising cases of high-risk pregnancies and complications, healthcare providers are prioritizing precision-based devices to ensure better outcomes. This shift towards enhanced monitoring and intervention techniques is fueling the demand for innovative obstetrical devices, as they support quicker decision-making and reduce delivery-related risks, ultimately driving growth in the overall market.

For Instance,

High Cost and Limited Access to Advanced Medical Equipment

The obstetrical devices market faces challenges due to the expensive nature of advanced equipment and unequal distribution across healthcare systems. In many developing areas, budget constraints prevent hospitals from investing in modern childbirth tools. Moreover, inadequate training and maintenance support make it difficult to operate maintenance support make it difficult to operate technological solutions, creating disparities in maternal care and slowing the overall accessibility of the market.

Integration Remote Monitoring Technologies

Artificial intelligence and remote monitoring are shaping the future of obstetrical care by offering more personalized and timely interventions. These technologies allow healthcare providers to track fetal and maternal health from a distance, ensuring quicker responses to potential risks. They are especially beneficial in rural regions with limited access to specialists. As demand for smart, efficient parental care rises, such innovations are expected to open new growth avenues in the obstetrical devices market.

The fetal monitoring devices segment led the market due to growing clinical emphasis on improving birth outcomes and reducing complications. With more healthcare providers prioritizing early detection of fetal issues, these devices have become essential during both parental checkups and labour. Technological progress, including portable and non-invasive monitors, has boosted their use in hospitals and clinics alike, leading to higher adoption rates and strong revenue performance within this category.

The delivery assist devices segment is anticipated. To grow quickly due to rising childbirth complications requiring assisted procedures, and the preference for vaginal deliveries over surgical options. Technological improvements and better-designed tools are making these devices safer and more effective, increasing their demand across maternity care settings.

The vacuum extractors subsegment is gaining momentum due to its growing use in managing prolonged or complicated labor without resorting to surgery. These devices reduce maternal trauma and recovery time compared to caesarean sections. Increasing adoption in both developed and emerging healthcare systems is driving its strong market performance and rapid growth.

In 2024, the labor & delivery monitoring segment held the largest revenue share due to increasing reliance on real-time data to manage childbirth more effectively. Hospitals and clinics are prioritizing advanced monitoring systems to track maternal vitals and fetal well-being, reducing the risk of complications. The rising number of high-risk pregnancies and the adoption of digital technologies further supported the strong market performance.

The caesarean section procedures segment is expected to grow rapidly due to the increasing number of complicated pregnancies, maternal age, and preference for planned deliveries. Advancements in surgical tools and improved safety protocols have made C-sections more accessible and reliable. Additionally, rising awareness among expectant mothers and growing hospital capacity to perform such procedures are further accelerating the demand for obstetrical used in caesarean deliveries.

In 2024, the hospitals segment held the strongest position in the obstetrical devices market due to its ability to deliver complex maternity care services. Hospitals manage high-risk pregnancies, cesarean sections, and emergency interventions, all requiring advanced fetal monitoring, surgical tools, and specialized equipment. Equipped with skilled personnel, comprehensive infrastructure, and integrated monitoring systems, hospitals continue to drive demand and adoption of sophisticated obstetrical devices, driving the market expansion.

The maternity clinics & birthing centers segment is projected to grow rapidly due to the rising preference for more personalized, low-intervention birth experiences. These centers offer a less clinical environment compared to hospitals while still providing access to essential obstetrical devices. As awareness about alternative birthing options increases, along with supportive policies and growing midwife-led care models, these facilities are expanding, driving higher demand for modern, compact, and efficient obstetrical tools.

In 2024, the electronic & digital monitoring devices segment held the largest share of the obstetrical devices market due to the growing adoption of smart technologies that enhance accuracy and efficiency in maternal care. These devices support real-time tracking of fetal and maternal health, reducing manual error and improving clinical decision-making. Their integration with telehealth platforms and increasing preference for automated monitoring solutions have made them a preferred choice in modern obstetric practices.

The portable & wireless monitoring devices segment is projected to grow rapidly due to their ability to provide continuous maternal and fetal monitoring beyond hospital walls. Their lightweight design, ease of use, and integration with digital health systems make them ideal for outpatient and home-based care. As demand for convenient, tech-enabled parental solutions rises, these smart devices are becoming essential tools in modern obstetrics, especially in managing pregnancies in remote or underserved areas.

North America dominated the market share by 40% in 2024, due to its well-established healthcare infrastructure, high awareness of maternal health, and early adoption of advanced technologies. The region sees a significant number of high-risk pregnancies and elective procedures like C-sections, driving demand for modern obstetrical tools. Strong presence of key market players, favorable reimbursement policies, and continuous investment in maternal care innovation have further supported the widespread use of advanced monitoring and delivery-assist devices across the U.S. and Canada.

The U.S. market is growing thanks to robust technological advancements, heightened maternal health awareness, and rising healthcare spending. Innovations such as wearable sensors, AI-assisted fetal monitors, and telehealth tools enhance prenatal care and enable real-time monitoring both in clinics and at home. Additionally, a gradual increase in birth rates and C-section deliveries fuels the need for surgical and diagnostic devices.

The Canadian market is expanding due to the rising incidence of preterm births and maternal complications, which are triggering demand for fetal monitoring and neonatal equipment. Provincial governments are investing in prenatal care infrastructure and diagnostic imaging tools, supported by favorable reimbursement policies and public health initiatives. Additionally, technological innovation, especially AI-enhanced and portable devices, is enhancing accessibility and fueling market momentum across Canada.

AsiaPacific is expected to achieve the fastest CAGR in the market because of its large and growing population in India and China, which increases pregnancy volume and demand for maternal-fetal monitoring. Government support via subsidies and health infrastructure upgrades in countries like India, Indonesia, and Vietnam is accelerating adoption, especially in public hospitals. Moreover, regional innovation focused on affordable, portable monitoring devices tailored for local care settings is further propelling growth.

China’s market is expanding due to rising birth rates, increased awareness of maternal health, and a surge in high-risk pregnancies. Government initiatives to modernize healthcare facilities and improve prenatal care have boosted the adoption of advanced monitoring and delivery devices. Additionally, strong local manufacturing, rapid urbanization, and growing investments in AI-based and portable obstetrical technologies are further driving market growth across the country.

India’s market is expanding due to its high birth rate, growing awareness of maternal health, and increasing cases of high-risk pregnancies. Government initiatives like the National Health Mission and PMSMA have improved access to prenatal care and diagnostic tools in public hospitals. Additionally, the rising demand for advanced monitoring technologies and the expansion of healthcare infrastructure in rural areas are further driving market growth across the country.

Europe is approaching the market in 2024 by promoting innovation through research, government-supported prenatal programs, and rigorous regulatory oversight. Countries like Germany, France, and the UK are rolling out smart fetal monitoring belts, portable ultrasound tools, and AI-powered diagnostics across hospitals to enhance maternal and neonatal safety. Despite strong infrastructure in Western Europe, disparities in adoption remain in Eastern regions due to funding gaps and training shortages.

The UK market is expanding due to rising cases of preterm and high-risk pregnancies, driving the need for advanced prenatal and neonatal monitoring tools. Government initiatives and NHS investments in maternal health services have improved access to quality care. Additionally, the adoption of AI-powered, wearable, and home-based monitoring technologies is enhancing patient outcomes and supporting the growing demand for modern obstetrical solutions across the country.

Germany’s market is expanding in 2024 due to a rising number of preterm and lowbirthweight infants, which fuels demand for advanced fetal and neonatal monitoring technologies. Government-backed maternal health programs and strong public awareness further boost uptake of prenatal care equipment. Technological innovation, especially AI-enhanced, portable devices, Doppler monitors, and modern ultrasound systems, supports expanding use across hospitals and clinics nationwide.

In September 2024, at the 34th ISUOG World Congress 2024 in Budapest, Samsung Medison unveiled its new premium OB&GYN ultrasound system, HERA Z20. The system features advanced AI tools like Live ViewAssist™, Live Q-scan, and A-Focus™, offering faster, more accurate diagnostics and improved image quality. Alongside, Samsung introduced the SUITE, an educational platform for global users. CEO Kyutae Yoo stated that their goal is to boost global market share and lead through innovation and AI-powered solutions. (Source - Samsung)

By Product Type

By Application

By End User

By Technology

By Region

January 2026

December 2025

December 2025

December 2025