February 2026

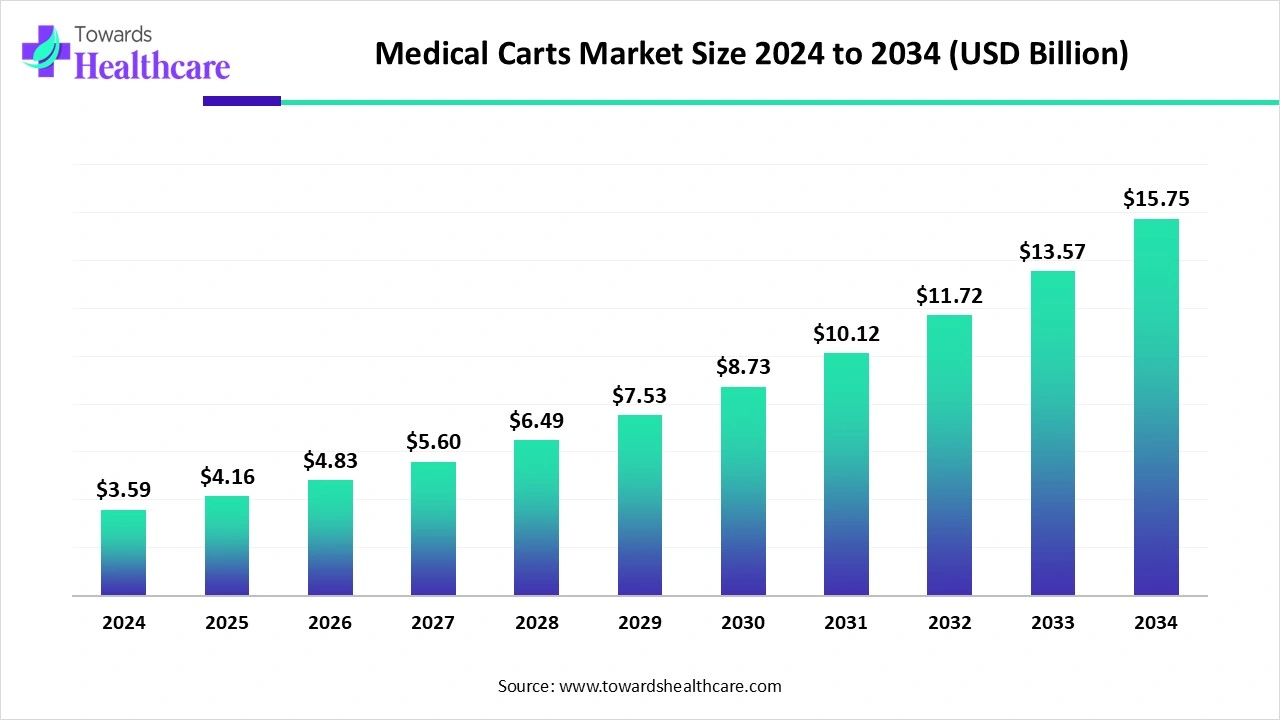

The global medical carts market size recorded US$ 3.59 billion in 2024, set to grow to US$ 4.16 billion in 2025 and projected to hit nearly US$ 15.75 billion by 2034, with a CAGR of 16.03% throughout the forecast timeline.

The medical carts market is growing rapidly as healthcare facilities increasingly adopt mobile solutions to enhance workflow efficiency and patient care. These carts, often integrated with computers, medication storage, and point-of-care devices, enable clinicians to access electronic health records and administer treatments at the bedside. Rising demand for smart, ergonomic, and customizable carts, coupled with the expansion of hospitals and clinics, digitization of healthcare, and focus on reducing medical errors, is driving the market’s steady growth globally.

| Table | Scope |

| Market Size in 2025 | USD 4.16 Billion |

| Projected Market Size in 2034 | USD 15.75 Billion |

| CAGR (2025 - 2034) | 16.03% |

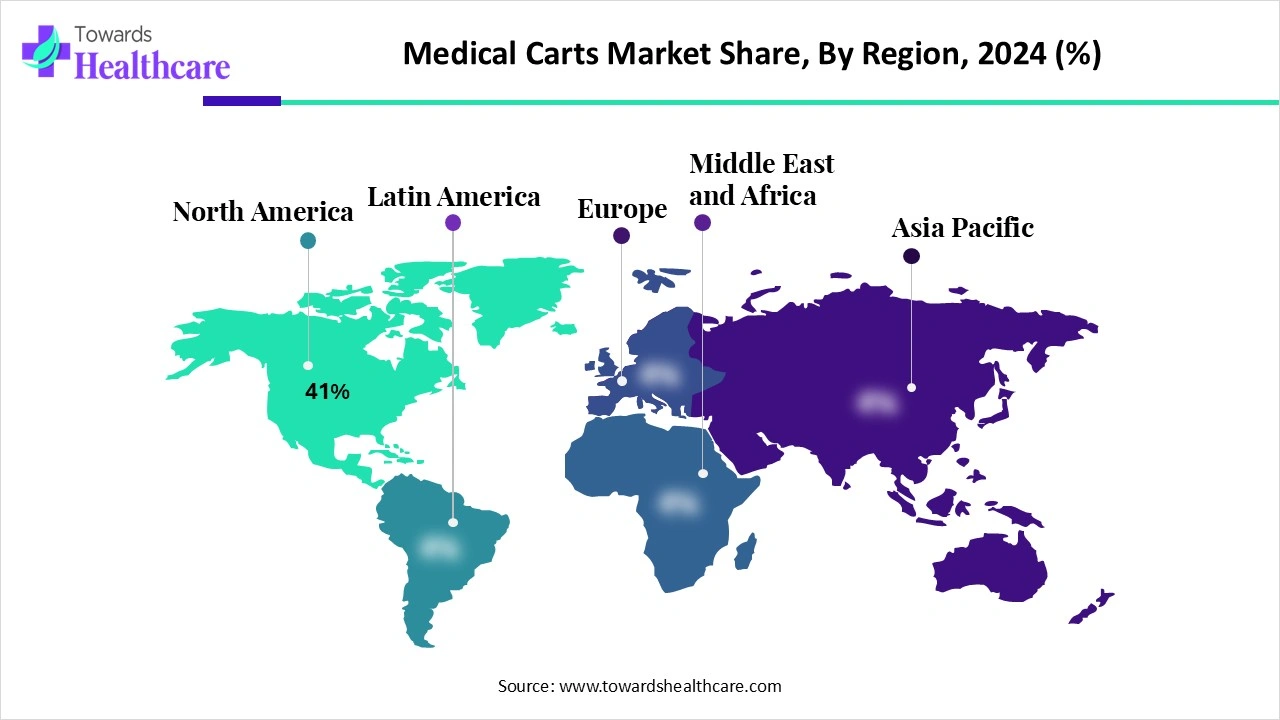

| Leading Region | North America by 41% |

| Market Segmentation | By Product Type, By Application, By Technology, By End User, By Region |

| Top Key Players | Capsa Healthcare, Ergotron, Inc., Harloff Company, Inc., Midmark Corporation, InterMetro Industries (part of Ali Group), Advantech Co., Ltd., JACO, Inc., AFC Industries, ITD GmbH, Armstrong Medical Industries, Inc., Omnicell, Inc., Medline Industries, LP, Bergmann Group, Humanscale Healthcare, GCX Corporation, TouchPoint Medical, Parity Medical, Villard Medical, Nanjing Tianao Medical Equipment Co., Ltd., BiHealthcare |

The market refers to mobile equipment units used in healthcare facilities to store, organize, and transport medical supplies, medications, and electronic equipment at the point of care. These carts enhance workflow efficiency, patient safety, infection control, and mobility in hospitals, clinics, and ambulatory centers. Growing demand is driven by the digitalization of healthcare (EHR integration), rising patient volumes, focus on emergency preparedness, and adoption of ergonomic designs with advanced materials and battery-powered mobility solutions.

The medical carts market is evolving as healthcare facilities adopt advanced, multifunctional carts designed for specialized tasks like anesthesia, pharmacy, and telemedicine. Lightweight, durable materials and wireless connectivity are enhancing portability and ease of use. Additionally, integration with AI-powered analytics and automated inventory management is improving clinical decision-making and reducing errors. Expansion of outpatient care centers and home healthcare services is further increasing demand, positioning medical carts as essential tools for modern, efficient, and flexible healthcare delivery.

Technological Advancements-Wireless connectivity, IoT integration, automated inventory management, and battery-powered designs improve cart functionality, mobility, and efficiency.

Introduction of Smart and Connected Carts-Companies are launching carts with integrated computers, IoT connectivity, and automated features, improving workflow efficiency and real-time data access at the point of care.

AI can transform the market by enabling autonomous navigation, smart task allocation, and real-time analytics for clinical workflows. AI-driven carts can adapt to changing hospital environments, prioritize urgent tasks, and provide data insights on equipment usage and patient interactions. Integration with voice assistants and machine learning algorithms can streamline documentation and reduce clinician workload. These innovations improve efficiency, safety, and care quality, positioning AI-enabled medical carts as a next-generation solution in modern healthcare facilities.

Growth of Telemedicine and Remote Care

The rise of telemedicine and remote care fuels the medical carts market as healthcare systems require adaptable platforms to integrate new digital tools. Beyond virtual consultations, carts are increasingly used to support mobile diagnostic equipment, remote imaging, and cloud-based applications. They provide flexibility for multidisciplinary teams to collaborate across distance, helping manage larger patient volumes. BY enabling mobility and seamless technology integration, medical carts address the growing demand for scalable and efficient remote healthcare infrastructure.

For Instance,

High Initial and Maintenance Cost

High initial and maintenance Costs restrain the medical carts market because specialized design, advanced materials, and customization to meet varied clinical needs add to production expenses. Frequent wear and tear from daily hospital use often demands costly servicing and spare parts. Furthermore, integrating carts with evolving digital health systems can require additional investments in compatibility upgrades. These financial burdens discourage smaller facilities from adopting modern carts, creating a gap in market growth across regions with limited healthcare budgets.

Expansion of Telemedicine and Virtual Care

The growing focus on telemedicine and virtual care creates a strong opportunity in the medical carts market because carts can serve as adaptable hubs for integrating emerging digital tools. Beyond virtual visits, they can host AI-driven diagnostics, remote imaging systems, and real-time health analytics. Their mobility ensures that clinicians can seamlessly shift between in-person and remote tasks, enabling hybrid care models. This adaptability positions medical carts as vital infrastructure for the future of digitally connected healthcare delivery.

For Instance,

The emergency/crash carts segment held the largest market share in 2024 because these carts are universally required across all healthcare facilities, from tertiary hospitals to smaller clinics. Their standardized presence ensures immediate access to life-saving drugs and equipment, making them essential for accreditation and compliance. Growing investments in advanced design with better organization, mobility, and digital tracking further increased their adoption. This widespread necessity and ongoing product innovation solidified their leading position in the medical carts market.

The computer/mobile computing carts segment is projected to expand at the fastest CAGR because of increasing demand advanced at the fastest CAGR because of increasing demand for advanced medication management, automated billing, and bedside diagnostics. These carts support seamless integration of bracoding and scanning systems, reducing errors in drug administration and improving workflow accuracy. Their adaptability for specialized tasks such as imaging review, mobile documentation, and multi-department collaboration also boosts uptake. As hospitals focus on efficacy and precision, the versatility of computing carts positions them for accelerated growth.

The acute care segment dominated the medical carts market in 2024 as healthcare facilities increasingly required specialized, high-performance carts for ICUs, ERs , and surgical units. These carts streamline workflow by providing organized storage, rapid access to critical equipment, and integration with monitoring devices. Growing investment in hospital infrastructure, emphasis on patient safety, and the need for efficient emergency response systems further reinforced the adoption of acute care carts, making this application segment the leading revenue generator in the market.

The telemedicine & remote care segment is projected to grow rapidly because healthcare providers are adopting mobile, connected carts to support hybrid care models. These carts facilitate real-time data sharing, remote diagnostics, and collaboration between specialists across locations. Increasing patient demand for convenient, at home care and monitoring, along with the rise of virtual clinical trials and monitoring along with the rise of virtual clinical trials and remote ICU management, is driving adoption. Their flexibility and ability to integrate emerging digital health tools position this segment for the fastest market growth.

By technology, the non-powered carts segment led the market in 2024 due to their versatility and ease of customization for different clinical applications. They are ideal for facilities with limited infrastructure, as they do not rely on batteries or electrical connections. Hospitals and clinics favor them for transporting supplies, organizing equipment, and supporting point-of-care tasks without the risk of mechanical failures. Their affordability and durability make them a preferred choice, contributing to their dominant market share.

The powered carts segment is projected to grow rapidly because healthcare facilities are increasingly investing in smart, motorized carts that reduce staff fatigue and improve mobility in large hospitals. These carts can handle heavier equipment, offer automated height adjustments, and support a continuous power supply for multiple devices. As hospitals adopt digital health technologies, such as bedside monitoring, AI-enabled analytics, and connected EMR systems, the need for reliable, energy-efficient powered carts rises, driving strong growth during the forecast period.

The hospitals segment dominated the medical carts market in 2024 due to their high patient volumes and complex operational needs. Hospitals require versatile, durable, and technology-integrated carts for medication delivery, diagnostics, and telehealth support across multiple departments. Continuous adoption of digital healthcare solutions, expansion of hospital networks, and focus on improving clinical efficiency and patient safety have further increased demand. This widespread reliance on mobile and connected carts makes hospitals the leading revenue-generating end-user segment.

The home healthcare & remote care segment is projected to grow rapidly as healthcare systems increasingly focus on decentralized care models. Portable medical carts allow caregivers to deliver diagnostic services, medication administration, and real-time monitoring directly in patients’ homes. Rising prevalence of chronic illnesses, demand for elderly care, and advancements in telehealth and IoT-enabled devices are fueling this trend. Their ability to provide efficient, flexible, and technology-integrated care positions this segment for the fastest growth in the market.

North America dominated the market share 41% in 2024, due to the region’s advanced healthcare infrastructure, widespread adoption of digital health technologies, and high investment in hospital modernization. Hospitals and clinics increasingly rely on mobile carts for medication delivery, patient monitoring, and telemedicine support. Strong focus on improving workflow efficiency, patient safety, and compliance with healthcare regulations, combined with the presence of leading medical cart manufacturers, contributed to North America capturing the largest revenue share in the global market.

The U.S. market is growing as hospitals and clinics upgrade infrastructure to support digital workflows and patient-centric care. Rising demand for portable, multifunctional carts for diagnostics, telemedicine, and supply management drives adoption. Additionally, healthcare providers are investing in ergonomic and modular cart designs to improve staff efficiency and reduce errors, while technological integration with EMR systems and remote monitoring solutions further accelerates market expansion during this period.

The Canadian market is expanding as healthcare providers focus on improving operational efficiency and reducing staff workload. Growing adoption of specialized carts for critical care, surgical, and outpatient services enables seamless mobility of equipment and supplies. Increased awareness of patient safety, integration of smart technologies, and government support for digital healthcare initiatives are further driving the market, positioning medical carts as essential tools in Canada’s evolving healthcare infrastructure.

The Asia-Pacific market is projected to grow rapidly due to the rising number of private and specialty healthcare facilities and increasing focus on modernizing hospital workflows. Adoption of smart, multifunctional carts for critical care, diagnostics, and telehealth is accelerating, driven by technological advancements and cost-effective manufacturing. Furthermore, supportive government policies, growing healthcare expenditure, and rising demand for efficient patient management solutions in both urban and rural areas are fueling the region’s fast-paced market expansion.

R&D- R&D in medical carts aims to enhance healthcare efficiency and patient outcomes by creating durable, specialized, and technology-integrated carts. These innovations focus on seamless integration with Electronic Health Records (EHRs) and other digital systems, supporting streamlined workflows and improved clinical care.

Regulatory Approvals- Regulatory approval for medical carts varies by country, based on device classification and intended functions. In India, the CDSCO oversees approvals under the Medical Device Rules, 2017. Manufacturers must classify their carts, submit appropriate applications for each class, and ensure designs meet safety standards, including impact resistance and proper cable management, before the product can be marketed.

Patient Support and Services- Medical carts enhance patient care by delivering equipment and medications directly to the bedside. They improve workflow efficiency and communication through access to point-of-care data, while organized storage and real-time information help ensure patient safety

In September 2024, Capsa Healthcare launched the Tryten P-Series tablet and monitor carts, designed to improve telehealth, virtual care, and patient experience across modern healthcare settings. The Tryten P1 features a longer articulating arm than the S-Series, allowing flexible height adjustments for comfortable interaction by patients in bed or seated. Its sturdy base enhances stability and device security. Craig Rydingsward, Senior VP at Capsa Healthcare, stated that the P-Series represents a major step forward in combining stability, security, and performance to elevate patient care and technology integration.

By Product Type

By Application

By Technology

By End User

By Region

February 2026

February 2026

February 2026

February 2026