February 2026

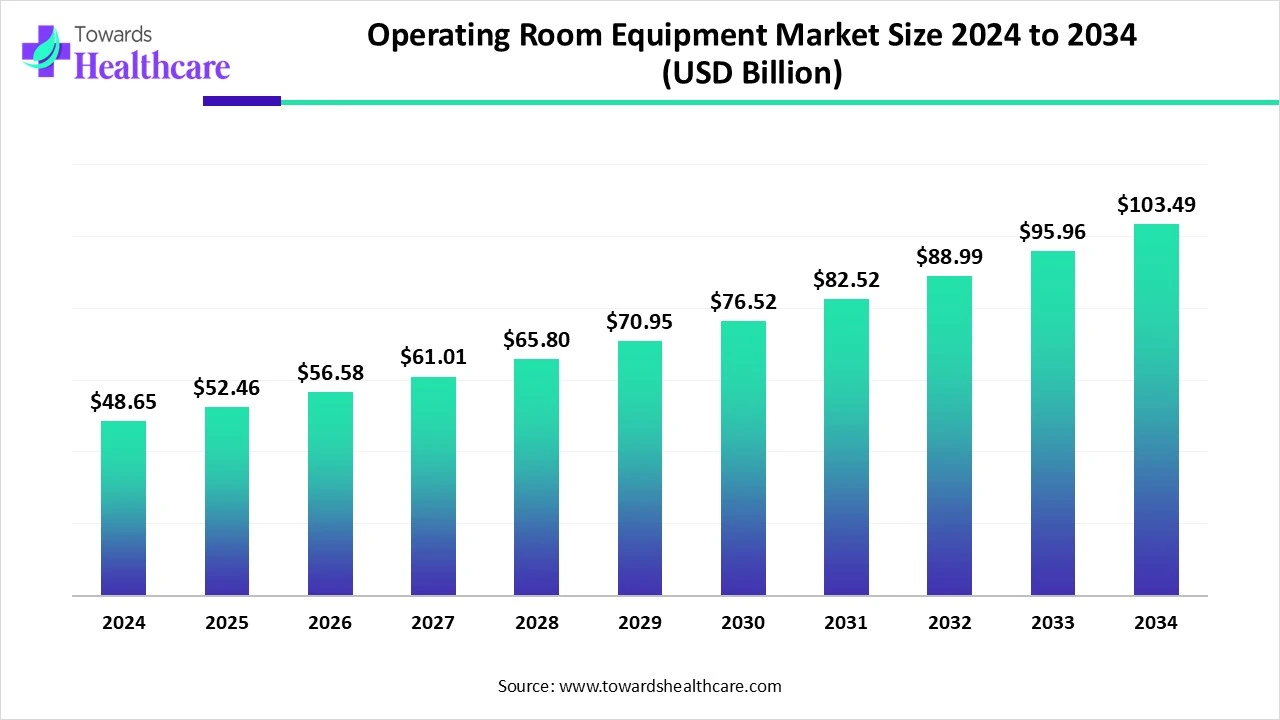

The global operating room equipment market size is calculated at US$ 48.65 billion in 2024, grew to US$ 52.46 billion in 2025, and is projected to reach around US$ 103.49 billion by 2034. The market is projected to expand at a CAGR of 7.84% between 2025 and 2034.

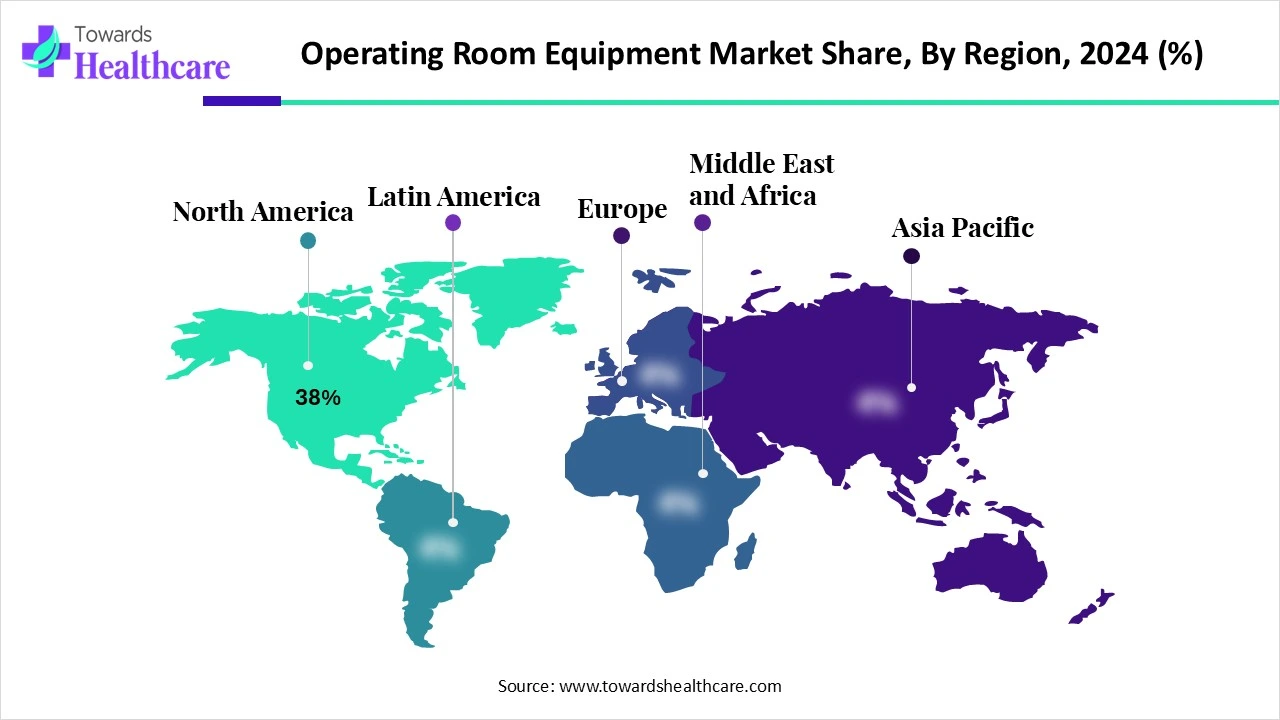

The operating room equipment market is expanding due to the growing number of surgical procedures, increasing demand for minimally invasive procedures, and advancements in medical technology. North America is dominant in the market due to huge healthcare spending and early adoption of modern technology. Asia Pacific is the fastest-growing market with growing healthcare investment and an increasing aging population.

| Metric | Details |

| Market Size in 2025 | USD 52.46 Billion |

| Projected Market Size in 2034 | USD 103.49 Billion |

| CAGR (2025 - 2034) | 7.84% |

| Leading Region | North America share by 38% |

| Market Segmentation | By Product Type, By End User, By Technology, By Surgical Specialty, By Region |

| Top Key Players | Stryker Corporation, Getinge AB, Drägerwerk AG & Co. KGaA, Hill-Rom Holdings, Inc. (Baxter), STERIS plc, GE HealthCare, Medtronic plc, Siemens Healthineers, Philips Healthcare, Karl Storz GmbH & Co. KG, Olympus Corporation, Skytron, LLC, Trumpf Medical (Hill-Rom/Baxter), Mindray Medical International Limited, B. Braun Melsungen AG, Canon Medical Systems Corporation, Richard Wolf GmbH, Zimmer Biomet (Surgical Navigation Systems), Integra LifeSciences, Eschmann Equipment |

The operating room equipment market comprises medical instruments and diagnostic tools used for the treatment, management, and surgical intervention of ear, nose, and throat conditions. These include hearing loss, sinusitis, otitis media, tonsillitis, snoring, and voice disorders. Devices span from diagnostic endoscopes and hearing aids to surgical instruments and implantable solutions. The market is driven by an aging population, growing prevalence of ENT disorders, advancements in minimally invasive ENT procedures, and technological innovations in hearing restoration and navigation systems. (Source - Plastic Surgery)

Integration of AI in the operating room equipment drives the growth of the market as AI-based technology is used in the operating room equipment to enhance diagnosis, treatment, and patient outcomes. AI-driven algorithms analyze huge data to detect patterns and make predictions, helping medical care professionals make more up-to-date decisions. The incorporation of robotics and artificial intelligence (AI) is increasing the efficiency of modern surgery, providing high levels of precision, control, and intelligence beyond reach. Robotic-assisted surgery (RAS) primarily offers better visualization and dexterity, making minimally invasive procedures even more accessible. Integrating artificial intelligence (AI) technologies has shown advanced potential in enhancing operating room equipment.

Government bodies from several countries take necessary measures to support surgeries.

Better Patient Safety Needs are Driving the Market

Investing in high-quality surgical instruments is crucial for the success of medical procedures. These tools improve precision, enhance patient safety, and offer long-term cost savings. They also increase surgical efficiency, meet medical standards, and support the surgical team's performance. While surgical instruments can cause complications, infections, or errors, leading to potential malpractice claims, high-quality instruments help reduce these risks. Designed with careful attention to detail, they ensure superior precision. This accuracy enables surgeons to perform complex procedures confidently and minimizes the chance of mistakes. Ultimately, high-quality surgical instruments are vital for ensuring the safety, precision, and efficiency of surgical operations, driving the market growth.

High-Cost Challenges of Operating Room Equipment

Operating room devices demand precise manufacturing, typically involving specialized materials such as biocompatible metals and polymers. Maintaining consistent quality across batches increases production costs, which consequently restricts the growth of the operating room equipment market.

How are Brain-Machine Interfaces Promoting the Market Expansion?

Brain-machine interfaces are used to assist patients with spinal cord injuries in controlling prosthetic devices. Additionally, spinal cord epidural stimulation (scES), which delivers electrical current directly to the spinal cord, shows great potential for aiding recovery. Assistive technology has advanced, with improved wheelchairs, smartphones, and other devices increasing independence for those with spinal injuries. A Brain-Machine Interface (BMI) allows direct communication between the brain and external devices without muscle control. BMIs decode brain signals to operate devices, helping individuals with disabilities, boosting cognitive functions, and potentially transforming human-computer interaction. This also creates opportunities for growth in the operating room equipment market.

By product type, the surgical tables segment led the operating room equipment market, due to the surgical table's support to keep a patient in place during an operative procedure. The surgical team efficiently operates on the still patient. The team moves parts of the patient's body using surgical table accessories. It enables simple access to the surgical site. These tables are intended to be modifiable in height, enabling the surgical team to simply position the table at the required height for the procedure. These tables are particularly designed to offer a stable and safe platform for surgical procedures, helping to lower the risk of complications and enhance patient outcomes.

On the other hand, the surgical lights segment is projected to experience the fastest CAGR from 2025 to 2034, as surgical lights are more than just a source of light; they are significant components of the operating room, which directly impact advanced surgical results. Current operating theatre lights have shadow management properties to minimise barriers caused by obstructions. This ensures that the surgical area is sufficiently lit, even during challenging procedures.

In the surgical lights segment, the LED surgical lights sub-segment is the fastest growing, as this light decreases shadow formation, confirming reliable illumination even in deep cavities, improving precision during surgery. This LED light offers clear, bright, and focused lighting, which enables surgeons to envisage tissues and organs more precisely. This LED has a high Color Rendering Index (CRI), making it easier to differentiate among tissues, blood vessels, and anomalies during complex surgeries.

By end user, the hospitals segment dominated the operating room equipment market in 2024, as these rooms are prepared with modern healthcare devices and technology, as well as dedicated lighting and ventilation technology, to ensure the comfort and safety of the patient and healthcare staff. During an operative procedure, the operating theatre of the hospital is kept sterile to avoid infections. High-grade, long-lasting materials that handle the severity of a busy hospital setting are used in the building of modular OTs.

The ambulatory surgical centers (ASCs) segment is projected to grow at the highest CAGR from 2025 to 2034, as patients feel more relaxed at a surgery center than in a hospital because ASCs are specifically intended for outpatient surgery, so the environment is typically quieter and calmer. ASC staff are generally experienced in working with patients having orthopedic surgery. Ambulatory operation centers, also called outpatient surgery centers, same day operative centers, or surgicenters, are health care facilities where operative procedures that do not require an overnight hospital stay are performed.

For Instance,

By end user, the conventional OR equipment segment led the operating room equipment market in 2024, due to OT equipment supporting seamless incorporation with hospital networks, enabling effective data management and sharing. Operating room apparatus is luxurious and varies based on the type of equipment. Operating rooms are intended for surgeons and surgical staff to perform surgical procedures that require time, patience, focus, and safety. Different types of equipment are used for use in the operating room.

The hybrid operating room equipment segment is projected to experience the fastest CAGR from 2025 to 2034, as hybrid ORs are advantageous to any patient who needs a procedure that includes imaging and intervention. The addition of the imaging equipment to the room where the process takes place lowers the requirement to move patients between imaging and surgical suites. This could be particularly beneficial for reduced time to treatment, like in cases where the patient has a medical emergency or when the hybrid ORs are particularly designed for trauma surgeries.

By surgical specialty, the general surgery segment dominated in the Operating Room Equipment Market in 2024, as general surgery, as the name denotes, encompasses a broad spectrum of operative procedures with regard to the diagnosis and treatment of injuries and diseases in any region of the body. Its scope of interest includes the skin, breasts, abdomen, peripheral vasculature, and head and neck, among other areas. It includes procedures such as abdominal surgery, thoracic surgery, orthopedic surgery, cardiovascular surgery, and more. General surgeons are highly skilled in a variety of procedures and techniques, making them essential to many areas of medicine.

On the other hand, the cardiovascular & thoracic surgery segment is expected to grow at the fastest CAGR over the forecast period, 2025 to 2034, as cardiovascular bypass surgery helps create a novel path for blood to flow around a blocked artery. This enhances blood flow to the heart and releases devastating symptoms such as chest pain and shortness of breath. The surgery significantly reduces the risk of death due to cardio disease. Thoracic surgery is a type of surgical procedure that focuses significantly on managing conditions in the thoracic area. Which include the lungs, mediastinum, oesophagus, diaphragm, and trachea

North America dominated the market share by 38% in 2024. Medical services in North America are largely offered by private sector healthcare facilities and paid for by a combination of public programs, private insurance, and high deductibles. The health care system is exclusive in advanced industrialized countries. North America has highly developed hospitals and surgical centers equipped with modern technologies. Healthcare innovation is active in multiple R&D sectors, including the deployment of artificial intelligence, telemedicine, machine learning, wearable devices, and 3D printing, which drive the growth of the market.

For Instance,

In the United States, increasing surgical procedure volumes of over 92.3 million in 2024 in 12 major medtech categories will increase the demand for operating room equipment. In the US, there are currently around 4,600 free-standing ambulatory surgicenters in operation, a growth of about 50% over the past years, which contributes to the growth of the market.

In 2023, Canada, surgical volumes returned to pre-pandemic levels with 2.22 million measures performed, an increase of 0.2% over the past years. Canada is a global leader in patient and day surgery, avoiding major hospital admissions in the first place. An advanced proportion of surgeries are laparoscopic, usually less invasive than traditional surgical procedures, lowering recovery times, which increases the demand for operational equipment.

Asia Pacific is estimated to be the fastest-growing operating room equipment market during the forecast period, as the Asia Pacific medical care landscape is undergoing a reflective transformation, shaped by demographic shifts, financial development, and fast digital innovation. The Asia Pacific region has made great strides in reducing deficiencies, financial growth, and better health results. Governments are progressively using cloud computing to decrease cost, increase access, enhance quality, and create innovations in healthcare, which drives the advanced operative equipment.

China built an advanced system that covered all poor people under the triple system of basic healthcare insurance, severe disease insurance, and healthcare assistance. China has progressively overcome obstacles in the provision of equality in access to medical care in rural and urban provinces, and has countless successes. With a population exceeding 1.4 billion and a fast ageing demographic, China is suffering a surging demand for medical care services, medical devices, and pharmaceuticals which drives the growth of the market.

India's medical care equipment sector, driven by revolution and government incentives, drives the growth of the market. The increasing use of advanced healthcare technologies has significantly driven up medical expenses in India. Progresses such as AI-based diagnostic tests and enhanced medical management come with better treatment but at a higher price. India is at the forefront of innovation, with advanced technology to improve access to high-quality and affordable care, contributing to the growth of the market.

Europe is notably growing in the market as growing life expectancy and lessening birth rates are placing growing demands on health and long-term healthcare facilities. Growing healthcare investment in advanced surgical technologies contributes to the growth of the market.

Germany is the largest economy in Europe and has a stable economic environment. The country has a high level of disposable income, which allows customers to afford expensive healthcare devices. The government has been aggressively encouraging digital health initiatives, which have created a favourable government environment for the adoption of medical equipment.

The growing adoption of minimally invasive surgeries in the UK is for faster recovery and lower healthcare expenses. The government is supporting UK healthcare providers to do more business overseas by encouraging the UK healthcare sector to enter overseas markets and supporting healthcare partnerships.

The latest research activities involve embedding AI-based technologies into operating room equipment to enhance efficiency.

Key Players: STERIS Surgical, Getinge, and Trivitron Healthcare.

Clinical trials assess the safety and efficacy of the equipment and are subsequently approved by regulatory agencies.

Key Players: Dräger, Clinztech, Staan, and Repligen.

Healthcare organizations focus on providing a safe and effective surgical environment for patients.

In March 2025, Hani Abouhalka, Company Group Chairman, Surgery, Johnson & Johnson MedTech, stated, “The DUALTO Energy System presents a noteworthy development in human-centric design, delivering a fully connected solution that simplifies surgical energy and enhances efficiencies in the OR.” (Source - Johnson & Johnson)

By Product Type

By End User

By Technology

By Surgical Specialty

By Region

February 2026

December 2025

December 2025

November 2025