February 2026

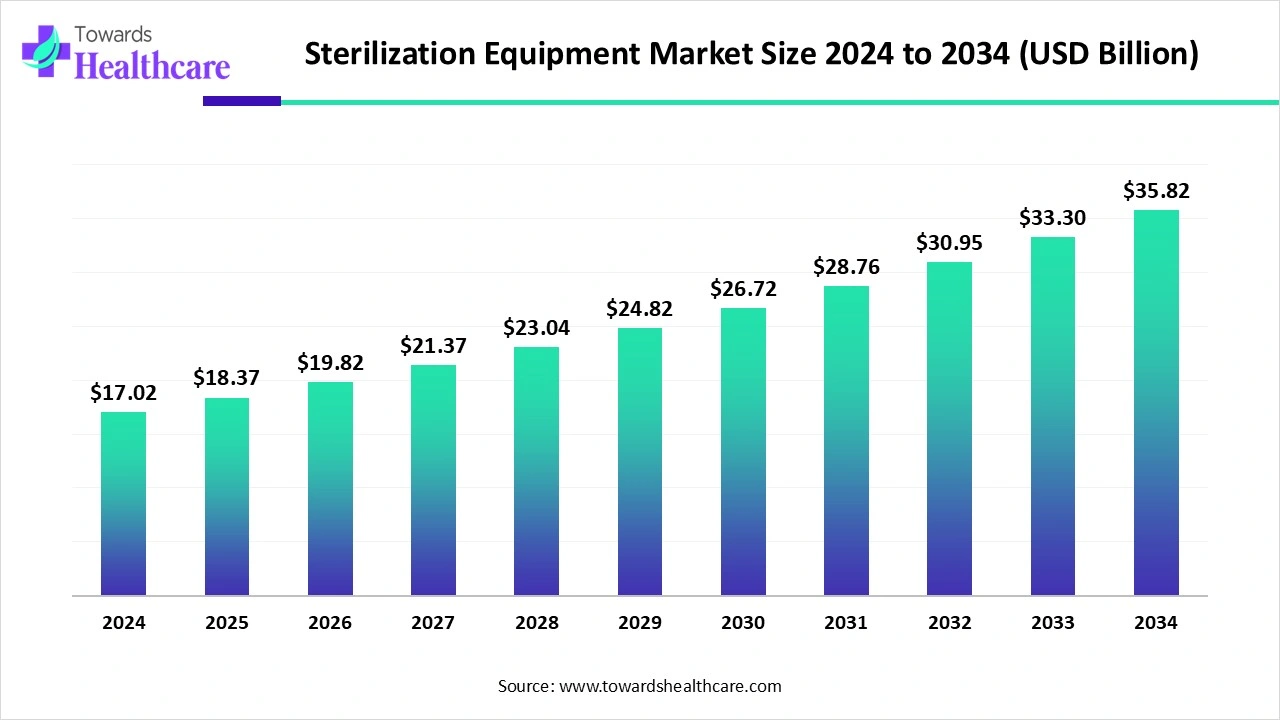

The global sterilization equipment market size is estimated at US$ 17.02 billion in 2024, is projected to grow to US$ 18.37 billion in 2025, and is expected to reach around US$ 35.82 billion by 2034. The market is projected to expand at a CAGR of 7.89% between 2025 and 2034.

The sterilization equipment market is growing due to the growing demand for medical equipment for infection control in the pharmaceutical and food industries. Rising technological advancement, surgical processes, and growing awareness of maintaining hygiene standards. North America is dominant in the market due to increasing medical tourism, while the Asia Pacific is the fastest-growing region in the market due to rising innovation in efficient and eco-friendly sterilization technologies.

| Table | Scope |

| Market Size in 2025 | USD 18.37 Billion |

| Projected Market Size in 2034 | USD 35.82 Billion |

| CAGR (2025 - 2034) | 7.89% |

| Leading Region | North America |

| Market Segmentation | By Sterilization Technology, By Product, By Offering, By End-User, By Service Mode, By Region |

| Top Key Players | 3M Company, Astell Scientific Ltd., Andersen Instruments (Andersen Samplers / biological indicators), Belimed AG, Ecolab Inc., Getinge AB, Johnson & Johnson (Advanced Sterilization Products / related businesses), Matachana Group, MMM Group (MMM Medcenter / Sterilization division), Nelson Laboratories (sterilization testing & validation services), STERIS Corporation, Sotera Health (Sterigenics / Sterigenics International), Steriline S.p.A., Tuttnauer Europe (Tuttnauer), Vektek / SteriPro |

The sterilization equipment market for instruments, systems, consumables, and services used to render medical devices, instruments, pharmaceutical products, laboratory items, food packaging, and industrial components free of viable microorganisms. Covers sterilizers (steam/autoclaves, ethylene oxide, hydrogen peroxide plasma/vapor, gamma/e-beam, peracetic-acid systems, dry-heat, ozone), ancillary equipment (sterilant generators, aeration units, dose readers), consumables (sterilant gases/chemistries, biological and chemical indicators, packaging), process monitoring & validation systems, and contract/central sterilization services across healthcare, pharma, biotech, labs, food & beverage and industrial end-markets.

Increasing advancement in modern sterilization equipment, which helps in the pharma industry, drives the growth of the sterilization equipment market

For instance,

Increasing collaboration between academic institutes and healthcare organizations to manufacture advanced sterilization technology, which drives the growth of the market.

For Instance,

Integration of AI in sterilization equipment drives the growth of the market as AI-based systems are enhancing sterilization cycles, increasing energy efficiency by up to 30%, and confirming steady sterility assurance levels. AI-driven technology enhances medical device sterilization services by growing efficiency, confirming safety, lowering expenses, and meeting the ideal standard. AI-driven sensors incessantly display sterilization equipment, ensuring constant performance and lowering contamination challenges. Automation confirms compliance with severe government standards by maintaining accurate control of sterilization parameters. Analytical maintenance powered by AI has revolutionized healthcare device sterilization services. AI-driven systems monitor devices in real time, detecting significant challenges before they lead to failures. This proactive strategy reduces downtime and confirms continuous operations.

Sterilization Equipment Market Demand 2025

Recent advances in surgical technology, such as optical imaging and robotics, are enhancing precision and making procedures less invasive. This optimization is expected to significantly improve surgical outcomes soon. Our understanding of infections has improved, prompting quick changes like better handwashing and sterilization practices among doctors and surgeons, which had an immediate positive impact. Despite the progress, operating times have increased as surgeons handle more complex, high-risk patients. This trend fuels the growth of the sterilization equipment market.

Major Challenges of Surgical Equipment

Surgical instruments must stay sterile after sterilization before reuse. Many SPDs use digital tracking systems to monitor inventory, but those relying on paper records face a higher chance of human error. This challenge restricts the expansion of the sterilization equipment market.

Increasing Advancement in Endoscope Sterilizer

A new endoscope sterilizer has been introduced, featuring a unique low-temperature sterilization process designed for safe, quick, and effective terminal sterilization of endoscopic tools. This method significantly enhances safety margins in endoscopic procedures. It employs well-known hydrogen peroxide gas plasma technology, which directs vaporized hydrogen peroxide (VHP) into the interior lumen channels. By leveraging pressure differences in each channel, it rapidly disperses VHP and reaches the necessary sterilization concentration in all internal channels in under 20 seconds. This innovation has the potential to expand the sterilization equipment market.

For Instance,

By sterilization technology/method, the steam sterilization segment led the sterilization equipment market, as this method of sterilization is harmless, affordable, fast, microbicidal, sporicidal, and speedily heats and penetrates fabrics. Steam autoclaves are efficient at killing a broad range of bacteria, viruses, and spores. The high temperature and pressure of the steam ensured by sterilization make steam autoclaves a dependable choice for important applications.

On the other hand, the hydrogen peroxide vapor/plasma & low-temperature sterilization segment is projected to experience the fastest CAGR from 2025 to 2034, as low-temperature sterilization can sterilize heat and moisture-sensitive medical equipment instead of compromising their functionality or producing degradation. Also, most low-temperature sterilization processes need less time and energy than outdated sterilization techniques, making them a rapid turnaround for regular usage in hospitals.

By offering/solution component, the consumables and capital equipment combined segment is dominant in the sterilization equipment market in 2024, as sterilization consumables offer vigorous protection against wounds and abrasions during transportation and handling. Sterilization equipment supports the removal of harmful bacteria and microorganisms, increasing the shelf life of food products and maintaining their quality and taste.

The contract sterilization services and turnkey validation services segment is projected to grow at the fastest CAGR from 2025 to 2034, as contract sterilizers offer sterilization services for regulated products, including medical devices, drugs, and biologics. Using a contract sterilizer results in the savings of the capital associated with the purchase of a sterilizer and its ancillary equipment. Contract sterilization confirms that controlled products meet strict sterility standards.

By end-user/industry, the healthcare segment led the sterilization equipment market in 2024, as the sterilization services in the healthcare industry provide a significant contribution to confirming that there are continuously clean instruments ready to go, thus lowering equipment-related delays. Steam sterilization expertise plays a significant role in germ-free processing and offering inclusive patient care. Sterilization procedures such as tubal ligation are efficient, suitable, and permanent.

The pharmaceutical and biotech segment is projected to experience the fastest CAGR from 2025 to 2034, as the increasing importance of sterilization processes in biotechnological research, advancement, and manufacturing has increased predominantly in the public since the pandemic years. It plays a significant role in the manufacturing of advanced testing options and vaccines against SARS-CoV-2. It is also applied in drug production, fermentation and cell cultivation, cleansing of proteins and other pharmaceutical products, and is also used in various laboratory and diagnostic procedures.

By service mode/deployment, the in-house/institutional sterilization segment led the sterilization equipment market in 2024, as it enhanced operational logistics and inventory control, and advanced consumer responsiveness. In-house sterilization abilities remove waiting time for equipment processing, offering instant access when vital procedures increase. Emergencies need sterile instruments that no longer depend on outside service plans or delivery timelines.

The outsourced contract sterilization and centralized sterilization hubs segment is projected to experience the fastest CAGR from 2025 to 2034, as it reduces hospital expenses, provides access to the novel sterilization services, time saving, the opportunity of employing professional staff, and offers continuous training for them. It enables organizations to focus on central activities such as R&D and product design, improves risk management, and offers access to skilled personnel and effective processes, eventually leading to faster marketplace entry for products.

North America is dominant in the sterilization equipment market in 2024, due to the increasing cases of patients suffering from chronic and acute diseases, which increases the demand for advanced sterilization equipment. The medical equipment sector in North America makes an enormous number of products, ranging from surgical gloves to artificial joints to imaging devices, which need to be timely sterilized, and it contributes to the growth of the market.

For Instance,

In the United States, a strong presence of highly developed medical infrastructure, like thousands of hospitals, surgical facilities, and outpatient centers, all of which need sterilization equipment to deal with patient safety and infection control standards. There is strict government regulation to drive hospital and laboratory investment in advanced sterilization technology, which contributes to the growth of the market.

For Instance,

In Canada, there is a large volume of healthcare centers and hospitals, which increases the need for sterilization equipment in this region. Technological advancements are driving innovation and growth in the medical device industry, leading to improved patient outcomes, enhanced healthcare delivery, and increased efficiency in medical device development and manufacturing.

Asia Pacific is the fastest-growing region in the sterilization equipment market in the forecast period, due to growing technological advancements in medical devices and equipment, and the medical device sector is a multi-product sector in this region, which drives the growth of the market. Growing ambulatory surgery centers and minimally invasive surgery contribute to the growth of the market.

Many R&D processes include pre-cleaning/decontamination, cleaning, inspection, assembly, sterilization, packaging, and storage/transportation. In-lab sterilization equipment in life sciences R&D and its impact on research quality, safety, and efficiency.

Key Players: NovaSterilis and Ansana

The clinical trials of the sterilization procedure should be monitored regularly by using a mixture of mechanical, chemical, and biological indicators to regulate the sterilizing conditions and indirectly the microbiologic status of the processed items.

Key Players: STERIS Applied Sterilization Technologies (AST) and 3M

Medical care personnel should achieve most cleaning, disinfecting, and sterilizing of patient-care supplies in a central processing department to easily control quality.

Key Players: Getinge and Sterigenics

In June 2025, Doug Bartlett, senior vice president of the company's Infection Prevention & Surgical Solutions business, stated, “In the high-stakes environment of sterile processing where patients' lives are at stake, both speed and accuracy are non-negotiable. Solventum innovations equip dedicated professionals with intuitive, cutting-edge resources that help them to safeguard patient health, reflecting our drive to continually support elevated standards of care in critical settings.”

By Sterilization Technology / Method

By Product / Equipment Type

By Offering / Solution Component

By End-User / Industry

By Service Mode / Deployment

By Region

February 2026

February 2026

February 2026

February 2026