February 2026

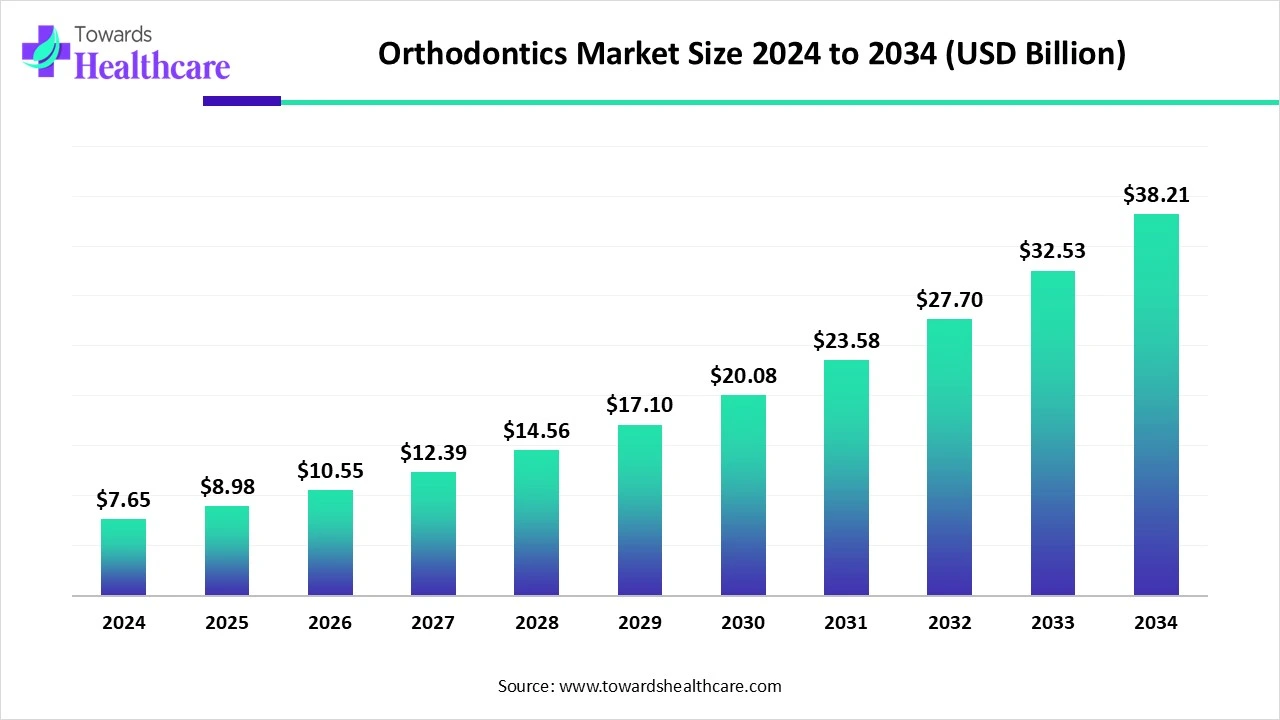

The global orthodontics market size is calculated at USD 7.65 billion in 2024, grow to USD 8.98 billion in 2025, and is projected to reach around USD 38.21 billion by 2034. The market is expanding at a CAGR of orthodontics 17.45% between 2025 and 2034.

| Metric | Details |

| Market Size in 2025 | USD 8.98 billion |

| Projected Market Size in 2034 | USD 38.21 Billion |

| CAGR (2025 - 2034) | 17.45% |

| Leading Region | North America |

| Market Segmentation | By Product Type, By Product, By Type, By Age Group, By End-user, By Region |

| Top Key Players | 3M Company, Align Technology, Inc., American Orthodontics, Danaher Corporation, Dentaurum GmbH & Co. KG, DENTSPLY International, Inc., G&H Orthodontics, Inc., Henry Schein, Inc., Rocky Mountain Orthodontics, Inc., TP Orthodontics, Inc. |

Orthodontics is a specialized branch of dentistry that focuses on diagnosing, preventing, and correcting misaligned teeth and jaws. It involves the use of devices like braces, aligners, and retainers to improve dental function and appearance. The market is experiencing steady growth due to increasing awareness about dental aesthetics and the importance of oral health. A rising number of people, especially teenagers and adults, are seeking treatments to correct misaligned teeth and improve their smiles. Technological advancements, such as clear aligners, 3D imaging, and faster treatment methods, have made it efficient, comfortable, and appealing. Additionally, the influence of social media, growing disposable incomes, and better access to dental care services are further driving the global demand for orthodontic treatment. According to a report published in the Journal of Clinical Medicine in January 2023, nearly 50% of the global population experiences malocclusions that are serious enough to need orthodontic treatment.

Artificial Intelligence (AI) is revolutionizing the market by enhancing accuracy, efficiency, and patient care. AI-powered tools assist in analyzing dental scans, enabling orthodontists to create highly precise and customized treatment plans. These technologies also streamline the design and production of clear aligners and braces, reducing human error and saving time. AI further supports remote monitoring, allowing practitioners to track progress virtually and make timely adjustments. This not only improves patient convenience but also boosts treatment outcomes. As AI continues to evolve, it is expected to further drive innovation and growth in the orthodontics sector, making care more accessible and effective.

Rising Number of Patients

With rising awareness about oral health and aesthetics, more individuals, teenagers, and adults are opting for corrective procedures to address misaligned teeth and bite problems. This growing demand leads to higher adoption of orthodontic devices such as braces and clear aligners. As a result, manufacturers and clinics are expanding their services and product offerings, contributing to market expansion and continuous technological advancement in the fields.

For instance,

High-Cost Orthodontic Treatment

The high cost of orthodontic treatment is a major factor limiting market growth, as it makes care unaffordable for many individuals, especially in developing regions. Procedures like braces and clear aligners often involve significant expenses, and insurance coverage is either limited or non-existent in many cases. This financial burden discourages patients from seeking necessary treatment, even when aware of its benefits, ultimately reducing the number of people undergoing orthodontic care and slowing the overall expansion of the orthodontics market.

Rising Adoption of Technological Advancements

Innovations like 3D imaging, AI-based treatment planning, and clear aligners have significantly improved the accuracy, speed, and comfort of orthodontic procedures. These advancements attract more patients by offering less visible, more patients by offering less visible, more convenient solutions. Additionally, they help clinics streamline operations and reduce manual errors. As demand for modern and efficient dental treatments continues to rise, technology-driven solutions are expanding the orthodontics market potential.

For instance,

By product type, the supplies segment held a dominant presence in the market in 2024 due to consistent demand for essential treatment materials like brackets, wires, bands, and adhesives. These items are fundamental for both traditional and modern orthodontics procedures. The wide application of these products in fixed and removable appliances, along with their frequent need for replacement and replenishment, contributed to their strong market presence. Additionally, technological improvements in materials enhanced treatment efficiency, further boosting the orthodontics market demand.

For instance,

By product type, the instrument segment is anticipated to grow at a significant rate in the orthodontics market during the studied years. Advancements in digital technologies such as 3D imaging and computer-aided design (CAD) have enhanced the precision and customization of orthodontic treatments, leading to improved patient outcomes and satisfaction. Additionally, the increasing demand for cosmetic dentistry, particularly among adults seeking discreet treatment options like clear aligners, has further fueled market expansion.

By age group, the adult segment was dominant in the orthodontics market in 2024. This segment dominated because a growing number of adults are seeking treatment for both cosmetic and functional reasons, driven by increased awareness of oral health’s impact on overall well-being. The availability has made orthodontics care more appealing to this age group. Additionally, higher disposable incomes and willingness to invest in personal appearance have further boosted the demand for adult orthodontics treatments.

For instance,

By age group, the teens segment is expected to grow at a lucrative rate in the coming years. Adolescents commonly experience malocclusion, making them prime candidates for orthodontics care. The rising influence of social media has increased the desire for aesthetic improvements among teens, boosting interest in treatments like clear aligners. Additionally, advancements in technology offer more comfortable and discreet options, while supportive parents with growing disposable incomes are more willing to invest in their children's long-term dental health.

By end-use, the dentist & orthodontist-owned practices segment held the highest share & is projected to grow significantly in the orthodontics market in 2024. This segment shows promising growth as these private practices are the primary providers of orthodontics treatments, offering comprehensive services that include diagnosis, treatment planning, and follow-up care. The increasing number of orthodontics clinics, particularly in emerging regions, has further bolstered this market dominance. Additionally, the adoption of digital technologies such as intraoral scanners and 3D printing has enhanced treatment effectiveness and patient satisfaction. The personalized care and advanced treatment options available in these settings continue to drive the growth of the orthodontics market.

North America dominated the orthodontics market in 2024 is largely attributed to its robust healthcare infrastructure. The region boasts a high concentration of skilled orthodontists, state-of-the-art clinics, and advanced hospitals equipped to handle complex dental procedures. This infrastructure supports the adoption of cutting-edge technologies such as 3D imaging, digital scanning, and clear aligners, enhancing treatment precision and patient satisfaction. Additionally, comprehensive insurance coverage and a cultural emphasis on dental aesthetics have increased accessibility and demand for orthodontic services, further solidifying North America's leading position in the market.

For instance,

There is a rising demand for aesthetic treatments, such as clear aligners, driven by increasing awareness of dental aesthetics and oral health. Technological advancements like 3D imaging and AI-driven treatment planning have improved the precision and efficiency of treatments, attracting more patients. Additionally, the availability of flexible payment options, such as insurance coverage and financing plans, has made orthodontic care more accessible. Lastly, a strong healthcare infrastructure and high disposable incomes further contribute to the growth of the market.

For instance,

The launch of the Canadian Dental Care Plan (CDCP) in 2023 has improved access to orthodontic services for millions without insurance, especially low-income families. Additionally, rising demand for aesthetic dental treatments like clear aligners and braces is fueling market expansion. Technological advancements such as 3D imaging and CAD have enhanced treatment precision and appeal. The entry of specialized companies further boosts availability, making orthodontic care more accessible and in demand across the country.

Asia-Pacific is anticipated to grow at the highest CAGR in the market during the forecast period. Rising awareness of dental health, increasing demand for aesthetic treatments, and a growing middle-class population with higher disposable incomes are driving market expansion. Additionally, the region is witnessing rapid urbanization and improvements in healthcare infrastructure. Government initiatives and the presence of cost-effective treatment options further encourage people to seek orthodontic care, contributing to the region's strong market growth potential.

For instance,

China's market is growing due to a rising awareness of dental aesthetics and health, particularly among younger populations. Increasing urbanization and higher disposable incomes have led to a greater demand for orthodontic treatments, such as clear aligners and braces. The expansion of dental care infrastructure and the availability of advanced treatments, including digital imaging and AI-driven orthodontics, are also boosting market growth. Additionally, the growing acceptance of orthodontic treatments as a part of overall healthcare further contributes to the market’s expansion in China.

A high prevalence of malocclusion, with about 35.4% of children affected, is driving demand for orthodontic treatments. Technological advancements, such as the introduction of clear aligners that improve treatment efficiency, are also contributing to growth. Rising disposable incomes are increasing access to cosmetic dental care, while government initiatives, like the National School Oral Health Program, are raising awareness and improving accessibility to dental services across the country. These factors are fueling the market's expansion.

Europe is anticipated to grow at the highest CAGR in the Orthodontics market during the forecast period. A high prevalence of malocclusion in the population drives demand for orthodontic treatments. Technological advancements, such as 3D imaging and clear aligners, have enhanced treatment precision and appeal. Rising demand for aesthetic dental procedures, fueled by increased awareness and social media influence, further contributes to growth. Additionally, strong healthcare infrastructure in countries like Germany, the UK, and France supports better access to advanced orthodontic care.

Growing disposable incomes and a rising middle class have made orthodontic treatments more accessible. Additionally, the increasing popularity of minimally invasive treatments, such as clear aligners, is attracting more patients. The rise in dental tourism, with patients from nearby countries seeking affordable care in the UK, is also contributing to market growth. Moreover, the country's well-established healthcare infrastructure supports the expansion of orthodontic services across various regions.

Germany's market is expanding due to the increasing adoption of minimally invasive treatments, such as clear aligners and lingual braces, which offer more discreet options. The growing middle-class population with higher disposable incomes is fueling demand for orthodontic procedures. Additionally, Germany's reputation for high-quality dental care and a strong focus on research and development in dental technologies are further driving market growth. The country's strong dental insurance coverage also makes orthodontic treatments more accessible, contributing to the market’s expansion.

For instance,

In September 2024, NiTime Clear Aligners, the first aligner system designed for shorter wear times, received clearance from the U.S. Food and Drug Administration (FDA) under 510(k). These aligners are now available for treating all types of dental malocclusions. OrthoFX will present this groundbreaking material at the 58th Indian Orthodontic Conference in Bengaluru, India, from September 20-22, 2024. Ren Menon, Co-founder of OrthoFX, stated, "NiTime Clear Aligners represent the most significant advancement in polymer science in orthodontics, addressing key treatment challenges faced by providers and their patients."

By Product Type

By Product

By Type

By Age Group

By End-user

By Region

February 2026

February 2026

February 2026

February 2026