January 2026

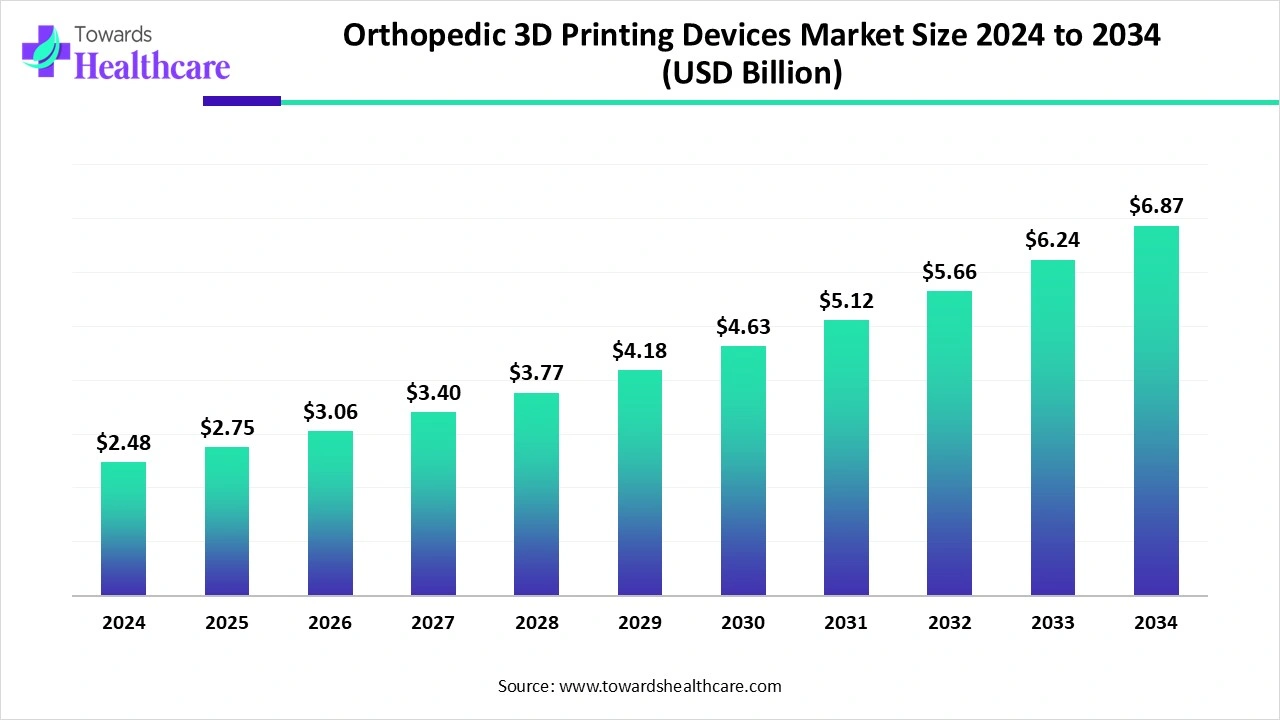

The orthopedic 3D printing devices market size is calculated at US$ 2.48 billion in 2024, grew to US$ 2.75 billion in 2025, and is projected to reach around US$ 6.87 billion by 2034. The market is expanding at a CAGR of 11.24% between 2025 and 2034.

The orthopedic 3D printing devices market is experiencing robust growth, driven by the growing use of surgical guides, implants, and prosthetics tailored to each patient, which improve accuracy and result in orthopedic procedures. In comparison to traditional manufacturing techniques, the technology allows for quicker prototyping, shorter recovery times, and enhanced customization. Demand is also being driven by the growing geriatric population, the prevalence of musculoskeletal disorders, and technological developments in biomaterials. Furthermore, because of its low cost and capacity to optimize supply chains, 3D printing is being adopted by healthcare providers, establishing it as a revolutionary force in contemporary orthopedics.

| Table | Scope |

| Market Size in 2025 | USD 2.75 Billion |

| Projected Market Size in 2034 | USD 6.87 Billion |

| CAGR (2025 - 2034) | 11.24% |

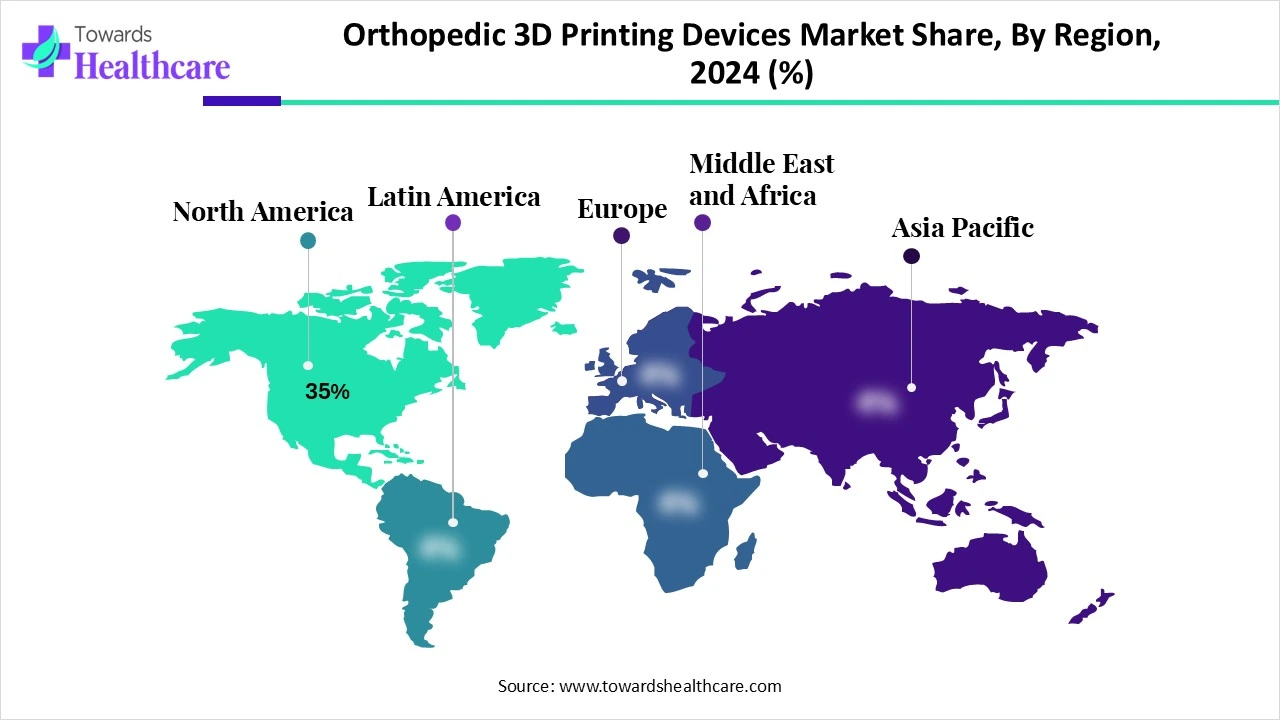

| Leading Region | North America Share 35% |

| Market Segmentation | By Type / Material, By Technology / Printing Method, By Application, By End User, By Region |

| Top Key Players | Stryker, 3D Systems Corporation, ENVISIONTEC US LLC, EOS GmbH Electro Optical Systems, General Electric, Smith & Nephew, Johnson & Johnson, Abbott, Zimmer Biomet Holding Inc., Aspect Biosystems Ltd., Stratasys Ltd., Materialise NV, SLM Solutions, Formlabs, Renishaw plc, Organovo Holdings, Inc., Bioprinting Solutions, Xilloc Medical, Prellis Biologics, Nano3D Biosciences |

The global orthopedic 3D printing devices market is witnessing significant expansion as healthcare systems increasingly integrate advanced additive manufacturing technologies into orthopedic care. The increasing prevalence of bone fractures, arthritis, and other musculoskeletal conditions, along with the growing demand for personalized implants and prosthetics that enhance patient mobility and recovery, are the main factors propelling this market. The use of biocompatible materials and advancements in 3D printing technology are making it possible to produce intricate long long-lasting, and patient-specific solutions at reduced costs. Furthermore, collaborations among medical device manufacturers, healthcare facilities, and research institutes are speeding up clinical applications, making 3D printing an essential part of orthopedic treatment in the future.

To drastically lower revision surgeries and long-term expenses, customized solutions are gradually taking the place of one-size-fits-all devices. Surgeons can practice intricate procedures using CT-derived anatomical models, which increases precision and confidence. This method facilitates the treatment of complex deformities and trauma cases that traditional implants are unable to adequately address while also increasing patient comfort and mobility. International adoption is accelerating as long-term cost savings are also becoming apparent to insurers and healthcare systems.

The orthopedic 3D printing devices market is changing due to the use of advanced materials like biodegradable polymers, PEEK, and titanium alloys. These materials encourage osseointegration and natural bone regeneration in addition to offering strength and durability. Biodegradable implants don't require further surgery because they can be safely dissolved after healing is finished. Patient safety is being improved, and wider clinical acceptance is being fueled by this innovation.

Artificial Intelligence is playing a transformative role in the market by accelerating implant design, enhancing pre-surgical planning, and ensuring real-time quality control during production. AI-powered algorithms cut turnaround times from weeks to just hours by converting medical imaging data into precise patient-specific models far more quickly than traditional methods. These tools also improve workflow efficiency, printing parameters, and material selection, leading to more accurate, safe, and affordable orthopedic implants. As the demand for minimally invasive treatments and customized healthcare continues to rise, artificial intelligence (AI) is emerging as a crucial catalyst for innovation and scalability in the orthopedic 3D printing industry.

Demand for Patient-Specific and Customized Implants

The orthopedic 3D printing devices market is driven primarily by customization since patients need implants that fit their individual anatomy for increased comfort and mobility. By lowering the chance of implant failure and revision surgeries, personalized devices help healthcare systems save a lot of money. Patients have better results and shorter recovery periods, and surgeons gain from increased surgical accuracy. The global orthopedic implant market is changing as a result of this move from mass production to precision care.

Regulatory and Approval Challenges

The regulatory processes for 3D printed orthopedic devices are still different and time-consuming despite advancements. Product launches may be delayed because regulatory agencies such as the FDA and EMA demand strict safety and performance data. Global harmonization and standardized testing procedures are lacking, which makes approvals even more difficult. In addition to delaying patient access to new devices, these obstacles deter smaller innovators from entering the orthopedic 3D printing devices market.

Hospital on-site 3D printing has the potential to completely transform orthopedic care by enabling instantaneous implant and surgical tool customization. This lowers overall expenses and decreases reliance on surgical preparation times. Additionally, point-of-care manufacturing allows surgeons to directly influence the design process, improving alignment with the unique needs of each patient. This model is anticipated to be adopted by more hospitals as regulations change.

The plastics segment dominates the orthopedic 3D printing devices market because they are inexpensive, simple to process, and can be used to create models that are both lightweight and robust. Polyether ether ketone (PEEK), polylactic acid (PLA), and acrylonitrile butadiene styrene (ABS) are materials that are materials that are frequently used for the prototyping of surgical instruments, anatomical models, and even implants that are patient-specific. The market leadership of plastics is further reinforced by their proven clinical safety and compatibility with various printing technologies.

The biomaterials segment is expected to be the fastest-growing segment as the focus of healthcare moves toward regenerative and biologically compatible solutions. Bioresorbable polymers, hydrogels, and bioceramics are examples of advanced biomaterials that make it possible to create implants that organically blend into human tissues. Rapid adoption in orthopedic surgeries is being driven by the growing need for customized biocompatible implants that improve healing and lower the risk of rejection.

The powder bed fusion (PBF) segment dominates the orthopedic 3D printing devices market because it can create high-strength implants from metals like titanium and cobalt chrome with accuracy and dependability. Its widespread use in the manufacturing of load-bearing orthopedic devices such as knee and hip replacements demonstrates its scalability and clinical reliability. Because PBF produces intricate geometries with superior mechanical qualities that are necessary for long-term orthopedic use, surgeons and manufacturers prefer it.

The binder jetting segment is estimated to be the fastest-growing printing technology segment because it provides lower costs, scalability for mass customization, and faster production speeds. It is perfect for creating implants and models that are unique to each patient because it can work with metals, ceramics, and biomaterials. Binder jetting is becoming more popular in hospitals and research facilities where turnaround time and cost effectiveness are crucial.

The orthopedic implants segment dominated the orthopedic 3D printing devices market in 2024, fueled by an increase in fractures, joint replacements, and osteoarthritis cases worldwide. High custom implants with better osseointegration and anatomical fit can be made thanks to 3D printing. Implants are the most used in this market since titanium 3D printed hip cups, knee implants, and spinal cages are already revolutionizing orthopedic care.

The surgical planning segment is anticipated to be the fastest-growing application, as preoperative accuracy is increased by surgeons using 3D printed anatomical models and guides. The precise visualization of intricate anatomy made possible by these patient-specific models cuts down on surgical time and complications. The need for planning tools is rising quickly as hospitals implement digital workflows that combine AI and 3D printing. To educate their students, medical schools and training facilities are also using surgical models. In the upcoming years, this trend is anticipated to greatly quicken the adoption curve.

The hospitals & surgical centers segment dominated the orthopedic 3D printing devices market in 2024 because they serve as the main locations for joint replacements, trauma surgeries, and implant procedures. In-house 3D printing labs enable hospitals to create models, implants, and surgical guides instantly, enhancing patient outcomes and cutting down on wait times. Their market dominance is guaranteed by their direct clinical care delivery role. Their adoption rates are being further increased by expanding partnerships with device manufacturers. Major hospital chains are also at the forefront of 3D printing technology investments.

The academic & research institutes segment represents the fastest-growing segment because they promote bioprinting, advanced orthopedic applications, and material innovation. Medtech companies are increasingly working with universities and research labs to investigate next-generation implants AI AI-driven design tools, and regenerative biomaterials. New applications reaching the clinical market are accelerated by their emphasis on experimental and proof-of-concept studies. R&D efforts in this area are being fueled by grants and projects supported by the government. Future clinical innovations are being laid by these institutions.

North America dominates the orthopedic 3D printing devices market share 35% in 2024, supported by a high rate of innovative technology adoption, sophisticated healthcare infrastructure, and robust regulatory approvals from organizations such as the FDA. Personalized medicine broad acceptance and the presence of significant players guarantee North America's leadership. The region's position is further reinforced by government financing and insurance coverage. Furthermore, innovation is being accelerated through partnerships between research institutes and hospitals. North America's hegemony is further reinforced by venture capital funding for medical technology startups.

The U.S. market is witnessing rapid growth driven by the integration of AI-assisted surgical planning improvements in biocompatible materials and the growing use of patient-specific implants. To improve surgical outcomes and save time, hospitals and surgical centers are increasingly using in-house 3D printing labs to create anatomical model's surgical guides, and customized implants. Powder bed fusion is still the most popular printing method, but binder jetting and bioprinting are rapidly expanding industries because of their quicker production and greater material versatility. The FDA's regulatory support partnerships between research institutions and device manufacturers, and point-of-care manufacturing, are also bolstering market expansion.

Asia Pacific is the fastest growing region, driven by the aging of the population, rising healthcare spending, and increased knowledge of superior orthopedic solutions. The region's hospitals and medical facilities are implementing 3D printing technologies on a large scale, especially for surgical planning and implants. In the Asia Pacific rapid urbanization, medical tourism, and local manufacturing initiatives are driving remarkable market expansion. Furthermore, encouraging government policies fosters innovative ecosystems. Growth is being accelerated by local companies entering the market with affordable 3D printing solutions.

The India market is experiencing significant growth, driven by growing awareness of customized orthopaedic solutions, rising healthcare spending, and the expanding use of cutting-edge 3D printing technology in medical facilities and research centers. A growing number of point-of-care 3D printing facilities are making it possible to produce anatomical model's surgical guides, and customized implants for quicker, more accurate surgeries. Technologies like binder jetting and bioprinting are gaining popularity quickly because they are affordable and work well with a variety of biomaterials. Further propelling the expansion of 3D printing applications in India are government programs to support medical innovation partnerships between regional hospitals and foreign device manufacturers, and the growing orthopedic surgery market.

Research and development (R&D) in the orthopedic 3D printing devices market is concentrated on developing patient-specific implants, advancing additive manufacturing methods, and improving biomaterials. Lightweight, strong, and biocompatible materials like PEEK, titanium alloys, and bioresorbable polymers are the focus of efforts. Incorporating AI into surgical planning, robotic-assisted printing, and next-generation technologies like bioprinting for cartilage and bone scaffolds and tissue regeneration are further innovations.

Key Players: include 3D Systems, Stryker, Zimmer Biomet, DePuy Synthes (Johnson & Johnson), and Axial3D.

The safety, structural soundness, and functionality of 3D-printed implants under load-bearing circumstances are assessed in clinical trials and validations. To guarantee device safety, efficacy, and adherence to medical standards, regulatory agencies like the FDA (United States), EMA (Europe), and CDSCO (India) supervise approvals. Surgical guides, biocompatible materials, and implants customized for each patient are covered by these approvals.

Key Players: include 3D Systems, Stryker, Lima Corporate, Exactech, and DePuy Synthes.

In the market for orthopaedic 3D printing, patient support focuses on helping patients, surgeons, and hospitals achieve the best results. These services include digital workflows for implant design, post-operative guidance, instructional materials for implant use, and pre-operative planning tools. To guarantee prompt delivery, companies also offer hospital-based point-of-care solutions, quality certifications for implants, and training programs for surgeons. Enhancing access to surgical planning and customized implants in developing areas is the main goal of outreach programs.

Key Players: include 3D Systems, Stryker, Zimmer Biomet, Axial3D, and LimaCorporate.

By Type / Material

By Technology / Printing Method

By Application

By End User

By Region

January 2026

December 2025

December 2025

December 2025