February 2026

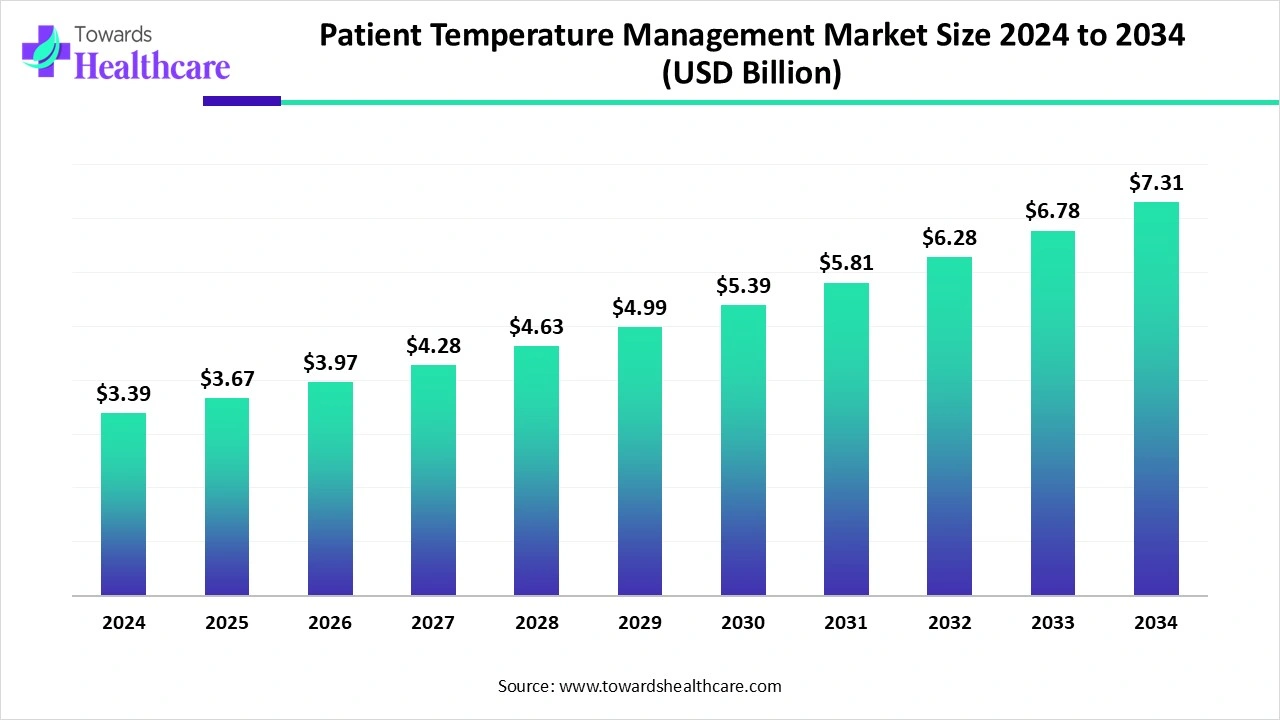

The global patient temperature management market size is calculated at US$ 3.67 billion in 2025, grew to US$ 3.97 billion in 2026, and is projected to reach around US$ 8.03 billion by 2035. The market is expanding at a CAGR of 8.15% between 2026 and 2035.

Around the globe, there is an increasing prevalence of cardiovascular conditions, neurological issues, and other severe concerns are further fostering demand for advanced surgical procedures. These procedures are boosting the adoption of diverse temperature management solutions, including warming & cooling systems, and targeted temperature management. Alongside, the global patient temperature management market is stepping into the design of wearable temperature sensors, portable warming, and cooling devices.

The patient temperature management market for medical devices, systems, and consumables used to monitor, maintain, raise, or lower a patient’s core or surface body temperature across care settings (pre-op, OR, PACU, ICU, ED, transport, and ward). Includes active warming systems (forced-air, conductive/resistive, circulating-water, fluid/blood warmers, resistive/mattress systems), active cooling/targeted temperature management (surface cooling pads, intravascular/endo-catheters, endovascular systems), temperature monitoring probes/modules, disposables (blankets, pads, gel pads), control consoles, and related services/support.

A growing awareness of patient safety during numerous medical interventions and other technological expansions in temperature measurement is supporting the overall market progression.

The widespread emergence of soft, wearable, and wireless temperature sensors is integrated with AI algorithms and Internet of Things (IoT) technology to establish closed-loop systems. Furthermore, the adoption of AI models assists in the analysis of data from wearable sensors to estimate a patient's thermophysiological status and further offers early warnings for health abnormalities. Alongside advances in AI-enabled alert systems are supporting targeted temperature management (TTM) in patients with cardiac arrest is being supported, focusing on improvements in outcomes.

A Surge in Surgical Procedures and Technological Advances

The global patient temperature management market is stepping into raising patient safety and comfort, including technological breakthroughs. These breakthroughs are blooming as non-invasive forced-air warming blankets, cooling pads, wearable sensors, and advanced portable warming systems for blood and IV fluids, to boost clinical efficacy. Additionally, current expansion in complex and routine surgical procedures, particularly general surgery, cardiac, and gynecological operations, is a prominent driver, where temperature management acts as a significant factor in the prevention of complications like perioperative hypothermia.

Barriers in Logistics

The implementation and efficient integration of new temperature management systems with existing hospital systems are imposing hurdles in the market development, which require training and infrastructure adjustments. Also, a shortage of specialized professionals in operating and maintaining highly sophisticated temperature management approaches.

Prospective Applications in RPM, NICUs, and & Cardiology

In the future, numerous digital solutions are expanding their utilization in diverse areas, like remote patient monitoring, NICUs. In the case of RPM, ongoing breakthroughs are boosting their applications in temperature management in home healthcare settings, with enhanced convenience and patient outcomes. Alongside, day by day number of premature births is accelerating the requirement for highly accurate temperature management to ensure optimal outcomes for vulnerable newborns. Moreover, the cardiology area is widely adopting these advances to manage heart attacks with the involvement of targeted temperature management (TTM)

| Table | Scope |

| Market Size in 2026 | USD 3.97 Billion |

| Projected Market Size in 2035 | USD 8.03 Billion |

| CAGR (2026 - 2036) | 8.15% |

| Leading Region | North America |

| Market Segmentation | By Product/Technology, By Application/Clinical Use, By End-User/Point-of-Care, By Technology Architecture/Delivery, By Patient Group/Demography, By Region |

| Top Key Players | 3M Company, Atom Medical Corporation, Augustine Surgical, Inc., Belmont Medical Technologies, Becton, Dickinson & Company, BrainCool AB, Cincinnati Sub-Zero/Gentherm, Geratherm Medical AG, Inditherm plc, Inspiration Healthcare Group /The Surgical Company, Medtronic, Pintler Medical, Stryker, Smiths Medical, ZOLL Medical Corporation |

How did the Forced-Air (Convective) Warming Systems Lead the Market in 2024?

In 2024, the forced-air (convective) warming systems segment was dominant in the patient temperature management market. A prominent factor is a rise in surgical procedures, which is expanding the need for the management of perioperative hypothermia. Also, the improvements in clinical protocols mandating normothermia are fostering the adoption of these advanced technologies. Current developments are emphasizing system safety, comprising filters for intake air and optimized blanket designs to prevent surgical site contamination by disturbing laminar airflow.

And, the intravascular/endovascular cooling & warming catheters segment will expand rapidly. Mainly, the growing cases of cardiac arrest and cardiovascular diseases, and the increasing demand for therapeutic hypothermia to accelerate neurological outcomes, are impacting the segmental expansion. In these cases, intravascular cooling supports patient recovery and lowers long-term morbidity. Moreover, these IVTM offer swift and stable temperature management with lower fluctuations. Recently, Philips and Zoll companies have increasingly innovated with new catheter designs.

Why did the Perioperative Normothermia Prevention Segment Dominate the Market in 2024?

The perioperative normothermia prevention segment accounted for the biggest share of the patient temperature management market in 2024. The rising awareness among healthcare providers regarding serious complications associated with perioperative hypothermia, such as escalated infection risk, blood loss, slower recovery, and possible post-operative cardiac events, is assisting in the overall prevention solutions. In this era, this segment is focusing on an entire, multimodal approach comprising preoperative skin surface warming, intraoperative active warming with forced air and heated fluids, environmental temperature control, and robust postoperative recovery room warming.

However, the targeted temperature management/therapeutic hypothermia segment is estimated to register the fastest growth. A wide range of adoption of TTM in traumatic brain injury, stroke, and other critical care concerns beyond cardiac arrest is propelling the demand for advanced temperature monitoring. Continuous developments are emphasizing the transformation of high-quality TTM as a bunch of interventions, standardized protocols for sedation and shivering control, and the awareness of patient-specific factors in preferring a temperature target. Highly sophisticated TTM focuses on controlling hyperthermia instead of aggressive cooling.

What Made the Hospitals (Operating Rooms) Segment Dominant in the Market in 2024?

The hospitals (operating rooms) segment held a major share of the patient temperature management market in 2024. Various areas, like cancer, cardiovascular, and orthopedic procedures, are fostering the need for active temperature management in operating rooms to maintain patient normothermia. It is important to maintain a stable body temperature to mitigate serious adverse events, including surgical site infections, blood loss, and prolonged recovery, which are connected with hypothermia. In these facilities, there is a need for prewarming patients for 30 minutes before anesthesia, raising ambient operating room temperatures.

Although the emergency departments & ambulance/transport providers segment is predicted to expand at a rapid CAGR, the increasing prevalence of health issues is demanding accurate temperature control, like in critical diseases and surgical interventions, as well as the expanding focus on patient safety, comfort, and improved patient outcomes, which are driving the emergence of emergency departments. Additionally, well-established ambulance providers are utilizing surface ice packs and cold saline infusions. Technological breakthroughs encompass non-invasive surface cooling systems, intravascular devices, and a combination with electronic health records, leveraging precise control and improved effectiveness.

How did the Surface/External Systems Segment Dominate the Market in 2024?

In 2024, the surface/external systems segment registered dominance in the patient temperature management market. The segment is mainly driven by the rising adoption of intelligent, closed-loop systems and non-invasive, soft-silicone pads to enable faster, controlled cooling, enhanced patient comfort, and lowered nursing burden as compared to traditional methods. Currently, digital solutions are applying proprietary software to track and adjust cooling to mitigate overcooling and rebound hyperthermia, building upon previous models that depend on external blankets or pads.

Moreover, the hybrid systems segment is anticipated to expand rapidly during 2025-2034. The broader use of IoT and AI enables real-time monitoring, automated responses, and better data analysis, which further assist in the development of advanced hybrid systems. These systems comprise the integration of warming and cooling functionalities that facilitate a complete and adaptable approach to patient care, meeting various clinical requirements in serious care and perioperative settings. Developing hospital unit designs are combine physical and virtual environments, utilizing virtual beds, also accelerates virtual communication with remote patients, and improves patient safety and communication.

Why did the Adult Perioperative & ICU Patients Segment Lead the Market in 2024?

The adult perioperative & ICU patients segment dominated the patient temperature management market in 2024. A rise in the elderly population with chronic issues and the need to lower surgical-site infections and hospital stays are bolstering the adoption of advanced temperature systems in these patients. The market is focusing on prewarming protocols, the application of AI/ML for early fever/hypothermia prediction, and customized, device-specific plans for both hypothermia and hyperthermia. Also, the wider contribution of specific device technologies, particularly convective air-warming and advanced bladder probes, for more precise and effective temperature measurement and control.

Whereas the pediatric and neonatal patients segment is predicted to register rapid growth. Eventual growth in rates of premature births, expanding awareness, and focus on preventing neonatal hypothermia are supporting the development of the overall market. Preventive approaches are evolving a stable thermal environment for the maintenance of an infant’s stable core temperature with lower oxygen and energy consumption. Alongside, the private and public organizations are heavily investing in sophisticated neonatal care facilities, and the progress of Neonatal Intensive Care Units (NICUs) will develop a higher need for sophisticated devices, especially specialized incubators and warming systems.

In the patient temperature management market, North America captured the biggest share in 2024. North America is facing a rise in several instances of chronic diseases, including cardiovascular concerns, along with widespread surgical procedures are also boosting the demand for advanced temperature management solutions. The leading companies are involved in strategic alliances with hospitals, group purchasing organizations (GPOs), and healthcare networks to accelerate market penetration and product accessibility.

U.S. Market Trends

In August 2025, Philips, a global company in health technology, announced a plan for new investments of more than USD 150 million in U.S. manufacturing and research and development (R&D), to produce AI-powered healthcare technologies for hospitals across the U.S.

Canada Market Trends

Canada’s patient temperature management market is focusing on the expansion of targeted temperature management (TTM), which is increasingly suggested in post-cardiac arrest patients to maintain controlled body temperatures for better neurologic outcomes. Canadian healthcare systems are operating advanced endovascular catheters and hemofiltration devices in active cooling, while using esophageal or bladder probes to track core temperature.

During the forecast period, the Asia Pacific is estimated to witness rapid expansion in the market. China and India are facing a huge burden of chronic conditions among aging populations, which further fosters the demand for advanced solutions. ASAP’s patient temperature management market is expanding portable warming and cooling devices for home use, which support patients in managing conditions post-surgery or chronic issues. Besides this, the diverse region of ASAP is leveraging wearable temperature management solutions to provide continuous, real-time monitoring and treatment during daily activities.

China Market Trends

In October 2024, Meddax Medical, the German Chinese joint venture among Altride Healthcare and Maxwell Medical, distributed Gentherm Medical patient temperature management products in selected provinces in China.

India Market Trends

India’s patient temperature management market is revolutionizing, with the major contribution of local companies like Codex Healthcare are designing and distributing patient warming systems customized to meet the specific needs of the Indian healthcare market. The NCDC is supporting with its "Strengthening Health Systems Preparedness for Heat Related Illnesses" document involved in the management of heat strokes, like the recommended modified portable whole-body cold water immersion (CWI) for situations where traditional immersion is infeasible.

Europe, with its notable growth in the market, is assisting in the adoption of advanced digital solutions in the healthcare systems. Moreover, ongoing collaborations, such as Medtronic's with Methinks AI in Central and Eastern Europe, are emphasizing improvements in stroke treatment, which often comprises temperature management, by exploring AI-enabled systems. At the same time, Europe is also stepping into optimizing and standardizing perioperative temperature management to prevent complications like hypothermia. Involvement of European guidelines, like those from the National Institute for Clinical Excellence (NICE), suggests frequent temperature checks in the pre-anesthesia, intraoperative, and post-anesthesia care unit (PACU) periods.

South America is expected to grow significantly in the patient temperature management market during the forecast period, due to the growing prevalence of chronic disease. This is increasing the surgical procedures, driving the demand for patient temperature management systems. The growing technological advances and government initiatives are also increasing their adoption rates, enhancing the market growth.

Brazil Patient Temperature Management Market Trends

The growing healthcare investments in Brazil are increasing the adoption of advanced technologies like patient temperature management systems. The growing chronic disease, surgical volumes, and government support are also increasing their adoption rates. Additionally, growing medical tourism and technological advancements are also increasing their demand.

MEA is expected to grow significantly in the patient temperature management market during the forecast period, due to expanding healthcare infrastructure, which is increasing the adoption of advanced technologies like wearable patient temperature management systems. The growing chronic disease, surgical volumes, and government policies are also encouraging their use, promoting the market growth.

Saudi Arabia Patient Temperature Management Market Trends

Saudi Arabia is experiencing a growth in the healthcare infrastructure, which is backed by investments from various sources, promoting the use of patient temperature management systems during complex surgical procedures. The growing focus on patient safety and technological innovations are also increasing their use.

By Product/Technology

By Application/Clinical Use

By End-User/Point-of-Care

By Technology Architecture/Delivery

By Patient Group/Demography

By Region

February 2026

February 2026

January 2026

January 2026