February 2026

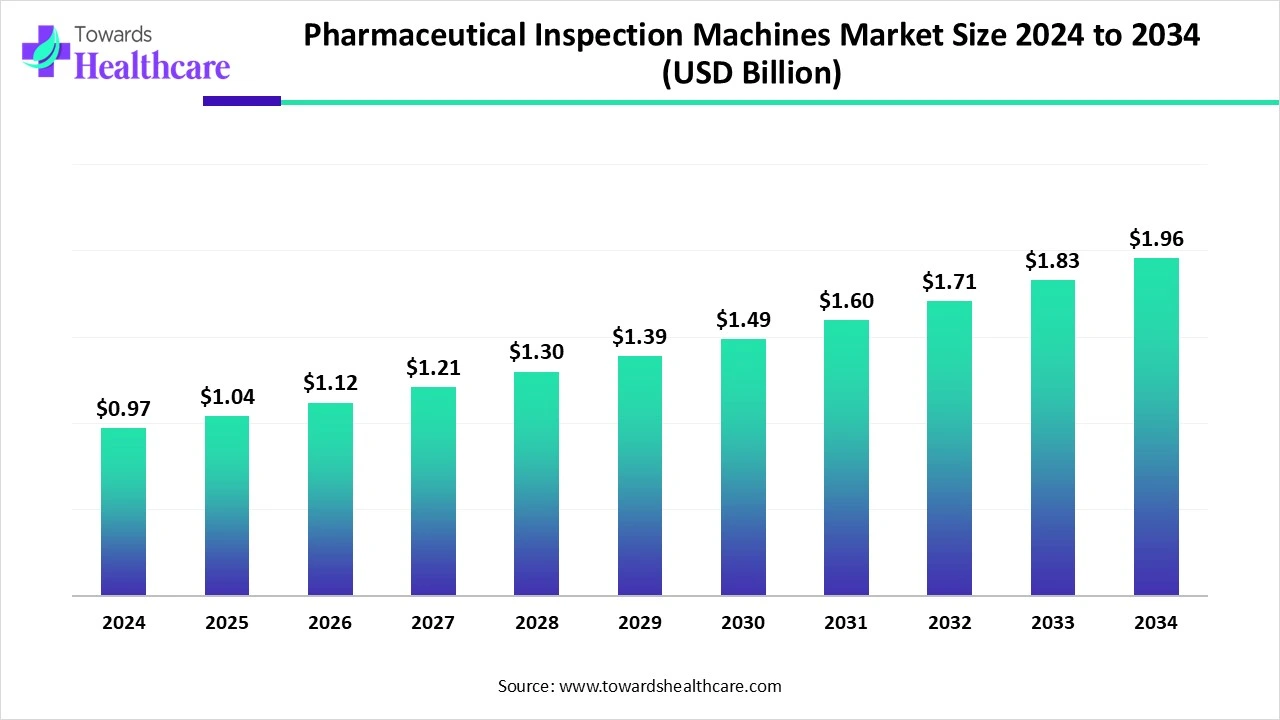

The global pharmaceutical inspection machines market size is calculated at US$ 0.96 billion in 2024, grew to US$ 1.04 billion in 2025, and is projected to reach around US$ 1.96 billion by 2034. The market is expanding at a CAGR of 7.56% between 2025 and 2034.

The pharmaceutical inspection machines market is witnessing steady growth, driven by growing demand for high-precision machinery to guarantee the quality, safety, and effectiveness of pharmaceutical products. Manufacturers are using more sophisticated inspection systems to find flaws, contaminants, or irregularities in products like tablets, capsules, vials, and ampoules as a result of the FDA and EMA's strict regulatory standards.

Inspection efficiency, accuracy, and speed are being improved by the move toward automation and the integration of technologies like robotics, AI, and machine vision. Furthermore, the pharmaceutical industry's need for flexible inspection solutions is being fueled by the expanding production of complex biologics, injectable medications, and customized medications.

| Table | Scope |

| Market Size in 2025 | USD 1.04 Billion |

| Projected Market Size in 2034 | USD 1.96 Billion |

| CAGR (2025 - 2034) | 7.56% |

| Leading Region | North America |

| Market Segmentation | By Type (automation level), By Technology / Detection Principle, By Packaging / Dosage Form (where inspection is applied), By End-User / Buyer, By Geography / Region (regions only, per request) |

| Top Key Players | Stevanato Group, Syntegon, Marchesini Group, Romaco Group, Körber Pharma, Krones AG, Cozzoli Machine Company, PTI Inspection Systems, CCI Inspection Systems / Compagnie des Machines, STERIS / Cantel, Seidenader, NTS, Willach / Gebr. Willach, Mettler-Toledo Safeline, Thermo Fisher Scientific, S+S Inspection, Vision Systems / Vision Engineering suppliers, Compromec / regional camera inspection suppliers, Aptar Visual Inspection / specialized vendors, Micronclean / specialized inspection suppliers |

Pharmaceutical inspection machines are automated and semi-automated systems used across pharmaceutical manufacturing and packaging lines to inspect product quality and package integrity. They detect visual defects (particles, cracks, fill level, foreign matter), packaging defects (seal integrity, blisters, tamper evidence), dimensional defects, label/code verification, and non-visible faults (e.g, via X-ray, leak testing, vacuum/pressure-based CCI). These machines enable regulatory compliance (GMP, USP, EMA/FDA expectations), reduce recall risk, increase throughput and traceability, and are used for a wide range of dosage forms (vials/ampoules, syringes/cartridges, bottles, blisters, tablets/capsules).

Rising Demand for Serialization and Anti-Counterfeit Measures: Inspection devices with serialization and track and trace capabilities are in greater demand as worries about fake medications grow. These systems protect the public's health by guaranteeing product authenticity and adherence to international regulatory standards.

By enabling quicker, more precise defect detection and lowering false rejections, AI integration is transforming pharmaceutical inspection. Machine learning algorithms enhance the inspection of tablets, capsules, vials, and ampoules by adapting to product variations. Along with identifying defect patterns and improving compliance documentation, AI also supports predictive maintenance. AI-powered systems are a major force behind automation and efficiency in contemporary pharmaceutical manufacturing, and this technology is especially useful for biologics and personalized medications where accuracy is crucial.

AI-powered inspection machines are helping pharmaceutical companies boost productivity while meeting strict regulatory standards. These systems reduce waste, guarantee consistent product safety, and provide real-time quality control by fusing machine vision and intelligent analytics. As the sector adopts Industry 4.0, integrating AI is no longer merely an innovation but is now a competitive requirement.

Growing Emphasis on Patient Safety and Product Quality

There is a growing pressure on pharmaceutical companies to release safe, flawless medications. Even slight flaws in injevtab; es tablets or capsules can present serious health risks and result in recalls, legal problems, and harm to one's reputation. Manufacturers are consequently giving inspection technologies top priority to find contamination, chips, cracks, and labeling errors. In addition to being required for compliance, this increased emphasis on safety is also a selling point for the brand. Before a product is delivered to a patient, advanced inspection systems help guarantee that it satisfies the highest safety standards.

Complex Integration with Existing Production Lines

Modern inspection equipment can be difficult to integrate with legacy production systems used by many pharmaceutical companies. This frequently necessitates extensive customization workflows, redesign and installation, and testing downtime. Sometimes integration calls for extra spending on environmental controls, conveyor systems, or software compatibility. Decision-making can be slowed down, and the rapid adoption of new inspection technologies is impeded by the time and complexity needed for such integration.

Growing Biologics and Biosimilars Production

The demand for specialized inspection solutions is being driven by the move toward biologics and biosimilars, which are more conventional small-molecule medications. For these products to be safe and stable, advanced visual inspection, container integrity checks, and accurate particulate detection are frequently necessary. Businesses stand to gain from creating injection systems that can handle a variety of container types, including cartridges, vials, and pre-filled syringes. The global regulatory approval of biosimilars is expected to increase the market for specialized inspection equipment.

The semi-automated inspection machines segment dominated the pharmaceutical inspection market due to they strike a balance between cost effectiveness and operational efficiency. Many manufacturers favor these systems because they ensure accuracy while preserving production line flexibility by fusing automated procedures with human oversight. Particularly preferred in mid-sized production setups, where complete automation may be unnecessary or prohibitively expensive, are semi-automated machines. Their ability to adjust to different product categories and packaging designs also helps explain why they have maintained their dominance.

The fully automated inspection machines segment is estimated to be the fastest growing, driven by the growing need for increased accuracy, throughput, and a decrease in human error. These systems are perfect for large-scale pharmaceutical manufacturing because of advancements in AI and robotics, which allow them to carry out intricate inspections with little manual intervention. Furthermore, the demand for real-time quality assurance and the drive toward continuous manufacturing hasten the adoption of fully automated solutions. These machines also support compliance with stricter regulatory requirements by providing detailed audit trails and traceability.

The X-ray inspection segment dominated the market in 2024 due to its capacity for non-destructive testing, including density checks, fill level verification, and foreign body detection. It is a popular option in many pharmaceutical plants due to its great dependability and versatility with different packaging types. Because X-ray systems are non-invasive, they can detect even the smallest contaminants or irregularities while guaranteeing product integrity. Their efficacy and user acceptability have also been further increased by advancements in processing speed and image resolution.

The integrated multi-technology systems segment is the fastest growing, demonstrating the movement toward thorough quality control. These hybrid systems combine the best features of several technologies to offer more precise, adaptable inspection solutions that satisfy strict legal requirements. Operating complexity and downtime are decreased by their capacity to identify a greater variety of flaws and packaging problems on a single platform. The adoption of these integrated systems is fueled by the growing complexity of pharmaceutical packaging and the growing need for zero-defect manufacturing.

The vials & ampoules segment dominates pharmaceutical inspections, largely because of their widespread use in injectable medication and vaccines. Inspection technologies are primarily focused on them because of their crucial role in delivering sterile drugs, which necessitates strict quality checks. Strict regulatory oversight is also applied to vials and ampoules, necessitating regular checks for fill volume, particulate contamination, and seal integrity. The need for inspection solutions specifically designed for injectable therapies and biologics is further reinforced by their growing popularity.

The prefilled syringes & cartridges segment is the fastest-growing packaging form in inspection due to their specialty medications and biologics are increasingly using them. Investments in specialized inspection solutions are being driven by their ease of use, dosage accuracy, and growing preference for personalized medicine. Prefilled systems increase the market demand for healthcare providers by lowering preparation time and contamination risks. To manage the special difficulties presented by these devices, such as intricate shapes and delicate materials, inspection machines are being developed.

The innovator/branded pharmaceutical manufacturers segment has dominated the market in 2024, since it adheres to stringent regulatory standards and makes significant investments in quality assurance, safeguarding the reputation of its brand. Usually, these businesses need sophisticated inspection systems to guarantee the efficacy and safety of their products. Their dedication to quality and larger R&D budgets spur innovation and the uptake of state-of-the-art inspection technologies. They also frequently establish the industry standard impacting supplier offerings and market trends.

The biotechnology companies segment is estimated to grow at the highest CAGR during the forecast perio d, especially those producing injectables and sterile products, which are the fastest-growing buyers of inspection machines. The demand for advanced inspection technologies catered to the specific requirements of biologics and biosimilars is fueled by their rapid growth, which necessitates precise and contamination-free manufacturing. Because these businesses deal with intricate regulatory environments and highly complex products, trustworthy inspection solutions are essential. The need for specialized inspection equipment is further increased by increased investment in advanced therapies and personalized medicine.

North America dominates the pharmaceutical inspection machine market due to its developed pharmaceutical sector, strict regulatory framework, and early adoption of innovative technologies. High healthcare spending and a strong R&D infrastructure further solidify its position as a leader. The existence of significant pharmaceutical firms and producers of inspection tools also contributes to market expansion. Better inspection standards are constantly being pushed for by regulatory agencies like the FDA, which promote innovation and adoption in this area.

The U.S. pharmaceutical inspection machine market is led by semi-automated systems valued for their cost-effectiveness, while fully automated machines are the fastest-growing segment because of developments in robotics and AI. The predominant technology is X-ray inspection while integrated multi-inspection while integrated multi-technology systems are quickly becoming increasingly well-liked for through quality control. Although prefilled syringes and cartridges are rapidly expanding due to their use in biology, vials and ampoules continue to be the primary packaging inspected. The primary purchasers are innovative pharmaceutical companies with growing demand for injectables from biotechnology companies. Continuous innovation and strict regulatory oversight keep the U.S. market leader in inspection technology.

Asia Pacific is the fastest-growing region, driven by rising exports, rising healthcare awareness, and rising investments in pharmaceutical manufacturing. The area is implementing cutting-edge inspection equipment and quickly updating production facilities to satisfy international standards. Growing demand for reasonably priced medications and government programs bolstering pharmaceutical infrastructure both support market growth. Technology transfer and market penetration are also made easier by expanding partnerships between regional producers and international firms.

The pharmaceutical inspection machine market in India is growing fast, with semi-automated systems leading due to cost-effectiveness and flexibility, while fully automated machines grow quickly thanks to AI and robotics. Integrated multi-technology systems are becoming increasingly popular, and X-ray inspection still holds a dominant position. The most frequently inspected packaging is still vials and ampoules, but prefilled syringes are becoming more common in biology. Innovative pharmaceutical companies dominate the market, with biotech injectables seeing the fastest growth. The government's initiatives and emphasis on international quality standards fuel growth.

Focuses on AI-enabled vision, automation, and compact modular design to improve speed and accuracy in defect detection. Companies are also advancing machine learning algorithms for real-time defect classification and predictive quality control. This helps manufacturers cut errors, enhance throughput, and lower operational costs.

Key players include: Korber AG, Syntegon Technology GmbH, Antares Vision S.p.A., and ACG inspection.

Makes sure that equipment complies with FDA, EMA, and cGMP regulations and is validated for dependability and safety in pharmaceutical manufacturing. For delicate drug classes like injectables and biologics, compliance also helps with risk management and traceability. This phase increases machine adoption in international markets and fosters regulator trust.

Key Players include: Cognex Corporation, METTLER TOLEDO, Brevetti CEA S.p.A., Nikka Densok Limited.

Although patients are indirect beneficiaries, inspection machines ensure that drugs reaching them are free from defects, contamination, or labeling errors. Service providers focus on training pharma staff, offering preventive maintenance, and deploying cloud-enabled monitoring for continuous machine optimization. Ultimately, these systems safeguard patient safety and maintain confidence in drug quality.

Key Players Include: ACG Inspection, Brevetti CEA S.p.A., Syntegon Technology GmbH, Körber AG

In June 2025, Antares Vision Group launched AI GO, an advanced artificial intelligence-driven visual inspection platform, developed in collaboration with Orobix, an AI service company and part of Antares Vision Group. This platform aims to elevate inspection standards by enabling systems capable of understanding, self-adapting, and continuously improving. Gianluca Mazzantini, CEO of Antares Vision Group, stated that AI integration enhances industrial competitiveness by improving product quality, reducing false rejects, and increasing production efficiency.

By Type (automation level)

By Technology / Detection Principle

By Packaging / Dosage Form (where inspection is applied)

By End-User / Buyer

By Geography / Region (regions only, per request)

February 2026

February 2026

February 2026

February 2026