January 2026

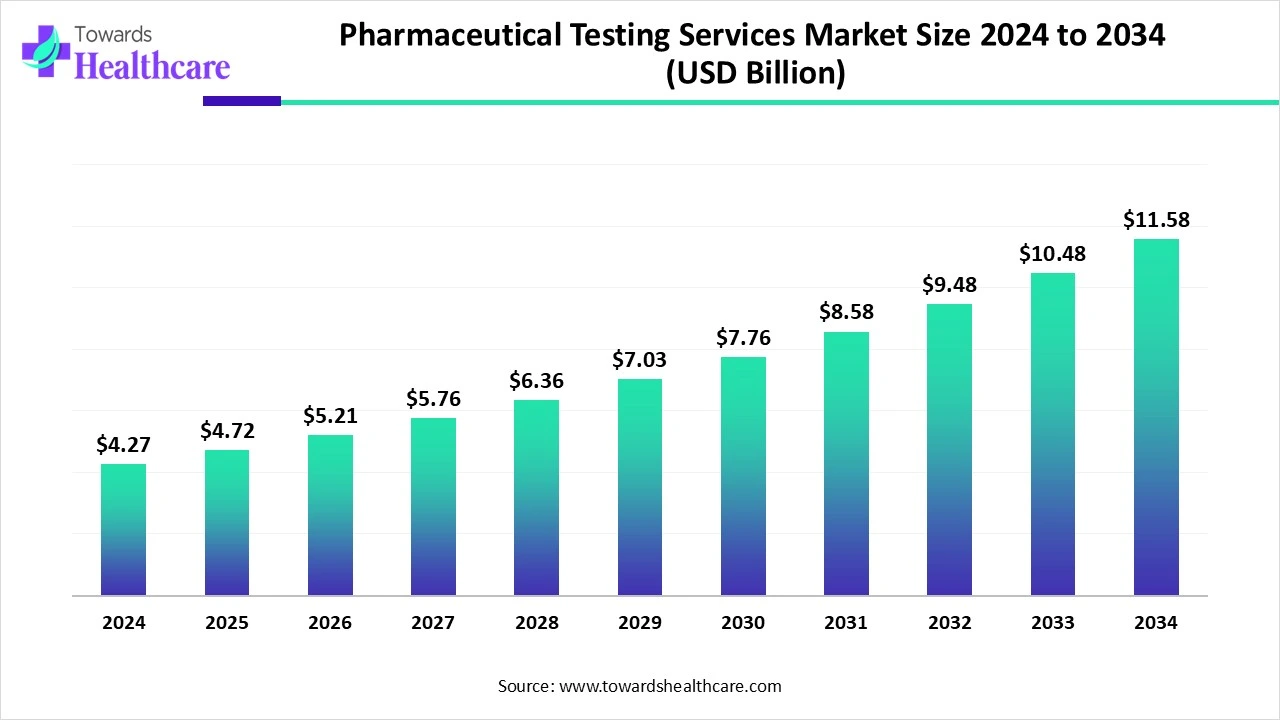

The global pharmaceutical testing services market size is calculated at US$ 4.27 in billion 2024, grew to US$ 4.72 billion in 2025, and is projected to reach around US$ 11.58 billion by 2034. The market is expanding at a CAGR of 10.54% between 2025 and 2034.

In 2025, a major expansion of the global pharmaceutical testing services market will be driven by widespread R&D investments by robust pharmaceutical and biopharmaceutical companies. Moreover, tremendous adoption of advanced AI technologies, machine learning, and other breakthroughs in analytical testing to expand their services to ensure the product quality, safety, and efficacy. However, rising demand for diverse biologics, like monoclonal antibodies, vaccines, in oncology and autoimmune conditions, is propelling the broad adoption of innovative and sophisticated testing. Alongside the involvement of data analytics and digital platforms, such as LIMS, assists in simplifying the processes, expanding data management, and escalating regulatory compliance.

| Metric | Details |

| Market Size in 2025 | USD 4.72 Billion |

| Projected Market Size in 2034 | USD 11.58 Billion |

| CAGR (2025 - 2034) | 10.54% |

| Leading Region | North America |

| Market Segmentation | By Service Type, By Molecule Type, By Phase, By End-Use, By Region |

| Top Key Players |

Eurofins Scientific, SGS SA, Charles River Laboratories, Labcorp Drug Development, Thermo Fisher Scientific, WuXi AppTec, Intertek Group, PPD Inc., Pace Analytical Services, BioAgilytix Labs, ICON plc, Alcami Corporation, LGC Limited, Syneos Health, Frontage Laboratories, Pharmalex GmbH, Medpace Holdings, Inc., Toxikon Corporation, Analytical Bio-Chemistry (ABC) Laboratories, Neopharm Labs |

The pharmaceutical testing services market encompasses third-party or outsourced laboratory services that conduct testing of drugs, biologics, and medical formulations throughout the development lifecycle, including preclinical, clinical, and commercial phases. These services ensure safety, efficacy, stability, and regulatory compliance. Pharmaceutical testing services cover a wide array of analytical testing (e.g., stability, method validation), microbiological testing, bioanalytical testing, material characterization, robust pharmaceutical services, biotechnology, and generic drug manufacturers. In 2025, the market will emphasize on integration of AI and automation, the expansion of testing capabilities in developing markets, and an increased focus on biosimilar and biologics testing.

The worldwide growing investments in AI technologies by many pharmaceutical companies to boost drug development and reach a market position are mainly impacting the widespread adoption of AI tools. Eventually, AI-powered measures give minimal expenses and time linked with drug discovery and development in both the chemical and biological sectors, with enhanced success rates in various clinical trial designs. In clinical trial optimization, AI has a crucial role in accelerating and improving trial design, patient recruitment, and monitoring. Whereas, in quality control, AI algorithms assist in automated data entry, analysis of vast datasets to resolve possible quality concerns, and estimate failures, with progressed product safety.

Escalating R&D Expenditure and Demand for Diverse Biologics

The pharmaceutical testing services market is primarily driven by a surge in heavy investment in research and development by robust pharmaceutical and biotechnology companies to expand novel drug discovery approaches. This ultimately supports a wider need for string analytical testing to study the safety, efficacy, and quality of these novel candidates. Along with this, the expansion of the biopharmaceutical area with accelerating demand for certain advanced biologics and biosimilars necessitates specialized bioanalytical testing services.

High Spending and Strict Standards

The requirement of cGMP-compliant analytical testing equipment and facilities needs a major investment, which creates an obstacle for small-scale industries and for developing markets. An imposition of stricter standards described by global regulatory agencies, like the FDA and EMA, is generating a huge hurdle for companies with compliance to reference method development and validation approaches.

Development of Specialized Testing Services and Adoption of Digitalization

The global pharmaceutical testing services market will assist in the emergence of innovative opportunities to accelerate its expansion, including enhancing demand for specialized testing services like bioanalytical testing, extractables and leachables testing, and cell-based assays show opportunities for companies with highly trained personnel in these areas. Moreover, nowadays, the globe is widely involved in the adoption of AI technologies, machine learning, and automation in testing, which further develops the chances of digitalization with enhanced work effectiveness. Besides this, leveraging data analytics and digital platforms like LIMS supports streamlining the processes, improving data management, and boosting regulatory compliance.

In 2024, the analytical testing services segment registered dominance. Due to the increasing cases of chronic health issues, requiring the development of innovative and more efficacious therapies, there is a need for comprehensive analytical testing. Additionally, a significant involvement in the R&D sector by different pharmaceutical and biopharmaceutical companies contributes to the fulfillment of the wide range of needs for analytical testing services.

From these analytical testing services, the stability testing segment held the largest share of the market. As this type of testing comprises the ability to run faster, more stable data generation for novel drug products, with minimal progression time. Currently, a growing movement towards long-term stability testing with temperature-controlled and other environmental factors management is driving the overall segment growth.

However, the bioanalytical testing services segment is predicted to expand fastest in the pharmaceutical testing services market. The segment will expand by adopting technological breakthroughs, particularly the application of liquid chromatography-mass spectrometry (LC-MS), gas chromatography-mass spectrometry (GC-MS), and immunoassays. Although an increasing demand for a variety of biologics and biosimilars to treat the emerging cancer and autoimmune diseases burden in the world.

Under this segment, the biomarker testing approach is anticipated to grow at the fastest CAGR during 2025-2034. Globally, the rising demand for customized treatments is driving the application of biomarker testing with personalized treatments to individual patient profiles, resulting in enhanced outcomes and minimized side effects. Mainly, advancements like next-generation sequencing (NGS) and omics technologies are allowing the broad development of highly advanced and precise biomarker testing.

The small molecules segment was dominant, with the biggest share of the global pharmaceutical testing services market in 2024, as these types of drug molecules possess complex structures that need more sophisticated analytical techniques, with a demand for highly developed testing services. Also, the accelerating strong pipeline for small-molecule drugs in numerous stages of development, especially in oncology and neurological areas, is acting as a crucial driver for this segment expansion.

Moreover, the large molecules segment is expected to register the fastest growth. Integrated factors are fueling the development of this segment, such as greatly evolving biologics markets, consisting of monoclonal antibodies, vaccines, and gene therapies. These kinds of molecules demand advanced and specialized bioanalytical approaches for their development and production. Furthermore, a major R&D investment and the emergence of innovations, like high-throughput screening, automation, and advanced analytical platforms, are boosting large molecule development.

In the pharmaceutical testing services market, the clinical phase segment held a major share in 2024. One of the important drivers, the COVID-19 pandemic, greatly influenced the emergence of virtual and decentralized clinical trials. This also contributes to boosting remote patient monitoring and data collection, which has proven robust in diminishing logistical restrictions and maintaining trial continuity during public health crises.

Under the clinical phase segment, the phase III sub-segment was dominant in 2024. This phase is mainly involved in ensuring the overall drug's efficacy and safety before regulatory submission. So, the increasing demand for novel therapies directly contributes to the need for clinical trials to meet the required efficacy and safety in these therapies, especially currently raising focus on cancer and rare disorder areas. Also, high-quality central laboratory services and data management solutions are driving the phase III trials.

Under the clinical phase segment, the phase I sub-segment is predicted to expand fastest in the coming era. Primarily, this segment is focusing on the safety and dosage of new drugs in healthy volunteers, with the rising incorporation of R&D regarding advancements. In addition, innovation in adaptive trial designs provides more effective and flexible Phase I trials, particularly in the case of biomarkers' early-stage development studies to establish robust candidates.

The pharmaceutical companies segment led the pharmaceutical testing services market in 2024. Along with the enhanced R&D investments, other factors are fueling this segment's growth, such as growing adherence to a QbD approach in pharmaceutical research and manufacturing is resulting in escalated demand for analytical testing services. Also, these companies are actively following a strict regulatory framework for new drug development and safety, represented by the FDA and EMA bodies.

Whereas, the biopharmaceutical companies segment is anticipated to register rapid expansion in the predicted timeframe. The most important driver for this segment is the enormous complexity of biologics, like monoclonal antibodies and biosimilars, which are boosting the adoption of sophisticated analytical techniques for characterization, quality control, and stability testing. Inclusion of outsourcing testing enables companies to access specialized expertise, minimize capital investment, and boost resource allocation.

In 2024, a major revenue share captured by North America in the pharmaceutical testing services market. This region is widely addressing bioanalytical testing services, with an accelerating emphasis on healthcare spending. However, the trend of outsourcing is prominent in North America, with companies engaging CROs for complete testing, clinical trial management, and regulatory support. On the other hand, increasingly fostering the development of small and large molecule testing, mainly for complex biologics.

Predominantly, the US FDA’s stringent regulatory landscape for drug development and safety, this region is experiencing a major need for extensive testing throughout the process. As well as broad adoption and revolution in sophisticated analytical and bioanalytical techniques, it is also fueling the ultimate market expansion.

For instance,

In this region, the most important focus is on the completion of growing demand for sterile pharmaceuticals and biologics, coupled with stricter regulatory guidelines. Moreover, the evolving trend of contract research organizations (CROs) for pharmaceutical testing offers expense savings, regulatory compliance, and access to specialized expertise.

For this market,

During 2025-2034 in the pharmaceutical testing services market, the Asia Pacific is estimated to grow fastest, with significant healthcare investments, alongside increasing health issues are propelling the progression of clinical trials. In case of various testing, ASAP is increasingly relying on robust sterility testing, bioanalytical testing, and dissolution testing, for the drug development from the early-stage to the finished stage process.

For instance,

India is mainly catering to diverse analytical testing services, including stability testing in different products, method development, and the validation process. Along with this, increasingly focusing on the reliability and accuracy of these testing procedures, while ensuring efficacy and safety among them.

For this market,

China has large drug manufacturing capabilities, with an accelerating demand for quality control and testing services, including outsourcing. Moreover, the emergence of the National Medical Products Administration (NMPA) in China is executing reforms that meet international standards like the ICH guidelines, posing critical steps in cancer and neurological conditions.

For instance,

In this era, Europe is facing significant growth in the pharmaceutical testing services market because of the widespread adoption of advanced testing techniques, like LC-MS and immunoassays, with increased emphasis on the recognition of drug performance. Additionally, this region is aiming at the wider development of tailored medicine, with the incorporation of rigorous testing approaches. These testing services to driving the outsourcing trends to CROs to refuse high expenditure and boost focus on core competencies.

Germany encompasses major and international companies, including GlaxoSmithKline, Pfizer, Roche, and Sanofi operate production facilities, alongside local players like Bayer and Boehringer Ingelheim. Besides this, the German government has promised to foster the pharmaceutical industry through strategies like the National Pharma Strategy, which focuses on secure pharmaceutical supply and accelerates access to innovation.

For this market,

The UK mainly offers several analytical testing services, such as method development and validation, stability testing, impurity analysis, dissolution testing, microbiological testing, raw material testing, and batch release testing. As well as this region has been putting efforts into the transformation of the application of AI and automation technologies in testing services.

For instance,

By Service Type

By Molecule Type

By Phase

By End-Use

By Region

January 2026

January 2026

January 2026

January 2026