December 2025

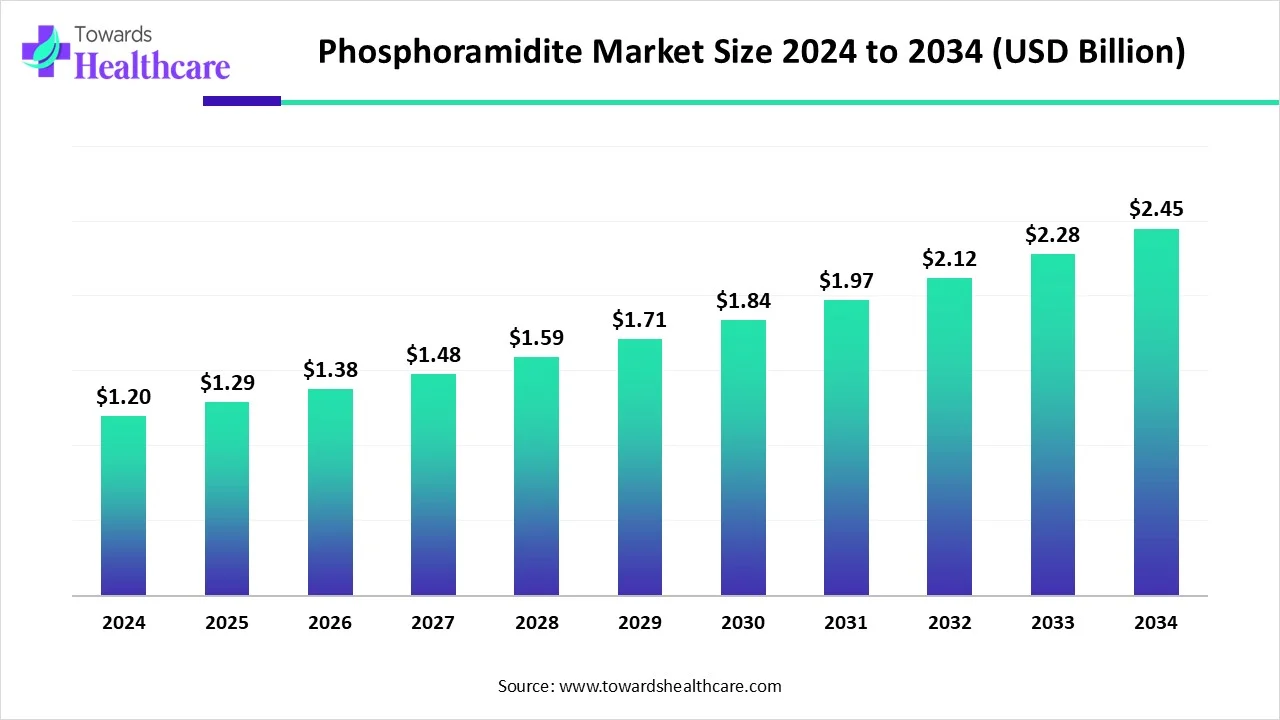

The global phosphoramidite market size is calculated at USD 1.2 in 2024, grew to USD 1.29 billion in 2025, and is projected to reach around USD 2.45 billion by 2034. The market is expanding at a CAGR of 7.4% between 2025 and 2034.

| Metric | Details |

| Market Size in 2024 | USD 1.2 Billion |

| Projected Market Size in 2034 | USD 2.45 Billion |

| CAGR (2025 - 2034) | 7.4% |

| Leading Region | North America |

| Market Segmentation | By Type, By Application, End-use, By Region |

| Top Key Players | BOC Sciences, Thermo Fisher Scientific Inc., Merck KGaA, Glen Research, LGC Biosearch Technologies, Biosynth, BIONEER CORPORATION, QIAGEN, PolyOrg, Inc, Lumiprobe Corporation |

An amidite, often referred to as a phosphoramidite, is a chemical molecule that is utilized in the production of short chains of nucleotides called oligonucleotides. They are made up of a phosphoramidite group that is joined to a nucleoside base, allowing for covalent interaction with the expanding chain of nucleotides during the synthesis process. From research applications to commercial manufacture for diagnostic and therapeutic companies, phosphoramidites are designed to assist in meeting the diverse demands of oligonucleotide synthesis. The online catalog has more than 136 small-pack, ready-to-ship phosphoramidites (abbreviated amidites below) for study and early development.

The use of AI and automation systems in manufacturing processes is one of the market opportunities that is probably going to be taken advantage of. Phosphoramide market trends include the use of phosphoramidites in the production of medicinal oligonucleotides and gene editing devices, as well as the growth of automated synthesizers that support solid-phase synthesis methods. The growing use of AI-powered automated synthesis technologies is also anticipated to support market growth as manufacturers and researchers alike seek scalability and efficiency.

Technological Advancements in NGS

Consumption of phosphoramidite is also significantly influenced by the molecular diagnostics and next-generation sequencing (NGS) industries. Because NGS platforms employ synthetic oligonucleotides as adapters and sequencing primers, customized phosphoramidites with improved stability and efficiency must be produced on a massive scale. In clinical and scientific contexts, phosphoramidite-based reagents are increasingly essential due to the increasing use of pathogen detection tests, customized genomes, and liquid biopsy diagnostics.

Limited Raw Material & High Synthesis Cost

Unpredictability in the supply chain and availability of raw materials required to produce phosphoramidite can lead to disruptions and compromise market stability. The high expenses of phosphoramidite-based oligonucleotide synthesis are a major deterrent to market expansion, especially for small and medium-sized businesses.

Precision Medicine Growth

Phosphoramidite products now have a lot of opportunities thanks to the growth of gene therapy and precision medicine, especially in the synthesis of unique oligonucleotides for genetic research and individualized therapies. Phosphoramidite reagent demand is driven by ongoing research in molecular biology, genomics, and genetics. High-purity and specific phosphoramidite compounds are always needed as science advances.

By type, the DNA phosphoramidites segment dominated the phosphoramidite market in 2024. The industry has been using phosphorimide chemistry, the gold standard for DNA synthesis, for about 35 years. Phosphoramidites with deoxyribonucleobases for DNA oligo synthesis are designed to satisfy the different needs of oligonucleotide producers, ranging from the process development of therapeutic and diagnostic applications to the proof of concept of research and development (R&D). As of right now, it's the only economically feasible chemical that can supply the amount of DNA needed by the synthetic biology business.

By type, the RNA phosphoramidite segment is estimated to be the fastest-growing in the phosphoramidite market during the forecast period. The protective group of RNA phosphoramidites has very recently been added to the production of oligoribonucleotides. Messenger RNA (mRNA) has drawn a lot of interest as a potent substitute genetic material for the production of proteins. mRNA is superior to traditional pDNA in a number of ways. There will be a lot of new chances as the industry concentrates on mRNA, since the hundreds of products that are now in development will provide fresh viewpoints based on this important paradigm shift, finding more modern answers to current healthcare problems.

By application, the drug discovery & development segment held the largest phosphoramidite market share and is estimated to grow at the fastest CAGR during the predicted time period. In drug development, phosphoramide chemistry is an essential technique, especially when it comes to creating oligonucleotides for use in medicines and diagnostic tests. It is the accepted technique for producing oligonucleotides, such as those required for gene synthesis, PCR, and DNA sequencing. As a result, these molecules may find use in a wide range of therapeutic purposes; in fact, a number of oligonucleotide medications have recently received approval.

By end-use, the pharmaceutical & biotechnology companies segment led the phosphoramidite market in 2024 and is estimated to grow at the fastest rate during the forecast period. Numerous uses for oligonucleotides may be found in biotechnology and molecular biology. A key component of contemporary biotechnology, oligonucleotide synthesis finds use in everything from genetic studies to medicine development. The importance of oligonucleotides in the biotech and pharmaceutical sectors is growing as the need for more individualized care and cutting-edge therapeutics increases.

North America dominated the phosphoramidite market in 2024. The market is anticipated to increase in North America due to the rising number of government investments, improvements in NGS research and development, and the rising incidence of target illnesses. The market in the area is expanding as a result of increased financing for next-generation sequencing from businesses, colleges, and research organizations. Additionally, the market is expanding as a result of businesses' increased emphasis on R&D initiatives as well as their increased use of different commercial tactics such as product launches, alliances, collaborations, and acquisitions.

The use of gene editing technology for medicinal purposes is widely supported by Americans. Equal percentages (30%) of American people believe that it would be beneficial or detrimental for society if gene editing were widely used to significantly lower a baby's lifetime probability of having severe illnesses or health issues.

With more than $1.6 billion invested in 600+ initiatives run by a network of academics, technological hubs, and innovative businesses striving to use genetics to solve our most urgent issues, Genome Canada has been constructing the Canadian genomics ecosystem for almost 25 years. Genome Canada contributed $46.5 million, and co-funders contributed $59.0 million of the $105.5 million spent on genome research in 2023–2024. $14.5 million from other federal sources, $29.8 million from the provinces, $5.9 million from business, and $8.8 million from foundations, foreign governments, and non-profit organizations in Canada are among the co-funding investments.

Asia Pacific is estimated to host the fastest-growing phosphoramidite market during the forecast period. Demand for a variety of sectors, including biotechnology and pharmaceuticals, is being driven by the fast industrialization and economic expansion of nations like China, India, Japan, South Korea, and Singapore. The need for phosphoramidites is being increased by large government and private sector investments in life sciences, pharmaceutical research, and healthcare infrastructure. The need for healthcare services is driven by the region's expanding population and increasing urbanization, which also increases pharmaceutical manufacturing and research efforts and propels market expansion.

The People's Republic of China (PRC) has recognized biotechnology as a catalyst for innovation and economic expansion. According to a number of national plans and policies that have been developed over many years, the PRC has identified biotechnology as a strategic emerging industry and has called for a top-down, nationwide initiative that mobilizes biotechnology innovation as a component of "comprehensive national power" by utilizing knowledge, funding, subsidies, and diplomatic support. The PRC envisions a biotechnology future where the majority of countries and industries rely on PRC-controlled pipelines for everything from pharmaceutical precursors to data required for medical, agricultural, and biosynthesis pathways for manufacturing. This vision is in opposition to U.S. objectives to create resilient, diversified, and sustainable supply chains for essential chemicals and medications through both domestic and international biotechnology partnerships.

India is among the world's top 12 biotechnology destinations. Within the Ministry of Science and Technology, the Department of Biotechnology (DBT) has made it a high priority to create an environment that fosters excellence and research in several biotechnology areas in India. To further promote biotechnology research, the Indian government has already budgeted 1000 crores for 2024. With its remarkable advancements in biotechnology and other cutting-edge technologies, India is a huge player on the global stage, driving innovation, sustainability, and economic growth.

Europe is expected to grow significantly in the phosphoramidite market during the forecast period. Europe seems to have a cost-effective phosphoramidite market because of its robust healthcare industry and growing demand for medicines and biotechnology products. A well-established regulatory framework governs the development and commercialization of pharmaceuticals and biotechnology goods. Research and development activities have expanded in the biotechnology and pharmaceutical industries due to the growing prevalence of infectious diseases and genetic anomalies, which has raised the market for phosphoramidites.

For Germany, biotechnology is a vital industry that contributes significantly to value creation across a range of sectors, but particularly in the industrial bioeconomy and the healthcare sector. The start-up strategy, the restart of the GO-Bio start-up funding program, the draft legislation regarding regulatory sandboxes, and, most recently, the WIN initiative are just a few of the legislative projects and initiatives implemented by the Ampel government that have given the biotechnology sector a boost. The upcoming government should undoubtedly advance these or greatly expand them.

In May 2023, we will be able to produce genetic constructs for researchers considerably more quickly, consistently, and with fewer sequence limits thanks to our incredibly long Ansamer oligonucleotides, said Daniel Lin-Arlow, PhD, CEO and co-founder of Ansa Biotechnologies.

By Type

By Application

End-use

By Region

December 2025

December 2025

November 2025

November 2025