January 2026

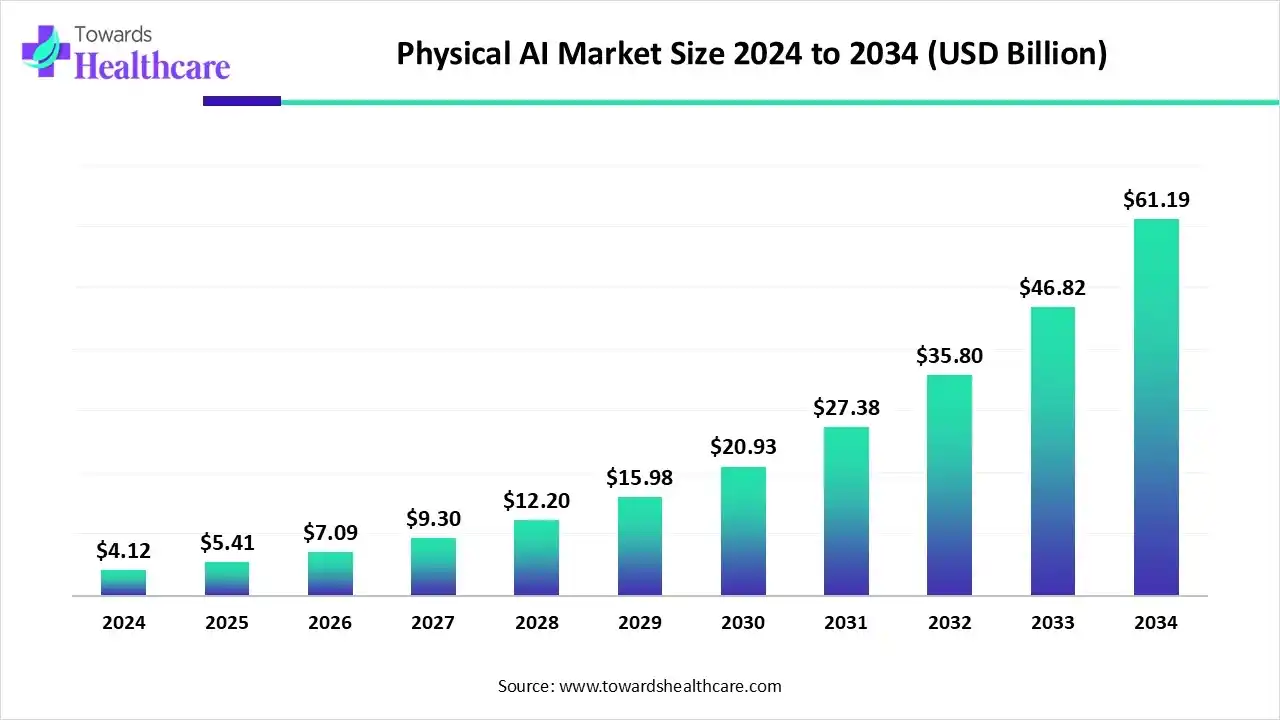

The global physical AI market size is calculated at US$ 4.12 billion in 2024, grew to US$ 5.41 billion in 2025, and is projected to reach around US$ 61.19 billion by 2034. The market is expanding at a CAGR of 31.26% between 2025 and 2034.

The introduction of next-generation robotics with action-based artificial intelligence in autonomous guided vehicles, autonomous mobile robots, humanoids, mobile manipulator arms, etc., is driven by the rise of the physical AI market. According to the Consumer Electronics Show (CES) 2025, physical AI will transform the $50 trillion manufacturing and logistics industries. The integration of physical AI in healthcare is accelerated by the rising trends of robot-assisted surgery, remote patient monitoring, wearables, AI-powered systems, and intelligent systems for physical therapy.

| Table | Scope |

| Market Size in 2025 | USD 5.41 Billion |

| Projected Market Size in 2034 | USD 61.19 billion |

| CAGR (2025 - 2034) | 31.26% |

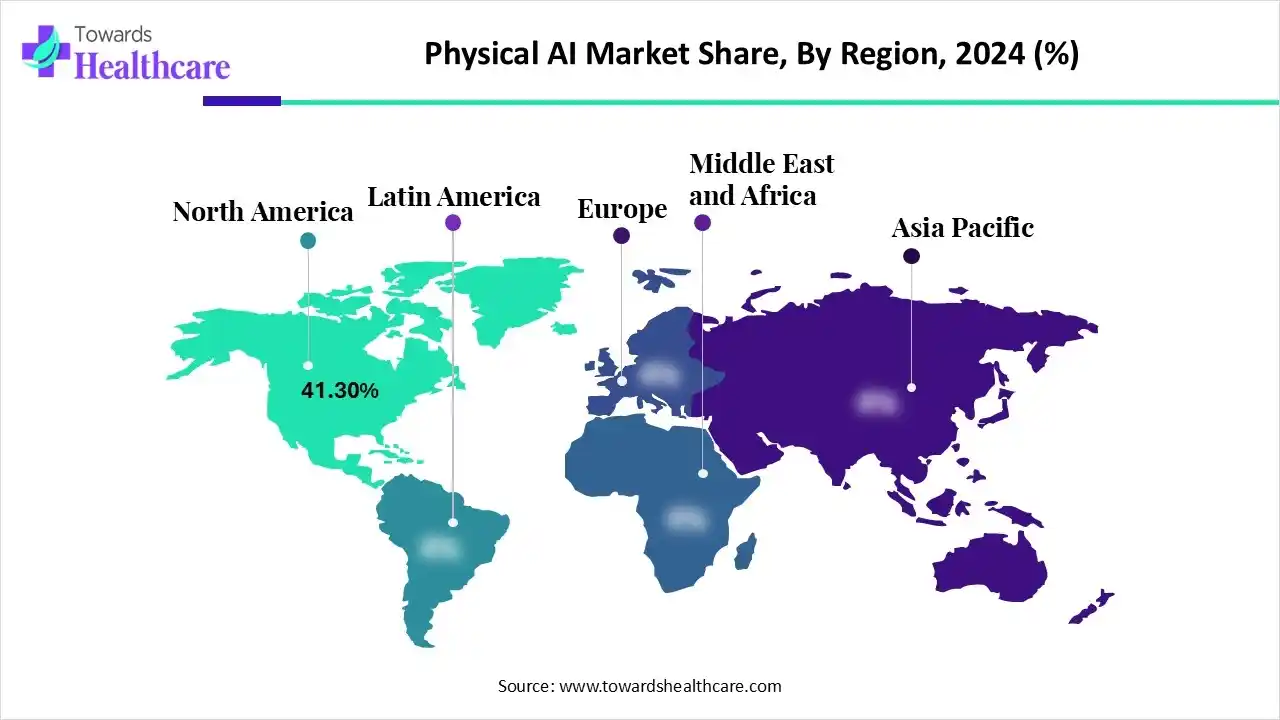

| Leading Region | North America by 41.30% |

| Market Segmentation | By Surgical Robotics, By End Use, By Region |

| Top Key Players | Tempus, PathAI, Cleerly, Owkin, Intuitive Surgical, CMR Surgical, Medtronic, Diligent Robotics, NDR Medical Technology, SWORD Health, Cera, Ekso Bionics |

The physical AI market is primarily expanded due to the huge adoption of automation and surgical robotics. It introduces rehabilitation robots and helps in hospital automation, logistics, and sanitation. The AI-powered wearable devices assist in remote patient monitoring, chronic disease management, and diagnostics. AI technologies highly impact clinical decision-making by delivering personalized treatments, enhancing precision diagnostics, and improving clinical communications.

Industry Growth Overview: The physical AI market is a rapidly advancing market due to the massive global expansion of AI in healthcare and the increasing investments from both private enterprises and government initiatives. These are the major drivers to fuel R&D in AI, led by the growing aging population and labor shortages.

Sustainability Trends: The strict Environmental, Social, and Governance (ESG) regulations and the consumer demand for ethical sourcing drive accountability and transparency in corporate sectors. The sustainable materials and packaging boost the circular economy and management of resources.

Major Investors: These include Amazon Web Services (AWS), Alphabet (Google), Johnson & Johnson, Microsoft, NVIDIA, and many others that invest in AI-enabled diagnostics, surgical robotics, and other forms of AI.

Certain investments and funding are intended to support robust R&D in cellular aging and save the aged population from severe health crises. For instance, in October 2025, Sensi.AI raised $45 million to accelerate AI-driven care intelligence for the aging population to address the rising crisis in global senior care.

The huge adoption of physical AI introduced robust innovations in manufacturing, logistics, healthcare, and patient care. For instance, in March 2025, Dexterity acquired $95 million at $1.65 billion valuation for the development of physical AI for robots.

| Sr. No. | Emerging Uses of AI for Health |

| 1. | Drug Development |

| 2. | Outbreak Prediction |

| 3. | Electronic Health Records |

| 4. | Cancer Research |

| 5. | Traditional Medicine |

| 6. | Personalized Healthcare Plans |

| 7. | Health Monitoring and Wearables |

| 8. | Virtual Health and Care |

| 9. | Mental Health |

| 10. | AI Robot-Assisted Surgery |

The robotic-assisted surgery systems segment dominated the market in 2024, owing to the emerging need for preoperative planning and real-time and intraoperative guidance. These systems enhance surgical training and enable autonomous tasks. They result in enhanced patient outcomes, reduced surgeon fatigue, and expanded access to care.

The neurosurgical and orthopedic robots segment is expected to grow at the fastest CAGR in the physical AI market during the forecast period due to their prime importance in minimally invasive procedures to deliver high precision and frameless navigation. They display enhanced functionality, optimized surgical plans, accurate implant placement, and reduced complications. They allow efficient procedures and provide real-time guidance in preoperative and intraoperative surgeries.

The hospitals & surgical centers segment dominated the market in 2024, owing to the assistance of physical AI applications in hospitals to improve patient care through the integration of robotic nurses, robotic assistants, and rehabilitation devices. AI technologies optimize hospital operations through automated logistics, patient scheduling, and management of facilities. They improve surgical workflow via preoperative planning, intraoperative assistance, and postoperative care.

The rehabilitation & physiotherapy clinics segment is estimated to grow at the fastest rate in the physical AI market during the predicted timeframe due to the rapid shift towards personalized and adaptive treatment plans. Physical AI supports remote monitoring and engagement of patients through the integration of telerehabilitation, wearable sensors, virtual assistants, and chatbots. AI technologies enhance diagnostic accuracy and assessment with the help of data analysis, computer vision, and predictive analytics.

North America dominated the market share by 41.30% in 2024, owing to the expansion of automated and AI-driven technologies, the shortage of healthcare professionals, etc. The White House released a new AI action plan for America in July 2025, which aims to expand access to AI resources, accelerate AI adoption, and strengthen the AI workforce. This new action plan of America will advance AI-enabled manufacturing, build world-class scientific datasets, and advance the science of AI.

This plan is intended to establish AI centers of excellence in healthcare and the public health sector. The well-establishment and adoption of national standards for healthcare AI systems bring together the public, private, and academic stakeholders. These efforts will allow the evaluation of the effectiveness of AI in clinical and operational settings.

The Advanced Research Projects Agency for Health (ARPA-H) conducted its research project using generative AI to boost the discovery of new antibiotics, and it has also launched the Women’s Health Initiative as a part of White House initiative. The National Institutes of Health (NIH) is advancing health research through multimodal AI. Moreover, the National Institute on Aging (NIA) promotes the development of AI technologies that improve healthcare for older Americans.

Canada is growing and expanding in healthcare at a massive rate due to investments in AI, the adoption of AI for health solutions, and medical device regulations. The direct funding supports AI startups and is scaling up businesses in the healthcare sector. The investments in computing infrastructure are also driven by federal programs and funding.

In September 2025, the Government of Canada launched the AI strategy task force and public feedback and engagement that will inform a new AI strategy for Canada to be an AI leader.

Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast period due to enhanced diagnostic capabilities, personalized and patient-centric care, and expansion of telemedicine. The Asia Pacific Medical Technology Association (APACMed) represents suppliers and manufacturers of medical equipment, in vitro diagnostics, and devices in the Asia Pacific region. The APACMed aims to improve the standards of care for patients through strategic collaborations between stakeholders that will shape the future of healthcare in the Asia Pacific.

This region has been transformed by the evolving regulatory frameworks and digital health regulations. It has experienced a rapid adoption of digital health solutions like Software as a Medical Device (SaMD). This adoption boosts Asian Pacific countries like Japan and South Korea to address cybersecurity, AI, and interoperability by updating their regulatory frameworks.

India remains a pioneer in the responsible application of AI in healthcare. It holds fair, secure, and efficient AI-driven solutions in the health sector. India has joined the Health AI Global Regulatory Network (GRN) to ensure a strong oversight of AI in healthcare. India, along with other nations, planned to share safety protocols and monitor AI performance in clinical settings.

According to research estimates, China invested $3.4 billion in new robotics ventures, and Chinese firms are moving forward towards the mass production of humanoids. Chinese firms are estimated to manufacture more than 10,000 humanoid robots in 2025, which will be a significant surge in the integration of physical AI in China. China aims to accelerate the development of AI to establish an AI innovation center and become a leader by 2030.

In April 2024, Beijing introduced a comprehensive plan to promote the development of AI, based on which the scale of its AI core industry is scheduled to reach 300 billion yuan.

Europe is expected to grow at a notable rate in the market in 2024, driven by EU funding, strategic programs, national initiatives, and targeted venture capital investments. According to the European Commission, AI is transforming the future of medicine. The establishment of a European AI Office boosts the development and use of promising AI and international cooperation. This office is the center of AI excellence across the European Union, which plays a crucial role in implementing the AI Act, particularly for general-purpose AI.

The European Artificial Intelligence Act (EU AI Act) entered into force in August 2024, aiming to drive the development and deployment of AI in the European Union. This act also ensures the compliance of high-risk AI systems, like AI-based software used for medical purposes, with many requirements. This compliance is associated with high-quality datasets, risk-mitigation systems, clear user information, and human oversight.

A rapid shift of the German population towards preventive care raises the expansion of digital healthcare. Some of the government actions that support physical AI in German healthcare include the Medical Informatics Initiative (MII), the Digital Healthcare Act (DVG), and the AI action plan. The launch of pilot projects is intended for intelligent health systems. The platforms and advisory services established by the government aim to support AI startups, including those dedicated to physical AI integration.

France is strongly committed to shaping the future of AI in healthcare through accelerating innovations and supporting healthcare professionals. It is also dedicated to developing a regulatory framework and best practices to boost confidence among professionals and patients. It has set a sustainable economic framework for AI innovations. It empowers healthcare professionals through training and upskilling in AI technologies.

By Surgical Robotics

By End Use

By Region

January 2026

January 2026

January 2026

January 2026