March 2026

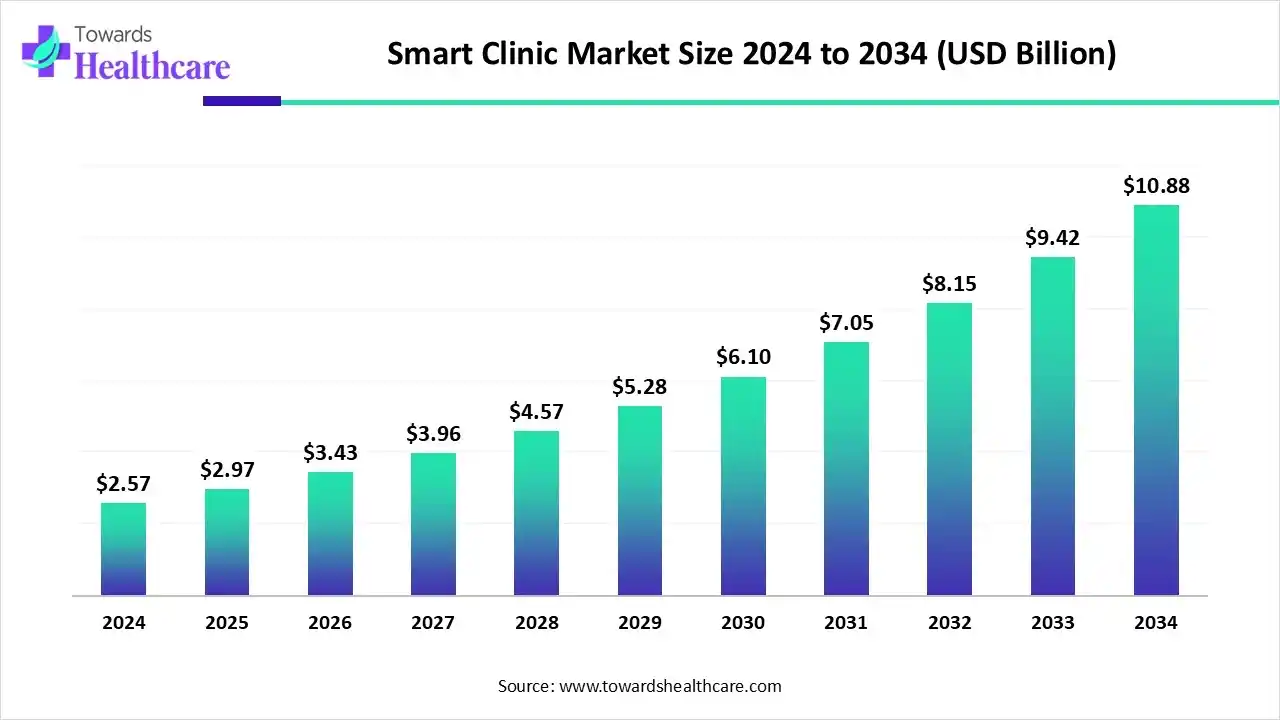

The smart clinic market size began at US$ 2.57 billion in 2024 and is forecast to rise to US$ 2.97 billion by 2025. By the end of 2034, it is expected to surpass US$ 10.88 billion, growing steadily at a CAGR of 15.47%.

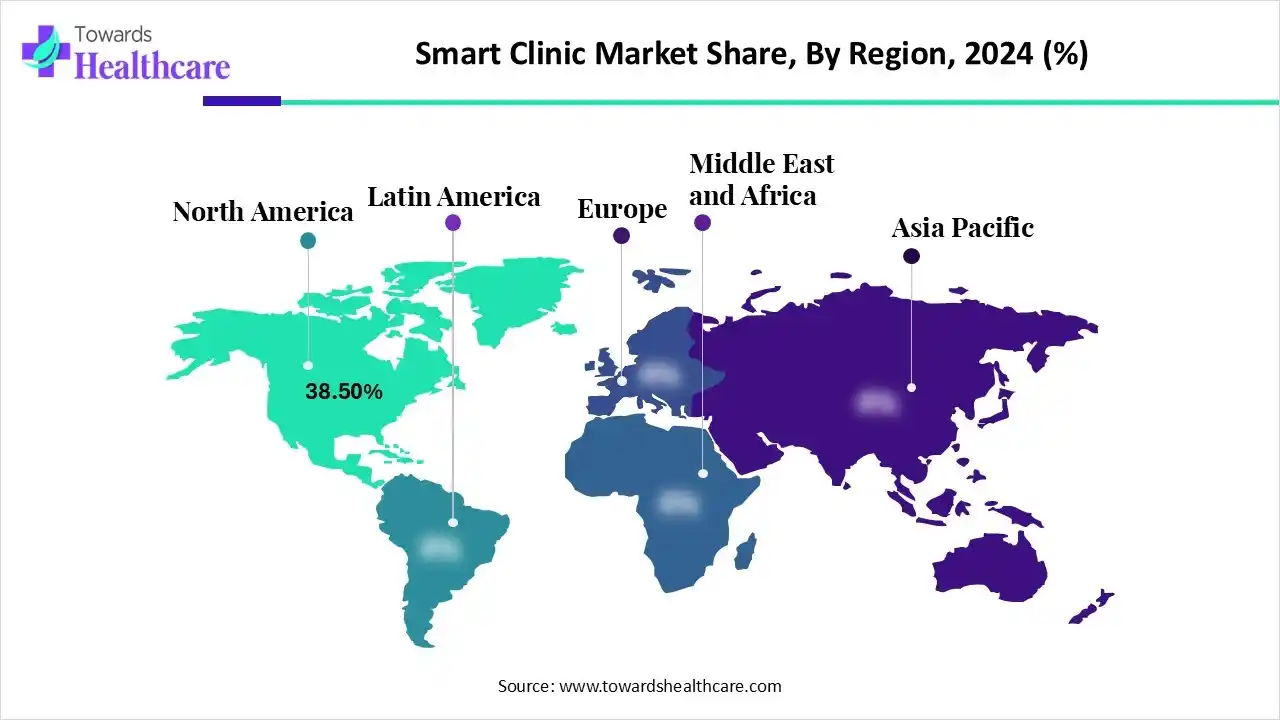

The smart clinic market is witnessing rapid growth, driven by the integration of advanced technologies such as AI, IoT, telemedicine, and electronic health records, which enhance patient care, streamline clinical operations, and improve healthcare outcomes. North America dominates the market due to its advanced healthcare infrastructure, high technology adoption, and supportive regulatory environment. Increasing consumer demand for convenient, personalized, and remote healthcare services coupled with the rising prevalence of chronic diseases and continuous innovations by leading players, is further accelerating the adoption of smart clinic solutions globally.

| Table | Scope |

| Market Size in 2025 | USD 2.97 Billion |

| Projected Market Size in 2034 | USD 10.88 Billion |

| CAGR (2025-2034) | 15.47% |

| Leading Region | North America by 38.50% |

| Market Segmentation | By Component, By Technology / Solution, By Application / Service Type, By End User, By Deployment Mode, By Region |

| Top Key Players | Teladoc Health, Amwell, CVS Health, Philips Healthcare, Siemens Healthineers, Cerner Corporation, GE Healthcare, Medtronic, Allscripts Healthcare Solutions, McKesson Corporation, Oracle (Cerner Corporation), Honeywell Life Care Solutions, Stanley Healthcare, Sensoriom, TytoCare, YOOV, Alcidion, ClinicONE, Oazhensuo |

The Smart Clinic market is driven by the increasing need for efficient, technology-enabled healthcare solutions that improve patient outcomes, reduce operational costs, and enhance accessibility, particularly in remote or underserved areas. Rising adoption of telemedicine, wearable devices, IoT-enabled monitoring systems, and AI-powered diagnostics is fueling market growth, while healthcare digitization and supportive regulations further accelerate implementation. A Smart Clinic refers to a healthcare facility that leverages advanced technologies, such as electronic health records (EHRs), remote patient monitoring, AI analytics, telehealth platforms, and connected diagnostic tools, to provide efficient, personalized, and accessible care. These clinics integrate data-driven decision-making and automation to streamline operations and improve patient experience.

Industry Growth Overview -The smart clinic market is poised for significant growth, driven by rising demand for telemedicine, AI-powered diagnostics, and remote patient monitoring, alongside supportive regulations, healthcare digitization, and increasing consumer preference for convenient, technology-enabled, and personalized healthcare services.

Global Expansion - The global smart clinic market is expanding rapidly, with Europe adopting advanced telemedicine and AI-driven healthcare solutions. Growth in the Middle East, Africa, and Latin America is fueled by rising digital health awareness, government initiatives, and increasing demand for remote monitoring, telehealth, and efficient, technology-enabled healthcare services.

Major Investors - The smart clinic market has attracted substantial investment from venture capital, private equity, and strategic corporate investors, fueling the growth of telemedicine, AI-driven diagnostics, and digital health solutions. Major investors include Point72 Private Investments, Livingbridge, Rock Health, Insight Partners, StepStone Group, Andreessen Horowitz, Fidelity, Cigna Ventures, and Norwest Venture Partners. Their funding supports startups like TytoCare, Maven Clinic, and Omada Health, accelerating technological innovation, expanding remote patient monitoring, and enhancing efficient, personalized, and accessible healthcare delivery globally.

Startup Ecosystem - The smart clinic market benefits from a vibrant startup ecosystem, driven by innovations in telemedicine, AI diagnostics, wearable devices, and remote patient monitoring. Startups are developing solutions that enhance patient care, streamline clinic operations, and enable data-driven decision-making. Accelerators, incubators, and venture capital funding support early-stage companies, while partnerships with established healthcare providers foster rapid adoption. This dynamic environment encourages continuous technological advancement, promotes digital health integration, and strengthens the overall growth and evolution of smart clinics globally.

| Year | Company / Country | Investment / Initiative | Focus Area / Technology | Outcomes |

| 2024 | Max Healthcare (India) | ₹5,000 crore expansion | Hospital infrastructure, smart clinics | Pan-India expansion to enhance access to quality healthcare |

| 2024 | India (Foreign Investments) | US$1.5 billion | Hospitals and healthcare services | Nearly half was directed to hospitals, boosting investor confidence |

| 2024 | Healthtech Startups (India) | US$1.13 billion funding | Digital health, telemedicine, e-pharmacy | Funding increased significantly, showing robust investor interest |

| 2024 | Healthcare IT Market (India) | Market size $16.1 billion | Healthcare IT solutions | Projected growth to $93.4 billion by 2033, CAGR 20.5% |

| 2024 | Medical Devices Park, Noida | Government-supported, 350 acres | MedTech innovation | Integration with IIT Kanpur for research and development |

| 2024 | AI in Diagnostics | Developed an AI system | Autonomous X-ray interpretation | Precision up to 98%, recall over 95%, deployed in 17 major healthcare systems. |

| 2024 | Ayushman Bharat Digital Mission (India) | National-level initiative | Digital health records, telemedicine | Integrated healthcare system connecting patients and practitioners |

| 2024 | Karnataka, India | Center of Excellence in Space Tech | Healthcare applications of space technology | Capturing 50% of the projected space market for tech-enabled healthcare |

| 2025 | Various Healthtech Players | Ongoing investments | Smart clinics, AI, IoT-enabled hospital tech | Focus on integrating AI diagnostics, patient monitoring, and telemedicine |

Which Component Segment Dominated the Global Smart Clinic Market?

The software segment dominates the market with a share of 49.20% due to its critical role in streamlining hospital operations, enabling electronic health records (EHR), telemedicine, and patient management. Advanced analytics, AI integration, and cloud-based solutions enhance efficiency, reduce errors, and support decision-making, making software an indispensable component for modern, technology-driven clinics.

The services segment is estimated to grow at the fastest rate in the market with a CAGR of 15.50% because of the rising demand for consulting, implementation, and maintenance support for advanced healthcare technologies. Customized IT services, cloud integration, training, and technical support help clinics optimize operations, enhance patient care, and ensure seamless adoption of AI, telemedicine, and remote monitoring solutions, driving rapid growth in this segment.

The telemedicine & teleconsultation segment dominates the market with a share of 38.60% due to increasing patient demand for remote healthcare access, convenience, and cost-effectiveness. Integration with digital health records, AI-driven diagnostics, and real-time monitoring enables efficient doctor-patient interactions, expands healthcare reach to remote areas, and reduces hospital congestion, making it a key market driver.

The artificial intelligence & machine learning solutions segment is anticipated to be the fastest-growing segment in the market, with a share of 24.70% due to their ability to enhance clinical decision-making, automate routine tasks, and improve diagnostic accuracy. AI-driven predictive analytics, patient monitoring, and personalized treatment plans streamline operations, reduce errors, and optimize resource utilization. Increasing adoption of intelligent algorithms and deep learning models in telemedicine, imaging, and patient management further accelerates growth in this segment.

The primary & outpatient care segment dominates the market with a share of 35.10% due to the high demand for accessible, preventive, and routine healthcare services. Smart clinics equipped with digital tools, telemedicine, and AI-driven patient management enhance efficiency, reduce wait times, and improve care quality. Integration of electronic health records, remote monitoring, and appointment scheduling ensures seamless operations, making this segment a cornerstone of technology-driven healthcare delivery.

The specialty care services segment is anticipated to be the fastest-growing in the smart clinic market, with a share of 19.80% due to rising demand for advanced treatments in areas like cardiology, oncology, and orthopedics. Smart clinics leverage AI, telemedicine, and remote monitoring to deliver specialized care efficiently. Enhanced diagnostics, personalized treatment plans, and seamless patient management improve outcomes and accessibility, driving rapid adoption of technology-enabled specialty services and fueling growth in this high-value segment.

The hospitals & multi-specialty clinics segment dominates the market with a share of 35.00% due to their extensive infrastructure, advanced medical equipment, and ability to integrate digital technologies at scale. These facilities adopt AI, IoT, and cloud-based solutions for patient monitoring, diagnostics, and management, enabling efficient operations, comprehensive care delivery, and improved patient outcomes, establishing them as key drivers of smart healthcare transformation.

The home healthcare providers segment is estimated to be the fastest-growing in the market share of 21.00% due to the increasing preference for personalized, convenient, and cost-effective care at home. Advances in remote monitoring, teleconsultation, and AI-driven health tracking enable continuous patient management. Growing elderly populations, chronic disease prevalence, and post-operative care needs further drive the adoption of smart home healthcare solutions.

The cloud-based smart clinic solutions segment dominates the smart clinic market with a share of 63.20% due to its scalability, cost efficiency, and ability to enable real-time data access across multiple healthcare facilities. Cloud platforms support seamless integration of electronic health records, telemedicine, and AI applications, improving collaboration, data security, and operational flexibility, which drives widespread adoption among healthcare providers globally.

The hybrid deployment segment is anticipated to be the fastest-growing segment in the market, with a share of 20.00% because it combines the security of on-premises systems with the flexibility of cloud solutions. This approach allows healthcare providers to manage sensitive patient data securely while enabling remote access and scalability. Hybrid models also support AI integration, telemedicine, and interoperability, enhancing efficiency and accelerating digital transformation in clinics.

North America, especially the U.S., dominates the smart clinic market share by 38.50% because of its substantial healthcare infrastructure, early digital health adoption, high spending power, and favorable regulatory frameworks. The region’s advanced IT systems, large number of technology-ready providers, and strong reimbursement support accelerate the deployment of smart clinics. In 2025, U.S. national health expenditure is projected to reach US$5.6 trillion, reflecting deep funding capacity and underscoring leadership in health technology.

U.S. government initiatives in 2025 supporting the implementation of smart clinic-type concepts, with numerical funding. For instance, in September 2025, the U.S. Centers for Medicare & Medicaid Services (CMS) launched a US$50 billion Rural Health Transformation Program under the Working Families Tax Cuts Act to strengthen healthcare infrastructure in rural areas. Also in 2024, the Health Resources & Services Administration (HRSA) awarded US$56 million to modernize technology and data systems in health centers serving high-need communities.

Additionally, there was a legislative extension through September 30, 2025, of Medicare telehealth waivers that allow broader telehealth services (including audio-only and remote delivery), enabling better access to digital consultation and monitoring.

Canada has been steadily investing in smart clinic-like initiatives, especially in digital health interoperability, virtual care, and innovation grants. For instance, Canada Health Infoway in 2025 awarded 18 clinical leaders up to CAD US$40,000 each under its Connected Care Innovation Grant to advance interoperability and improve patient-provider digital health systems. Also, the Saskatchewan government created a US$10 million Innovation Fund in 2024 to support family-physician-led, team-based clinics across communities for better access and quality care.

Furthermore, the federal government launched a US$25 million Digital Health Innovation Fund in 2025 through the Strategic Innovations Fund to promote SME-led projects in AI, machine learning, and big data, especially targeting precision medicine and digital health solutions. These moves show Canada pushing for modernization, remote care, and tech-enabled clinic infrastructure to strengthen accessibility and system efficiency.

Asia-Pacific is the fastest-growing smart clinic market because of rapid digital-health adoption, large underserved populations, and rising healthcare spending. Strong government digitization drives, expanding broadband and mobile penetration, and growing telemedicine acceptance enable scalable remote care. A vibrant startup ecosystem, foreign investment, and cost-effective manufacturing accelerate the deployment of AI, IoT, and cloud-based clinic solutions. Additionally, aging populations and increasing chronic disease prevalence create urgent demand for decentralized, technology-enabled primary and specialty care across urban and rural areas.

China’s market is being propelled by government expenditure and major digital health reforms. Total healthcare spending is expected to reach about RMB 11,629 billion in 2025 as the country invests heavily in public health, basic insurance, and digital health infrastructure. Major drivers include national policies such as “Internet-plus-Healthcare,” widespread adoption of AI and big data, rollout of unified electronic medical records, and regulatory support for smart hospitals. Growth is further spurred by rising chronic disease burdens, an aging population, and expanding rural access to telemedicine.

India’s smart clinic market is growing rapidly due to increasing digital health adoption, government initiatives, and rising demand for accessible healthcare. Programs like the Ayushman Bharat Digital Mission promote electronic health records and telemedicine integration, while investments in AI, IoT, and cloud-based systems enhance clinic efficiency. Rising chronic disease prevalence, a growing urban population, and underserved rural regions drive the adoption of smart clinics. Government funding and startup innovation further accelerate implementation, improving patient care, operational efficiency, and remote healthcare delivery.

Japan’s smart clinic market is expanding, driven by an aging population, government healthcare digitization programs, and advanced technological infrastructure. Initiatives like My Number Healthcare Integration and national telemedicine guidelines facilitate electronic health records, remote monitoring, and AI-assisted diagnostics. Increasing demand for elderly care, chronic disease management, and preventive services encourages smart clinic adoption. Strong IT infrastructure, regulatory support, and private sector investments enable seamless integration of digital solutions, enhancing care quality, operational efficiency, and accessibility across urban and rural healthcare facilities.

Europe's smart clinic market is experiencing notable growth due to strategic investments, supportive policies, and technological advancements. The European Union has allocated approximately US$16.2 billion through the Recovery and Resilience Facility (RRF) for digital health initiatives, including smart clinic development. Additionally, the EU4Health Program provides over US$939 million, supporting projects like smartCARE, which aims to enhance cancer survivor care through digital tools. National governments supplement EU funding, fostering innovation and digital transformation in healthcare. These efforts are further bolstered by the US$1.3 billion USD Apply AI strategy, promoting AI integration across key sectors, including healthcare. Collectively, these investments and policies are accelerating the establishment and expansion of smart clinics across Europe.

Germany’s smart clinic market is growing steadily due to strong government initiatives, robust healthcare infrastructure, and advanced technology adoption. Programs like the Digital Healthcare Act (DVG) and government funding promote telemedicine, electronic health records, and AI-driven patient management. Rising demand for chronic disease management, elderly care, and efficient outpatient services drives smart clinic adoption. Integration of IoT, cloud-based platforms, and AI in hospitals enhances operational efficiency and patient outcomes, positioning Germany as a leader in Europe’s digital healthcare transformation.

The U.K.’s smart clinic market is expanding, fueled by NHS digital transformation programs, government-backed innovation grants, and widespread telemedicine adoption. Initiatives like the NHS Long Term Plan and Digital Innovation Hubs encourage AI, remote patient monitoring, and cloud-based healthcare solutions. Aging populations, rising chronic disease prevalence, and demand for preventive care drive adoption. Investments in interoperability, secure electronic health records, and AI-enabled diagnostics enhance patient care quality, efficiency, and accessibility, accelerating the implementation of smart clinics across urban and rural regions.

Offerings: Teladoc Health provides comprehensive telehealth services, including virtual consultations, mental health support, and AI-driven diagnostics. Their platform integrates seamlessly with electronic health records (EHR) and wearable devices.

Offerings: Amwell offers a telehealth platform that connects patients with healthcare providers via video, phone, or chat. Their services include urgent care, behavioral health, and chronic disease management.

Offerings: CVS Health provides a range of healthcare services, including in-store clinics, telehealth consultations, and prescription management. Their MinuteClinic locations offer walk-in care for minor illnesses and injuries.

Offerings: Philips Healthcare delivers advanced medical technologies, including patient monitoring systems, diagnostic imaging, and telehealth solutions. Their products aim to improve clinical workflows and patient care.

Offerings: Siemens Healthineers specializes in diagnostic imaging, laboratory diagnostics, and digital health services. Their solutions support personalized medicine and efficient clinical decision-making.

Offerings: Spring Health provides mental health solutions for employers, offering personalized care plans, therapy, and coaching through a digital platform.

Offerings: Artisight offers a "Smart Hospital Platform" that integrates virtual nursing, physician teleconsults, interpreter services, remote video monitoring, and virtual case management across health systems.

Several clinics worldwide are recognized for their excellence in integrating smart technologies:

Dubai, UAE – Fakeeh Smart Clinic at Dubai Airport Free Zone

Colombia – Mobile Smart Clinic for Female Migrants

Government Initiative

By Component

By Technology / Solution

By Application / Service Type

By End User

By Deployment Mode

By Region

March 2026

March 2026

March 2026

March 2026