March 2026

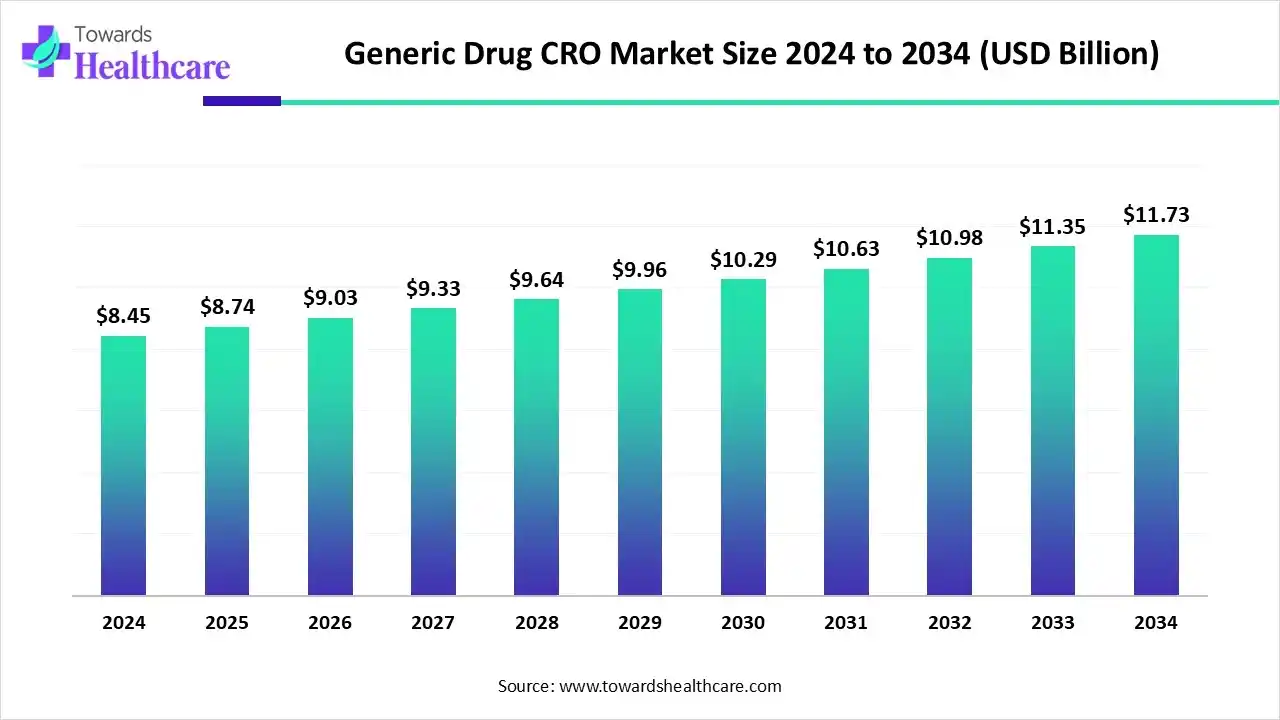

The global generic drug CRO market size is estimated at US$ 8.45 billion in 2024 and is projected to grow to US$ 8.74 billion in 2025, reaching around US$ 11.73 billion by 2034. The market is projected to expand at a CAGR of 3.36% between 2025 and 2034.

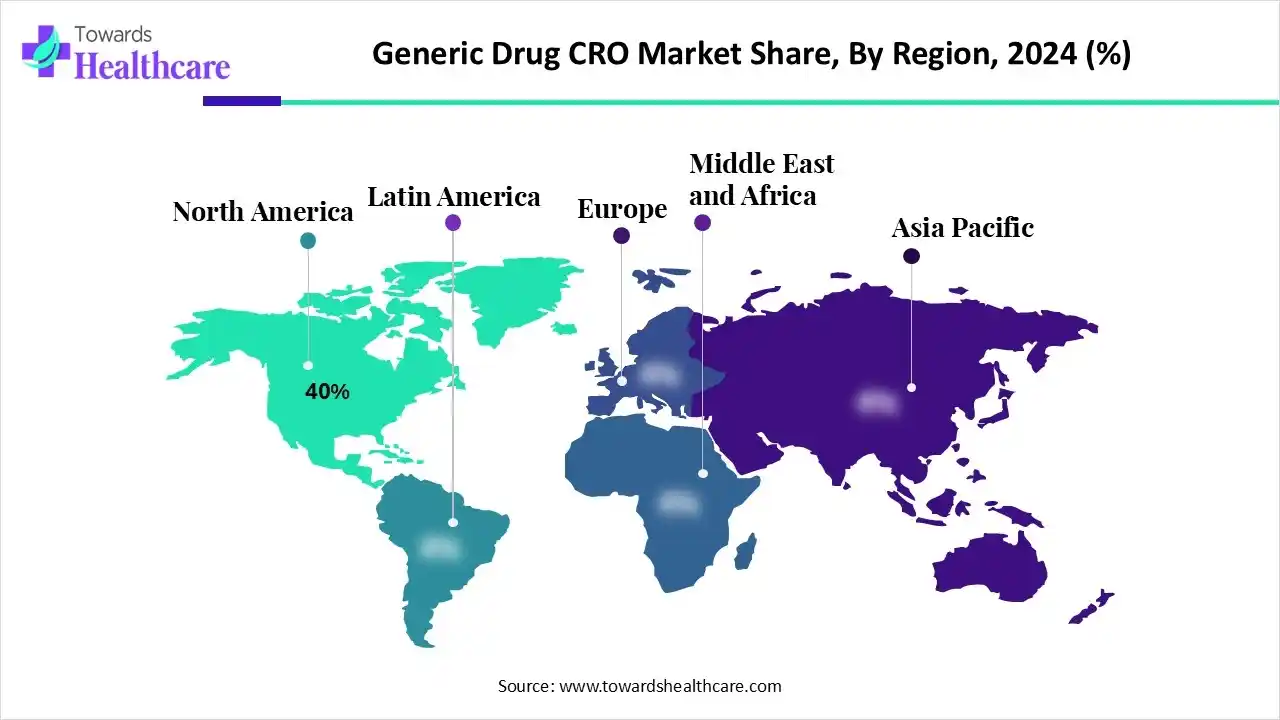

The generic drug CRO market is growing because of increasing research and development outsourcing through generic drug manufacturers and government support. North America is dominated by the rising demand for more cost-effective drug manufacturing and expanding pipelines of generic drugs. Asia Pacific fastest-growing region due to technological advancements in healthcare solutions and growing strategic partnerships among research institutes and medical care organizations.

| Table | Scope |

| Market Size in 2025 | USD 8.74 Billion |

| Projected Market Size in 2034 | USD 11.73 Billion |

| CAGR (2025 - 2034) | 3.36% |

| Leading Region | North America by 40% |

| Market Segmentation | By Service Type, By Dosage Form, By End-User, By Business Model, By Technology / Platform Adoption, By Region |

| Top Key Players | Parexel International, ICON plc, Syneos Health, IQVIA, Covance (Labcorp), PPD (Thermo Fisher), Medpace, WuXi AppTec, Eurofins Scientific, Pharmaron, Bioclinica, Frontage Laboratories, SGS Life Sciences, Celerion, Kendle International, Charles River Laboratories, Pharmaceutical Product Development (PPD), CTI Clinical Trial & Consulting Services, Labcorp Drug Development, Nucleus Network |

The generic drug CRO market comprises organizations that provide outsourced research, testing, and regulatory support services specifically for the development and approval of generic pharmaceuticals. CROs in this space focus on activities such as bioequivalence studies, formulation development, analytical testing, stability studies, pharmacokinetic and pharmacodynamic assessments, and regulatory submissions.

The market is driven by the rising demand for affordable medicines, patent expirations of branded drugs, and growing outsourcing by generic drug manufacturers to reduce R&D costs and accelerate time-to-market. Generic CROs cater to pharmaceutical and biotechnology companies, contract manufacturers, and government organizations, offering specialized services for oral, injectable, and topical dosage forms, ensuring compliance with global regulatory requirements.

| Company | Investment |

| Dash Bio | In July 2025, Dash Bio Secures $11M to accelerate a new era in bioanalysis, bringing total funding to $17.5M. |

| Avandra | In February 2025, Avandra Launches with $17.75 in Funding to advance the Use of Real-World Medical Data. |

| Incite Health | In May 2025, Incite Health raised a total of $331K from 1 Seed round |

Industry Growth Overview: Between 2025 and 2030, the market is expected to grow, driven by the continuing expiration of patents for major drugs offer significant growth opportunities for generic drug producers, and the adoption of advanced technologies such as AI and data analytics, is support optimizing trial protocols, predicting patient recruitment, and enhancing monitoring.

Sustainability Trends: The major medical industry is significantly focused on environmental, social, and governance (ESG) standards. CROs are accepting more environmentally friendly chemical technology, which reduces or eliminates dangerous substances, lowers the waste, and increases effectiveness.

Major Investors: Large private equity firms and major pharmaceutical organizations that acquire CROs to enlarge their own strength. Some major players in the CRO market include IQVIA, ICON plc, Thermo Fisher Scientific (PPD), Labcorp, and Charles River Laboratories.

Integration of AI in a generic drug CRO drives the growth of the generic drug CRO market, as cutting-edge claims of AI-driven technology throughout the drug manufacturing lifespan, with specific importance on multifaceted generics. AI-driven technology integrated into government frameworks to modernize workflows, speed up advancement timelines, and advance quantitative medicine strategies. Generic drug organizations might apply AI-driven technology for outcome substitutes to brand-name drugs. These organizations likely have a massive database of presenting drug and chemical information.

In October 2025, India's PRIP Scheme will transform from generics leader to innovation powerhouse in pharma & MedTech. Center launches ₹5,000 crore PRIP scheme to boost pharma and MedTech R&D, supporting innovation, startups, and Centers of Excellence across India.

In October 2025, the U.S. Food and Drug Administration (FDA) introduced a novel pilot program to prioritize Abbreviated New Drug Applications (ANDAs) for generic drugs that utilize U.S.-based manufacturing and testing. This additional FDA initiative aims to strengthen the domestic pharmaceutical supply chain and reduce reliance on foreign sources. By offering expedited reviews, the ANDA prioritization pilot continues the FDA’s push to further incentivize investments in U.S. operations.

By service type, the clinical development services segment led the generic drug CRO market with approximately 45% share, as contract research organizations (CROs) provide outsourced drug development solutions that span the complete product lifecycle. Their abilities include clinical trial management, government support, pharmacovigilance, and data management. These solutions encompass all phases of the drug manufacturing lifecycle, from composite selection, clinical testing, discovery, preclinical research, and post-approval functions like commercialization, safety assessment, consulting, and monitoring, among other solutions.

On the other hand, the laboratory services segment is projected to experience the fastest CAGR from 2025 to 2034, as lab outsourcing enables an organization or other institution to swap higher fixed prices for lower variable expenses, reducing the requirement for capital investment and offering quick access to world-class analytical skills and abilities. Lab outsource advisors are seasoned specialists who partner with clients to assurance that laboratory outsourcing results are intelligent and meet or better lab outsourcing goals.

By dosage form, the oral solids segment led the generic drug CRO market in 2024 with approximately 50% share, as oral dosage forms enhance efficacy and avoid side effects events also increasing convenience and patient compliance. The solid form of these medications drives ease of storage, handling, and transportation. They are separate, do not need dimensions for dosing liquids, and are often intended for easy ingestion, all of which leads to higher patient compliance. The availability of different OSD forms, such as chewables, effervescents, and mini-tablets, further caters to various patient requirements and preferences, improving adherence to treatment regimens.

On the other hand, the injectable formulations segment is projected to experience the fastest CAGR from 2025 to 2034, as this form becomes an important part of medical development, offering faster and more effective drug delivery. Injectable medicines are formulations directed directly into the body by various routes, including intravenous, intramuscular, and subcutaneous injections. These processes ensure that the drug influences the bloodstream rapidly, avoiding the digestive system for rapid action.

By end use, the generic pharmaceutical companies segment led the generic drug CRO market in 2024 with approximately 50% share, as generic pharma organizations play a significant role in offering cost-effective and high-quality medications, making healthcare more nearby for millions of people both locally and worldwide. As the demand for affordable treatment choices rises, generic drug producer are incessantly expanding their reach, producing a wide range of medicines that cater to various therapeutic requirements. A generic pharma company focuses on manufacturing medicines that are bioequivalent to brand-name drugs.

On the other hand, the contract manufacturing organizations (CMOs) segment is projected to experience the fastest CAGR from 2025 to 2034, as the role of CMOs in the pharmaceutical industry is significant, as they play a significant role in hastening the drug development process, lowering costs, and enhancing flexibility and effectiveness. By collaborating with CMOs, pharmaceutical organizations leverage their proficiency, infrastructure, and resources to bring novel drugs to market faster and more effectively.

By business model, the full-service CROs segment led the generic drug CRO market in 2024 with approximately 45% share, as it serves as a single point of accountability. Complete-service CRO removes the requirement to coordinate various vendors, simplifying communication and ensuring alignment in all trial functions. This integrated strategy not only improves efficiency but also reduces challenges and shortens development timelines.

On the other hand, the specialty/niche CROs segment is projected to experience the fastest CAGR from 2025 to 2034, as working with a specialty CRO has a massive strength to provide customized solutions in a focused service area, like home health, which leads to more well-organized and effective clinical trial results. Health specialty CROs focus on tackling the difficulties of conducting clinical research in a non-traditional setting. This type of CRO’s patient-centric ethos lies in its capability to foster higher levels of patient retention by enabling participants to engage in the trial from the convenient and familiar setting of their homes, such as respite homes, community centers, hotels, or other settings.

By technology/platform adoption, the analytical & bioanalytical platforms segment led the generic Drug CRO Market in 2024 with approximately 35% share, as these platforms use specific analytical tools that analyze and estimate the amount of medicinal molecules in drug development processes. Bioanalysis is the technique that quantifies drugs and metabolites in biological matrices, including plasma, blood, and urine. This supports scientists to better understand how the drug impacts the body; therefore, they can put together a comprehensive regulatory submission.

On the other hand, the cloud-based data management & analytics segment is projected to experience the fastest CAGR from 2025 to 2034, with the aid of cloud-based infrastructure, data is rapidly transmitted, including photography, lab, and statistical analysis data of healthcare. The cloud-based technology delivers flexibility and reliability, growing performance and efficiency, and supports lowering healthcare costs. It advances innovation, enabling organizations to achieve rapid time to market and integrate AI and machine learning use cases into their policies.

North America is dominant in the market in 2024, with approximately 40% share, due to its presence of a large pharmaceutical industry, significant R&D spending, and a robust government environment. North America hosts the main CROs, such as IQVIA and Labcorp Drug Development, which have widespread experience and worldwide reach. The region is at the forefront of integrating novel technologies such as AI and big data analytics in clinical research, which increases efficacy and lowers development timelines, contributing to the growth of the market.

For Instance,

In the U.S. high prevalence of chronic diseases in the country and the growing aging population make a strong demand for cost-effective, high-volume generic medications. The presence of a highly expert workforce, also with technological development such as digital data analysis, gives U.S. CROs a competitive edge.

In FY 2024, the FDA fully approved 694 generic drugs, including 70 "first-time" generics. The total number of generic pharmaceutical manufacturers in the U.S. was 441 in 2024, representing a decrease from the previous year. While specific production volumes are proprietary, these figures indicate the pace of new generic drug approvals. For FY 2024, the FDA reported a total of 14,689 registered drug establishments, with 4,176 of those registered as Finished Drug Product (FDP) manufacturers. This category includes both brand-name and generic products.

The medical industry in Canada heavily relies on contract research organizations (CROs) to facilitate the drug manufacturing process. CROs play a significant role in conducting clinical trials, offering research support, and ensuring government compliance.

Although total generic drug production volume for Canada in 2024 is not public, the market was valued at USD $10.4 billion. In 2023, generics comprised 76.6% of prescriptions by volume, saving over $1.2 billion in 2024. Multiple biosimilar approvals and launches occurred, and the Canadian manufacturing sector employed around 35,000 people.

Asia Pacific is the fastest-growing region in the market in the forecast period, due to the presence of a large patient population, reduced operational costs, and an expansion of the life sciences ecosystem. Governments of APAC enacted regulatory reforms to accelerate clinical trial application and approval processes, though some differences still present among the countries.

The research and development (R&D) technology for generic drug CRO mainly includes intellectual characteristics analysis, formulation development, analytical process validation, bioequivalence research, and government submission.

Key players: IQVIA and Labcorp

Clinical trials of a generic drug CRO involve study design, participant recruitment, information collection, and reporting to government bodies.

Key players: ICON plc and Thermo Fisher Scientific

CRO significantly offers patient-centric services primarily for bioequivalence research and continuing safety monitoring. A CRO recognizes and screens healthy volunteers who meet targeted, strict inclusion and exclusion criteria for the bioequivalence research.

Key players: Parexel and Syneos Health

Tempus Labs: In October 2025, the U.S. Food and Drug Administration (FDA) is announced a novel pilot prioritization program for the review of abbreviated new drug applications (ANDAs) that aims to spur and reward investment in U.S. drug manufacturing and research and development and strengthen the domestic pharmaceutical supply chain by providing faster reviews for generic companies who test and manufacture their products in the U.S.

Lantern Pharma Inc. In August 2025, Teva Pharmaceuticals, Inc., a U.S. affiliate of Teva Pharmaceutical Industries Ltd., announced the FDA approval and U.S. launch of a generic version of Saxenda. Liraglutide injection is indicated for adults with obesity or overweight who also have weight-related medical problems, and pediatric patients

By Service Type

By Dosage Form

By End-User

By Business Model

By Technology / Platform Adoption

By Region

March 2026

March 2026

February 2026

February 2026