December 2025

The remote patient assessment monitoring and management market is rapidly advancing on a scale, with expectations of accumulating hundreds of millions in revenue between 2025 and 2034. Market forecasts suggest robust development fueled by increased investments, innovation, and rising demand across various industries.

Around the ASAP, many leading companies are stepping into exploring digital health technologies, including remote patient care, hospital care at home. Moreover, the global remote patient assessment monitoring and management market is impacted by the growing use of software-as-a-service, as well as predictive analytics, and other AI-driven solutions. Alongside, various key players are expanding the development of highly advanced wearable devices, which accelerates patients' reliability and accessibility.

The remote patient assessment monitoring and management market covers technologies, devices, platforms, services, and workflows that enable clinicians and care teams to assess, monitor, manage, and intervene for patients outside traditional care settings, primarily in the home, assisted-living, or community settings. Growth is driven by aging populations, rising chronic disease burden, reimbursement expansion for remote care, healthcare capacity constraints, patient preference for home care, and advances in low-cost sensors, connectivity, and AI-driven analytics.

It includes continuous and intermittent physiological monitoring devices (wearables, patches, connected medical devices), software platforms and clinical back-end systems (RPM platforms, telehealth/virtual-care platforms, care-management dashboards), connectivity and integration services (EHR/EMR integration, device management), analytics and clinical decision support (AI triage, risk stratification), and associated clinical services (nurse monitoring, remote care coordination, chronic care management).

| Global Digital Health Certification Network (GDHCN) | In October 2025, the WHO and EU introduced a collaboration to advance digitized health systems |

|

National Tele Mental Health Programme (Tele MANAS) |

In January 2025, this program accelerated to 53 cells across 36 states and union territories. |

| Ayushman Bharat Digital Mission (ABDM) | In January 2025, it had developed over 73 crore Ayushman Bharat Health Accounts (ABHA). |

Across the globe, the global remote patient assessment monitoring and management market is leveraging various technological innovations, including the progress of hospital-at-home models. This eventually enables patients having acute issues to acquire hospital-level care remotely, coupled with the integration of telehealth and RPM. Furthermore, the leading technology companies are imposing hybrid care models, which combine telemedicine and RPM, offering a robust blend of virtual and in-person care.

By capturing nearly 34% share, the chronic disease management segment dominated the market in 2024. A crucial driver is the increasing expenses of managing chronic diseases, which impact the overall healthcare spending, and this further propels demand for RPM with a more affordable and scalable choice. Nowadays, the key players are expanding advanced AI-integrated technologies, such as wearable ECG, continuous glucose monitors, blood pressure cuffs, pulse oximeters, and wearable sensors for gait analysis in the remote patient assessment monitoring and management market.

Eventually, the post-acute care & hospital-at-home segment will register rapid expansion. Mainly, the rising demand for convenient and accessible healthcare, breakthroughs in digital health technology, and an emphasis on healthcare spending reductions and hospital readmissions are supporting RPM solutions. Current approaches are focusing on the use of AI and machine learning for accelerated analysis, the utilization of contactless monitoring, including ballistocardiography (BCG). Current Health (Best Buy Health) and Health Recovery Solutions (HRS) are facilitating hospital-level care at home.

The wearable biosensors & patches segment held approximately 30% revenue share of the remote patient assessment monitoring and management market in 2024. These kinds of devices provide continuous, real-time data collection outside of traditional clinical settings, along with assistance to a proactive and patient-centered healthcare model. Microneedle patches are a recent innovation that enable a minimally invasive approach for assessing ISF for continuous glucose, lactate, and pH monitoring without the pain of a traditional blood draw.

Whereas the software & analytics segment will expand rapidly in the coming era. A rise in the wider use of predictive analytics helps in the detection of early signs of health deterioration. Alongside, the broader adoption of generative AI is supporting the development of personalized care plans, improving interventions, and automating documentation. However, software platforms are created for detailed integration with existing EHR systems, which further offers clinicians a comprehensive, real-time view of a patient's health data. The latest solution, like HealthArc, is integrating RPM, RTM, and AI analytics to assist practices in implementing these technologies effectively and complying with reimbursement policies.

In 2024, the software-as-a-service segment held nearly a 34% share of the market and will expand rapidly during 2025-2034 in the remote patient assessment monitoring and management market. These platforms usually use standards, including FHIR (Fast Healthcare Interoperability Resources), for further syncing real-time patient data from multiple sources directly into a hospital's EHR. Recently, sophisticated SaaS tools have encompassed tailored health recommendations, medication reminders, and gamification to support patients in managing their own care efficiently. Also, they provide more nuanced, condition-specific modules for the management of concerns, such as diabetes, COPD, and heart failure.

The health systems & hospitals segment captured an approximate 36% share of the remote patient assessment monitoring and management market in 2024. Involvement of advanced biosensors, smart patches, and even smart fabrics is increasingly being integrated feasibly into a patient's daily life. Additionally, the major contribution of RPAM in Acute Hospital Care at Home programs expands the application of remote monitoring and in-person visits to offer hospital-level care in the home.

However, the home health & home-based care providers segment is estimated to expand fastest. Ongoing innovations in smarter wearables for monitoring multiple vitals, AI-assisted predictive analytics for the detection of health trends, and more integrated, user-friendly platforms for data management are boosting the expansion. Furthermore, they escalate care coordination, allow early intervention, and enhance the use of RPM in models, such as Hospital-at-Home (HaH) programs.

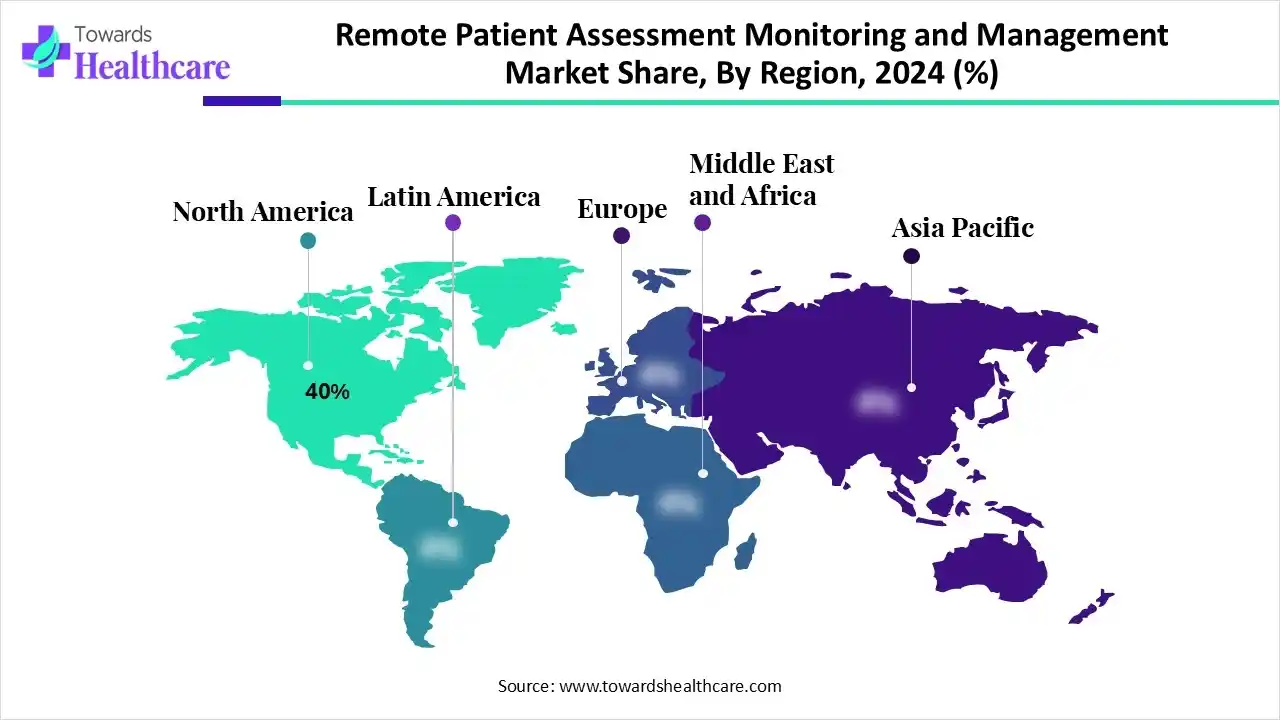

North America’s remote patient assessment monitoring and management market held an approximate 40% share in 2024. This expansion is led by the large market penetration, well-developed reimbursement, and mature vendor ecosystem. Recently, in 2025, CMS implemented changes to the 2026 Physician Fee Schedule to lower operational barriers for RPM and Remote Therapeutic Monitoring (RTM).

For instance,

The U.S. remote patient assessment monitoring and management market is widely putting efforts into establishing advanced RPM technologies, including diverse cellular devices. For this, the FDA has approved several RPM devices, specifically blood pressure cuffs and weight scales, that are now cellular-powered, which ensures automatic and reliable data transmission for patients who may lack Wi-Fi access.

For instance,

During 2025-2034, the Asia Pacific will expand rapidly in the remote patient assessment monitoring and management market. This region is pushing 5G and low-power 5G RedCap technology, which allows more reliable and robust connectivity for remote monitoring devices, specifically in rural and underserved areas. Besides this, ASAP is accelerating the usage of virtual wards to enable patients to receive hospital-level care from home.

For instance,

China’s various hospitals and universities are exploring the widespread applications of AI tools, such as Tencent's AI models for diagnostic support. As well as AI-driven systems, such as RuiPath at Ruijin Hospital, which supports the analysis of pathology images and significantly lowers diagnosis times. Moreover, China's ongoing "Internet + Healthcare" initiative and state-level AI plan are bolstering the digitalization of medical systems and encouraging a supportive regulatory environment.

Europe’s remote patient assessment monitoring and management market is experiencing notable growth due to the presence of strong government encouragement. This mainly comprises reimbursement policies and digital transformation initiatives, such as France was the foremost European country to reimburse remote monitoring for all eligible patients. Alongside, the region is increasingly involved in voice and video-powered RPM, which are highly advanced, and voice-first technology, utilizing AI assistants to remind patients to take medication and record vitals.

Day by day, the UK’s remote patient assessment monitoring and management market is widely leveraging funds for chronic disease management and contactless patient monitoring, which employs infrared sensors and cameras to monitor patients without physical contact, particularly in mental health settings.

For instance,

By Application Use Case

By Technology/Device Type

By Offering/Product Format

By End User

By Region

December 2025

December 2025

December 2025

December 2025