February 2026

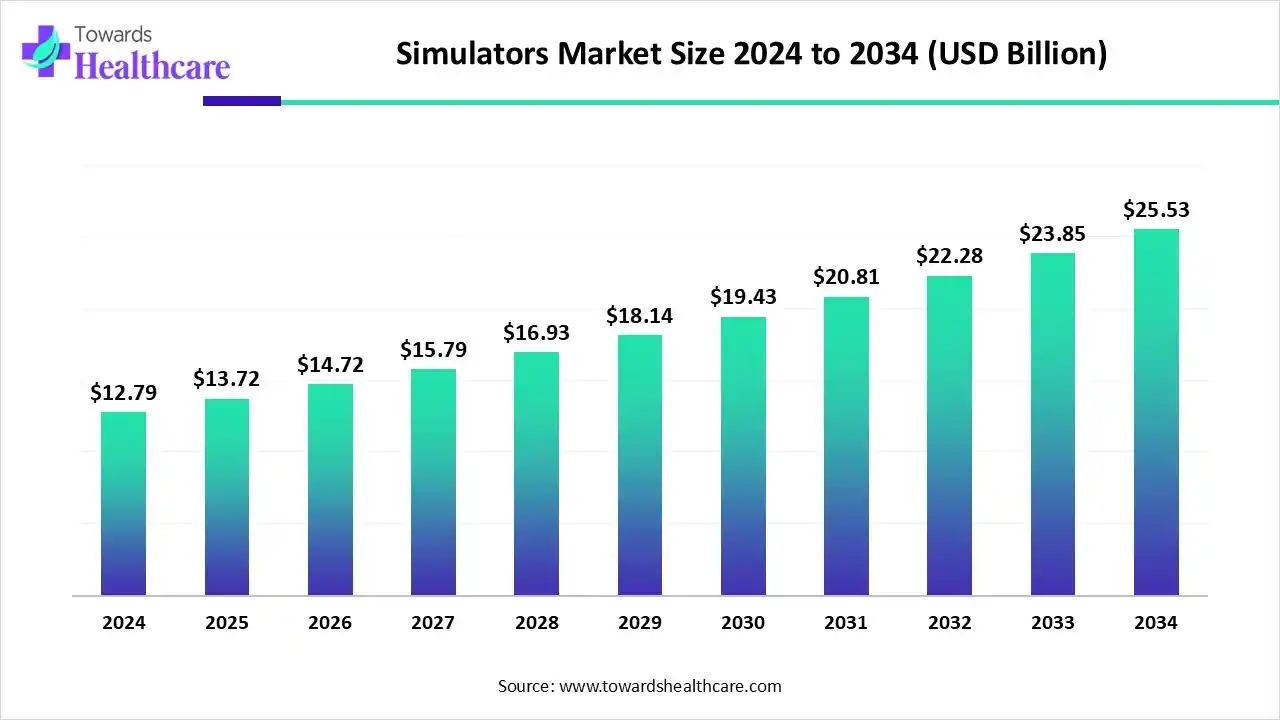

The global simulators market size is calculated at US$ 13.72 billion 2025, grew to US$ 14.71billion in 2026, and is projected to reach around US$ 27.59 billion by 2035. The market is expanding at a CAGR of 7.24% between 2026 and 2035.

Diverse Indian, Chinese, and Indonesian hospitals are fostering the adoption of hands-on training options, including innovative virtual reality simulators and other platforms in the simulators market. Moreover, the emergence of advanced haptic devices is providing tactile sensations to replicate the feel of real-life procedures, which are utilized in surgical and procedural training. These developments are further integrating with various technologies, like AI, VR/AR/XR, and hardware (cockpits, haptics, sensors), which promote novel applications in the medical and healthcare sector.

| Table | Scope |

| Market Size in 2026 | USD 14.71 Billion |

| Projected Market Size in 2035 | USD 14.71 Billion |

| CAGR (2026 - 2035) | 7.24% |

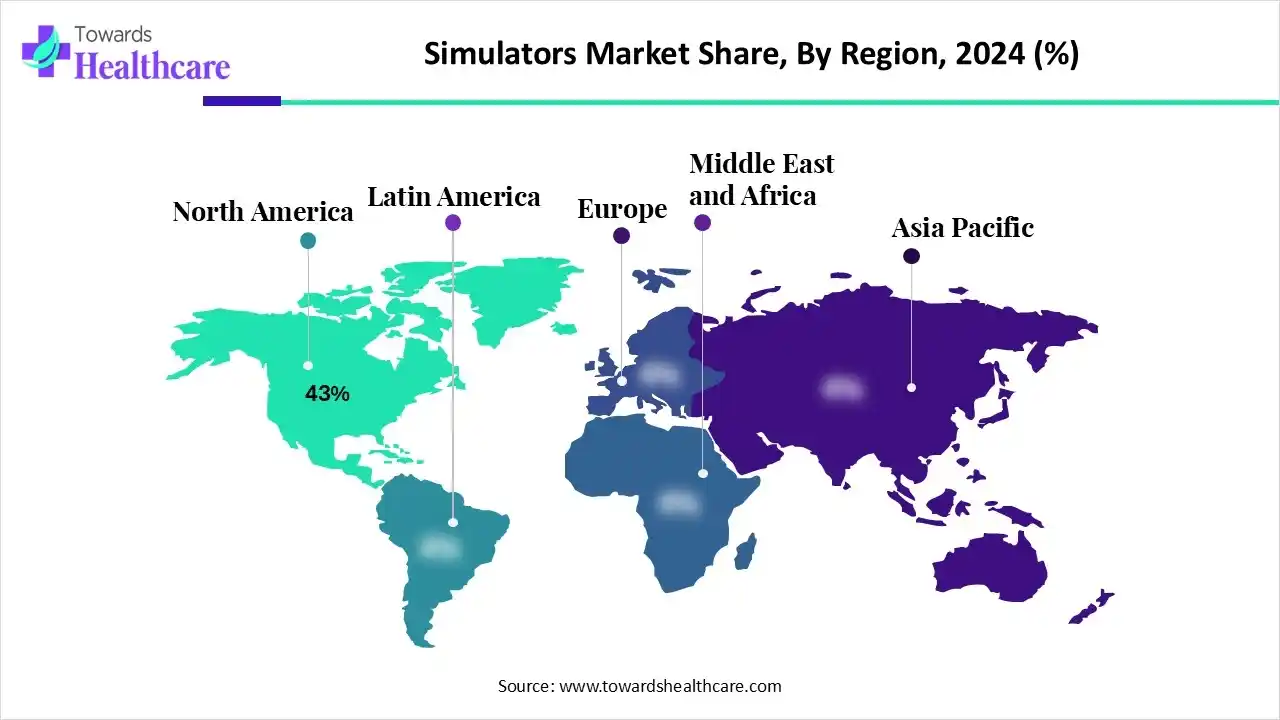

| Leading Region | North America by 43% |

| Market Segmentation | By Type, By Application/End Market, By Technology, By Component, By End User, By Region |

| Top Key Players | Gaumard Scientific, Surgical Science Sweden, Limbs & Things Ltd., 3D Systems, Inc., Inovus Medical, 3B Scientific GmbH, Biomed simulation, Operative Experience Inc. |

The simulators market refers to systems and platforms that replicate real-world conditions to train personnel, test equipment, or analyze scenarios in a safe, controlled, and cost-efficient environment. Market growth is driven by rising safety requirements, cost savings in training, technological advances (VR/AR, AI-based adaptive learning), and increased adoption across defense, civil aviation, automotive, healthcare, and energy sectors. These include flight, driving, military, medical, maritime, and industrial process simulators. Simulators integrate hardware (cockpits, haptics, sensors), software, AI, and extended reality (XR/VR/AR) technologies to deliver immersive training and analytics.

In the respective market, the empowerment of AI algorithms in supporting realistic dialogue with virtual characters, tailored learning pathways that adapt to user proficiency, and the application of generative design for quicker concept exploration in engineering and product development. Additionally, the widespread adoption of Large Language Models (LLMs) in creating realistic, dynamically responding virtual patient dialogues, simulating patient anxieties, and improving communication skills, which are significant in healthcare.

A Surge in Healthcare Expenses & Other Developments

Primarily, various regions are widely contributing their major role in expanding healthcare expenditures, and they are highly seeking to lower hospital stays and complications. This further makes simulations an affordable choice with a strong training method in the global simulators market. Ongoing technological advances in Virtual Reality (VR) and Augmented Reality (AR) platforms are evolving innovative and engaging approaches for health education. Moreover, a rise in demand for minimally invasive procedures is fostering the use of medical simulators for training surgeons in complex surgical procedures.

Greater Initial Investment

A major challenge in the market is the need for a high initial investment for high-fidelity simulators and the necessary equipment, such as monitoring systems and synthetic fluids. This mainly possesses a price of up to $200,000. Operating these labs also incurs crucial operational costs for maintenance, updates, and consumables.

Breakthroughs in Cloud-based Platforms & AI

During 2025-2034, the global simulators market will encompass diverse opportunities in advancing cloud-based platforms and AI solutions. This will assist in moving from hardware-centric models to flexible, cloud-driven platforms, which will offer extensive training beyond conventional campus settings. In the case of AI, it will be employed in the assessment and analysis of clinician performance, facilitating feedback and transforming skill acquisition. However, current use of sophisticated haptic devices will offer tactile sensations to replicate the feel of real-life procedures, which are vital for surgical and procedural training.

In 2024, the hardware-based simulators segment accounted for nearly 62% share of the simulators market. The segment is mainly driven by a growing emphasis on the reduction of medical errors and enhancing patient outcomes through hands-on practice in a risk-free environment. Moreover, the emergence of this type in the accelerating aging population, which needs specific training, and the progression of military and emergency response simulation programs. Currently, 3D printing for anatomical models and Computational Modeling and Simulation (CM&S) are increasingly used for medical device development and patient-specific planning.

Although the software & virtual simulation platforms segment will expand with the highest CAGR in the coming era, factors like the wider need for improvements in patient safety, addressing the increasing complexity of medical procedures, and boosting the quality of medical education and training will fuel further market expansion. These kinds of platforms are providing vast, comprehensive libraries of reviewed clinical scenarios, with user-friendly tools to evolve and personalize unique, situation-specific training modules.

The healthcare & medical Simulation segment held the second-largest share of the market in 2024, which was approximately 18%. The segment is mainly propelled by the increasing focus on the reduction of medical errors, a lack of well-trained healthcare professionals, and the need for standardized training. Involvement of the latest approaches, such as the Next Generation Harvey, a cardiopulmonary simulator that possesses optimized physical exam features and peripheral pulses, patient communication in trauma situations, and the management of a variety of communities. Alongside, the adoption of high-fidelity human patient simulators, virtual dissection tables, and electronic medical record simulations to practice workflows is also bolstering the comprehensive solutions in this segment.

Whereas, the education & research segment is expected to grow at the highest CAGR in the simulators market in the studied years. Certain regions are facing a lack of healthcare professionals, for which medical institutions are widely adopting competency-based training models, which are perfectly aligned with simulation-based education. This further accelerates skill assessment and mastery in a standardized manner. Continuous application of VR/AR and AI is supporting simulation in several fields, mainly STEM education and teacher training, while also emphasizing boosting global access to simulation-based training.

In 2024, the traditional motion & hardware-driven simulation segment led with nearly 54% share of the simulators market. The segment is propelled by the greater need for affordable and realistic training, and the breakthrough of hardware technologies, including high-fidelity manikins and motion platforms. Majorly, high-fidelity mannequins are led by Laerdal and Harvey, which offer realistic physiological responses, consisting of palpable pulses, heart and lung sounds, and reactive eyes, expanding realism for different clinical skills.

And, the virtual reality (VR) simulation segment will witness rapid growth with the highest CAGR. Currently, sophisticated VR solutions are being employed for pre-operative planning to improve surgical accuracy and minimize errors, and also facilitate non-invasive therapy options for patients. The greater adoption of VR simulations in specialized areas comprises EYESI, which enables modular training for diverse ophthalmic surgeries. Also, the training for complex procedures like ultrasound-guided regional anesthesia (UGRA) provides a safer and more effective learning environment for interns.

The motion platforms & haptics segment accounted for approximately 40% revenue share of the market in 2024. A surge in demand for robotic surgical systems is assisting the expansion of haptic feedback systems, as they are important for replicating the sensation of touch and force during robotic procedures. Recent transformations include compact and high-resolution haptic actuators like vibrotactile and shape memory alloy (SMA) systems, the integration of Extended Reality (XR), which further escalates scalability and assessment.

The simulation software engines segment will expand rapidly during the forecast period. Involvement of different engines, like physiology engines, which offer core physiological models and behaviors, enabling simulations to precisely demonstrate bodily functions and reactions to interventions. As well as the contribution of 3D modeling and rendering are using tools like iMSTK with 3D Slicer are employed in the establishment of insightful 3D anatomical models from medical scans for realistic visualization.

The hospitals & medical universities segment is expected to expand at the highest CAGR in the simulators market during 2025-2034. Incorporation of greater healthcare demand, global healthcare workforce limitations, technological advancements in AI and VR/AR, and regulatory landscapes for expanded training standards are propelling the overall growth. Hospitals are putting efforts into realistic setups of intensive care units, operating rooms, or emergency bays equipped with actual medical equipment. Universities are emphasizing digital anatomy tables to represent 3D datasets of the human body, attributed to anatomy teaching, surgical planning, and even virtual autopsies.

Due to the presence of strong defense, aviation training, and advanced VR development, North America dominated with nearly 43% share of the market in 2024. The leading players are focusing on revolutionary digital twin technology to enable real-time process simulation and modeling of complex systems, such as nuclear power plants, expanding training and operational planning.

For instance,

In September 2025, Anatomy Warehouse, a leading distributor of anatomical education tools, partnered with Erler-Zimmer to foster innovative 3D printed anatomical models to schools and training facilities across the U.S.

In June 2025, New Georgian, Brightshores collaborated to advance palliative care simulation training to a diverse group of health care providers in Grey-Bruce

Ongoing civil aviation expansion, healthcare simulation adoption, and defense modernization in the Asia Pacific are predicted to expand at a nearly 22% CAGR in the simulators market. Moreover, a significant contribution of OCTET Training Systems in Singapore is merging inexpensive simulation tools, which are specifically advantageous for healthcare systems with developing infrastructure. Additionally, the widespread adoption of simulators in Indian, Chinese, and Indonesian hospitals for hands-on training is also influencing the comprehensive market transformation.

In September 2025, Shanghai-based Zhongshan Hospital, affiliated with Fudan University, launched its Meta Medical Simulation Laboratory is shifting towards intelligent healthcare and detailed its exploration of the meta-medical field.

In December 2024, Fujifilm India, a company in medical technology, launched the innovative Mikoto Colon Model, a cutting-edge endoscopy simulation technology, in Chennai.

In this era, Europe is experiencing a notable growth in the simulators market. Primarily, this region's population is increasingly stepping towards hybrid learning models, which encompass the integration of e-learning with hands-on simulation to accelerate reach and feasibility for healthcare workers. Along with this, European governments are facilitating incentives for digital medical education and access to EU funding through public-private collaborations that bolster a dynamic innovation ecosystem.

For instance,

By Type

By Application/End Market

By Technology

By Component

By End User

By Region

February 2026

February 2026

February 2026

February 2026