February 2026

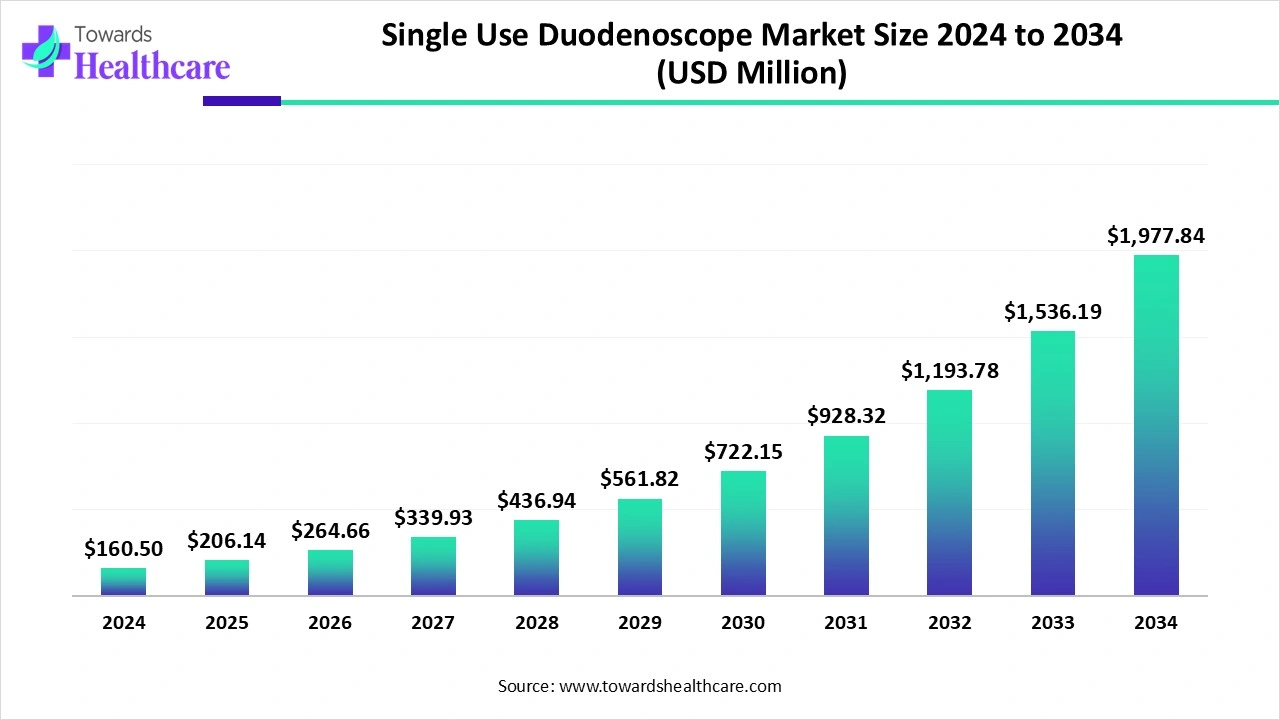

The global single-use duodenoscope market size is calculated at USD 206.15 million in 2025, grew to USD 264.77 million in 2026, and is projected to reach around USD 2518.71 million by 2035. The market is expanding at a CAGR of 28.44% between 2026 and 2035.

The single-use duodenoscope market is primarily driven by the rising prevalence of gastrointestinal and pancreatic disorders. The changing hospital policies facilitate the demand for single-use duodenoscopes and reduce infection risk. Numerous key players develop innovative duodenoscopes to enhance patient comfort and simplify the procedure. Artificial intelligence (AI) transforms the design and manufacture of single-use duodenoscopes. The future looks promising, with the increasing use of 3D printing technology.

The single-use duodenoscope market covers fully disposable (single-patient-use) duodenoscopes used to perform endoscopic retrograde cholangiopancreatography (ERCP) and related biliary/pancreatic diagnostic and therapeutic procedures. Single-use duodenoscopes eliminate the risk of reprocessing and reuse, reduce concerns about cross-contamination and infection transmission linked to complex reusable duodenoscope designs, and simplify logistics for low-volume or high-infection-risk settings. Infection-control priorities, regulatory guidance, hospital policy changes, cost-of-reprocessing considerations, increasing ERCP procedure volumes, and growing availability of commercial single-use devices with near-parity performance to reusable scopes drive adoption.

AI can revolutionize the design and manufacturing of single-use duodenoscopes, increasing efficiency and accuracy. It can help researchers develop novel and innovative duodenoscopes with enhanced safety and biocompatibility. It suggests a combination of materials, including elastic materials, recyclable plastics, and metal alloys, for developing strong duodenoscopes. Integrating AI into manufacturing potentiates speed and reproducibility. AI-based predictive analytics detects potential errors in manufacturing, enabling manufacturers to make proactive decisions.

Increasing Focus on Infection Control

In order to avoid the risk of hospital-acquired infections and cross-contamination, there is a rise in the adoption of disposable devices across the healthcare sector, which is promoting the use of single-use duodenoscopes.

Growing Gastrointestinal Diseases

Due to growing incidences of gastrointestinal diseases, such as cancer, bile duct stones, and strictures, there is a rise in their diagnostic and treatment processes, which is increasing the adoption rates of the single-use duodenoscopes.

Blooming Innovations

The companies are focusing on integrating advanced optics and high-definition imaging solutions to enhance the imaging quality, diagnostics, and performance of the single-use duodenoscopes.

Hospital-Associated Infections

The major growth factor for the single-use duodenoscope market is the increasing risk of hospital-associated infections (HAIs). Reusable duodenoscopes possess a higher chance of developing HAIs due to the possibility of inappropriate reprocessing. The World Health Organization (WHO) reported that around 1 in 10 patients are affected by HAIs. HAI is a serious health concern and leads to economic burden on the healthcare sector. In Europe, approximately 9 million HAIs are reported annually in acute and long-term care facilities, which lead to 25 extra hospital days and cost 13 to 24 billion euros. This potentiates the demand for single-use duodenoscopes in healthcare facilities.

Increasing Medical Waste

Single-use duodenoscopes generate a large amount of medical waste, thereby significantly impacting the environment. They contribute to the hospital’s plastic waste problem and lead to an increased cost of their disposal. This limits the use of single-use duodenoscopes, hindering market growth.

What is the Future of the Single-use Duodenoscope Market?

The market future is promising, driven by the increasing use of 3D printing technology. 3D printing is emerging as an ideal technology for manufacturing customized medical devices. It can design and manufacture duodenoscopes based on patients’ conditions. The adoption of 3D printing is increasing due to numerous benefits, such as low cost and minimal production time. It generates less waste, complying with the regulatory policies. 3D printing allows the production of highly optimized parts with high accuracy and precision. The device manufactured from 3D printing can have higher flexibility, lower friction between the instrument and organ surface, and better torsional stiffness.

| Table | Scope |

| Market Size in 2026 | USD 264.77 Million |

| Projected Market Size in 2035 | USD 2518.71 Million |

| CAGR (2026 - 2035) | 28.44% |

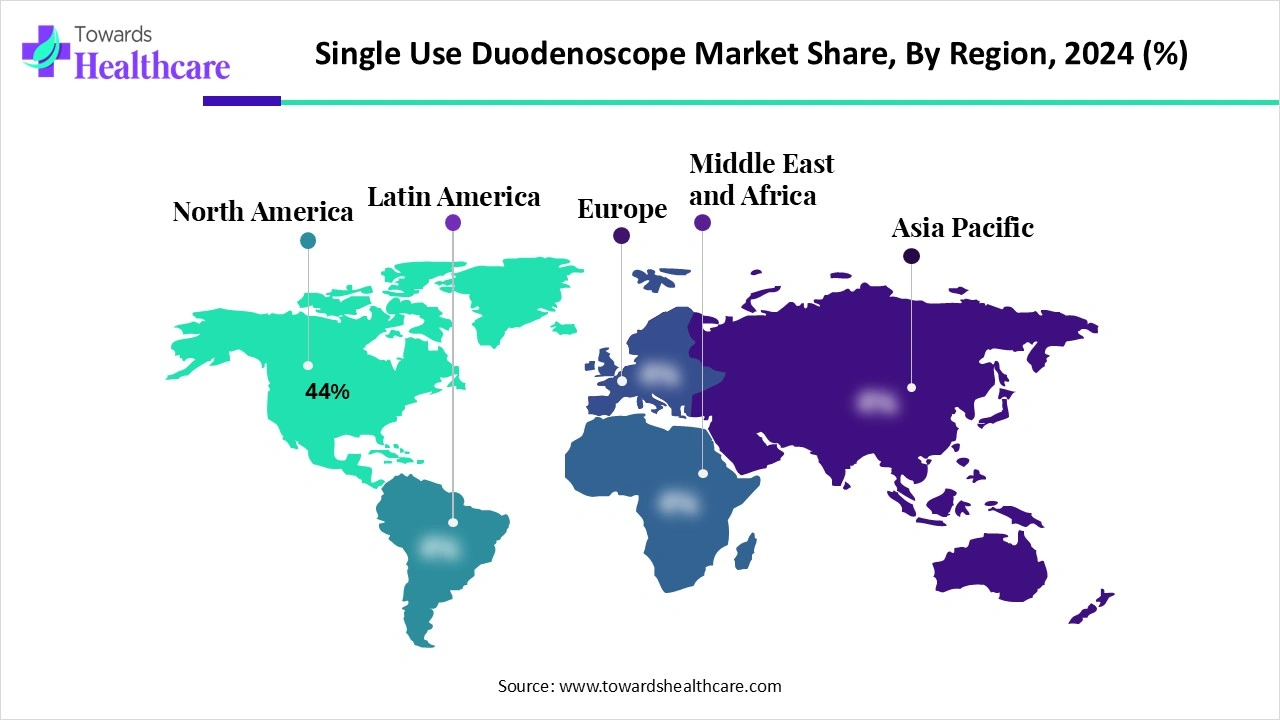

| Leading Region | North America by 44% |

| Market Segmentation | By Product Type, By Procedure/Application, By End-User, By Pricing/Commercial Model, By Feature/Technology, By Region |

| Top Key Players | Boston Scientific, Ambu A/S, Olympus Corporation, Fujifilm, PENTAX Medical, Karl Storz, Cook Medical, Richard Wolf, Ottomed / SonoScape, Huger Medical Instrument, EndoFresh, Micro-Tech, Merit Medical, STERIS / Cantel, B. Braun |

Which Product Type Segment Dominated the Single-use Duodenoscope Market?

By product type, the single-use duodenoscopes segment held a dominant presence in the market in 2024. This is due to the growing preference for single-use medical devices to prevent cross-contamination. The increasing incidences of HAIs and the use of cost-effective medical equipment potentiate the demand for single-use duodenoscopes. Reusable duodenoscopes require high capital investment due to higher operating expenses, unlike single-use duodenoscopes. Single-use duodenoscopes are highly preferred in high-risk individuals, such as immunocompromised patients.

By product type, the reprocessing accessories & disposable components segment is expected to grow at the fastest CAGR in the market during the forecast period. The reprocessing accessories & disposable components include trays, disposables, and other single-use accessories. They are essential components to be used along with duodenoscopes. This enhances safety in ERCP procedures. They are also discarded after use, eliminating the risk of contamination.

Why Did the Therapeutic ERCP Segment Dominate the Single-use Duodenoscope Market?

By procedure/application, the therapeutic ERCP segment held the largest revenue share of the market in 2024. This is due to the rising prevalence of bile duct stones and benign or malignant obstruction of the bile duct or pancreatic duct. ERCP is a procedure to diagnose and treat a blockage or restriction of the pancreatic or bile ducts. According to a multicenter observational study in Türkiye reported that a total of 66,993 ERCP procedures were performed in the surgical centers up to August 2024.

By procedure/application, the diagnostic ERCP and cholangioscopy segment is expected to grow with the highest CAGR in the market during the studied years. Single-use duodenoscopes are also used to diagnose problems within the pancreatic and bile ducts. The increasing demand for minimally invasive procedures necessitates healthcare professionals to use single-use duodenoscopes for diagnosing complications in the pancreatic and bile ducts.

How the Hospitals & Tertiary Care Centers Segment Dominated the Single-use Duodenoscope Market?

By end-user, the hospitals & tertiary care centers segment contributed the biggest revenue share of the market in 2024. The segmental growth is attributed to the presence of specialized infrastructure and suitable capital investments. Hospitals & tertiary care centers have professionals from multiple disciplines, providing multidisciplinary expertise to patients. Patients prefer hospitals due to favorable reimbursement policies.

By end-user, the ambulatory surgery centers/outpatient endoscopy centers segment is expected to expand rapidly in the market in the coming years. The demand for ambulatory surgery centers (ASCs) is increasing, as patients are not required to stay overnight. ASCs and outpatient endoscopy centers have suitable facilities to conduct minimally invasive and non-invasive surgeries at affordable rates. They have specialized equipment and skilled professionals. Single-use duodenoscopes in ASCs reduce the need for on-site reprocessing and capital equipment.

What Made Pre-Procedure Purchase the Dominant Segment in the Single-use Duodenoscope Market?

By pricing/commercial model, the pre-procedure purchase segment accounted for the highest revenue share of the market in 2024. This segment dominated because hospitals prefer buying duodenoscopes based on the number of procedures performed. This helps hospitals to manage costs and avoid over-purchasing or over-storage of single-use duodenoscopes. It also avoids high capital investment to purchase bulk duodenoscopes. The per-procedure cost of a disposable duodenoscope in the U.S. ranges from $800 to $1500.

By pricing/commercial model, the scope-as-a-service/managed supply contracts segment is expected to witness the fastest growth in the market over the forecast period. Scope-as-a-service model is highly preferred by endoscopy centers and surgical clinics due to the increasing patient inflow for endoscopic procedures. They purchase duodenoscopes on a contract or subscription basis to avoid their shortage. This model reduces upfront capital burden and bundles disposables and waste management.

Which Feature/Technology Segment Led the Single-use Duodenoscope Market?

By feature/technology, the standard single-use imaging & working channel scopes segment led the global market in 2024. Duodenoscopes with 4-way tip control and standard optics are widely used. They enable side-viewing for accessing the bile and pancreatic ducts. They also include a working channel to accommodate endoscopic accessories, such as biopsy forceps and stents, for ERCP procedures. They possess a complex elevator mechanism to control the positioning and angle of accessories.

By feature/technology, the enhanced single-use platforms segment is expected to show the fastest growth over the forecast period. Enhanced single-use platforms are developed with advancements in technologies, such as cameras and sensors. They provide high-resolution imaging and improve the torque/control of duodenoscopes. They are integrated with advanced sensors, enhancing visual clarity. Additionally, they have wider therapeutic channels and disposability-optimized accessories.

North America dominated the market share 44% in 2024. The presence of key players, favorable reimbursement policies, and favorable regulatory policies are the major growth factors for the market in North America. Hospitals and healthcare organizations in North America have a robust healthcare infrastructure, providing state-of-the-art care. Government organizations support the development and use of single-use duodenoscopes.

U.S. Market Trends

Companies like Boston Scientific and Ottomed are the major providers of single-use duodenoscopes in various healthcare organizations in the U.S. The National Institute of Health (NIH) estimated that approximately 20 million gastrointestinal (GI) endoscopies are performed annually in the U.S.

Canada Market Trends

In June 2025, the Ontario government announced an investment of $155 million over two years to deliver MRIs, CT scans, and GI endoscopy services across 57 new community surgical and diagnostic centers. This will help 1.2 million people to access publicly funded procedures faster.

Asia-Pacific is expected to grow at the fastest CAGR in the single-use duodenoscope market during the forecast period. The increasing prevalence of pancreatic and bile-related disorders and the growing preference for minimally invasive surgeries bolster market growth. The increasing healthcare expenditure and the burgeoning healthcare sector contribute to market growth. The rising access to ERCP procedures owing to the growing adoption of advanced technologies propels the market. Increasing investments and collaborations among key players augment the market.

China Market Trends

The prevalence of gallstones in China is estimated to be 11%, imposing significant medical and economic burdens. A recent meta-analysis reported that the prevalence of HAIs in mainland China is approximately 3.12% in general hospitals. A 2024 study by researchers of the Naval Medical University found that the total number of endoscopic procedures increased from 28.8 million to 44.5 million from 2012 to 2019.

India Market Trends

In January 2024, Omega Healthcare and Sanjivani Gastro Liver Clinic brought AI-enabled endoscopy to Odisha for the diagnosis and treatment of GI disorders. Computer-assisted detection (CAD) technology will help the identification and treatment of cancerous, precancerous, and even non-cancerous lesions.

South America is expected to grow significantly in the single-use duodenoscope market during the forecast period, due to the presence of a robust regulatory framework. The growing focus on infection control and increasing GI diseases are also increasing their adoption rates. Additionally, the presence of advanced healthcare infrastructure and increasing healthcare investments is driving their innovations, enhancing the market growth.

UK Single-use Duodenoscope Market Trends

The growing focus on patient safety is increasing the demand for single-use duodenoscopes in the UK. The growing healthcare investments and increasing gastrointestinal diseases are also encouraging their adoption. Furthermore, new collaborations are being formed to develop new disposable endoscopic devices.

MEA is expected to grow significantly in the single-use duodenoscope market during the forecast period, due to growing healthcare investments and expanding healthcare infrastructure. This is increasing the adoption of the single-use duodenoscopes for early detection and effective management of GI diseases. The growing government initiatives and medical tourism are also promoting the market growth.

Saudi Arabia Single-use Duodenoscope Market Trends

Due to rapid healthcare expansion in Saudi Arabia, the demand for single-use duodenoscopes is increasing, where the adoption is also backed by investment from various sources. The growing government initiatives and focus on infection control are also increasing their use and promoting their advancements.

R&D activities in single-use duodenoscopes include the development of scopes focusing on visualization, maneuverability, and ergonomics, with a strategic approach to best-in-class solutions.

Key Players: Olympus Corporation, Boston Scientific

After manufacturing, duodenoscopes are packaged and sterilized to avoid microbial contamination. The sterile packaging is opened only prior to its use.

Key Players: Ambu A/S, Fujifilm Corporation

The sterilized duodenoscopes are distributed, either directly or with the help of distributors, to hospitals, ASCs, and pharmacies.

Key Players: Hugger Medical Instrument, B.Braun

Single-use duodenoscopes ensure enhanced patient safety and improved patient outcomes by eliminating patient-to-patient contamination risk.

| Companies | Headquarters | Single-use Duodenoscopes |

| Boston Scientific | Massachusetts, U.S. | EXALT Model D |

| Ambu | Ballerup, Denmark | aScope Duodeno |

| Olympus | Tokyo, Japan | TJF-Q190V |

| Pentax Medical | Tokyo, Japan | DEC Duodenoscope |

| Fujifilm | Tokyo, Japan | ED-580XT |

| EndoFresh | Shenzhen, China | EndoFresh Single-use endoscopy systems |

| Sumitomo Bakelite | Tokyo, Japan | Single-use duodenoscope |

| Karl Storz | Tuttlingen, Germany | Single-use duodenoscope and single-use endoscopic solutions |

| EndoMed Systems | Ravensburg, Germany | EndoMed Single-use Duodenoscope |

| AOHUA Endoscopy | Shanghai, China | AOHUA Single-use Duodenoscope |

| Shenzhen Tianlang Medical | Shenzhen, China | Disposable Duodenoscope |

Britt Meelby Jensen, CEO of Ambu, commented that the company’s next-generation duodenoscope solution is a result of their close partnership with gastroenterologists. The company is dedicated to continuing its focused journey within GI, anchored in profound customer understanding as a pivotal driver for unlocking long-term potential – for gastroenterologists, patients, and Ambu.

By Product Type

By Procedure/Application

By End-User

By Pricing/Commercial Model

By Feature/Technology

By Region

February 2026

February 2026

February 2026

February 2026