January 2026

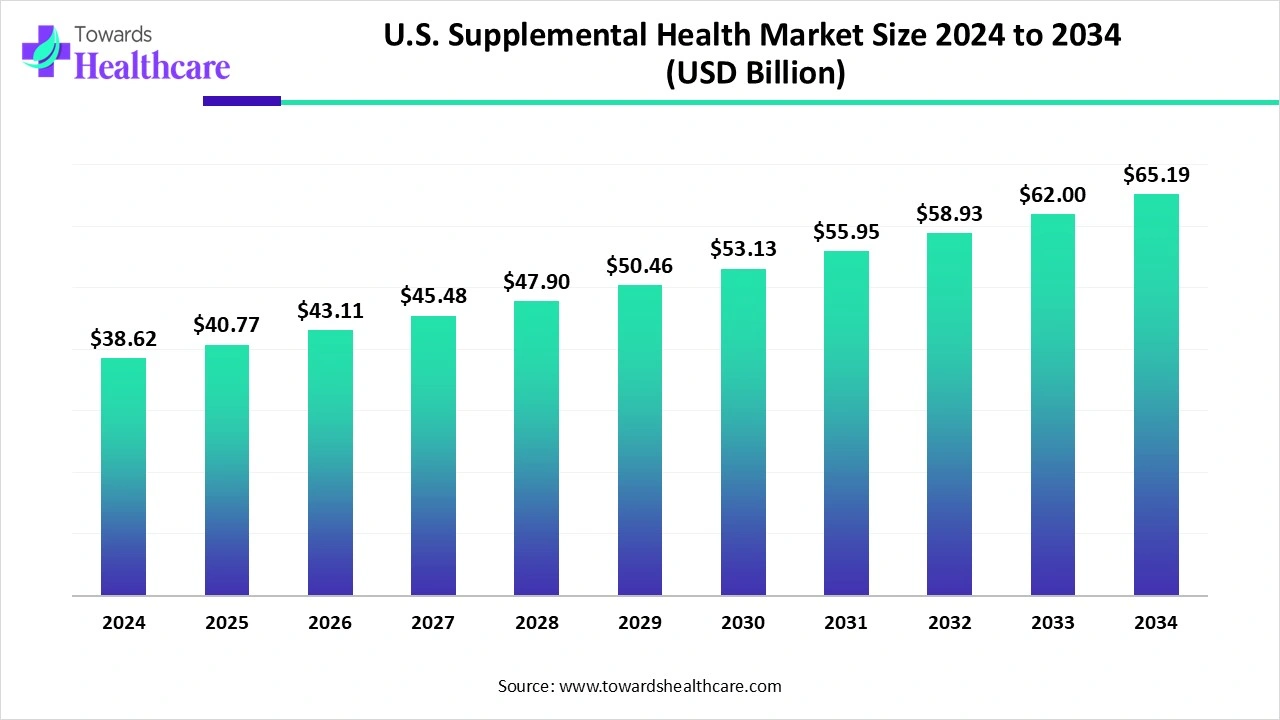

The U.S. supplemental health market size recorded US$ 38.62 billion in 2024, set to grow to US$ 40.77 billion in 2025 and projected to hit nearly US$ 65.19 billion by 2034, with a CAGR of 5.64% throughout the forecast timeline.

The U.S. supplemental health market is witnessing steady growth driven by rising healthcare costs and increasing consumer awareness of preventive care. An aging population and the growing prevalence of chronic diseases are boosting demand for additional coverage beyond standard health insurance. Employers are increasingly offering voluntary benefits to enhance employee satisfaction and retention. Technological advancements, including digital health solutions and telemedicine, are improving accessibility. Flexible and customizable plan options, combined with supportive regulatory frameworks, are further strengthening market adoption and expansion across diverse demographics.

| Table | Scope |

| Market Size in 2025 | USD 40.77 Billion |

| Projected Market Size in 2034 | USD 65.19 Billion |

| CAGR (2025 - 2034) | 5.64% |

| Market Segmentation | By Product Type, By Coverage Type, By Distribution Channel, By End User, By Region |

| Top Key Players | Aflac Inc., Cigna Healthcare, UnitedHealthcare (UnitedHealth Group), Humana Inc., Elevance Health (Anthem), MetLife, Inc., Prudential Financial, Guardian Life Insurance, Colonial Life (Unum Group), Allstate Benefits, Mutual of Omaha, Ameritas Life Insurance Corp., Delta Dental of America, VSP Vision Care, Aetna (CVS Health), Assurant, Inc., Transamerica Corporation, ManhattanLife Insurance, Globe Life Inc., National Guardian Life Insurance (NGL) |

Supplemental health refers to insurance products designed to complement a person’s primary health coverage by providing additional financial protection against specific medical expenses. Unlike standard health insurance, which covers general medical care, supplemental plans target gaps such as hospitalization, critical illnesses, accident-related costs, dental, vision, or prescription coverage. These plans help reduce out-of-pocket expenses, covering co-payments, deductibles, or lost income due to illness or injury. They are particularly valuable for individuals with chronic conditions, high-risk lifestyles, or families seeking comprehensive protection. Employers often offer these plans as voluntary benefits, enhancing overall healthcare security and financial stability.

Regulatory support plays a crucial role in driving the growth of the U.S. supplemental health market by establishing frameworks that enhance consumer protection, ensure plan transparency, and promote equitable access to healthcare.

In 2025, several regulatory developments have significantly impacted this sector:

Digital technologies are increasingly integrated into the supplemental health market, enhancing accessibility and efficiency. Notable trends include:

AI integration can significantly enhance the market by improving efficiency, personalization, and accessibility. AI-powered tools can streamline claims processing, detect fraud, and reduce administrative costs, making plans more affordable. Machine learning algorithms enable insurers to offer personalized recommendations based on individual health profiles, lifestyle, and risk factors, enhancing customer satisfaction. AI-driven virtual assistants and chatbots improve customer support and engagement, while predictive analytics can identify at-risk members, facilitating early intervention and preventive care.

Rising Healthcare Costs

Rising healthcare costs are a significant driver of the U.S. supplemental health market, compelling individuals and employers to seek additional coverage to mitigate out-of-pocket expenses.

Lack of Awareness & Limited Employer Adoption

The key players operating in the market are facing issues due to limited employer adoption and a lack of awareness. Expensive supplemental plans can limit adoption among cost-sensitive consumers. Many individuals are unaware of the benefits and availability of supplemental health coverage. Not all employers offer supplemental benefits, restricting access for employees.

Introduction of Customizable and Flexible Supplemental Health Plans

Customizable and flexible supplemental health plans are pivotal in driving the growth of the U.S. supplemental health market by addressing diverse consumer needs and enhancing accessibility. These plans allow individuals to tailor their coverage to specific health concerns, financial situations, and lifestyle choices, fostering greater engagement and satisfaction. Employers are increasingly offering voluntary benefits, such as critical illness, accident, and hospital indemnity insurance, which employees can opt into based on personal preferences. This approach not only empowers employees but also aids employers in attracting and retaining talent by providing comprehensive, yet personalized, benefits packages.

The critical illness insurance segment dominates the market due to the rising prevalence of chronic diseases such as cancer, heart disease, and diabetes, which increase demand for financial protection against high medical costs. Growing consumer awareness of out-of-pocket expenses and gaps in primary health coverage further drives adoption. Employers increasingly offer critical illness plans as part of voluntary benefits to enhance employee satisfaction. Additionally, customizable policy options, streamlined claims processes, and supportive regulatory frameworks contribute to the segment’s widespread acceptance and sustained growth.

The dental insurance segment is estimated to be the fastest-growing in the U.S. supplemental health market due to increasing awareness of oral health’s impact on overall well-being and preventive care. Rising cases of dental diseases and cosmetic dentistry demand drive consumer interest. Employers are expanding voluntary dental benefits to attract and retain talent, while flexible and customizable plans cater to diverse needs. Technological advancements, such as tele-dentistry and digital claim processing, improve accessibility and convenience, further fueling adoption and accelerating market growth in this segment.

The individual supplemental plans segment dominates the U.S. supplemental health market due to increasing demand for personalized coverage among self-employed individuals, freelancers, and those without employer-sponsored insurance. Rising healthcare costs and growing awareness of gaps in standard health plans encourage consumers to seek additional protection. Flexible plan options allow individuals to tailor coverage to specific needs, such as critical illness, accident, or hospital indemnity. Supportive regulatory frameworks and digital platforms that simplify enrollment and claims further enhance accessibility, driving widespread adoption and sustaining the segment’s market leadership.

The employer-sponsored/group plans segment is anticipated to be the fastest-growing in the U.S. supplemental health market due to increasing adoption of voluntary benefits programs by companies aiming to attract and retain talent. Rising healthcare costs and gaps in standard coverage motivate employers to offer critical illness, accident, and hospital indemnity plans as part of comprehensive benefits packages. Flexible and customizable options cater to diverse employee needs, while digital platforms streamline enrollment and claims management. Growing awareness of employee well-being and supportive regulatory frameworks further accelerates the segment’s rapid expansion.

The brokers & agents segment dominates the market due to their established networks, expertise, and personalized service, which help consumers navigate complex plan options. They play a crucial role in educating individuals and employers about the benefits of supplemental coverage, increasing adoption. Brokers and agents also facilitate plan customization and enrollment, enhancing customer satisfaction. Additionally, strong relationships with insurance carriers enable them to offer competitive products, while their ability to provide ongoing support and claims assistance reinforces trust and drives sustained market dominance.

The employer/workplace benefits programs segment is estimated to be the fastest-growing distribution channel in the U.S. supplemental health market due to rising employer adoption of voluntary benefits and a focus on employee well-being. Digital platforms simplify enrollment, plan management, and claims processing, while customizable offerings cater to diverse workforce needs. This convenience, combined with growing awareness of healthcare gaps, fuels rapid market expansion.

The working adults segment dominates the market due to their higher exposure to healthcare costs and greater awareness of coverage gaps in standard insurance plans. This segment seeks additional protection against critical illnesses, accidents, and hospital expenses to manage out-of-pocket costs effectively. Employers increasingly offer voluntary supplemental benefits tailored for this demographic, enhancing adoption. Moreover, working adults value customizable and flexible plans that align with their lifestyle and financial needs, while digital platforms facilitate easy enrollment and claims management, reinforcing their dominance in the market.

The seniors segment is estimated to be the fastest-growing segment in the U.S. supplemental health market due to increasing life expectancy and a higher prevalence of chronic illnesses, which drive demand for additional medical coverage. They seek protection against out-of-pocket costs for hospital stays, critical illnesses, and prescription drugs. Growing awareness of preventive care and specialized insurance products, such as Medicare supplements, further fuels adoption. Flexible, customizable plans and digital enrollment platforms make it easier for seniors to access coverage, supporting rapid growth in this demographic segment.

The Southern U.S. dominates the supplemental health market due to a combination of demographic, economic, and healthcare factors. The region has a large working-age population with growing awareness of healthcare gaps and rising out-of-pocket medical costs, driving demand for supplemental coverage. High prevalence of chronic diseases, such as diabetes and cardiovascular conditions, further fuels adoption. Employers in the South increasingly offer voluntary benefits to attract and retain talent, while supportive state-level regulations facilitate plan accessibility. Additionally, expanding digital enrollment platforms and insurance broker networks enhances market penetration, positioning the South as a leading region in supplemental health growth.

The Western U.S. is the fastest-growing region in the supplemental health market due to a combination of high health awareness, tech-savvy populations, and increasing adoption of digital health platforms. The rising prevalence of chronic diseases and lifestyle-related health risks drives demand for supplemental coverage. Employers in the region are expanding voluntary benefits to attract skilled talent, while customizable and flexible plans cater to diverse workforce needs. Supportive state regulations and widespread access to brokers and benefits platforms further accelerate market growth in this region.

The Northeastern U.S. exhibits steady growth in the supplemental health market due to a well-established healthcare infrastructure, higher income levels, and greater employer adoption of voluntary benefits. Rising awareness of healthcare gaps and preventive care drives individual and corporate demand for supplemental coverage. The region benefits from strong regulatory support and widespread access to insurance brokers and digital enrollment platforms, facilitating plan customization and efficient claims processing. These factors collectively support sustained and notable growth in the supplemental health market across the Northeast.

In October 2024, Chris DeRosa, president, U.S. Government business, stated that Cigna Healthcare provides clients with stable plans, a consistent service area, competitive pricing, and leading value as the Medicare market continues to change quickly. Medicare shoppers can anticipate seeing a variety of options from Cigna Healthcare so they can select a plan with the benefits they value most and that best fits their particular health and lifestyle requirements. In addition to standalone Prescription Drug Plans (PDP) nationwide, as well as in the District of Columbia and Puerto Rico, Cigna Healthcare still offers Medicare Advantage (MA) plans in 29 states and the District of Columbia, Medicare Supplement plans in 48 states and the District of Columbia, and more.

By Product Type

By Coverage Type

By Distribution Channel

By End User

By Region

January 2026

January 2026

January 2026

January 2026