February 2026

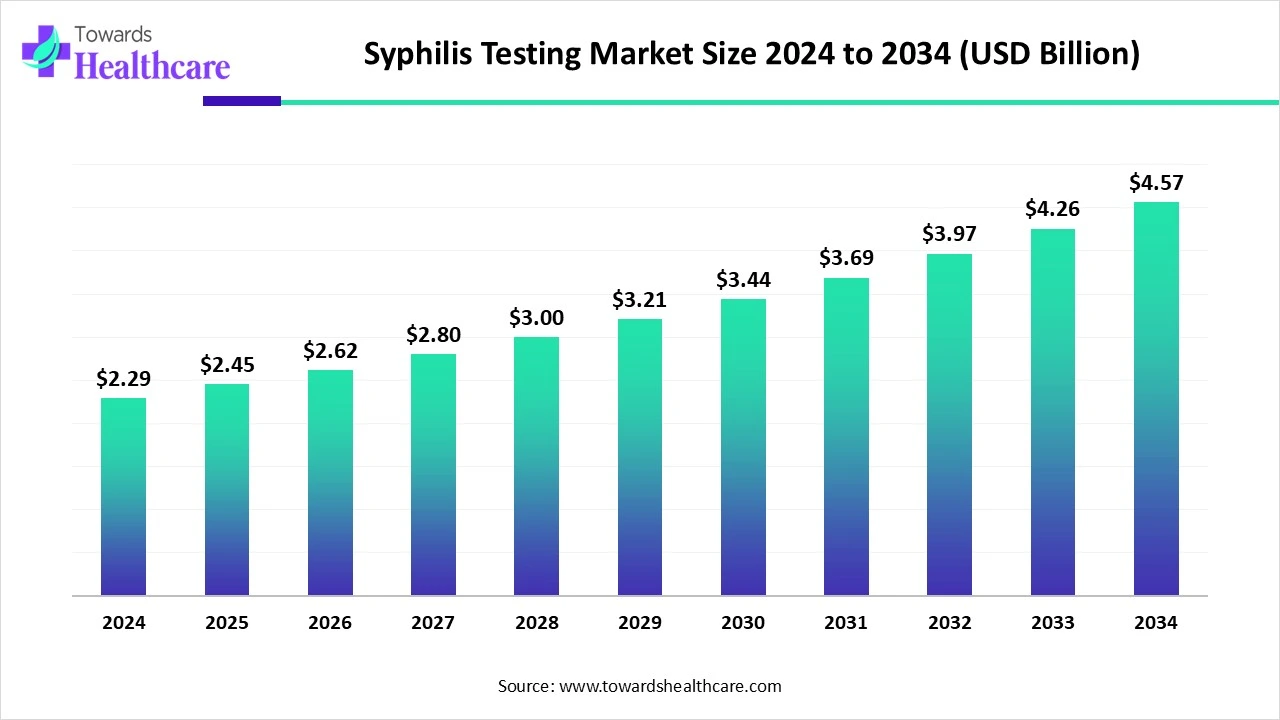

The global syphilis testing market size recorded US$ 2.29 billion in 2024, set to grow to US$ 2.45 billion in 2025 and projected to hit nearly US$ 4.57 billion by 2034, with a CAGR of 6.85% throughout the forecast timeline.

The syphilis testing market is witnessing steady growth driven by the rising incidence of syphilis and other sexually transmitted infections worldwide. Increasing awareness, government-led screening programs, and routine prenatal testing are boosting demand. Advancements in rapid, accurate, and point-of-care diagnostic technologies are further accelerating adoption. Additionally, the growing focus on early detection and timely treatment to prevent complications is supporting sustained market expansion globally.

| Table | Scope |

| Market Size in 2025 | USD 2.45 Billion |

| Projected Market Size in 2034 | USD 4.57 Billion |

| CAGR (2025 - 2034) | 6.85% |

| Leading Region | North America |

| Market Segmentation | By Test methodology/assay type, By Product format/delivery, By Specimen type, By Setting / end-user, By Algorithm/testing workflow, By Region |

| Top Key Players | Roche Diagnostics, Abbott Laboratories, BD (Becton, Dickinson & Co.), Siemens Healthineers, bioMérieux, Hologic, Cepheid (molecular/cartridge NAAT platforms), Bio-Rad Laboratories, Thermo Fisher Scientific (diagnostics reagents & instruments), Ortho Clinical Diagnostics, QuidelOrtho (rapid tests and immunoassays), Trinity Biotech (treponemal/rapid syphilis tests), SD Biosensor / SD Genect (rapid lateral-flow suppliers), Healgen Scientific / Autobio Diagnostics (rapid test manufacturers), Mologic and other specialist POC/self-test developers |

Diagnostic tests and associated reagents, instruments, and services used to screen, diagnose, confirm, and monitor syphilis infection (Treponema pallidum), covering non-treponemal tests (RPR, VDRL), treponemal immunoassays (ELISA, CLIA, TPPA/TPHA), rapid lateral-flow/point-of-care tests, molecular PCR/NAAT, multiplex STI panels, specimen types (serum, plasma, whole blood, oral fluid, DBS), along with confirmatory algorithms, quality-control, laboratory instruments, and public-health screening programs.

The syphilis testing market is evolving with the development of multiplex assays that can simultaneously detect multiple sexually transmitted infections, improving diagnostic efficacy. Innovation in microfluidics and biosensor-based platforms is enabling more sensitive, low-cost testing suitable for remote and resource-limited settings. Partnerships between biotech companies and public health organizations are expanding testing outreach, while regulatory support for faster approvals of advanced diagnostics is accelerating market adoption, making syphilis testing more widespread and technologically advanced.

Funding and Investments - Increased investments support R&D for advanced diagnostics and expand testing infrastructure.

Government and Public Health Initiatives – Screening programs, especially during pregnancy, promote routine testing and support public health goals.

AI is transforming the market by enabling the development of smart diagnostic devices that can automatically detect infection markers with minimal sample volumes. It supports real-time monitoring of testing data across populations, helping identify hotspots and inform public health interventions. AI-driven automation also accelerates laboratory throughput and quality control, while predictive analytics assist in optimizing resource allocation for testing campaigns. These innovations make syphilis diagnostics faster, more scalable, and more accessible in both clinical and remote settings.

Rising Prevalence of Syphilis and STIs

The increasing incidence of syphilis and STIs is driving the syphilis testing market by increasing demand for reliable and timely diagnostics. Higher infection rates compel healthcare providers to implement broader testing programs across hospitals, clinics, and community health initiatives. This surge in testing needs promotes tools. Additionally, it opens opportunities for innovative solutions in remote and resource-limited regions, supporting early detection, effective treatment, and overall market growth.

Limited Test Specificity and Early Detection Challenges

Limited test specificity and difficulties in early detection hinder the syphilis testing market because some tests cannot reliably distinguish between past and current infections. This uncertainty can cause healthcare providers to delay treatment or repeat tests, increasing costs and patient inconvenience. Additionally, early-stage infections may go undetected due to low antibody levels, allowing continued disease transmission. These challenges reduce confidence in testing solutions and slow market adoption, especially in regions lacking advanced diagnostic infrastructure.

Rapid Point-of-care Diagnostic Tests

Rapid point-of-care tests offer a future opportunity in the syphilis testing market because they allow on-the-spot screening in non-traditional settings such as mobile clinics, workplaces, and community outreach programs. By simplifying the testing process and reducing dependency on laboratories, these tests can reach underserved populations, encourage more frequent testing, and technological advancements in portable diagnostics further enhance their potential to expand market adoption and improve overall disease management.

For Instance,

The treponemal immunoassays (ELISA) & chemiluminescent immunoassays (CLIA) segment dominated the market in 2024 because these methods support early-stage detection and confirmatory testing in a single workflow, reducing the need for multiple tests. Their integration into automated laboratory platforms ensures faster turnaround times and standardized results, which are critical for large healthcare networks. Growing demand for reliable screening in blood safety programs and prenatal care also strengthened their adoption, securing their leading position in the syphilis testing market.

The rapid diagnostic tests segment is projected to record the fastest growth as the facilities' large-scale screening campaigns and outbreak response efforts, making them highly suitable for public health programs. Their portability and minimal training requirements allow quick deployment in mobile clinics, emergency settings, and correctional facilities. Increasing collaborations between test manufacturers and health agencies to expand access, along with innovations in multi-disease combo kits, are further fueling the rapid adoption of RDTs in syphilis diagnostics.

The reagents & kits segment captured the largest revenue shares in 2024 because of frequent product replenishment needs and their role in enhancing test accuracy and reliability. Unlike instruments, which are one-time investments, kits drive steady sales through repeated use in both clinical and research settings. Growing availability of multipurpose reagent kits, tailored for combined STI detection, and rising demand from prenatal and blood donor screening programs also strengthened their dominance in the syphilis testing market.

The cartridge-based molecular tests segment is set to grow at the fastest CAGR as these platforms reduce cross-contamination risks and standardize workflows, ensuring consistent results even in low-resource labs. Their scalability allows healthcare providers to expand testing capacity without extensive infrastructure upgrades. Growing partnerships between diagnostic firms and governments deploy cartridge-based systems in national STI control programs, along with rising demand for portable, point-of-care molecular solutions, are further accelerating their uptake in the market.

The serum/plasma segment led the market shares as these specimens are easier to process, store, and transport compared to other sample types, making them highly practical for larger diagnostic networks. They are also compatible with high-throughput automated analyzers, enabling laboratories to handle bulk testing efficiently. Growing use of serum/plasma samples in prenatal screening, blood donor testing, and epidemiological surveillance further strengthened their adoption, securing their position as the leading specimen type in syphilis diagnostics.

The dried blood spot (DBS) segment is projected to grow fastest as it reduces the need for trained phlebotomists and laboratory infrastructure, allowing even non-specialists to collect samples in outreach or home settings. DBS is increasingly being adopted in maternal and child health programs for syphilis screening, as it enables convenient testing for newborns and pregnant women. Rising support from global health agencies to integrate DBS into large STI monitoring initiatives is further fueling its rapid market expansion.

The central clinical laboratories/reference labs segment dominated revenue in 2024 as they are often contracted for specialized and complex testing that smaller facilities cannot perform. Their strong infrastructure, availability of skilled professionals, and compliance with stringent regulatory standards make them the trusted choice for critical diagnostics. Moreover, rising collaborations with governments and research institutions for large epidemiological studies and screening programs boosted the testing volumes handled by these labs, strengthening their market leadership.

The point-of-care segment is set to expand at the fastest CAGR as it supports immediate clinical decision-making, enabling treatment to begin during the same visit and lowering the risk of patient loss to follow-up. These settings are increasingly favored in correctional facilities, emergency departments, and maternal health clinics where rapid action is critical. Growing investment in portable devices and combined STI test kits is also boosting their adoption, positioning point-of-care testing as a key growth driver ahead.

The reverse algorithm segment led the market in 2024 because it streamlines confirmatory testing by automatically following positive treponemal results with non-treponemal tests, reducing manual interpretation errors. This approach is favored in high-volume laboratories and blood screening programs for efficiency and reliability. Growing awareness of its ability to detect both recent and past infections, combined with increased adoption in national STI surveillance and preventive healthcare initiatives, contributed to its dominant revenue position in the syphilis testing market.

The single-test POC diagnosis segment is projected to grow rapidly because it minimizes workflow complexity and reduces the need for multiple follow-up tests, making screening more efficient and cost-effective. Its portability and ease of use allow testing in outreach programs, prisons, and rural clinics, expanding access to underserved populations. Additionally, increasing investments in quick, reliable diagnostic solutions are driving faster adoption of single-test POC approaches in the market.

North America led the market in 2024 because of favorable regulatory support, easy access to point-of-care and at-home testing solutions, and robust reimbursement policies. The region’s high focus on early detection programs, including blood donor and community screening initiatives, increased demand for reliable diagnostics. Moreover, continuous product innovations by major diagnostic companies and growing public-private partnerships to combat rising STI rates further strengthened market penetration and revenue generation, maintaining North America’s dominant position.

The U.S. market is growing due to a rising incidence of syphilis and other STIs, increasing awareness about early detection, and government-led public health initiatives. Widespread adoption of advanced diagnostic technologies, including rapid tests and automated laboratory assays, supports large-scale screening programs. Additionally, growing demand for point-of-care and at-home testing, coupled with investments by diagnostic companies to develop accurate, user-friendly solutions, is driving market expansion and improving access to timely syphilis diagnosis across the country.

The market in Canada is expanding due to enhanced public health funding, implementation of national surveillance programs, and increased accessibility of diagnostic services in remote and indigenous communities. Rising demand for convenient and accurate testing methods, such as cartridge-based molecular tests and multiplex rapid kits, is also contributing. Furthermore, collaborations between healthcare providers and research institutions to improve STI monitoring and early intervention strategies are driving higher adoption of syphilis testing, supporting overall market growth in Canada.

The Asia-Pacific market is projected to grow fastest due to increasing urbanization, rising healthcare spending, and greater availability of modern diagnostic technologies. Expansion of private laboratories, growing adoption of cartridge-based and multiplex testing, and government-led STI control programs in countries like India, China, and Australia are boosting testing capacity. Additionally, rising demand for convenient and rapid screening in remote and rural areas, along with public health initiatives targeting high-risk populations, is accelerating market growth across the region.

Clinical Trials: Clinical trials in syphilis testing evaluate rapid and point-of-care tests for accuracy and reliability, aiming to improve screening, accelerate diagnosis, and enhance treatment and partner notification across clinical settings.

Regulatory Approvals: Regulatory approval for syphilis tests is overseen by the U.S. Food and Drug Administration (FDA) in the United States and involves ensuring the test's safety and effectiveness through mechanisms like the De Novo pathway for novel devices.

Patient Support and Services: Patient support for syphilis testing involves pre- and post-test counseling, confidential testing at government centers like NACO, and access to at-home test kits. It also includes partner notification and contact tracing services, with some platforms providing free and anonymous options, helping ensure timely treatment and reducing the spread of infection.

In 2024, NOWDiagnostics, Inc. (NOWDx) launched its First To Know® Syphilis Test nationwide, making it the first FDA-authorized over-the-counter syphilis self-test in the U.S. Available on Amazon and in thousands of pharmacies and retail stores, the test provides accurate in-home results in just 15 minutes using a single drop of blood. Priced under $30, it aims to expand access, reduce stigma, and encourage timely testing. CEO Rob Weigle stated that the test is designed to “break down barriers to healthcare access” and support public health efforts to curb syphilis spread.

By Test methodology/assay type

By Product format/delivery

By Specimen type

By Setting / end-user

By Algorithm/testing workflow

By Region

February 2026

February 2026

February 2026

February 2026