January 2026

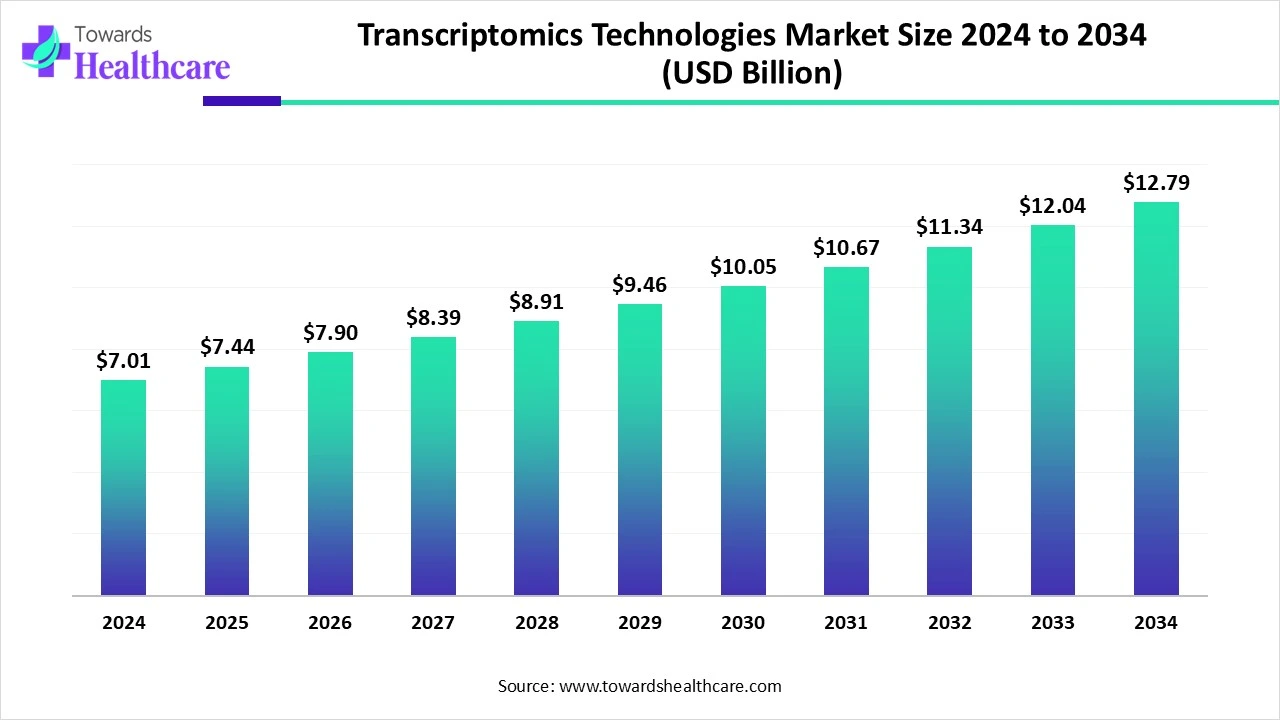

The global transcriptomics technologies market size is calculated at US$ 7.01 in 2024, grew to US$ 7.44 billion in 2025, and is projected to reach around US$ 12.79 billion by 2034. The market is expanding at a CAGR of 6.24% between 2025 and 2034.

New technologies and shifting market conditions are driving the rapid adoption of transcriptomics in clinical and scientific settings, marking a watershed in the field's evolution. Since gene expression analysis is becoming more and more significant in biomedical research and personalized medicine initiatives, stakeholders hoping to maintain or improve their competitive advantage must be aware of the current state of affairs.

Each of the well-known companies that make up the transcriptomics sector has unique advantages over the competition. Well-known sequencing giants still leverage economies of scale and extensive service networks to drive advancements in platform performance and reagent quality.

| Metric | Details |

| Market Size in 2025 | USD 7.44 Billion |

| Projected Market Size in 2034 | USD 12.79 Billion |

| CAGR (2025 - 2034) | 6.24% |

| Leading Region | North America |

| Market Segmentation | By Product Type, By Technology, By Application, By End-Use, By Region |

| Top Key Players | Illumina, Inc., Thermo Fisher Scientific Inc., Agilent Technologies, Inc., QIAGEN N.V., 10x Genomics, Inc., Bio-Rad Laboratories, Inc., Roche Holding AG, Pacific Biosciences of California, Inc., Oxford Nanopore Technologies Limited, Fluidigm Corporation |

An organism's transcriptome, or the whole of its RNA transcripts, may be studied using transcriptomics technology. By using transcriptomics approaches, scientists may investigate the complex transcriptome landscapes in a variety of biological settings. By revealing molecular pathways, regulatory mechanisms, and patterns of gene expression, these methods greatly advance our knowledge of biological processes. Additionally, they aid in the development of novel medicines, therapeutic targets, and biomarkers for a range of illnesses. Transcriptomics continues to develop with new tools and uses, making it a promising topic that might help us better understand life and health.

Artificial intelligence (AI) technologies used in transcriptome analysis meet the need for accurate results and efficient processing. It expands the applications of transcriptomic technology in cancer research, specifically. AI-assisted transcriptome analysis has proven to be highly effective in predicting therapeutic response and exploring the underlying processes of drug resistance and immunotherapy toxicity, with important implications for cancer treatment. AI can adequately meet the growing need for transcriptome analysis. AI tools can improve decision-making and discovery with little human intervention.

Single-Cell Technology Advancements

Single-cell transcriptomics has revolutionized the global transcriptomics business by facilitating the comprehensive study of gene expression at the individual cell level. This subject is rapidly gaining popularity as researchers aggressively search for ways to comprehend cellular heterogeneity in a range of diseases, such as cancer and neurological disorders. The growing prevalence of cancer fuels this trend and contributes to the growth of the transcriptomics market as single-cell transcriptomics is essential for understanding tumor complexity and developing customized treatments.

High Cost Associated with Transcriptomics

Next-generation sequencing and RNA sequencing are costly procedures. Certain processes, including DNA or RNA separation, library preparation, sequencing chemicals, data analysis, and storage, are believed to be used to carry out these operations. To conduct such a study, it is imperative to have trained professionals who have undergone the required technique maintenance training. As a result, ambiguous transcriptomics research and high maintenance costs make it challenging to exchange technical knowledge about this industry.

How is Investment in Research Beneficial for Transcriptomics Growth?

The increase in funding for genomic research is a major factor in the market expansion for transcriptomics technology. The significance of genomics in promoting customized treatment and cutting-edge healthcare solutions is becoming more widely acknowledged by governments, the commercial sector, and academic institutions. Increased financing for research projects enables the creation of novel transcriptomics techniques and applications, opening the door for discoveries that have the potential to completely transform approaches to illness prevention and treatment.

By product type, the analyzers segment domiated the transcriptomics technologies market in 2024. In-depth knowledge of intricate regulatory processes and fresh perspectives on cellular activities are provided by transcriptomic data analysis, a potent research tool that offers thorough insights into gene expression patterns in biological systems. Fast, accurate, and reasonably priced solutions are offered by the transcriptomic data analysis services for the investigation of gene expression data.

By product type, the software segment is estimated to be the fastest-growing in the transcriptomics technologies market during 2025-2034. Software is crucial for data analysis and interpretation, particularly for scholars attempting to glean insights from huge, complex data sets. Bioinformatics technologies, which include both commercial and open-source software, enable spatial mapping of gene expression and 3D visualization. The development of analytical databases, cloud-based storage, and imaging technology allows for deeper understandings of tissue architecture and disease pathophysiology.

By technology, the next-generation sequencing segment held the largest share of the transcriptomics technologies market in 2024. One of the most obvious applications of NGS technology platforms is genome sequencing. Thanks to the NGS revolution, large-scale genome sequencing now takes a lot less time and money. The NGS technique for de novo sequencing thus becomes quite interesting. NGS provides genome-level, objective, high-throughput, and cost-effective analytical methods.

By technology, the polymerase chain reaction segment is estimated to grow significantly in the transcriptomics technologies market during the upcoming timeframe. One of the key technologies driving this transformation is the Quantitative Polymerase Chain Reaction (qPCR). Despite being very sensitive and quantitative, the qPCR approach is most effective when analyzing a small number of transcripts in a large collection of samples. In the domains of qPCR and transcriptomics, new techniques and technologies are constantly being created.

By application, the drug discovery and research segment led the transcriptomics technologies market in 2024. Pharmaceutical, therapeutic, medical, and biological research are all making extensive use of high-throughput RNA-sequencing and gene expression microarrays. RNA-seq has a much greater detection flow at a reduced cost thanks to advancements in analytical procedures and detection technologies, which makes it a useful tool for biomarker identification and drug development. scRNA-seq is more accurate and efficient than normal RNA-seq, and gene expression pattern analysis at the single-cell level can provide more information for medication and biomarker development.

By application, the diagnostics segment is expected to be the fastest-growing in the transcriptomics technologies market during the forecast period. Because it allows for the discovery of biomarkers and offers insights into disease causes, transcriptomics the study of the entire collection of RNA transcripts in a cell is a useful diagnostic tool. It aids in predicting therapy response, comprehending how gene expression varies throughout illness, and maybe locating novel therapeutic targets.

By end-user, the pharmaceutical and biotechnology companies segment was dominant in the transcriptomics technologies market in 2024. Biotechnology and pharmaceutical companies are increasingly using transcriptomics, the study of a cell's whole collection of RNA transcripts, to enhance drug discovery, individualized therapy, and development. Scientists may better understand the origins of diseases, identify potential therapeutic targets, and predict how well patients will respond to therapies by using transcriptomics, which reveals patterns of gene expression.

By end-user, the academic research and government institutes segment is expected to grow at the highest CAGR in the transcriptomics technologies market during the forecast period. Research organizations are essential parts of autonomous academic research institutes as well as corporations. As targets are obtained from cell analysis, next-generation sequencing is mostly used in research to find biomarkers and create medications. Research groups also have an obligation to look into new ways to improve molecular diagnostic skills and technologies.

North America dominated the transcriptomics technologies market in 2024. Due in large part to its extensive public and private investment, emphasis on research and development, and advanced healthcare system. Thus, having leading biotechnology, pharmaceutical, and genomic companies that drive transcriptomic technology improvements benefits the region. North America's advantage in genetic research and customized treatment might be further enhanced by Illumina's partnership with the Harvard and MIT Broad Institute to extend single-cell sequencing, for instance.

In recent decades, the biotechnology industry in the U.S. has grown at an unparalleled rate, establishing itself as a vital component of the country's economy. In addition to spurring scientific advancement, this boom has produced significant economic advantages, including diversification of the market, greater investment, and job creation.

The biotechnology industry in Canada is expanding, and it ranks among the top countries in the world. To provide innovative solutions for agriculture, the environment, and health, the biotechnology industry in Canada blends business and science. Due to entrepreneurship, government support, and strong academic standards, Canada's biotechnology industry has expanded dramatically in recent years.

Asia Pacific is estimated to host the fastest-growing transcriptomics technologies market during the forecast period. To counteract the increased prevalence of cancer, government initiatives and healthcare facilities are spreading throughout the Asia-Pacific region. Transcriptomics is a crucial technique for improving patient outcomes and precision medicine in the region due to its dense population and growing incidence of chronic diseases. China, India, and Japan are at the forefront of this movement, increasing funding for biotechnology research and fostering a closer connection between academia and industry. In this sense, there is a substantial market for transcriptomics development in the Asia-Pacific area.

Domestic biotech innovation has been a focus of recent Chinese government efforts. The expansion of the industry has been greatly aided by a new national plan. Subsidies, financial incentives, research parks, start-up incubators, talent recruiting programs, public-private collaborations, and measures to improve IP protection and speed up drug review are some of the drivers driving growth. China has established a number of benchmarks and objectives for the sector, including boosting biotech industrialization, developing a biotech innovation platform, and boosting biotech's uniqueness through new products and technology.

With over 4 percent of the global biotech market and notable strengths in agricultural biotechnology, bio-pharmaceuticals, and vaccines, India's biotechnology sector is rapidly emerging as a major driver of both scientific and economic progress. The National Biotechnology Development Strategy (NBDS) 2021–2025 and other strategic government initiatives that foster an environment that is conducive to investment, research, and innovation are helping to promote this expansion.

Europe is expected to grow significantly in the transcriptomics technologies market during the forecast period. In this sector, Germany, the UK, and France lead Europe, which also has a sizable market share. Numerous transcriptomics and genomic research initiatives are to blame for this. Academic institutions, biotech companies, and other comparable organizations are also increasingly working together regionally to identify biomarkers and create RNA-targeted drugs.

Both new, promising businesses and well-established biotech enterprises have grown in Germany's biotech sector. The turnover and R&D expenditures of German biotechnology companies have therefore skyrocketed. Germany is a desirable alternative for Wisconsin companies involved in the biotech and pharmaceutical industries due to the country's robust biotech sector and significant pharmaceutical import volume.

The UK is home to several biotech hotspots and is a major player in biotech innovation. In fact, after an £800 million surge in funding in the third quarter of 2023, the UK biotech scene is now one of the most dynamic in Europe. In May 2023, the UK government said that £650 million would be allocated to the life sciences sector as part of a package called "Life Sci for Growth." The package also contained plans to rename the Academic Health Science Network as Health Innovation Networks. By bringing together academia, industry, nonprofits, local communities, and the NHS to share best practices, this project seeks to promote innovation.

Latin America is considered to be a significantly growing area in the transcriptomics technologies market, due to the burgeoning biotech sector and increasing investments. Favorable government support and growing research and development activities contribute to market growth. The rising prevalence of chronic disorders and the rising adoption of advanced technologies boost the market. Government and private organizations conduct conferences, workshops, and seminars to share the latest updates on transcriptomics.

The Mexican healthcare system is increasingly adopting personalized medicine approaches as providers recognize their potential to improve outcomes. Mexico is home to about 180 firms that develop and/or use modern biotechnology. The favorable geographical presence of Mexico attracts foreign patients for affordable and high-quality, personalized treatments

In April 2024, MGI Tech Co., Ltd. announced the launch of its Customer Experience Center (CEC) in Brazil. The company aims to provide a facility for clinical and research laboratories, hospitals, and universities to enhance learning with genetic sequencing technology, strengthening precision oncology and multi-omics technology.

In February 2024, Parse Biosciences announced a significant enhancement to its flagship EvercodeTM Whole Transcriptome solutions. After taking into account feedback from customers, Charlie Roco, CTO and co-founder of Parse Biosciences, said, with this new version, we believe we're giving researchers tools that are unmatched in their sensitivity, scalability, and flexibility. We have been working to democratize and make single-cell research more accessible since the outset, and Evercode has received positive feedback from the scientific community.

(Source - Parsebiosciences)

By Product Type

By Technology

By Application

By End-Use

By Region

January 2026

December 2025

December 2025

February 2026