January 2026

The U.S. Controlled Substance Market size is estimated at US$ 52.3 billion in 2024, is projected to grow to US$ 55 billion in 2025, and is expected to reach around US$ 84.95 billion by 2034. The market is projected to expand at a CAGR of 5.24% between 2025 and 2034.

The U.S. controlled substance market is expanding as major controlled substances have increasing medical use, and growing access for patients in need is necessary. Controlled drugs, substances, and certain chemicals are those whose use and delivery are tightly controlled, as they have abuse potential, addiction, and illegal diversion and sale, such as opioid analgesics, benzodiazepines, and stimulants.

| Table | Scope |

| Market Size in 2025 | USD 55 Billion |

| Projected Market Size in 2034 | USD 84.95 Billion |

| CAGR (2025 - 2034) | 5.24% |

| Leading Region | North America |

| Market Segmentation | By Product Type, By Indication, By Distribution Channel |

| Top Key Players | AbbVie, Inc., Pfizer, Inc., Merck & Co., Inc, Mallinckrodt plc, F. Hoffmann-La Roche AG, Janssen Pharmaceuticals, Inc., Purdue Pharma L.P., Teva Pharmaceutical Industries Ltd., Other Prominent Players |

The U.S. controlled substance market is growing because controlled substances are chemicals whose manufacturing, possession, or use is controlled by the government. Illegitimately applying drugs or prescription drugs is intended as controlled drugs. Many researchers using controlled substances in their research, with research regarding animals and non-therapeutic research relating to human subjects, are subjected to wide-ranging state and federal regulatory necessities, to obtain licensure for laboratory use of controlled substances in addition to licensure for their practice as outlined in this policy.

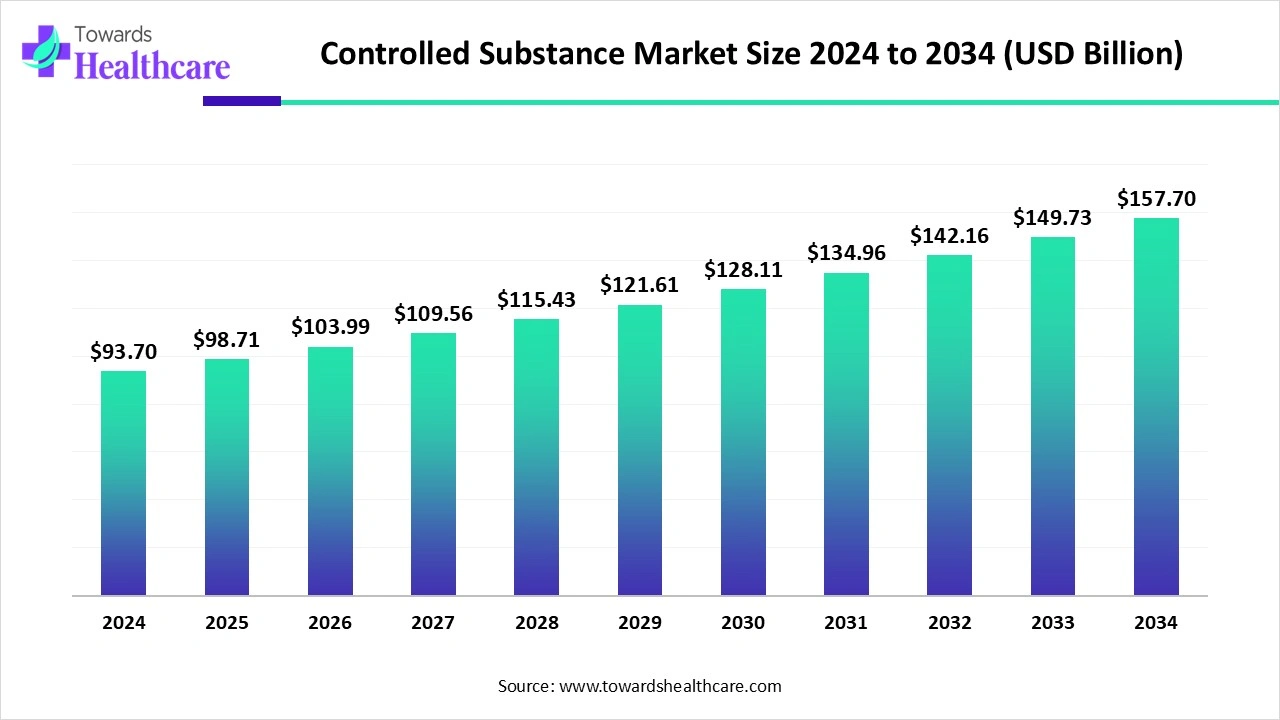

The global controlled substance market is valued at US$ 93.7 billion in 2024, expected to grow to US$ 98.71 billion in 2025, and projected to reach about US$ 157.7 billion by 2034, expanding at a CAGR of 5.35%.

Increasing government initiative, such as the National Action Plan for Drug Demand Reduction (NAPDDR), through which the Government is making a sustained and coordinated action to arrest the problem of substance abuse, which drives the growth of the market.

For instance,

Increasing awareness related to applications of controlled substances, which drives the growth of the market.

For Instance,

Integration of AI in the U.S. controlled substance drives the growth of the market, as AI-driven technology transforms the quality process in controlled drug manufacturing by improving inspection precision. Manufacturing process speed is improved with the support of the data and images available throughout the manufacturing process, and therefore, any deviations in product quality are identified. AI-based technology not only progresses the efficiency and affordability of drug manufacturing but also increases the quality and safety of the product, which causes better patient outcomes. AI-based technology reduces the challenges related to controlled substances by offering real-time monitoring, enhancing accountability, and improving inclusive security measures.

Increasing Applications of Controlled Substances

Controlled substances can be effective in managing and treating various conditions when used as directed by a healthcare provider. These medications, which include many types of prescription drugs, are used to address a range of issues such as moderate to severe pain, cough, attention disorders, anxiety, seizures, sleep problems, obesity, and more. The goal is to provide pain relief while minimizing toxicity, the risk of substance use disorder, and implementing safeguards to prevent drug diversion, which contributes to the expansion of the U.S. controlled substance market.

Major Limitations of Controlled Substances

Controlled substances pose a huge challenge of resulting in addiction and substance use disorder, which limits the growth of the U.S. controlled substance market.

Recent Advancements in Abuse-Deterrent Formulations

Abuse-Deterrent Formulations (ADFs) are specially modified opioid drugs aimed at decreasing their appeal and addictive potential. This is achieved by restricting the amount of drug absorbed by the body, making it less likely to be misused or tampered with. Developing a new abuse-deterrent formulation (ADF) is similar to creating a new opioid chemical entity. The primary goal of designing novel ADFs is to produce opioid medications that are both safe and effective for treating specific conditions within the target population. This also helps facilitate the growth of the U.S. controlled substance market.

For Instance,

By product type, the opioids segment led the U.S. controlled substance market, as opioids block pain messages sent from the body through the spinal cord to the brain. Also, they efficiently manage the pain. Physicians prescribe opioid medications to manage and treat moderate-to-serious pain. Common prescription opioid drugs comprise hydrocodone, fentanyl, and tramadol. Opioids enhance mood and increase a person's mood.

On the other hand, the depressants segment is projected to experience the fastest CAGR from 2025 to 2034, as controlled substances slow brain activity; depressants can help treat acute stress, anxiety, sleep disorders, and panic attacks. They majorly impact the ability to drive, operate machinery, and participate in responsibilities that require muscle coordination.

By indication, the pain management segment is dominant in the U.S. controlled substance market in 2024, as controlled substances dull the senses and help relieve pain, like morphine. These medications are used for chronic pain. This substance functions by binding to receptors in the brain, which blocks the sensation of pain. It is applied as part of a multimodal analgesic strategy in combination with paracetamol, non-steroidal anti-inflammatory drugs, and local anaesthetics, where it is appropriate to work in pain management.

The sleep disorder segment is projected to grow at the fastest CAGR from 2025 to 2034, as controlled substances such as opioids have a beneficial effect on sleep quality, duration, and efficacy. This substance has sedative effects to induce sleep. These substances directly integrate with sleep-regulating neurotransmitter systems and sleep architecture, leading to a precise sleep cycle, which increases the demand for the controlled substances by insomnia patients.

By distribution channel, the retail pharmacies segment led the U.S. Controlled Substance Market in 2024, as it provides a broad selection of controlled substance therapeutics and supplementary health products, addressing diverse healthcare requirements. With inclusive services, with pharmacy and mail order options, retail pharmacies modernise the medication access process. Retail pharmacies play a significant role in healthcare by offering convenient access to therapeutics and valuable supplementary services.

The online pharmacies segment is projected to experience the fastest CAGR from 2025 to 2034, as the online pharmacy services offer productive data related to diseases, drug interactions, and side effects of controlled drugs in the form of reports, informative blogs, and product facts. They are more helpful for reminding people at what time they have to take treatment and how much of the required dose is required. Online platforms enable consumer to browse and buy medications discreetly from the ease of their homes, instead of face-to-face communication.

In the U.S., the use of controlled substances has increased due to the increased availability of opioids used in the management of chronic pain. The presence of massive pharmaceutical industries like major key players Pfizer, Purdue Pharma, and Johnson & Johnson increases production and consumption of prescription drugs such as opioids, stimulants, and sedatives, which drives the growth of the market. The increasing rate of mental disorder patients due to economic stress and job insecurity is also increasing the demand in the U.S. controlled substance market.

For Instance,

In R&D processes of controlled substances in discovery and development, preclinical research, clinical research, FDA drug review, and FDA post-market safety monitoring

Key Players: Pfizer and Merck

Clinical trials of controlled substances are increasing as pharmaceutical companies examine the potential medicinal value of cannabis-derived complexes. Many companies are directing various indications of controlled substances that previously received U.S. Food and Drug Administration (FDA) approval.

Key Players: Illumina, Inc. and Avammune Therapeutics.

Proper opioid prescribing necessitates a thorough patient assessment, short and long-term therapy planning, regular follow-up, and continuous monitoring.

Key Players: Eli Lilly and Co. and AbbVie Inc

In June 2025, Karen Kobelski, Vice President and General Manager for Clinical Surveillance at Wolters Kluwer Health, said, “Invistics’ advanced technology solution fits perfectly with our existing offerings, such as Simplifi+ and Sentri7, which help customers achieve optimal clinical outcomes and regulatory compliance. Our efforts to help health systems deploy effective pharmacy surveillance and compliance programs to reduce patient risk are further enhanced by incorporating the Invistics solution."

By Product Type

By Indication

By Distribution Channel

January 2026

January 2026

January 2026

January 2026