January 2026

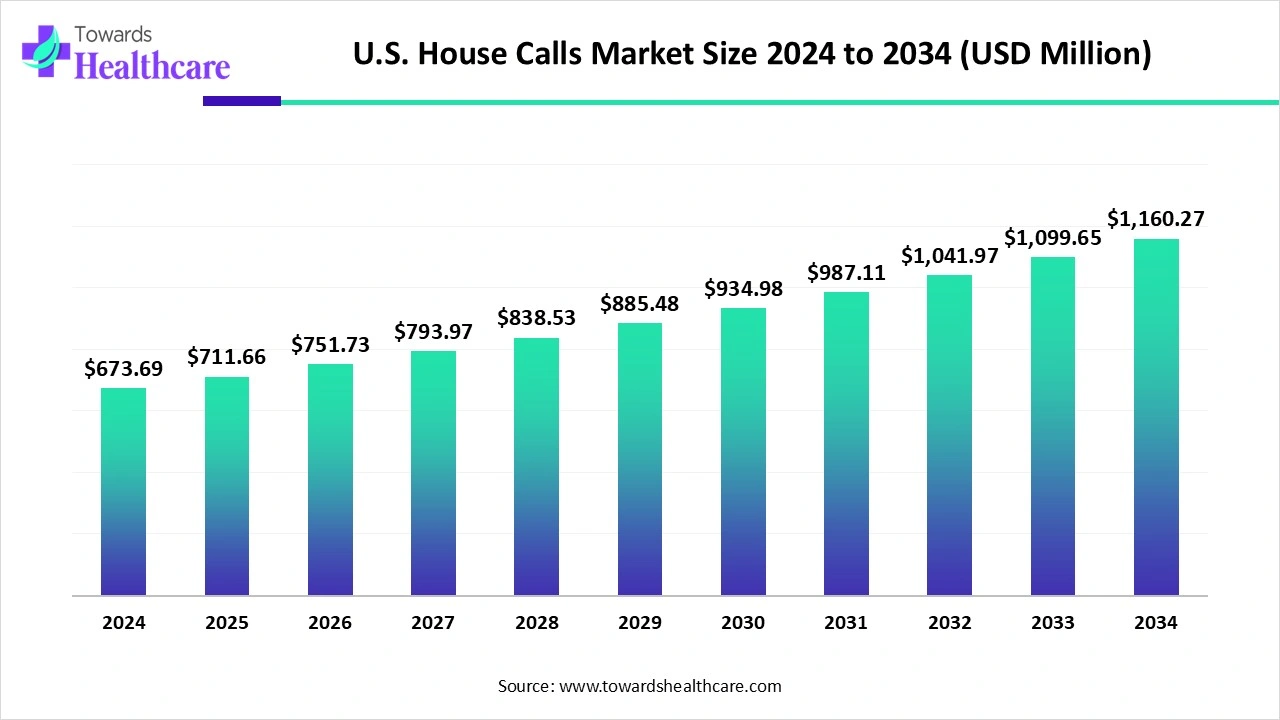

The U.S. house calls market size is estimated at US$ 673.69 million in 2024, is projected to grow to US$ 711.66 million in 2025, and is expected to reach around US$ 1160.27 million by 2034. The market is projected to expand at a CAGR of 5.65% between 2025 and 2034.

The U.S. house calls market is expanding because it provides various services, such as personalized care and increased accessibility for patients who need in-home healthcare visits. Increasing collaboration with senior living communities and medical care providers, which drives the growth of the market.

| Table | Scope |

| Market Size in 2025 | USD 711.66 Million |

| Projected Market Size in 2034 | USD 1160.27 Million |

| CAGR (2025 - 2034) | 5.65% |

| Market Segmentation | By Service Type, By Mode of Delivery, By End User, By Provider Type |

| Top Key Players | Apple Inc., Fitbit (Google LLC), Samsung Electronics, Garmin Ltd., Huawei Technologies (U.S. market presence via imports), Fossil Group, Inc., Withings, Suunto, Omron Healthcare, Bose Corporation, Amazfit (Huami Corporation), WHOOP, Polar Electro, Michael Kors (WearOS-based), Mobvoi (TicWatch), Valencell Inc., BioBeat Technologies, Verily Life Sciences (Alphabet), Abbott, Masimo Corporation |

The U.S. house calls market consists of healthcare services delivered directly at a patient’s home, including primary care, urgent care, chronic disease management, preventive health checks, and post-discharge follow-ups. Traditionally phased out in the late 20th century, house calls have resurged due to rising demand for personalized care, an aging population, growing chronic illness prevalence, and advancements in telemedicine and mobile diagnostics. These services reduce unnecessary ER visits, improve patient satisfaction, and lower overall healthcare costs. The market is further fueled by Medicare/Medicaid support for home-based care and increased adoption by concierge medicine and digital health platforms.

Medical house calls provide many advantages, such as enhanced convenience, targeted care, improved health results, affordability, and support for the aging population, which drives the growth of the market.

For instance,

Growing investment in healthcare by the government and public organizations, which drives the growth of the market.

For Instance,

Integration of AI in the U.S. house calls drives the growth of the market, as AI-driven calls support home service providers in assessing facility requests and urgency. AI-based technology in home health remotely tracks patients' vital symptoms based on the effort given by clients and attentive healthcare workers to potential challenges before they become complex. Automatic monitoring in home calls enhances the client care experience. They perceive certain sounds or variations in behaviour that mean the resident requires assistance or medical attention. AI-driven technology has improved healthcare software rapidly, allowing it to call up data related to patients’ histories from electronic health records, supporting physicians in documenting patient visits.

Increasing Aging Population Burden

The U.S. house calls market is rising due to the aging population, more patients living at home, and increased recognition of their value by both the public and the healthcare industry. Common reasons for house calls include managing acute or chronic conditions, coordinating post-hospital care, conducting health assessments, and providing end-of-life support. House calls can also involve observing daily activities, reconciling medications, assessing nutrition, evaluating caregiver stress, and ensuring patient safety at home. These factors contribute to the expanding house calls market.

Major Limitations of House Calls

Barriers to primary care physicians making house calls include inadequate pay, limited time and training, unsuitable home environments, concerns about liability and safety, and the perception that house calls add little value to the patient’s care. These factors restrict the growth of the U.S. house calls market.

Growing Demand for Patient-Centric Care

House calls significantly improve the patient-centric experience by customizing care to individual needs. They are typically less rushed and allow for more comprehensive assessments. This enables healthcare providers to communicate more effectively with patients, evaluate symptoms thoroughly, perform complete examinations, and establish appropriate treatments if needed. The combination of house calls and telehealth marks a major step forward in increasing healthcare accessibility and personalization, opening new opportunities in the U.S. house calls market.

For Instance,

By service type, the primary care house calls segment led the U.S. house calls market, as primary house call professional provides enhanced continuity of care for patients who might not then have access to reliable healthcare services. Chronic diseases such as diabetes, asthma, and arthritis need consistent monitoring and management. Primary care providers support patients to stay on top of their conditions by regular follow-ups, therapeutic adjustments, and monitoring the progression of symptoms and disease.

On the other hand, the chronic disease management segment is projected to experience the fastest CAGR from 2025 to 2034, as house call services ensure the management of physical, mental, and emotional well-being while addressing any difficulties or discomforts. In-home chronic disease management is patient-centered care provided by a visiting medical physician in a patient’s home to offer support and services to enhance health outcomes.

By mode of delivery, the in-person visits segment is dominant in the U.S. house calls market in 2024, as these visits go to see patients where they live, whether it is a nursing home, family home, or assisted living center. In-person house calls are direct patient-to-physician visits to a patient's home, providing advantages such as inclusive assessment of social circumstances, regular health monitoring, enhanced treatment plans, lowering frequency of hospital stays, and building relationships between physicians and patients.

The telehealth-assisted house calls segment is projected to grow at the fastest CAGR from 2025 to 2034, as these calls authorize patients to manage their illness, enhance their quality of life, improve their access to home-based services, lower the need for unnecessary hospitalization, and reduce hospital care expenses. This type of service offers access to resources and care for patients in rural areas or areas with shortages of physicians, growing efficiency without higher net prices.

By end user, the elderly population segment led the U.S. house calls market in 2024, as house call services support keeping aging patients out of hospitals, nursing homes, and emergency rooms. The Advance house calls program provides hassle-free and on-site visits where physicians meet and connect with their patients at their selected locations. These medical care services for the elderly allow patients who live a far distance from any hospital or medical office the opportunity to receive regular care.

The patients with chronic conditions segment is projected to experience the fastest CAGR from 2025 to 2034, as house calls provide inclusive social, emotional, and spiritual support. It is less hassled, more private, and offers advanced care. It helps to endure living independently in the home.

By provider type, the independent physician groups segment led the U.S. house calls market in 2024, as it is significant to patients as it offers timely, preventive care, manages patients’ critical and chronic conditions, and strives to avoid hospitalizations. Independent physician groups give a more targeted approach to healthcare than the homogenous approach of a healthcare system. It supports the demands of a progressively complex health care sector.

On the other hand, the home health agencies segment is projected to experience the fastest CAGR from 2025 to 2034, as it helps the patient with basic personal requirements like getting out of bed, bathing, walking, and dressing. In these agencies, major assistants received particular training to assist with more targeted care under the supervision of a nurse. Home health agencies are generally funded by Medicare, state medical assistance, and long-term care insurance.

The northeast U.S. dominated the market, as this region has a fast-growing elderly population, which requires frequent healthcare attention, increasing the demand for house call services. This region is the most densely populated in the U.S., with 320 people per square mile. This makes house calls logistically feasible and economically viable, which contributes to the growth of the market.

For Instance,

The West & South U.S. are estimated to be the fastest-growing regions in the U.S. house calls market, as rising awareness related to healthcare has led to an increase in the demand for house call services. Rising trends of the home-based healthcare ecosystem due to increasing demand for improved medical care services, rising population, and technological innovation, which drives the growth of the market.

In September 2025, Matt Dwyer, President of Exousia Pro, Inc., said, “The telehealth market is experiencing rapid expansion, and this acquisition positions us to be a key player. We project significant month-over-month revenue growth for Exousia Health, with the two large contracts being onboarded over 12 months to ensure a seamless transition for clients."

By Service Type

By Mode of Delivery

By End User

By Provider Type

January 2026

January 2026

January 2026

January 2026