January 2026

The U.S. oncology market size is calculated at US$ 72.79 billion in 2024, grew to US$ 81.34 billion in 2025, and is projected to reach around US$ 211.78 billion by 2034. The market is expanding at a CAGR of 11.75% between 2025 and 2034.

Primarily, the US is facing a huge burden of diverse cancer cases, with widespread demand for advanced therapies, including targeted therapies and immunotherapies are supporting the expansion of the U.S. oncology market. Also, the market is fostering the demand for radiation, surgical, and supportive care in the increasing cancer instances, particularly breast cancer. At the same time, the market emphasizes the development of personalized treatment, early detection of cancer, and advancements in biomarker testing.

The U.S. oncology market encompasses the research, development, manufacturing, and commercialization of cancer diagnostics, therapeutics, and treatment services aimed at the prevention, detection, and management of various cancer types. Market growth is driven by rising cancer incidence, rapid innovation in precision medicine, adoption of immuno-oncology and cell-based therapies, and increased investment in early detection technologies and personalized treatment models. It includes pharmaceuticals (chemotherapy, immunotherapy, targeted therapy, and hormonal therapy), diagnostics (biomarker and genetic testing), and oncology care services (radiation, surgical, and supportive care).

The respective market is bolstering diverse applications of AI algorithms, such as the use of AI-assisted systems in the analysis of medical imaging, like mammograms, CT, and MRI. Moreover, these solutions assist in the detection of malignancies and classification of cancer subtypes with an accelerated pace and precision. Along with this, various AI models leverage the integration of a patient’s genomics, lab results, and imaging for the development of evidence-based treatment recommendations.

In 2024, the breast cancer segment held nearly 22% share of the market. The segment is primarily driven by an increase in risk factors, including aging and lifestyle, as well as ongoing advancements in personalized and targeted therapies. Recently, the US has received approval for new therapies, especially the triplet combination for PI3K-mutated advanced breast cancer, and breakthroughs in employing cell-free DNA (ctDNA), which further anticipate outcomes. Expanded advantages of 3D mammography (digital breast tomosynthesis) over traditional 2D mammography are also impacting the overall progress.

In 2024, the U.S. was projected to have 310,720 new invasive breast cancer cases in women. In 2025, that figure is estimated to be 316,950 women, plus 2,800 new cases in men.

Whereas the leukemia segment will expand rapidly in the coming era. Primarily, growing advances in targeted therapies, immunotherapies, and combination therapies are supporting the increasing cases of leukemia. In 2024, Revumenib (Revuforj), a first-in-class menin inhibitor, was approved for adults and children (aged 1+) with advanced acute myeloid leukemia (AML) and acute lymphocytic leukemia (ALL). However, nearly 22,010 people were estimated to be diagnosed with acute myeloid leukemia (AML) in the U.S. in 2025. (Source- American Cancer Society)

In 2024, there were an estimated 62,770 new leukemia cases in the U.S., increasing to a projected 66,890 in 2025. These diagnoses represent approximately 3% of all new cancer cases each year. The incidence rate for leukemia is also rising among adults.

The targeted therapy segment dominated with approximately 28% share of the market in 2024. Ongoing developments in genomic profiling and precision medicine, and the exploration of novel, more efficient therapies with fewer side effects, are bolstering the segmental growth. Recently, the FDA has approved new drugs, especially zongertinib and dordaviprone, and enhanced the use of therapies for specific genetic mutations like KRAS G12C and EGFR. The US market is focusing on antibody-drug conjugates (ADCs), which further optimize outcomes and drug tolerability.

On the other hand, the immunotherapy segment is estimated to expand at a rapid CAGR. The US is emphasizing advances in checkpoint inhibitors, and CAR-T cell therapies are impacting the immunotherapy segment. Alongside, the market is aiming at the progression of biomarkers to estimate which patients will respond to immunotherapy, also researchers are widely putting efforts into gene expression, the tumor microenvironment (like tertiary lymphoid structures), and the role of HLA molecules.

In 2024, the monoclonal antibodies (mAbs) segment captured approximately 30% share of the U.S. oncology market. Expanded awareness and early detection of cancer are driving the development of novel treatments, and the increasing pipeline of biosimilar mAbs is propelling the comprehensive expansion. In this era, the FDA has approved Linvoseltamab (Lynozyfic) for adults with relapsed or refractory multiple myeloma, a BCMA-directed CD3 T-cell engager.

In the coming era, the CAR-T cell & gene therapies segment will witness the fastest growth. A rise in hematologic malignancies like leukemia and lymphoma cases is fueling the demand for these therapies in the US. The latest innovations include the FDA's investigation into secondary T-cell cancers, the approval of new therapies for solid tumors and other concerns, and breakthroughs in "in vivo" approaches and next-generation CAR-T cells. Involvement of genetic editing tools, particularly CRISPR, is increasingly employed to leverage more stable and potent next-generation CAR-T cells.

In 2024, the hospitals & cancer specialty centers segment led with nearly 48% revenue share of the U.S. oncology market. The rising requirement for efficient, affordable care, enhanced patient outcomes through specialized technologies, particularly Oncology Information Systems (OIS), and a robust pipeline of novel drugs from leading pharmaceutical companies. Consistent progress in tailored medicine through genomic technologies, such as the OncoSET program at Northwestern Memorial Hospital, and groundbreaking patient support systems, including the AI-enabled voice assistant platform, Aiva, are being piloted at Cedars-Sinai Medical Center.

The academic & research institutions segment will expand rapidly. Nowadays, MD Anderson Cancer Center, Memorial Sloan Kettering, and Harvard University are widely involved in the innovative developments of precision oncology, immunotherapy, and cancer screening. Recently, Stanford Medicine conducted its first patient with Tecelra, an FDA-approved TCR therapy for metastatic synovial sarcoma. In this era, the Harvard Medical School and its affiliates, Dana-Farber Cancer Institute and Mass General Brigham, are major centers for oncology research and training.

In 2024, the hospital pharmacies segment dominated with nearly 41% share of the market. A prominent driver is the rising complexity of cancer treatments and the requirement for coordinated, specialized patient care. These pharmacies are integral members of the oncology care team, working alongside oncologists, nurses, and other healthcare professionals to develop customized treatment plans and improve drug therapy.

The specialty pharmacies segment is expected to expand rapidly in the near future. These pharmacies are increasingly providing patient support services, including education, adherence programs, and real-time care coordination, resulting in better treatment outcomes. They have the potential to navigate a complex reimbursement landscape, particularly for expensive oral medications and injectable biologics, which require extensive coordination between providers and payers.

By capturing approximately 34% share, the West region led the market in 2024. Mainly, California is playing a major role in various and groundbreaking oncology clinical trial designs. The region has conducted a 67% rise in oncology trials over the past 20 years, with a 169% enhance in rare disease oncology trials during the same period. In 2024, the Clinical Trials in Oncology West Coast 2024 conference explored patient-centricity in trial design, resulting in increased patient enrollment and engagement rates in West Coast states compared to national averages.

The South region is expected to grow rapidly during the forecast period. Currently, this region is fostering crucial research advances, accelerated access to clinical trials, and the inauguration of new advanced treatment facilities. Also, researchers are exploring an experimental vaccine, ELI-002, which trains T cells to target specific gene mutations, critically delaying relapse in high-risk pancreatic and colorectal cancers. The University of Texas MD Anderson Cancer Center is developing innovative clinical trials for new drug types, such as mRNA-encoded antibodies, bispecific antibodies, and KIF18A inhibitors, for diverse cancers.

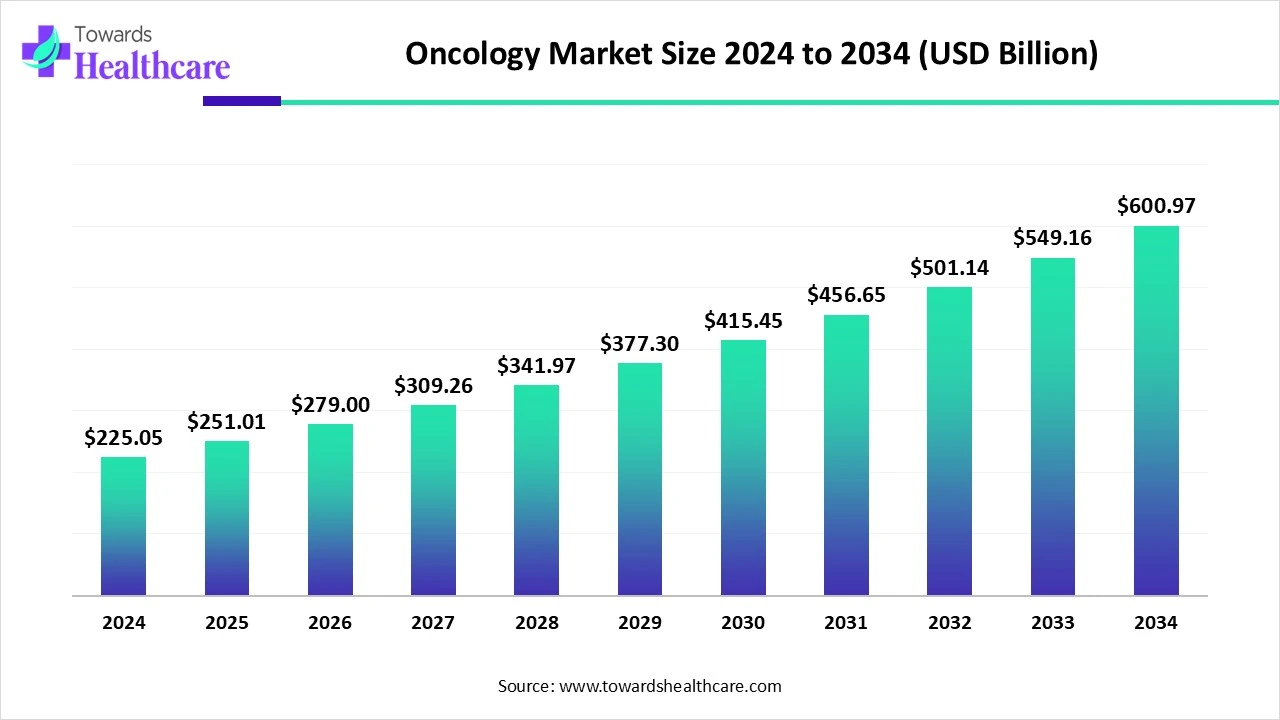

The global oncology market is valued at US$ 225.05 billion in 2024, expected to grow to US$ 251.01 billion in 2025, and projected to reach approximately US$ 600.97 billion by 2034. This growth represents a compound annual growth rate (CAGR) of 11.54% from 2025 to 2034.

Primarily, this encompasses a research-intensive phase that emphasizes the detection of and validating potential targets and compounds to treat cancer.

Key Players: Pfizer, Merck, Bristol Myers Squibb, AstraZeneca, etc.

The U.S. oncology market fosters safety, dosage studies, with the evaluation of efficiency and other crucial adverse effects.

Key Players: Matthew Galsky, UCSF Benioff Children's Hospital, Oakland, etc.

It mainly comprises medical treatments, such as surgery and chemotherapy, access to clinical trials, and supportive care services for physical and emotional needs, like symptom management, financial assistance, and emotional support through organizations.

Key Players: Daiichi-Sankyo & AstraZeneca (Enhertu4U), Genentech, etc.

By Cancer Type

By Therapy Type

By Modality/Drug Class

By End User

By Distribution Channel

By Region (U.S.)

January 2026

January 2026

January 2026

January 2026