January 2026

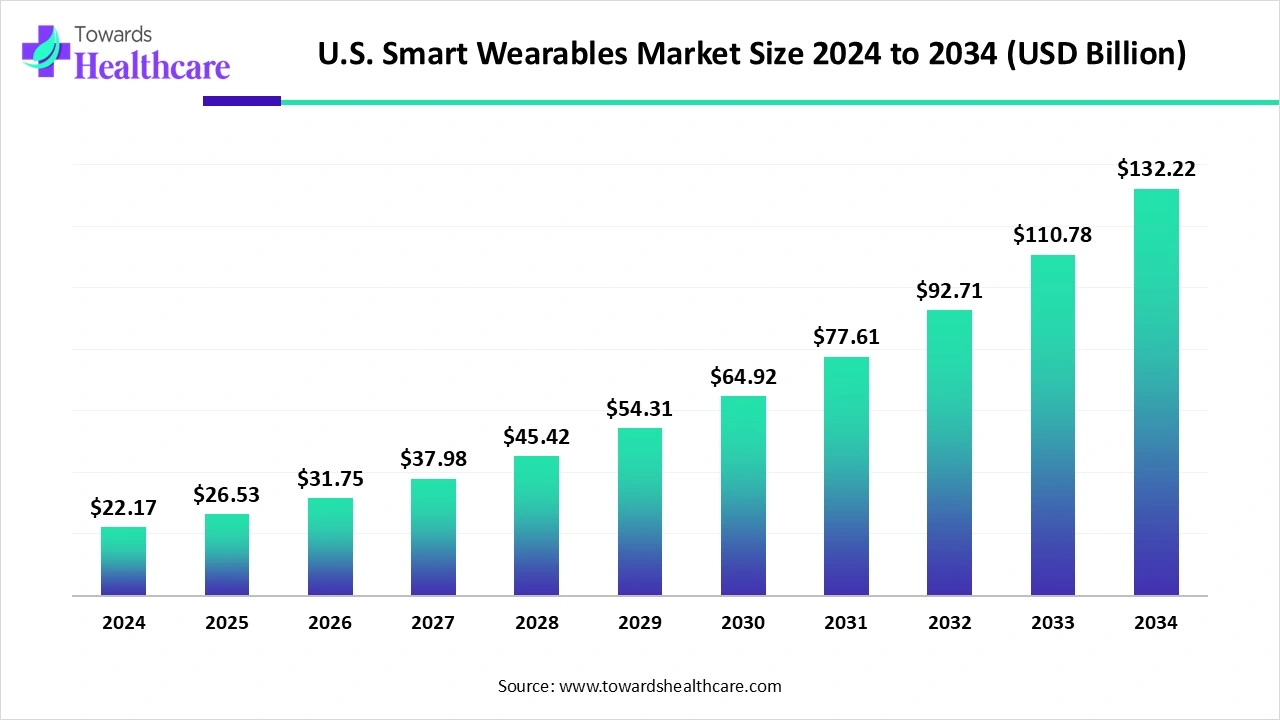

The U.S. smart wearables market size is estimated at US$ 22.17 billion in 2024, is projected to grow to US$ 26.53 billion in 2025, and is expected to reach around US$ 132.22 billion by 2034. The market is projected to expand at a CAGR of 19.72% between 2025 and 2034.

The U.S. smart wearables Market is expanding due to around 50% of US internet households recently owning and actively using wearable devices. Healthcare wearables assist in promoting health, minimizing challenges for disease, and enhancing early diagnosis, and patients spend less on visiting doctors. Increasing regulatory standards and sustainability goals are also driving the adoption of wearable technology.

| Table | Scope |

| Market Size in 2025 | USD 26.53 Billion |

| Projected Market Size in 2034 | USD 132.22 Billion |

| CAGR (2025 - 2034) | 19.72% |

| Market Segmentation | By Product Type, By Application, By Connectivity, By Distribution Channel, By End User |

| Top Key Players | Apple Inc., Fitbit (Google LLC), Samsung Electronics, Garmin Ltd., Huawei Technologies (U.S. market presence via imports), Fossil Group, Inc., Withings, Suunto, Omron Healthcare, Bose Corporation, Amazfit (Huami Corporation), WHOOP, Polar Electro, Michael Kors (WearOS-based), Mobvoi (TicWatch), Valencell Inc., BioBeat Technologies, Verily Life Sciences (Alphabet), Abbott, Masimo Corporation |

The U.S. smart wearables market encompasses a wide range of connected electronic devices worn on the body, designed to monitor health, fitness, communication, and lifestyle activities. These devices include smartwatches, fitness bands, smart glasses, hearables, and smart clothing. Their popularity is driven by increasing health awareness, the rise of chronic disease management, integration of AI/IoT technologies, and growing demand for remote monitoring. Enhanced features such as continuous heart rate monitoring, ECG tracking, sleep pattern analysis, and connectivity with smartphones and healthcare platforms are making wearables an essential part of preventive healthcare and personal wellness.

Increasing programs of healthcare wearables because of wearable technology spearheading an innovative transition, predominantly altering strategy to effective medical care and ushering in a novel era of active health management.

For instance,

Growing launch of novel healthcare wearables to monitor patients' health and assist with diagnosis, therefore allowing individuals to contribute to their health and improve greater control of their lives, which drives the growth of the market.

For Instance,

Integration of AI in the U.S. smart wearables drives the growth of the market, as the incorporation of AI-powered technology is transforming the accuracy and efficacy of wearable sensors by detecting and modifying errors in the collected information. AI-driven algorithms are used to analyse the huge amount of data collected by wearable devices, allowing healthcare professionals to detect patterns, predict health results, and make well-informed decisions related to patient care. AI algorithms analyze huge amounts of data collected from wearables, offering insights into user health and behavior. AI-powered voice assistants make communications with wearables seamless and hands-free. This technology plays a significant role in mental health monitoring, providing insights and support. Revolutions in battery technology enable wearables to last longer, lowering the requirement for frequent charging.

For Instance,

Increasing Applications of Smart Wearable Technology

Smart wearable technology devices have facilitated the digital monitoring and management of health and fitness metrics. Their popularity is increasing as more people become aware of health and fitness issues. These devices act as personal health guardians, continuously recording vital signs and alerting users to any irregularities. They can also monitor chronic conditions like diabetes, encouraging a proactive approach to health. Additionally, wearables can function as wireless payment methods, allowing users to make quick payments with a tap at checkout. This feature is contributing to the growth of the smart wearables market in the U.S.

Major Limitations of Data Privacy

Data privacy and security are pervasive challenges concerning healthcare wearable technology acceptance and use. Applications of medical care wearable technology range from usability problems to data privacy challenges to expanded health inequities, which limit the growth of the U.S. smart wearables market.

Increasing Advancement in Wearable Technology

Recent advancements in wearable technology have enabled the monitoring of organ surfaces like the skin and eyes, allowing for accurate diagnosis of internal health. Developments in materials and designs of wearable electronics now include electrochemical and electrophysiological sensors tailored to different organ systems. Innovative methods such as ultrasound, electrical impedance tomography, and temporal interference stimulation facilitate monitoring of deep internal organs like the heart, brain, and nervous system. These advancements open new growth opportunities for the U.S. smart wearables market.

By product type, the smartwatches segment led the U.S. smart wearables market, as it provides incessant patient monitoring at low costs and enables the gathering of patient-generated data despite physical separation from healthcare facilities under normal life conditions, providing healthcare providers with insights earlier unattainable or only accessible by patient self-monitoring.

On the other hand, the smart clothing & others segment is projected to experience the fastest CAGR from 2025 to 2034, as it protects from infectious disease, helps sense the state of the wearer's health, and helps prevent, treat, and manage health. Smart clothes presuppose that they have incorporated support to screen muscle activity, heart rate, respiration, and posture. They are useful for the reintegration of patients, as well as for athletes. It provides unceasing biometric data for healthcare use and fitness tracking.

By application, the health & fitness monitoring segment is dominant in the U.S. smart wearables market in 2024, as these tools use sensors to track movement and bodily functions. The information they gather tells and provides information related to health and wellness. Wearable tech, like patches, rings, smartwatches, and smart wearables, supports improving health simply by tracking and monitoring it. Fitness trackers offer real-time feedback and examination of physical activities like heart rate, patterns of sleep, and calorie consumption.

The sports & performance tracking segment is projected to grow at the fastest CAGR from 2025 to 2034, as this permits athletes and trainers to optimize tests, monitor recovery, and prevent injuries by early discovery of fatigue or strain. Athlete monitoring systems are becoming a vital device in exploiting performance while lowering injury risks.

By connectivity, the Bluetooth segment led the U.S. smart wearables market in 2024, as its multi-device support is an important benefit for wearables, enabling them to establish connections with numerous devices simultaneously. This capability is made possible by Bluetooth's ability to proficiently manage many connections in a single network. This enhances the adaptability and consumer experience of wearables, allowing them to seamlessly integrate with different aspects of a consumer's digital life while preserving robust and consistent connections with every connected device.

The cellular segment is projected to experience the fastest CAGR from 2025 to 2034, as cellular technology, a real game-changer in the wearable tech scope. It is called LTE or 4G watches, which are still an evolving product. LTE stands for long-term evolution; it’s a type of rapid-speed cellular data. Cellular connectivity offers a precise location and mapping solution, as well as a backup means of contact if the phone runs out of battery-operated or breaks.

By distribution channel, the direct-to-consumer brand stores segment led the U.S. smart wearables market in 2024, as this gives organizations complete control over their brand image, allowing direct consumer collaboration for a reliable brand experience. With D2C, brands simply scale globally because there is no requirement to spend in physical stores in each new location. D2C offers the autonomy desirable to make a unique brand narrative and implement precise brand values in all consumer touchpoints.

On the other hand, the online retail/e-commerce segment is projected to experience the fastest CAGR from 2025 to 2034, as online retail channels evolve as an important distribution channel for smart wearables. E-commerce platforms enable customer to purchase smart wearables from the comfort of their homes, providing simple access and saving time.

By end user, the individual consumers segment led the U.S. smart wearables market in 2024, as smart wearable expertise devices enhance healthcare results while reducing the expenses of treatment. Data is collected and reported digitally, removing geographical challenges and itinerant inconveniences from in-person appointments. Modified health coaching has developed a realism as medical care wearables help telehealth services and remote patient monitoring.

On the other hand, the healthcare providers segment is projected to experience the fastest CAGR from 2025 to 2034, as wearable technology provides extraordinary benefits by using historical data, consumer behaviour, and healthcare histories as guides. Wearable expertise empowers medical care to keep an eye on health metrics. This is particularly significant for chronic diseases when every elusive variation signals disease exacerbation.

The Western U.S. was dominant in the U.S. smart wearables market, as many people are progressively comfortable with advanced health tech devices. Around 35% of U.S. adults currently use wearable healthcare devices, and 40% people use health apps. The United States' strong manufacturing base, such as healthcare, IT, and automotive are rapid adopter of smart variable technologies. The increasing digital revolution in medical care in the United States, driven by federal government regulations and economic incentives. The presence of well-developed healthcare infrastructure, such as cloud, 5 G, and edge computing, supports the easy adoption of smart variables, which causes the growth of the market.

For Instance,

The Southern U.S. is expected to be the fastest-growing region in the U.S. smart wearables market as increasing government support and approval of novel devices drive the growth of the market. For instance, the Centers for Medicare & Medicaid Services (CMS) provides major requirements for Medicare patients. Growing adoption of novel technologies containing wearable devices plays a significant role in offering real-time data to objectively screen patients at home, which also contributes to the growth of the market.

For Instance,

R&D of smart wearable involves many steps, including cell device discovery, which begin with laboratory, preclinical research in this process, devices undergo laboratory and animal testing, pathway to approval in which particular device tested on patients to ensure they are safe and effective, and FDA post-market safety monitoring in which FDA monitors device safety once products are obtainable for use by the people.

Key Players: Medtronic, Johnson & Johnson, Abbott Laboratories, Siemens Healthineers, and GE Healthcare

Distribution of smart wearables involves managing logistics, government compliance, and the supply chain of medical tools. It also includes sourcing products from the manufacturers and importers, who confirm their quality and adherence to government norms.

Key Players: Medtronic and Johnson & Johnson

Smart wearables are applied in home medical care, required to be suitable for the patients who use them and for the environments in which they are used.

Key Players: Medtronic, Johnson & Johnson, Abbott, Siemens Healthineers, GE Healthcare, and Stryker

In August 2025, Kalvie Legat, CEO of Vitalist Inc., stated, “Master Distribution Agreement with Solutions 2 GO Inc. represents a pivotal step in our strategy to rapidly scale Reebok smartwatches' presence across the vast North and Latin American market.”

By Product Type

By Application

By Connectivity

By Distribution Channel

By End User

January 2026

January 2026

January 2026

January 2026