February 2026

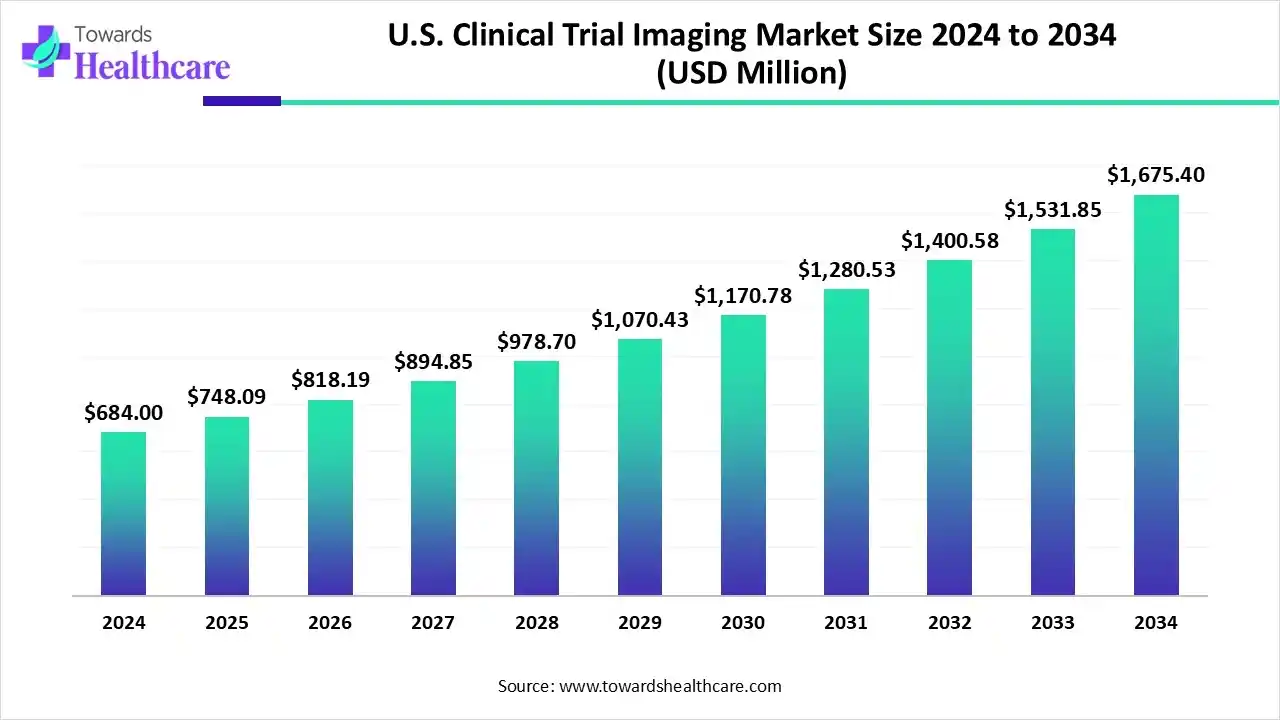

The U.S. clinical trial imaging market size marked US$ 684 million in 2024 and is forecast to experience consistent growth, reaching US$ 748.09 million in 2025 and US$ 1675.4 million by 2034 at a CAGR of 9.37%.

The U.S. clinical trial imaging market is experiencing significant growth driven by the increasing number of clinical studies, rising investment in pharmaceutical and biotechnology research, and the widespread adoption of advanced imaging modalities. The growing use of imaging biomarkers, combined with regulatory support for quantitative imaging endpoints, is enhancing trial efficiency and accuracy. Additionally, the integration of AI-driven image analysis, centralized imaging services, and precision medicine approaches is further strengthening the market, making the U.S. a global leader in clinical trial imaging innovation.

| Table | Scope |

| Market Size in 2025 | USD 748.09 Million |

| Projected Market Size in 2034 | USD 1675.4 Million |

| CAGR (2025 - 2034) | 9.37% |

| Market Segmentation | By Modality, By Therapeutic Area, By Technology/Service Type, By End User |

| Top Key Players | ICON plc, Parexel International, Medpace Holdings, BioTelemetry, Radiant Sage, Bioclinica, PAREXEL Informatics, Invicro LLC, WorldCare Clinical, IXICO plc, Intrinsic Imaging LLC, Clario, Siemens Healthineers Clinical Trials Imaging, GE Healthcare Clinical Research Imaging, Perceptive Informatics, BioTel Research, Prism Clinical Imaging, PAREXEL Medical Imaging, Resonance Health Ltd., Keosys Medical Imaging, ICON plc, Parexel International, Medpace Holdings, BioTelemetry, Radiant Sage, Bioclinica, PAREXEL Informatics, Invicro LLC, WorldCare Clinical, IXICO plc, Intrinsic Imaging LLC, Clario, Siemens Healthineers Clinical Trials Imaging, GE Healthcare Clinical Research Imaging, Perceptive Informatics, BioTel Research, Prism Clinical Imaging, PAREXEL Medical Imaging, Resonance Health Ltd., Keosys Medical Imaging |

The U.S. clinical trial imaging market is driven by a large volume of clinical trials, high research and development (R&D) spending, and technology advancements. Clinical trial imaging refers to the use of medical imaging techniques such as MRI, CT, PET, ultrasound, and X-ray to gather visual evidence in clinical studies. It helps researchers evaluate treatment safety and efficacy by tracking disease progression, measuring biological responses, and providing accurate, standardized data for regulatory and scientific assessment.

Industry Growth Overview:

The market is rapidly growing due to increasing clinical trial activity, adoption of advanced imaging modalities, integration of AI-driven analysis, and rising demand from pharmaceutical, biotechnology, and CRO sectors for precise, efficient, and standardized imaging solutions.

Sustainability Trends:

Sustainability trends in the U.S. clinical trial imaging market include reducing energy consumption in imaging equipment, minimizing radioactive tracer waste, adopting digital and paperless workflows, and implementing centralized imaging platforms to lower redundancies. These initiatives enhance environmental responsibility while improving operational efficiency and data management across clinical trials.

Major Investors:

Major investors in the U.S. clinical trial imaging market include venture capital firms and corporate investors that fund imaging technology providers, AI-driven analysis platforms, and imaging CROs. Notable investors are RA Capital Management, Pfizer Ventures, Bristol-Myers Squibb, and Kaiser Permanente Ventures, which support companies enhancing imaging efficiency, data accuracy, and advanced modalities to support clinical trial innovation and scalability.

AI integration is transforming the market by enabling faster, more accurate, and standardized analysis of imaging data. Machine learning algorithms can automatically detect, segment, and quantify disease biomarkers, reducing human error and inter-reader variability. AI also accelerates image processing, allowing real-time monitoring of patient responses and adaptive trial designs.

Additionally, predictive analytics and pattern recognition enhance patient stratification and endpoint evaluation. By integrating AI with centralized imaging platforms, sponsors can optimize workflows, improve data quality, and reduce trial timelines, ultimately increasing the efficiency, reliability, and scalability of clinical trial imaging operations across diverse therapeutic areas.

| CRO / Service Provider | Headquarters | Key Expertise | Notable Projects (2025) |

| Bioclinica | U.S. | Centralized image analysis | Oncology PET/MRI trials |

| Medpace Imaging Core Lab | U.S. | MRI/CT interpretation | Cardiovascular imaging trials |

| IQVIA Imaging | U.S. | Multi-modality imaging | Neurology clinical studies |

| Modality | Application Area | 2025 Notable Use Cases |

| MRI | Oncology, Neurology, Cardiology | Functional MRI for tumour response assessment |

| PET | Oncology, Neurology | Early detection of SSTR2-positive tumours |

| CT | Oncology, Cardiology | Tumour volume measurement and heart function evaluation |

| Molecular Imaging | Oncology | Radiopharmaceutical tracking of therapeutic response |

Adoption of Advanced Imaging Modalities

The adoption of advanced imaging modalities is significantly driving the growth of the U.S. clinical trial imaging market by enhancing the precision, efficiency, and scalability of clinical studies.

Data Management & Integration Issues & Patient Recruitment & Retention Challenges

The key players operating in the market are facing issues due to patient recruitment & retention challenges and data management & integration issues. Handling large imaging datasets across multiple sites is challenging, and a lack of standardized platforms can cause inconsistencies. Frequent or complex imaging procedures may discourage patient participation, affecting trial timelines.

Rising Clinical Trial Activity

Rising clinical trial activity is a major driver of growth in the U.S. clinical trial imaging market. On June 21, 2025, the Society of Nuclear Medicine and Molecular Imaging (SNMMI) Annual Meeting in New Orleans showcased significant advancements in clinical trial imaging. Perspective Therapeutics presented at the event, highlighting their [^212Pb]Pb-VMT-α-NET dosimetry in patients with advanced SSTR2-positive tumors. This presentation underscored the growing importance of precision imaging in clinical trials, particularly in oncology.

The Magnetic Resonance Imaging (MRI) segment dominates the market with approximately 34% due to its high-resolution soft tissue imaging, non-invasive nature, and versatility across therapeutic areas such as oncology, neurology, and cardiology. Its ability to provide functional, anatomical, and quantitative data, combined with increasing adoption of advanced techniques like fMRI and diffusion imaging, strengthens its preference in trials.

The positron emission tomography (PET) segment is estimated to be the fastest-growing segment in the U.S. clinical trial imaging market due to its ability to provide highly sensitive molecular and functional imaging, track metabolic and biological processes, and support early detection and therapeutic monitoring. Increasing use in oncology, neurology, and cardiology trials further drives its rapid adoption.

The oncology segment dominates the market with approximately 46% due to the high prevalence of cancer, growing investment in oncology research, and the critical need for precise tumor detection, monitoring, and treatment assessment. Advanced imaging techniques, such as MRI, PET, and CT, are extensively used for evaluating therapeutic efficacy in cancer trials.

The neurology segment is anticipated to be the fastest-growing segment in the U.S. clinical trial imaging market due to the increasing prevalence of neurological disorders such as Alzheimer’s, Parkinson’s, and multiple sclerosis. Rising R&D in neurotherapeutics, growing adoption of advanced imaging modalities like functional MRI and PET, and the need for precise monitoring of brain structure and function are driving rapid growth in this segment.

The image analysis & interpretation segment dominates the market with approximately 41% because accurate processing and evaluation of imaging data are critical for trial success. Centralized analysis ensures standardized interpretation, reduces inter-reader variability, and supports regulatory compliance. Advanced software platforms and AI-driven tools enhance quantitative assessment, biomarker extraction, and endpoint evaluation, improving data reliability. Sponsors increasingly rely on expert image interpretation to guide patient stratification, monitor therapeutic responses, and optimize trial outcomes, making this segment a cornerstone of clinical trial imaging operations.

The imaging CRO services segment is estimated to be the fastest-growing segment in the U.S. clinical trial imaging market due to increasing outsourcing of imaging operations by sponsors, demand for specialized expertise, standardized protocols, centralized reading, and advanced data management. These services enhance trial efficiency, ensure regulatory compliance, reduce variability, and accelerate timelines across multi-site clinical studies.

The pharmaceutical & biotechnology companies segment dominates the market with approximately 49% due to their high investment in R&D and extensive clinical trial pipelines across oncology, neurology, and cardiovascular diseases. These companies rely heavily on advanced imaging techniques to monitor treatment efficacy, assess safety, and generate regulatory-compliant data, making them the primary users of imaging services and technologies in clinical trials.

The contract research organizations (CROs) segment is estimated to be the fastest-growing in the U.S. clinical trial imaging market, driven by increasing outsourcing of imaging services by pharmaceutical and biotechnology companies to reduce operational costs and enhance efficiency. CROs offer standardized protocols, centralized reading, and advanced data management, helping sponsors save significant resources. Their rapid adoption supports a more streamlined trial process, contributing to market growth.

The Northeast U.S. dominates the market with approximately 38% due to its high concentration of pharmaceutical and biotechnology companies, renowned research institutions, and advanced healthcare infrastructure. States like Massachusetts and New York host numerous clinical trial sites, imaging centers, and core laboratories, enabling streamlined trial execution. The region also benefits from strong collaborations between academic centers and industry, access to skilled radiologists and imaging specialists, and early adoption of advanced modalities such as MRI and PET, collectively driving the Northeast’s leadership in clinical trial imaging activities.

The West Coast is the fastest-growing region in the U.S. clinical trial imaging market due to the rapid expansion of biotechnology and pharmaceutical companies in California, Washington, and Oregon, coupled with a strong focus on innovative therapies, particularly in oncology, neurology, and rare diseases. The presence of advanced imaging centers, adoption of cutting-edge modalities such as functional MRI, PET, and molecular imaging, and integration of AI-driven image analysis enhance trial efficiency and data quality. Additionally, collaborations between tech-driven imaging startups and research institutions, along with increasing decentralized and patient-centric trial models, are accelerating growth in the region.

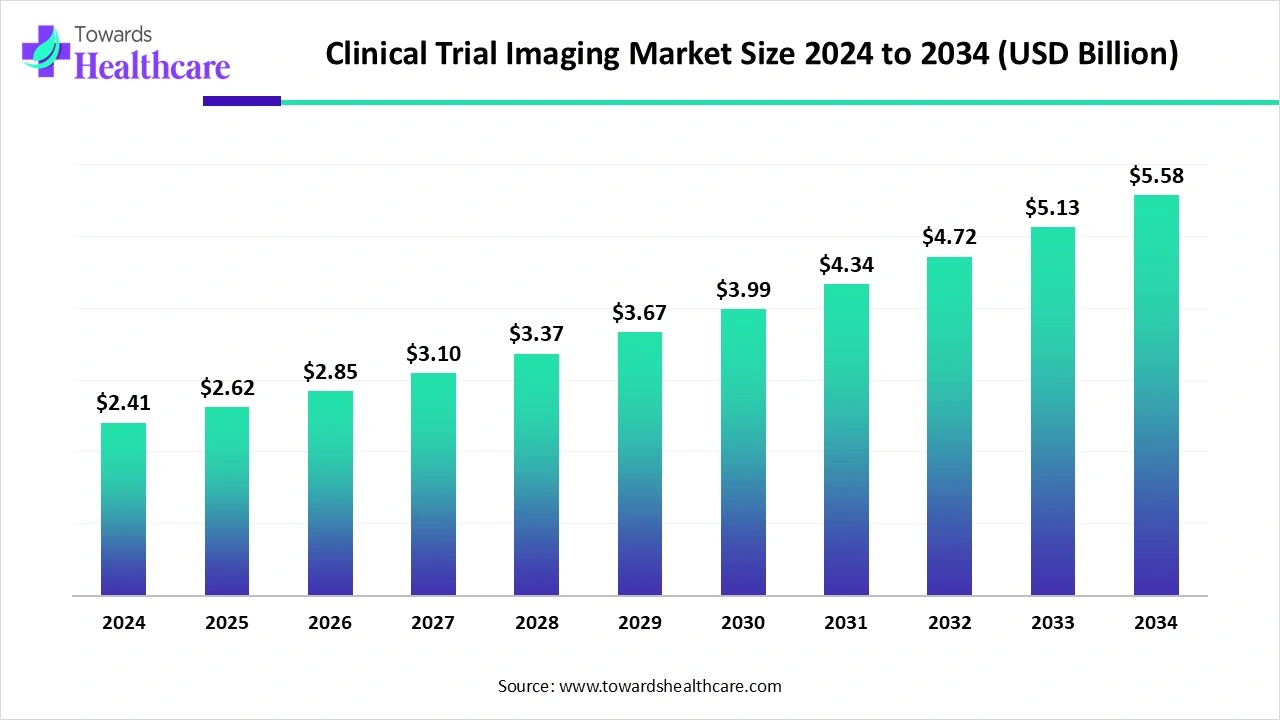

The global clinical trial imaging market was valued at US$ 2.41 billion in 2024 and is projected to grow to US$ 2.62 billion in 2025, reaching US$ 5.58 billion by 2034, expanding at a CAGR of 8.8% during the forecast period.

Organizations Involved:

Organizations Involved:

Organizations Involved:

Clario

Headquarters: Philadelphia, Pennsylvania

Services: Offers comprehensive imaging core lab services, including MRI, CT, PET, and X-ray, with centralized image analysis and quality control for clinical trials across all phases.

WCG Clinical

Headquarters: Princeton, New Jersey

Services: Provides full-service medical imaging core lab services, supporting clinical trials from Phase I through IV, with expertise in various therapeutic areas.

Medpace

Headquarters: Cincinnati, Ohio

Services: Offers an end-to-end suite of global imaging services, including protocol development, image acquisition, analysis, and interpretation across multiple therapeutic areas.

Medical Metrics Inc.

Headquarters: Houston, Texas

Services: An ISO 9001:2015-certified imaging core lab providing centralized image analysis and interpretation services for clinical trials.

ProScan Imaging

Headquarters: Cincinnati, Ohio

Services: Provides imaging core lab services, including MRI and CT imaging, for clinical trials, with a focus on neurological and musculoskeletal imaging.

Radiant Sage

Headquarters: San Diego, California

Services: Offers imaging core lab services, specializing in quantitative imaging analysis for clinical trials, with expertise in various therapeutic areas.

Intrinisic Imaging

Headquarters: San Francisco, California

Services: Provides imaging core lab services, including image acquisition, analysis, and interpretation, with a focus on oncology and neurology clinical trials.

By Modality

By Therapeutic Area

By Technology/Service Type

By End User

February 2026

February 2026

February 2026

February 2026