January 2026

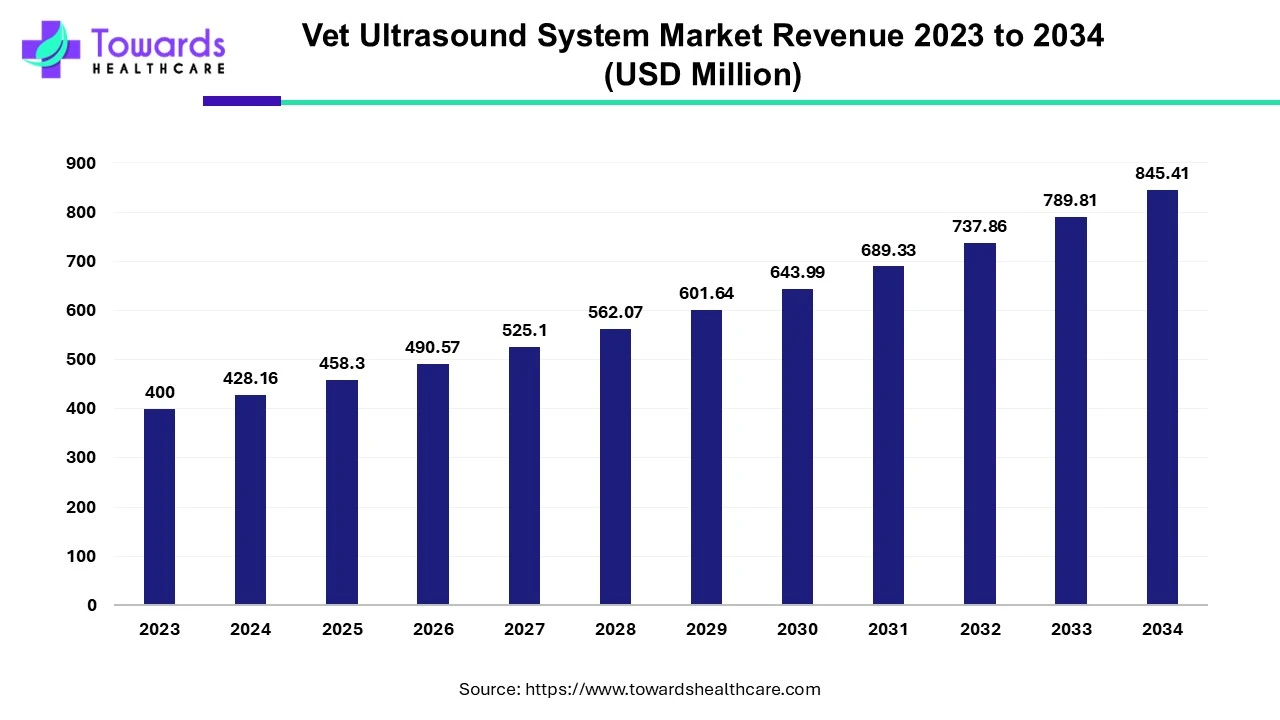

The global vet ultrasound system market was estimated at US$ 400 million in 2023 and is projected to grow to US$ 845.41 million by 2034, rising at a compound annual growth rate (CAGR) of 7.04% from 2024 to 2034. The demand for ultrasound systems is high due to the growing number of NGOs and animal shelters for animal care.

The vet ultrasound system market manufactures and distributes ultrasound devices to hospitals and veterinary clinics. These systems are used for ultrasound imaging during pregnancy or for detecting other conditions in the body. The market is growing due to the growing domestication of animals across the world.

Due to organizations like PETA, people are becoming more aware of animal cruelty and animal care. Governments, NGOs, and private organizations are taking significant steps like investments, awareness programs, and animal healthcare campaigns to ensure that animals (along with street animals) are getting needed care. Also, there has been a rise in the number of animal shelters that provide shelters to street animals, which is further promoting the growth of the market.

The market faces challenges due to a lack of trained professionals. The industry has fewer veterinary professionals compared to the large population of animals. Due to this, people with financial stability are able to afford the services provided by them.

The future of the market is promising, driven by the integration of AI/ML and the growing need for portable systems. AI/ML enhances the efficiency, accuracy, and precision of ultrasound by allowing vets to detect minor changes that are difficult to assess, reducing misdiagnoses and missed diagnoses. They introduce automation, saving time and cost. Portable ultrasound systems can offer numerous benefits, including increased convenience and improved animal care. They mitigate the logistical challenges of scheduling and interpreting scans.

North America led the veterinary ultrasound system market in 2023, driven by a growing cultural shift toward animal welfare and ethical treatment. With rising awareness around animal cruelty, the region has seen a surge in demand for advanced diagnostic technologies that support proactive and compassionate care. A growing movement toward plant-based lifestyles and cruelty-free choices reflects a deeper societal commitment to animal health.

Fuelling this momentum are NGOs, public health initiatives, and forward-thinking private players investing in next-gen veterinary infrastructure. One standout example is Transitions VET, a trailblazer empowering veterinary practice owners to successfully transition their clinics while preserving the culture of care they've built. By supporting seamless ownership changes, Transitions VET ensures that the quality of animal care doesn’t just continue, it thrives.

In the U.S., the Animal and Plant Health Inspection Services (APHIS) are shared by the Animal and Plant Health Inspection Service. To improve the early diagnosis of high-consequence animal illnesses, the organization received $2.3 million in 2023 to fund 14 National Animal Health Laboratory Network (NAHLN) projects. In order to evaluate the health, care, and treatment of animals covered by the AWA, the organization has carried out more than 10,000 AWA site inspections, including more than 900 surprise inspections at research sites.

| Dogs | Cats | |

| Number of households owning | 62M | 37M |

| Average number owned per household | 1.46 | 1.78 |

| Total number in the U.S. | 83,739,829–88,853,254 | 60,217,861– 61,910,686 |

| Veterinary expenditure per household per year | $367 | $253 |

The table shows the number of households that own dogs and cats in the U.S. and veterinary expenditure per house in 2022. This shows that a large population in the U.S. owns animals and spends money on animal care.

The government of Canada also takes necessary steps to care for animals, which significantly promotes the growth of the vet ultrasound system market in Canada.

For instance,

Asia Pacific is expected to grow at the fastest rate during the forecast period. Asia Pacific is the largest region with the largest population, and hence, a large portion of people domesticate and pet animals. The vet ultrasound system market is also growing in the region due to the growing number of veterinary clinics and animal care.

In 2023, China will have more than 120 million pets. While the number of dogs fell by 9% from 2022, they still made up 44% of all pets. Increasing by 6% every year, cats now make up 70% of the total. Of those who keep pets, 34.12 million are dog owners. In the meantime, 36.31 million individuals own cats worldwide.

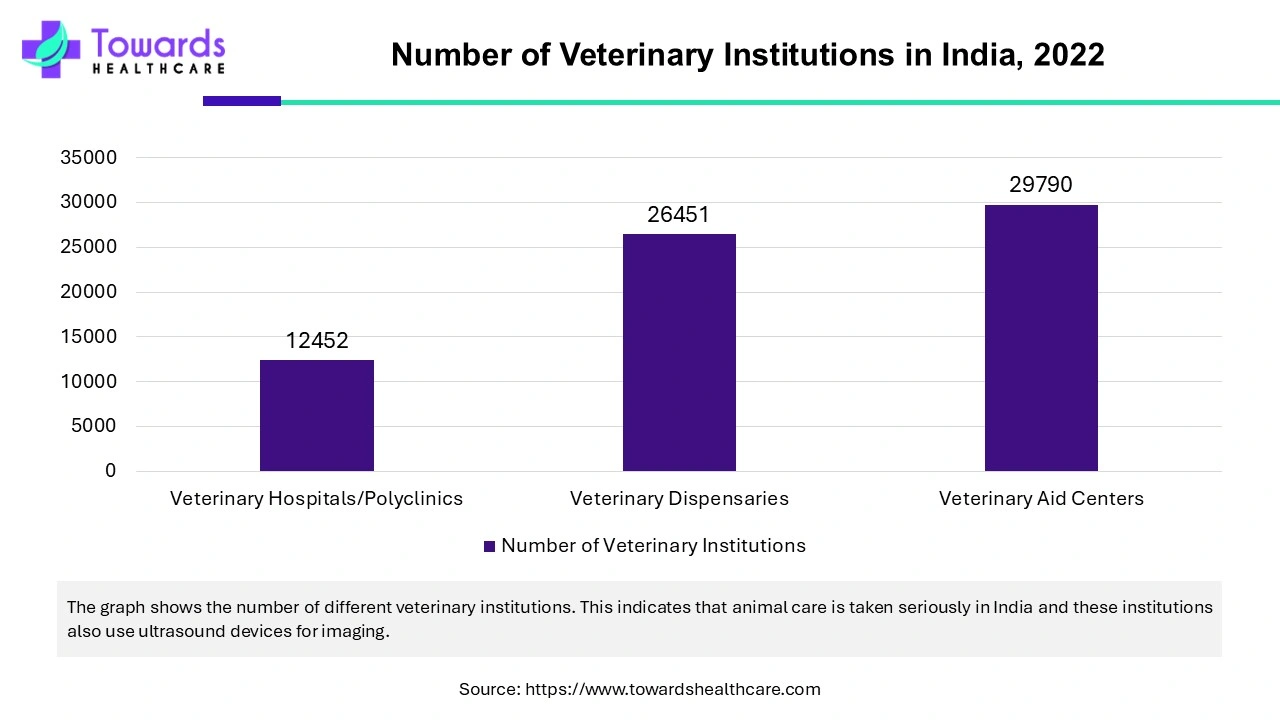

India is also contributing to the growth of the vet ultrasound system market by developing policies and programs for animal care. Apart from this, the country also has a significant number of veterinary clinics and hospitals that use ultrasound devices.

Europe is expected to grow at a notable CAGR in the foreseeable future. The increasing adoption of pets and technological advancements are the major growth factors in Europe. Government organizations launch initiatives to raise awareness among the general public to focus on animal health. The increasing investments enable key players to develop innovative ultrasound systems. The presence of key players also contributes to market growth. Key players, such as Esaote, Praxisdienst, and Kalstein, provide advanced ultrasound systems for veterinarians.

According to the International Trade Association, 45% of German households had a pet and 14% of households had two or more pets, as of 2023. (Source: International Trade Administration) In France, 61% of households own a pet. The Danish Veterinary and Food Administration is responsible for the prevention and control of animal diseases in Denmark. Additionally, Denmark has several pathogen-specific surveillance programmes to determine the occurrence, prevalence, or distribution of diseases or infections. (Source: Danish Veterinary and Food Administration)

By type, the 2D ultrasound segment dominated the market. 2D is the most commonly used ultrasound machine used in healthcare. The dominance of the segment is due to affordability, ease of use, and versatility.

By product, the portable segment held the largest share of the market. This segment dominated bacause portable ultrasound machines have several advantages that make them an ideal choice for vet ultrasounds. Portable devices are small in size, easily accessible, and can be taken to different locations. Portable devices are useful in providing animal care in remote locations, during campaigns, and at point of care.

For instance,

By technology, the digital segment held the dominant share of the market. Digital ultrasounds are popular due to the integration of digital technology that is useful in providing quality images, storage & retrieval of images, and enhanced diagnostic abilities. With the integration of AI, digital technology has improved even more, and human errors have been reduced significantly.

By application, the obstetrics/gynecology segment dominated the market in 2023. This segment is the market leader because ultrasound devices are used mainly in obstetrics and gynecology. Ultrasound ensures that there are no complications during pregnancy.

By animal, the small animals segment held the majority of market share. Small animals include dogs, cats, birds, fishes, rabbits, hamsters, and so on. Small animals are domesticated on a large scale, which is why people actively take steps to ensure that their pets live healthy lives.

By end-user, the veterinary clinics segment dominated the market. These are specialized clinics for animals. People visit veterinary clinics frequently for health check-ups or when their pets are sick. Apart from this, the number of veterinary clinics is growing due to the growing number of people who are domesticating animals.

Jaime Sage, Chief Radiologist and Founder of Sage Veterinary Imaging, commented that their mission is to help find answers fast using their human-quality imaging and work with local vets to deliver effective treatment. He also said that the treatment they offer is comparable to services at the best healthcare facilities for humans, yielding a better outcome for the pet. (Source: DVM 360)

By Type

By Product

By Technology

By Application

By Animal

By End-user

By Region

January 2026

January 2026

December 2025

December 2025