January 2026

The global atopic drugs market is on an upward trajectory, poised to generate substantial revenue growth, potentially climbing into the hundreds of millions over the forecast years from 2025 to 2034. This surge is attributed to evolving consumer preferences and technological advancements reshaping the industry.

The atopic drugs market is witnessing steady growth, driven by the rising incidence of conditions such as atopic dermatitis, asthma, and allergic rhinitis. Increasing adoption of biologics, targeted therapies, and improved diagnostic methods is fueling demand. Growing awareness, favorable healthcare policies, and expanding access to advanced treatments further support market expansion. Additionally, ongoing R&D investments and product innovations by key pharmaceutical players are expected to enhance future market opportunities.

New Product Launches: The introduction of advanced biologics, topical formulations, and oral therapies is increasing treatment options for patients.

Strategic Partnerships and Collaborations: Pharma companies are forming alliances with biotech firms, research institutes, and healthcare providers to accelerate drug discovery and clinical trials.

AI is transforming the market by enhancing drug discovery, accelerating clinical trials, and identifying novel therapeutic targets. It supports personalized treatment approaches through predictive analytics and patient data insights, improving outcomes for atopic conditions. AI-driven diagnostic tools also enable early detection and better disease management. Additionally, AI helps pharmaceutical companies optimize R&D costs, streamline regulatory processes, and bring innovative therapies to market faster, boosting overall market growth.

Rising Prevalence of Atopic Diseases

The increasing prevalence of atopic diseases fuels market growth by expanding the patient base seeking medical intervention. Rising global awareness about the long-term complications of untreated atopic condition drives more complications of untreated atopic conditions drives more people to seek professional care. These trends encourage healthcare providers and pharmaceutical companies to develop and offer innovative therapies. Additionally, the chronic nature of these diseases ensures recurring treatment demand, further sustaining the growth of the atopic drugs market.

For Instance,

High Treatment Cost

The high treatment cost of the atopic drugs market is limiting accessibility for a large segment of patients, especially in countries without comprehensive insurance coverage. Expensive therapies can lead healthcare providers to prefer older, more affordable alternatives, slowing the adoption of newer treatments. Moreover, budget constraints in public health reach to innovative drugs. This financial barrier poses a major challenge to expanding market growth.

Development of Biologics and Targeted Therapies

The growth of biologics and targeted therapies offers a promising opportunity in the atopic drugs market as they enable precision treatment tailored to individual patient profiles. These therapies can reduce individual patient profiles. These therapies can reduce reliance on broad-spectrum drugs, minimize flare-ups, and improve quality of life for patients with chronic to severe atopic conditions. Increasing investment in R&D and regulatory approvals for innovative products and expanding their presence in both developed and emerging markets.

For Instance,

In 2024, the atopic dermatitis/eczema segment dominated the market with a revenue share of 40%, because of the increasing burden of severe and treatment-resistant cases that require specialized therapies. Rising patient demand for safer, non-steroidal, and long-term treatment options contributed to growth.

The allergic rhinitis segment is projected to grow rapidly in the atopic drugs market due to increasing demand for convenient and non-invasive treatments, such as nasal sprays and oral antihistamines. Rising awareness among patients about the impact of untreated allergies on productivity and quality of life is encouraging more people to seek treatment.

The topical corticosteroids & emollients segment led the market with the revenue shares of 20% in 2024 due to their established efficacy in managing symptoms of atopic dermatitis and eczema. These treatments are widely prescribed for reducing inflammation, soothing irritated skin, and preventing flare-ups. Their affordability, easy availability, and proven safety profile for both adults and children contribute to high adoption rates.

The biologics segment is projected to grow rapidly because these therapies address unmet needs in patients with severe or chronic atopic conditions. Increasing investment by pharmaceutical companies in innovative biologics pipelines, coupled with growing awareness among healthcare providers about their long-term benefits, is boosting adoption.

The topical segment dominated the market with the revenue shares of 40% as it allows targeted treatment with minimal systemic exposure, reducing the risk of side effects compared to oral or injectable therapies. Its convenience, quick symptom relief, and versatility for use in mild to moderate cases make it highly preferred by patients and healthcare providers.

The parenteral/injectable segment is projected to grow rapidly because it supports advanced therapies like monoclonal antibodies that cannot be administered orally. Increasing awareness among physicians about the long-term benefits of injectables, such as sustained symptom control and reduced flare-ups, is boosting their adoption.

The mild segment led the market in 2024 as patients with the revenue shares of 50% less severe atopic conditions prefer continuous, preventive care to avoid flare-ups. This includes regular use of moisturizers, non-steroidal topicals, and lifestyle management, which are widely available and affordable. Early diagnosis and increasing self-care awareness among patients further drive treatment adoption in this group.

The severe patient segment is projected to grow rapidly as more patients are being diagnosed with chronic and difficult-to-treat atopic conditions that require long-term management. Growing awareness among healthcare providers about advanced treatment options, along with patient preference for therapies that offer sustained relief, is boosting adoption.

The outpatient clinics/dermatology & allergy specialists segment led the market in 2024, with the revenue shares of 55% because these centers offer convenient access to routine check-ups, early diagnosis, and follow-up care for atopic conditions. Their focus on preventive management, patient education, and combination therapies attracts a large patient base. Moreover, strong referral networks and the availability of both prescription and advanced treatments in these settings drive higher utilization, reinforcing their position as the largest end-user segment in the atopic drugs market.

The hospitals & specialty centers segment is projected to grow rapidly as these settings increasingly serve as centers for complex and chronic atopic condition management. Availability of multidisciplinary care, advanced diagnostic tools, and access to newly approved therapies attracts more patients.

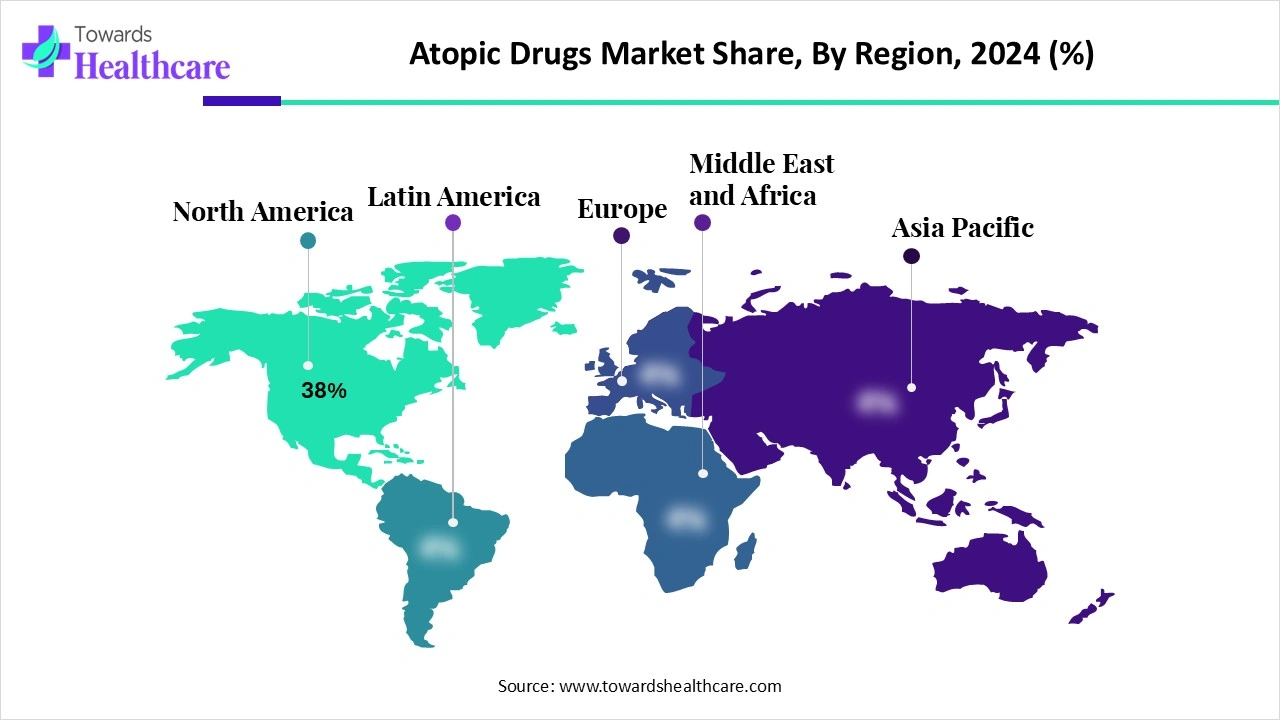

North America held the largest revenue share of approximately 38% in 2024 because of strong patient awareness and preference for advanced treatment options for atopic conditions. High healthcare spending, widespread availability of specialty clinics, and early adoption of innovative therapies such as JAK inhibitors and biologics further boosted market growth.

Additionally, robust investment by pharmaceutical companies in clinical trials and marketing, along with efficient distribution networks, has enhanced accessibility, solidifying North America’s dominant position in the market.

The U.S. market is expanding as more patients seek specialized care for chronic and treatment-resistant atopic conditions. Growing awareness about early intervention, rising healthcare access, and the introduction of novel therapies with improved safety and efficacy are boosting adoption. Additionally, strategic collaborations, product launches, and supportive insurance coverage for advanced treatments are enabling wider patient reach, driving steady growth in the U.S. market.

The market in Canada is growing as more patients seek effective management for chronic skin and respiratory conditions. Expansion of specialty clinics, increased availability of innovative topical and injectable therapies, and rising focus on preventive care are driving adoption.

Moreover, collaborations between pharmaceutical companies and healthcare providers, along with growing investment in patient support programs, are enhancing treatment accessibility and contributing to the steady growth of the Canadian market.

The Asia-Pacific market is projected to grow rapidly as rising disposable incomes and improved access to healthcare make advanced treatments more affordable. Increasing investments by pharmaceutical companies in local R&D, clinical trials, and distribution networks are expanding therapy availability. Additionally, heightened awareness among physicians and patients about effective management options, along with government programs supporting chronic disease care, is accelerating adoption, positioning the region as the fastest-growing market during the forecast period.

Clinical Trial- Ongoing clinical trials are exploring new treatments for atopic dermatitis (AD), a chronic inflammatory skin condition. These studies focus on drugs such as dupilumab, lebrikizumab, and ralokinumab that target specific immune pathways, along with oral small molecules and topical therapies, to assess their safety and effectiveness in patients with moderate-to-severe AD.

Regulatory Approvals- Regulatory bodies, such as the U.S. FDA, approve atopic dermatitis (eczema) drugs only after clinical trials confirm their safety and effectiveness.

Patient Support and Services- Patient support for atopic drugs includes educational resources on atopic dermatitis (AD) management, self-management training programs, and psychological support for the emotional impact of the chronic condition. Pharmaceutical companies offer patient portals for personalized care plans, while support organizations provide access to peer support, resources on managing symptoms like itch, and guidance on navigating treatment options and insurance.

In July 2024, Arcutis Biotherapeutics announced that the U.S. FDA approved its supplemental new drug application for ZORYVE (roflumilast) 0.15% cream to treat mild-to-moderate atopic dermatitis in adults and children aged 6 years and older. ZORYVE is a once-daily, steroid-free cream designed for long-term disease control, providing rapid clearance and significant itch reduction. According to Dr. Lawrence Eichenfield, ZORYVE effectively manages flares, with 9 in 10 patients showing improvement within 4 weeks, offering a safe, steroid-free alternative to traditional treatments.

By Indication

By Drug Class / Therapy Type

By Route / Formulation

By Patient Segment / Severity

By End User / Channel

By Region

January 2026

January 2026

January 2026

January 2026