February 2026

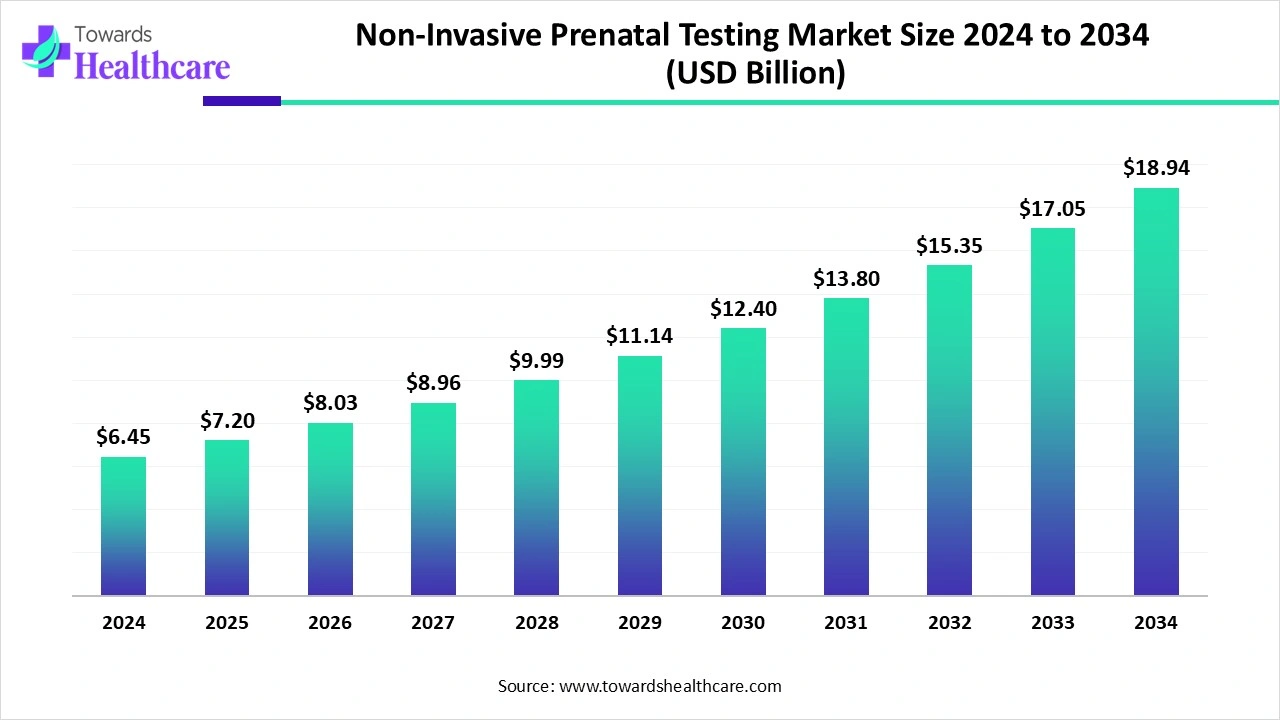

The non-invasive prenatal testing market size is calculated at US$ 6.45 billion in 2024, grew to US$ 7.2 billion in 2025, and is projected to reach around US$ 18.94 billion by 2034. The market is expanding at a CAGR of 11.65% between 2025 and 2034.

The non-invasive prenatal testing market is witnessing significant growth as safer, earlier, and more precise techniques for identifying fetal genetic abnormalities become increasingly important to expectant parents and medical professionals. Traditional diagnostic techniques like amniocentesis have a non-invasive substitute in NIPT, which lowers the risk of complications and yields accurate results as early as the first trimester. Improvements in sequencing technologies, growing awareness of genetic disorders, and the growing use of individualized prenatal care are the main factors propelling the market expansion.

| Table | Scope |

| Market Size in 2025 | USD 7.2 Billion |

| Projected Market Size in 2034 | USD 18.94 Billion |

| CAGR (2025 - 2034) | 11.65% |

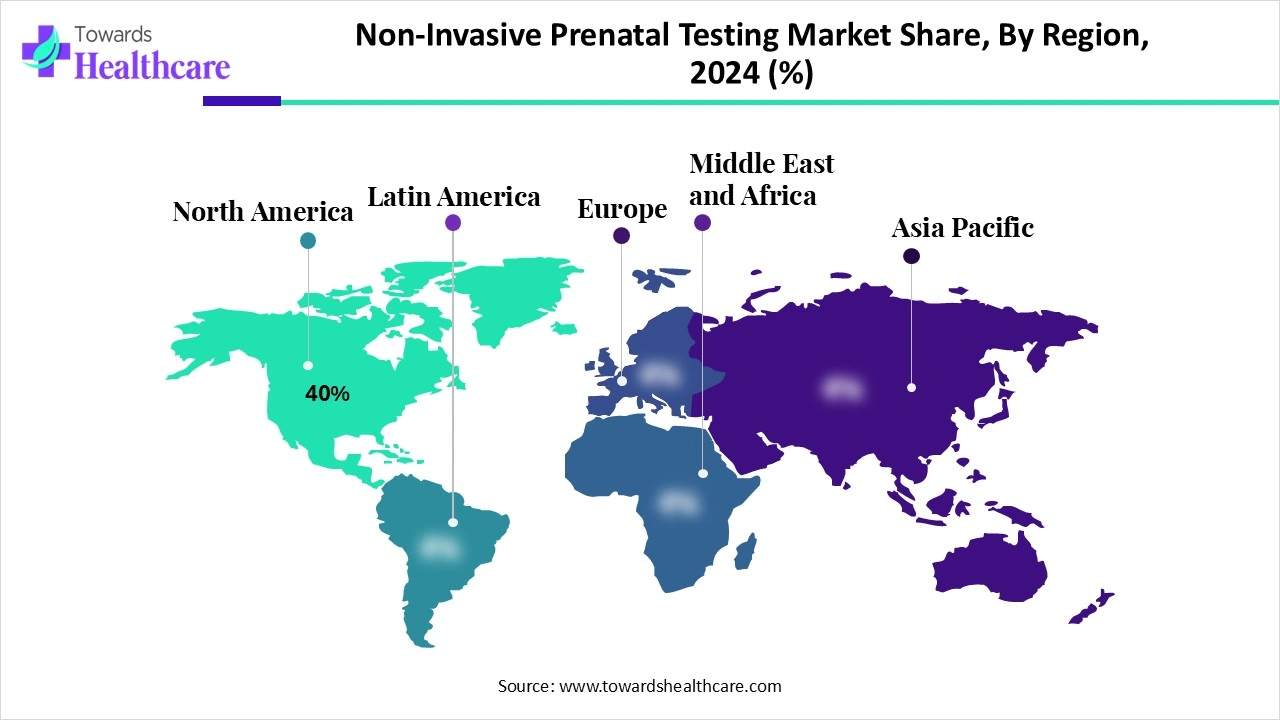

| Leading Region | North America by 40% |

| Market Segmentation | By Test Type, By Technology, By Application, By End User, By Region |

| Top Key Players | Illumina, Inc., Natera, Inc., Laboratory Corporation of America Holdings (LabCorp), Eurofins LifeCodexx GmbH, F. Hoffmann-La Roche Ltd, PerkinElmer Inc., Berry Genomics, BGI Genomics |

The non-invasive prenatal testing (NIPT) includes screening tests that analyze cell-free fetal DNA (cfDNA) circulating in maternal blood to assess the risk of chromosomal abnormalities such as trisomy 21 (Down syndrome), trisomy 18 (Edwards syndrome), trisomy 13 (Patau syndrome), and sex chromosome aneuploidies. NIPT offers a safer alternative to invasive methods like amniocentesis and chorionic villus sampling, with high accuracy, reduced miscarriage risk, and earlier detection (from 9–10 weeks of gestation).

The non-invasive prenatal testing market is expanding rapidly, motivated by the growing need for safer, earlier, and more precise detection of fetal genetic disorders as well as developments in genetic testing technologies. Leading businesses in the industry have introduced cutting-edge testing services and solutions, which have further fueled this growth.

In February 2025, Yourgene Health launched the IONA Care + non-invasive prenatal screening service in the UK, utilizing their IONA Nx NIPT Workflows to deliver safe, fast, and accurate results.

Rising Incidence of Genetic Disorders

The demand for early and precise prenatal screening is being driven by the rising prevalence of chromosomal abnormalities like Patau syndrome, Edwards syndrome, and Down syndrome. Pregnant women and medical professionals are looking for non-invasive, safer ways to identify these conditions early in the pregnancy. The global increase in maternal age, which raises the risk of genetic abnormalities, lends additional credence to this trend.

Possibility of False Positives and Negatives

Non-invasive prenatal testing is not a 100% accurate diagnostic test and can sometimes yield false positive or false negative results despite its high accuracy. Parents may become anxious and require invasive confirmatory testing as a result, which could reduce their trust in the technology. Inaccurate results can also increase healthcare costs due to unnecessary follow-up procedures.

Development of AI-Home and Direct-to-Consumer Testing

Pregnant parents now have timely access, privacy, and convenience thanks to the growth of telemedicine platforms and home-based sample collection kits. By reaching a larger customer base, these solutions can boost penetration in areas with inadequate laboratory infrastructure. The growing adoption of digital health and smartphone penetration makes direct-to-consumer NIPT increasingly feasible.

The chromosome aneuploidy testing segment dominated the market with a revenue of approximately 45%, because more genetic conditions than trisomies are being covered by companies' NIPT offerings, such as microdeletions, sex chromosome aneuploidies, and single-gene disorders. This boosts market competitiveness by enabling providers to offer complete screening solutions. Additionally, providers are launching test panels that can be customized for focused screening.

The expanded carrier screening & whole genome sequencing segment is the fastest growing, driven by the growing need for thorough understandings that go beyond common chromosomal disorders. More parents are looking for more comprehensive genetic data in order to comprehend rare diseases and possible inherited risks. Rapid market expansion is supported by the increased availability of cutting-edge genomic technologies and falling sequencing costs, which have further boosted adoption.

The next-generation sequencing (NGS) segment dominates the non-invasive prenatal testing market with a revenue of approximately 50% because of its unparalleled scalability, precision, and capacity to analyze massive amounts of genetic data at once. Because of its accuracy, high throughput, and affordability, NGS has emerged as the gold standard for identifying chromosomal abnormalities. Its well-established incorporation into clinical workflows guarantees that diagnostics labs and healthcare providers around the globe will continue to choose it as preferred technology.

The rolling circle amplification & emerging methods segment is the fastest-growing market, driven by its potential to provide quicker turnaround times, more efficient workflows, and lower testing costs. These technologies are being embraced. Additionally, they are becoming more and more appealing for increasing access to prenatal genetic screening due to their versatility in point-of-care and decentralized testing environments.

The Down syndrome screening segment dominates the market with a revenue of approximately 50% since trisomy 21 is still the most prevalent and clinically important chromosomal abnormality that is screened for during pregnancy. Down syndrome testing is now the standard initial application of NIPT due to high patient and physician awareness and broad clinical adoption. Its authority is further cemented by its proven accuracy and capacity to reassure expectant parents.

The microdeletion/other genetic abnormalities segment is growing rapidly in the non-invasive prenatal testing market, owing to previously unnoticed rare genetic syndromes that can now be detected thanks to advancements in genomic technologies. Growth in this market is being accelerated by the need for more thorough testing as well as a growing awareness of these conditions among families and clinicians.

The diagnostic laboratories segment dominates the non-invasive prenatal testing market with a revenue of approximately 55% because these cutting-edge genetic tests are still primarily performed there. Large-scale, precise testing is made possible by their established infrastructure, knowledgeable genetic counselors, and access to top-tier sequencing platforms. Preference for lab-based NIPT services is still influenced by patient trust in laboratory-based results and well-established referral networks from hospitals and doctors.

The direct-to-consumer/at-home testing services segment is growing rapidly in the market due to growing consumer demands for speedier results, privacy, and convenience. Parents are able to obtain samples at home, order tests directly, and consult with doctors from a distance thanks to digital health platforms and telemedicine integration. Prenatal testing is being reshaped by this expanding consumer model.

North America dominates the non-invasive prenatal testing market with a revenue of approximately 40% because of the robust healthcare system, the high level of awareness among expectant parents, and the extensive insurance coverage of prenatal genetic testing. Additionally, the area has been leading the way in the early adoption of clinical guidelines that support NIPT as a standard of care and advanced sequencing technologies. North America's dominance in this field is further supported by the established presence of important market players and continuous innovations.

The U.S. non-invasive prenatal testing market is witnessing strong growth, driven by growing awareness among expectant parents, the growing use of cutting-edge genomic technologies, and insurance coverage that is supportive of high-risk pregnancies. Demand is being further increased through direct-to-consumer testing services and diagnostic laboratory expansion. The market is still being supported by consumers' increasing desire for precise and early identification of chromosomal abnormalities.

Asia Pacific is estimated to be the fastest-growing region in the non-invasive prenatal testing market during the forecast period, propelled by growing prenatal health consciousness, rising health care expenditures, and easier access to sophisticated genetic screening. A move toward preventive healthcare and increasing urbanization are driving up demand for NIPT services among expectant parents. The nation's NIPT adoption rate is rising even faster thanks to partnerships with international testing providers and the expansion of private healthcare infrastructure.

The India non-invasive prenatal testing market is expanding rapidly, driven by the growing necessity for early genetic screening, the expansion of private diagnostic labs, and growing awareness of maternal and fetal health. Urban populations can now more easily access tests thanks to the declining costs of advanced sequencing technologies. Adoption is also being fueled by an increase in high-risk pregnancies and a stronger focus on preventive healthcare. The market is expanding even more quickly thanks to alliances between domestic labs and international suppliers.

R&D aims to increase test sensitivity, lower costs, and broaden the range of genetic conditions that can be detected in the non-invasive prenatal testing market. The development of next-generation sequencing, powered data interpretation, and innovations in liquid biopsy to improve diagnostic precision are important areas of focus. Additionally, research is focusing on single-gene disorders and the detection of uncommon microdeletions.

Key Players: Natera, Roche, BGI Genomics, and Invitae.

To guarantee safety, accuracy, and ethical compliance, noninvasive prenatal testing is subject to strict regulatory oversight, authorization from the FDA (U.S.A.), and the commercialization of advanced screening platforms depends on CE (Europe) and CDSCO. Clinical trials are essential for confirming accuracy in a variety of populations, especially when it comes to rare genetic abnormalities and early trimester testing.

Key Players: Natera, Illumina, Roche, Labcorp, and BGI Genomics are actively engaged in regulatory-compliant solutions and expanding trial evidence to support broader clinical adoption.

Patient support in the NIPT market prioritizes ease of access, early detection, and result confidence. To enhance teleconsultations, home sample collection and quick digital reporting are becoming commonplace services. Convenience is also being improved by integration with hospital and clinic systems and educational outreach to raise awareness among expectant parents.

Key Players: Natera, Labcorp, Roche, Quest Diagnostics, and MedGenome.

In May 2025, BillionToOne, Inc. launches an expanded panel for UNITY Fetal Risk Screen. Oguzhan Atay, Ph.D., Co-founder and CEO of BillionToOne, said: “By expanding our products to include a 14-gene offering that includes these prevalent and actionable conditions, we’re providing healthcare providers and expectant parents with vital information that can significantly impact pregnancy management and long-term health outcomes.”

By Test Type

By Technology

By Application

By End User

By Region

February 2026

January 2026

January 2026

January 2026