February 2026

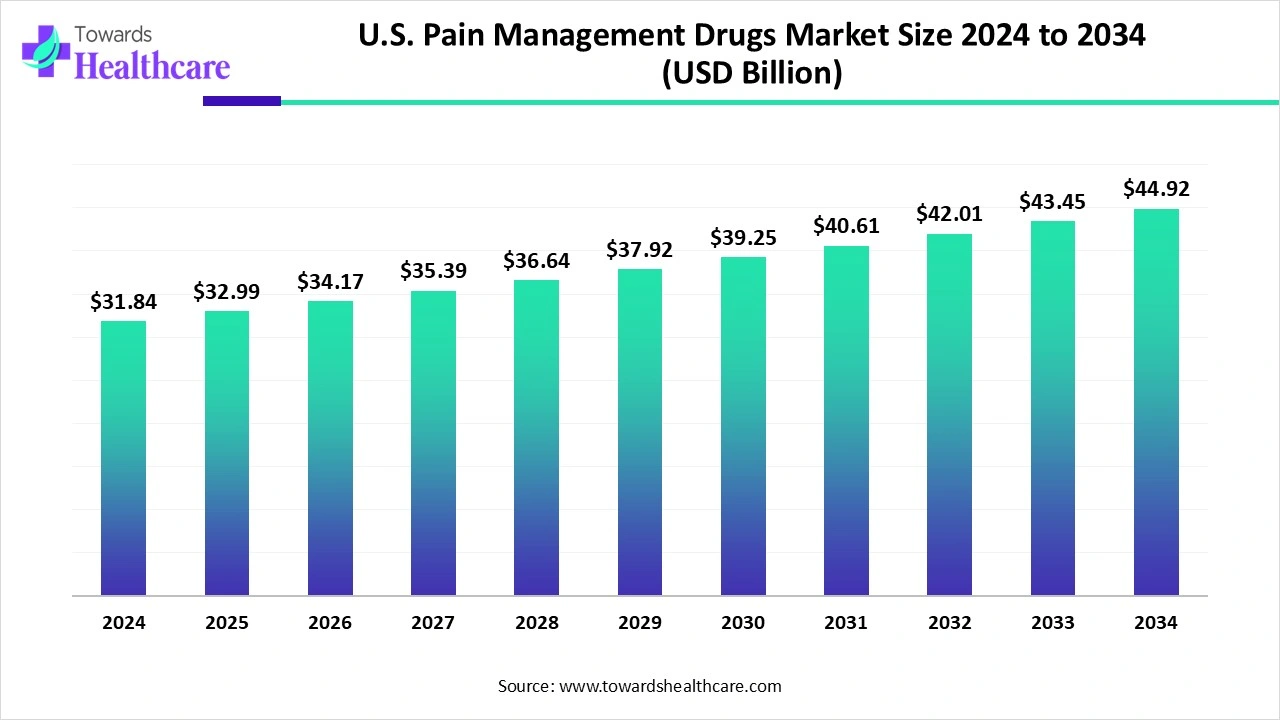

The U.S. pain management drugs market size is calculated at US$ 31.84 billion in 2024, grew to US$ 32.99 billion in 2025, and is projected to reach around US$ 44.92 billion by 2034. The market is expanding at a CAGR of 3.64% between 2025 and 2034.

Growth in the prevalence of pain-related diseases and improvements in pharmaceutical research and development are the main drivers of the U.S. pain management drugs market. The market for painkillers is driven by the increase in the prevalence of chronic illnesses such cancer, heart disease, stroke, and type II diabetes. Furthermore, developments in pharmaceutical research have contributed to the expansion of the industry. Improved patient comfort, safety, and efficacy are provided by innovative medication formulations and delivery systems.

| Table | Scope |

| Market Size in 2025 | USD 32.99 Billion |

| Projected Market Size in 2034 | USD 44.92 Billion |

| CAGR (2025 - 2034) | 3.64% |

| Market Segmentation | By Drug Class, By Indication, By Route of Administration, By Distribution Channel, By End-User |

| Top Key Players | AbbVie Inc., Amgen Inc., AstraZeneca, Bayer AG, Bristol-Myers Squibb, Endo International plc, GlaxoSmithKline (GSK), Indivior PLC, Johnson & Johnson (Janssen Pharmaceuticals), Mallinckrodt Pharmaceuticals, Novartis AG, Pfizer Inc., Purdue Pharma L.P., Teva Pharmaceutical Industries Ltd., Viatris Inc. |

Pain management drugs refer to the pharmaceutical drugs focused on medications that alleviate or manage acute and chronic pain resulting from conditions such as cancer, musculoskeletal disorders, neuropathic disorders, post-operative recovery, and other chronic illnesses. This U.S. pain management drugs market includes opioids, non-opioids, NSAIDs, anesthetics, antidepressants, anticonvulsants, and other drug classes tailored for different pain indications, distributed through hospitals, retail pharmacies, and online channels across the U.S.

Government support & guidance: The U.S. pain management drugs market is driven by the rising support and actions taken by various government organizations like the FDA, NIG, ACOG, etc. These organizations are developing guidance for the safe usage of pain management drugs. Organizations like the NIH are involved in developing new drugs, which further boosts the growth of the market.

For instance,

These issues can be addressed with the advent of artificial intelligence (AI) in healthcare. The analysis of intricate, multimodal information is made possible by recent developments in artificial intelligence (AI), especially in machine learning (ML) and deep learning (DL) which may improve objective, adaptive, and personalised healthcare management. AI has the ability to completely transform the U.S. pain management drugs market through applied modelling, pain intensity analysis, and real-time pain evaluation.

Rising Chronic Pain

One of the major drivers of the U.S. pain management drugs market is the rising number of patients who deal with chronic pain. Nearly 25% of Americans suffer from chronic pain, a common and complicated ailment marked by ongoing discomfort that lasts longer than three to six months. Chronic pain and opioid use disorders cost the US economy more than $600 billion a year, more than the expenditures of diabetes, heart disease, and cancer combined. More than 20 million people in the US suffer from severe, incapacitating chronic pain, and more than 50 million people fit the criteria for chronic pain syndrome.

Pain Management, Drug Abuse & Addiction

When people have a co-occurring substance use disorder (SUD) or are at risk for one, the ethical and clinical issues around pain treatment are exacerbated. Over the past 20 years, there has been a significant increase in the number of Americans suffering from opioid use disorder (OUD), which has led to an unprecedented number of overdose deaths and nonfatal overdoses. As a result, government agencies restrict or outright prohibit the use of painkillers, which creates problems for the industry.

Drug Formulation Innovation

Due to increased efficacy, compliance, and safety, new methods of drug formulation and distribution are anticipated to significantly expand the U.S. pain management drugs market. More consistent pain management with fewer side effects and a lesser burden of reliance is made possible by innovations including liposomal drug delivery, transdermal patches, sustained-release formulations, and targeted release drug delivery. Additionally, non-opioid analgesic innovations, particularly medication combinations, are developing to address the demand for safer alternatives for chronic pain treatment.

By drug class, the opioids segment held the largest share of the U.S. pain management drugs market in 2024. Doctors prescribe opioids, sometimes known as narcotics, as a treatment for severe or chronic pain. People with persistent headaches and backaches, patients recuperating from surgery or suffering from excruciating pain related to cancer, and adults and children who have been gravely injured in falls, car accidents, or other occurrences, as well as those who have been harmed playing sports, use them.

By drug class, the anticonvulsants segment is estimated to be the fastest-growing in the U.S. pain management drugs market during 2025-2034. Several anticonvulsant medications have been shown to have analgesic effects in experimental pain models in a number of laboratory experiments. Anticonvulsants may also lessen movement-evoked and spontaneous pain, as well as the need for opioids after surgery, according to a number of recent clinical investigations. According to preliminary research, anticonvulsant medications may lessen persistent postsurgical pain, hasten postoperative functional recovery, and ease postoperative anxiety.

By indication, the musculoskeletal disorders segment held the largest share of the U.S. pain management drugs market in 2024. Over 121 million individuals in the U.S. suffer from musculoskeletal disorders, which have the greatest rate of impairment of any illness category. This highlights the need for focused interventions. Musculoskeletal disorders are significantly impacted by ageing, especially when it comes to sarcopenia or muscle loss. Sarcopenia is common in more than half of those over 80.

By indication, the neuropathic disorders segment is estimated to be the fastest-growing in the U.S. pain management drugs market during 2025-2034. The two most prevalent neurodegenerative disorders are Parkinson's and Alzheimer's. Due in significant part to population growth and ageing, the absolute number of DALYs is rising. The majority of medications that relieve nerve pain may only be obtained with a prescription from a physician.

By route of administration, the oral segment held the largest share of the U.S. pain management drugs market in 2024. Simple and noninvasive, oral delivery of analgesics has demonstrated good efficacy in the majority of circumstances, with high patient acceptance and comparable efficacy to intravenous treatment. Moderate to severe postoperative pain has been treated with oral opioids.

By route of administration, the transdermal segment is estimated to be the fastest-growing in the U.S. pain management drugs market during 2025-2034. With a lengthy medication retention period, constant blood concentration, easy dosing and release rate control, minimal side effects, and painless administration, the transdermal route was a promising method with high patient compliance. The FDA has authorised more than 100 transdermal analgesics in the past several decades.

By distribution channel, the retail pharmacies & drug stores segment held the largest share of the U.S. pain management drugs market in 2024. With a third of stores and around a third of prescription income, retail chains are the biggest and most common of the four pharmacy categories. A significant amount of medical supplies and associated services are dispensed by retail pharmacies, which are an essential component of health systems in many nations. Retail pharmacies in high-income nations frequently have contracts with public or private insurance to provide medications to outpatients in the public and private sectors.

By distribution channel, the online pharmacies segment is estimated to be the fastest-growing in the U.S. pain management drugs market during 2025-2034. The most significant advantage of telemedicine and online pharmacy is the much streamlined access to care. These services give patients the ability to acquire prescription drugs and confer with medical professionals from the comfort of their own homes, which is especially beneficial for individuals who live in distant places or have mobility challenges. Additionally, patients who may be ashamed about obtaining therapy for stigmatised disorders may find that internet pharmacies provide more anonymity.

By end-user, the hospitals & clinics segment held the largest share of the U.S. pain management drugs market in 2024. Through multidisciplinary teams, pain management hospitals and clinics provide patients complete, individualised care, enabling them to receive cutting-edge therapies, lifestyle modifications, and psychological support for chronic pain. Comprehensive, individualised treatment regimens, enhanced functioning, less reliance on medications, quicker access to novel therapies, and an overall improvement in quality of life are some of the main benefits.

By end-user, the specialty pain management centers segment is estimated to be the fastest-growing in the U.S. pain management drugs market during 2025-2034. A emphasis on enhancing function and quality of life while reducing dependency on medicine is one of the benefits of speciality pain management centres. Other benefits include access to modern interventional procedures beyond medication and holistic, interdisciplinary treatment with customised programmes.

About 20% of individuals in the U.S. suffer from chronic pain, which is defined as pain that lasts longer than three months. It is the most expensive medical disease in the US, costing about $600 billion a year. 8-10% of the more than 50 million individuals who suffer from chronic pain are thought to have high-impact chronic pain, which is characterised as discomfort that interferes with daily activities or job.

In the U.S., an estimated 80 million individuals are treated for acute pain, defined as pain that lasts for three months or less, each year. An estimated 40 million Americans receive an opioid prescription each year to treat their acute pain.

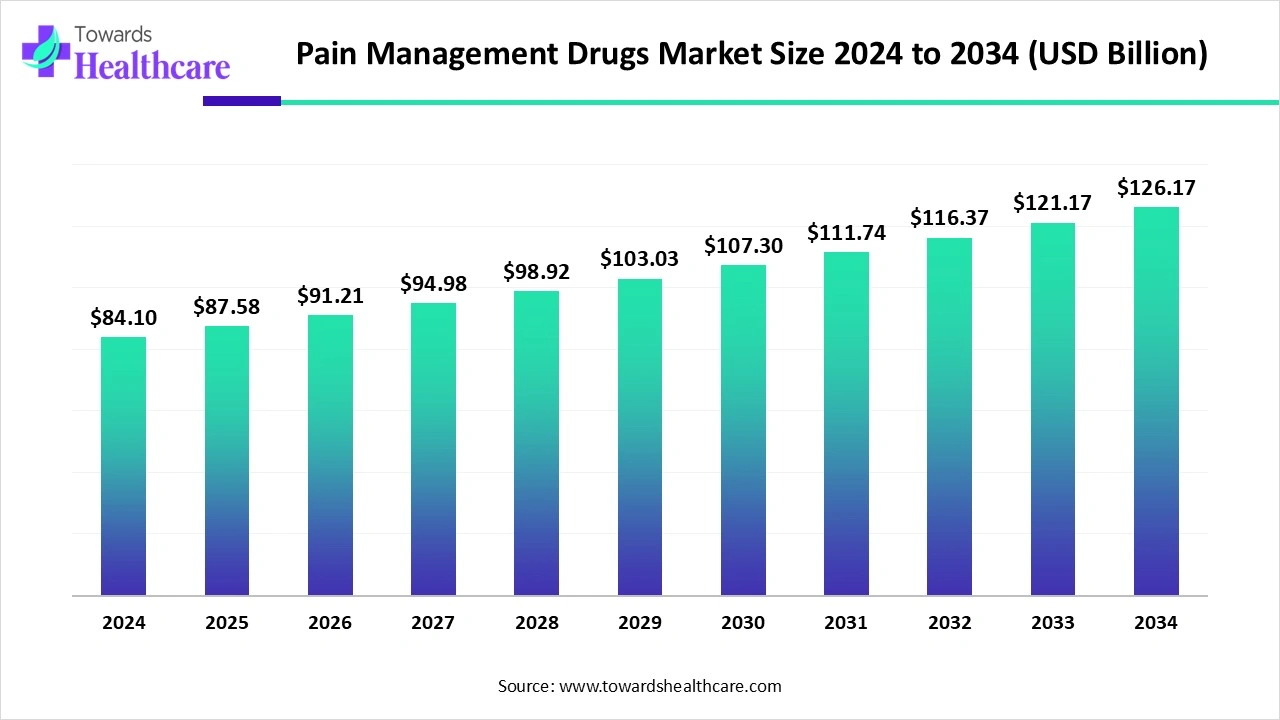

The global pain management drugs market is valued at USD 84.1 billion in 2024, expected to rise to USD 87.58 billion in 2025, and projected to reach around USD 126.17 billion by 2034. This growth reflects a steady CAGR of 4.14% from 2025 to 2034.

Discovery, which identifies a target and possible compounds; preclinical research, which tests the drug in labs and on animals; clinical trials (phase 1, 2, and 3) which test the drug's safety and efficacy in humans; regulatory review, which submits data for approval by agencies such as the FDA; and post-market surveillance, which is continuous safety monitoring after the drug is on the market.

Top Companies Include: Johnson & Johnson, Pfizer, Merck, Novartis, Abbott, Vertex Pharmaceuticals, and Latigo Biotherapeutics

For standardised items like ibuprofen, pain management medications are manufactured through mass production. For some patient needs, compounding pharmacies provide unique, customised formulations, such as mixing chemicals to create a topical cream.

Top Companies Include: Johnson & Johnson, Pfizer, Merck, Novartis, Abbott, Vertex Pharmaceuticals, and Latigo Biotherapeutics

Accurate pain assessment, patient education on risks (such as opioid addiction), access to support services like counselling and Cognitive Behavioural Therapy (CBT), and cooperative care planning to address concerns, side effects, and functional limitations are all essential components of patient support and services.

In April 2024, AtriCure President and CEO Michael Carrel said, I think CryoSPHERE+ is a significant innovation that will improve patient care, enhance outcomes, and allow physicians to perform procedures with greater ease and confidence. With this launch, we want to serve even more people in the future. Since the beginning of our pain management franchise more than five years ago, we have witnessed a tremendous impact on patients' lives.

By Drug Class

By Indication

By Route of Administration

By Distribution Channel

By End-User

February 2026

February 2026

January 2026

January 2026