February 2026

The worldwide AI-powered claim denial management market is experiencing significant expansion, with projections indicating a revenue increase reaching several hundred million dollars by the end of the forecast period, spanning 2025 to 2034. This growth is driven by emerging trends and strong demand across key sectors.

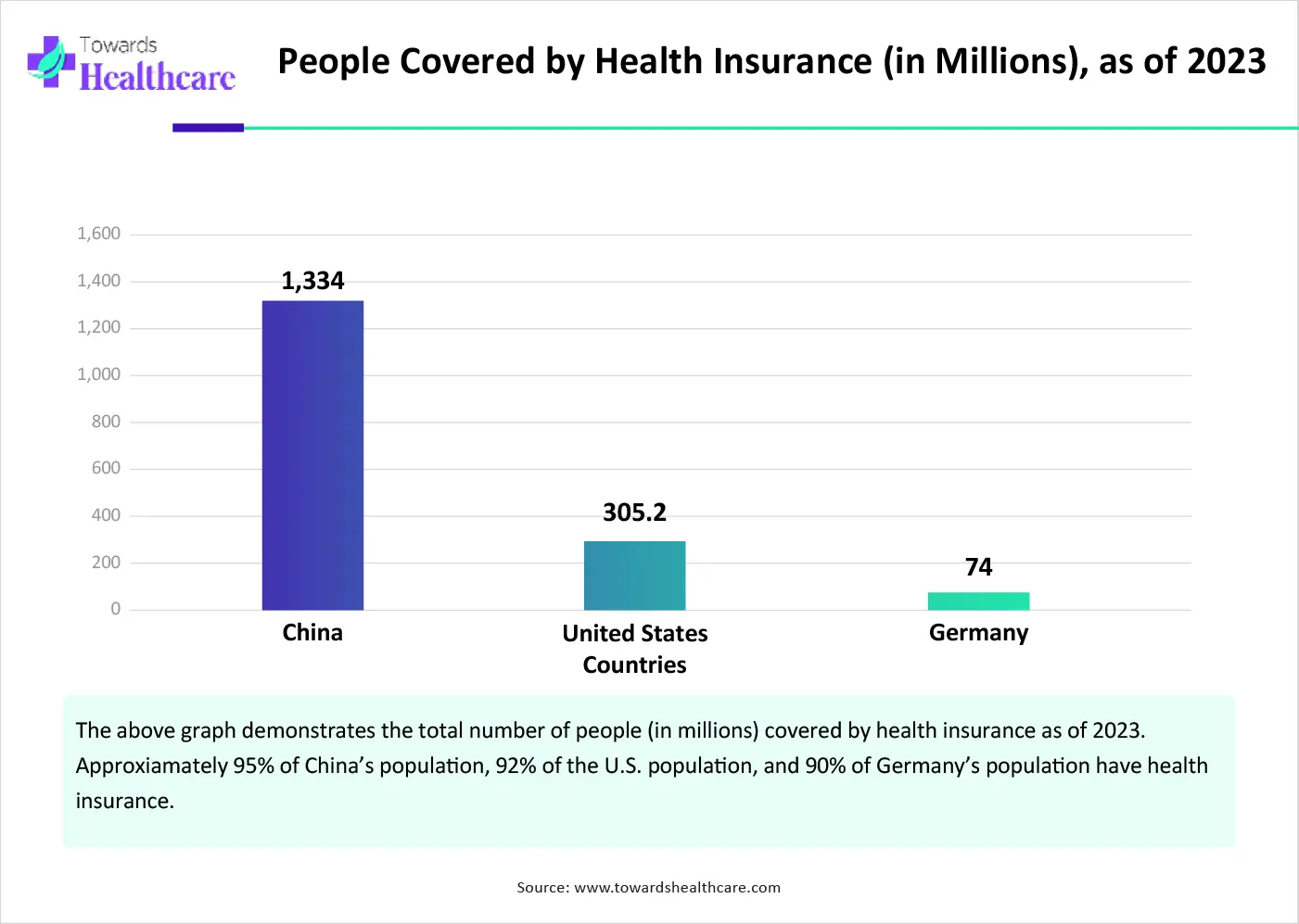

The AI-powered claim denial management market is primarily driven by the increasing claim denials by government and private insurance companies, and the growing number of people with health insurance policies. Most of the insurance companies are adopting AI tools to automate claims processing and reduce manual errors, thereby decreasing claim denials. Several government and private organizations provide funding for adopting AI tools in insurance companies. The growing need for revenue cycle management (RCM) and automation drives the market’s future.

| Metric | Details |

| Market Drivers | Rise in insurance coverage, claim denials, need for automation & RCM |

| Fastest Region | Asia-Pacific expected to grow at the quickest pace |

| Component Growth | Services expected to see the highest growth rate |

| Deployment Growth | On-premises setups projected to rise significantly |

| Key Trend | Investment in AI tools for claim prevention and automation |

| U.S. Insight | 73 million of 392 million claims denied; $57.23B in admin costs (2023) |

AI-powered tools are increasingly being adopted to scrutinize health insurance claims, driving automation and reducing manual errors. Since claim denials lead to financial losses, operational inefficiencies, and disruptions in patient care, it becomes necessary to mitigate and manage these denials. AI can review multiple claims simultaneously and can predict potential issues before submission. It can also aid in preventing claim denials, streamlining processes, and enhancing efficiency.

Numerous factors govern market growth, including the increasing potential of claim denials and manual errors. People are becoming aware of taking health insurance policies, encouraging insurers to adopt AI tools to manage vast amounts of data. Technological advancements drive the latest innovations in claim denial management. Government organizations provide funding and launch initiatives to support the adoption of advanced technologies in claims processing.

Increasing Health Coverage

The major growth factor of the AI-powered claim denial management market is the increasing health coverage. The rising prevalence of chronic disorders, the growing geriatric population, and the increasing healthcare expenditure pose a significant economic burden on people. This encourages them to take health insurance coverage. According to a World Bank report, 1.5 billion people will be over 65 years old by 2050. Additionally, non-communicable diseases (NCDs) account for 41 million deaths annually. (Source - worldbank.org) Numerous health insurance companies provide customized policies with various tax benefits. They provide access to quality healthcare and offer financial safety.

Lack of Affordability

Novel and innovative AI-powered tools are costly and are unaffordable by several insurance companies in low- and middle-income countries. These countries also find difficulties in accessing these tools, restricting market growth.

What is the Future of the AI-Powered Claim Denial Management Market?

The future of the market is promising, driven by the improvement in denial management workflow and the increasing demand for automated workflow. The rising adoption of electronic health records (EHRs) in healthcare organizations also presents future opportunities for market growth. Roughly 4 in 5 physician offices (78%) and 96% of all non-federal acute care hospitals in the U.S. have adopted EHRs. EHRs can help maintain and capture accurate patient information, reducing the likelihood of denials due to missing or incorrect information. They can aid in the coding and documentation process, ensuring clear communication of the medical necessity of a service to insurance providers.

By component, the software/platform segment held a dominant presence in the market in 2024. This segment dominated because AI-based software performs a variety of functions and provides complete control to healthcare professionals over the software. It maintains transparency of the claims processing workflow, enhancing efficiency and introducing automation. It helps to maintain the privacy of confidential patient medical data and financial data. AI-based software can handle repetitive tasks, analyze data for insights, and adapt to individual needs.

By component, the services segment is expected to grow at the fastest CAGR in the market during the forecast period. Numerous healthcare organizations outsource their claims processing workflows to access advanced technologies. Services provide relevant expertise to assist in analyzing claim denials. Services eliminate the need to adopt complex software and purchase annual subscriptions. The increasing number of healthcare startups and the lack of skilled professionals to operate novel software promote services.

By deployment mode, the cloud-based segment led the global market in 2024. This is due to the increasing use of cloud-based tools and the need to manage large amounts of patient data. Cloud-based tools can be operated by healthcare professionals, healthcare payers, and patients from anywhere and at any time. They eliminate the need for any favorable infrastructure in healthcare organizations. There is also no need to spend time on installation and configuration.

By deployment mode, the on-premises segment is expected to grow with the highest CAGR in the market during the studied years. On-premises AI-based tools for claims denial management provide complete control over the system. They reduce the risk of data leakage and security breaches. On-premises systems keep the data confidential due to in-house servers and IT infrastructure. They offer customization options and potential for lower long-term costs. Healthcare organizations can make customizations based on their requirements to store data more securely and cost-effectively.

By application, the denial tracking & management segment held the largest revenue share of the market in 2024. Denial tracking, workflow management, and reporting outcomes are essential for insurance companies. They are the most critical, complex, and time-consuming aspect of the revenue cycle. Hence, AI-based tools can enhance the efficiency of these processes, enabling healthcare professionals to focus on other crucial tasks related to patient care. AI can track outcomes easily with powerful reporting tools, providing insights into performance and guiding decision-making.

By application, the revenue cycle analytics segment is expected to expand rapidly in the market in the coming years. Claim denials are the primary causes of delayed payments and revenue losses. AI can identify the root cause of claim denials, reduce billing errors, and provide insights to resolve such issues. AI-based predictive analytics can detect financial losses, enabling providers and payers to make proactive decisions. Thus, revenue analytics by AI-based tools empowers businesses to maximize their financial health and maintain regulatory compliance.

By end-user, the hospitals segment contributed the biggest revenue share of the market in 2024. The increasing number of hospital admissions and favorable reimbursement policies in hospitals encourage people to take health insurance coverage. In 2023, more than 34 million people were admitted to hospitals in the U.S. (Source - aha.org). The presence of multidisciplinary expertise and the growing incidence of acute and chronic disorders also encourage patients to prefer hospitals. The availability of favorable infrastructure and suitable capital investment allows hospitals to use AI-powered claim denial management tools.

By end-user, the revenue cycle management (RCM) companies segment is expected to witness the fastest growth in the market over the forecast period. The increasing number of RCM companies and rising market competitiveness augment the segment’s growth. According to Becker’s Hospital Review, there are over 354 RCM solution companies in the healthcare space. AI-powered tools enable companies to streamline their processes and stay ahead in the competitive market.

North America dominated the global market in 2024. The presence of key players, increasing claim denials, and the rising adoption of advanced technologies are the major growth factors of the market in North America. The growing demand for personalized care and increasing hospital admissions contribute to market growth. Favorable reimbursement policies by government and private insurers facilitate the use of AI-powered claim denial management.

In 2023, 73 million of 392 million in-network claims were denied in the U.S. According to a recent survey by Premier, Inc., claims adjudication costs around $25.7 billion to healthcare providers in 2023, an increase of 23% from 2022. Claims adjudication and denials also increased administrative costs to $57.23 billion in 2023. Over $18 billion was wasted arguing over claims that should have been paid at the time of submission. (Source - premierinc.com)

Approximately 30 million Canadians are insured, with 27 million having health coverage and 23 million having life coverage. (Source - Clhia) The Canadian government announced an investment of $200 billion as part of Budget 2024 to support the health and well-being of Canadians. (Source - Canada.ca)

Asia-Pacific is expected to grow at the fastest CAGR in the AI-powered claim denial management market during the forecast period. The increasing number of hospital admissions and the rapidly expanding healthcare sector drive the market. Healthcare organizations and insurance companies need to comply with evolving regulatory standards. Government and private organizations create awareness among the general public to take healthcare coverage.

It is reported that around 70% of hospitals in China have adopted digital record-keeping systems to provide a rich source of structured and unstructured data for AI applications. Out of the 1.3 billion people with basic medical insurance, approximately 371 million people are urban employees, and the remaining 963 million people are rural and non-working urban residents. (Source - English)

The Insurance Regulatory and Development Authority of India (IRDAI) reported that 11% of health insurance claims were denied in FY24, accounting for Rs 26,000 crore. The primary reasons were incorrect documentation or errors in paperwork, non-coverage of pre-existing conditions, and policy lapses or delayed renewals. (Source - cnbctv18)

Europe is expected to be a significantly growing area in the AI-powered claim denial management market in the upcoming years. Several government organizations support the adoption of digital tools in healthcare organizations through initiatives and investments. The rising need to manage revenue losses and streamline claims processing propels the market. The increasing use of AI and EHRs encourages providers and payers to facilitate advanced and personalized services.

The UK government invested £250 million in the NHS AI lab to align with national healthcare priorities, such as reducing wait times and improving diagnostics. In England, 189 hospital trusts use electronic patient records (EPRs), meeting the government’s target. The England government launched “a plan for digital health and social care” to achieve a target of 90% of hospital trusts using EPRs by December 2023 and 100% of trusts using EPRs by 2025. (Source - Pharmaceutical-journal)

Matt Hawkins, CEO of Waystar, commented that generative AI unlocks a new era of productivity and precision, transforming how the industry simplifies claims, appeals, and payment workflows. He also said that the company’s AI-powered software platform enables providers to appeal denied claims with unprecedented efficiency, accuracy, and ease. (Source - pharmexec)

By Component

By Deployment Mode

By Application

By End-User

By Region

February 2026

January 2026

January 2026

December 2025