February 2026

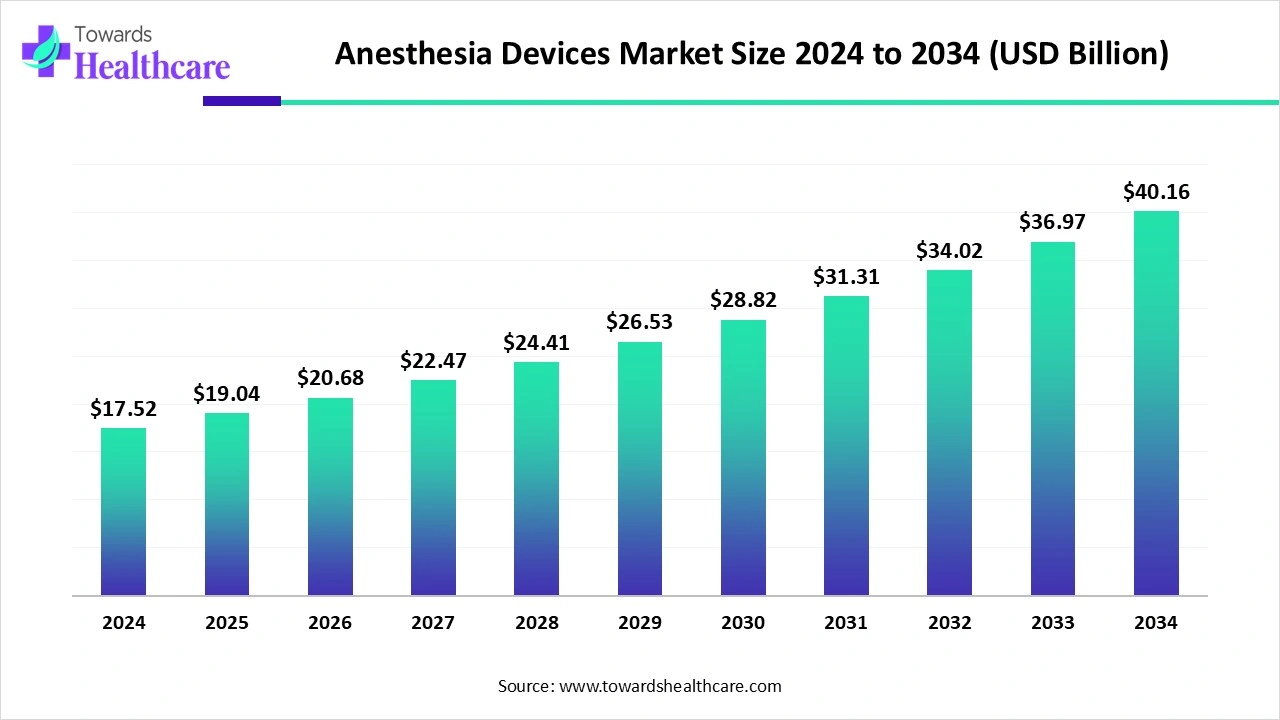

The global anesthesia devices market size is calculated at USD 17.52 billion in 2024, grew to USD 19.04 billion in 2025, and is projected to reach around USD 40.16 billion by 2034. The market is expanding at a CAGR of 8.65% between 2025 and 2034.

The anesthesia devices market is experiencing rapid growth due to the rising prevalence of chronic disorders and the growing need for personalized care. The burgeoning medical device sector, along with increasing investments in research activities, fosters market growth. Prominent players collaborate to access advanced technologies and develop innovative products. Artificial intelligence (AI) introduces automation into anesthesia devices, enhancing their efficiency. The growing demand for environmental sustainability presents future opportunities for market growth.

| Table | Scope |

| Market Size in 2025 | USD 19.04 Billion |

| Projected Market Size in 2034 | USD 40.16 Billion |

| CAGR (2025 - 2034) | 8.65% |

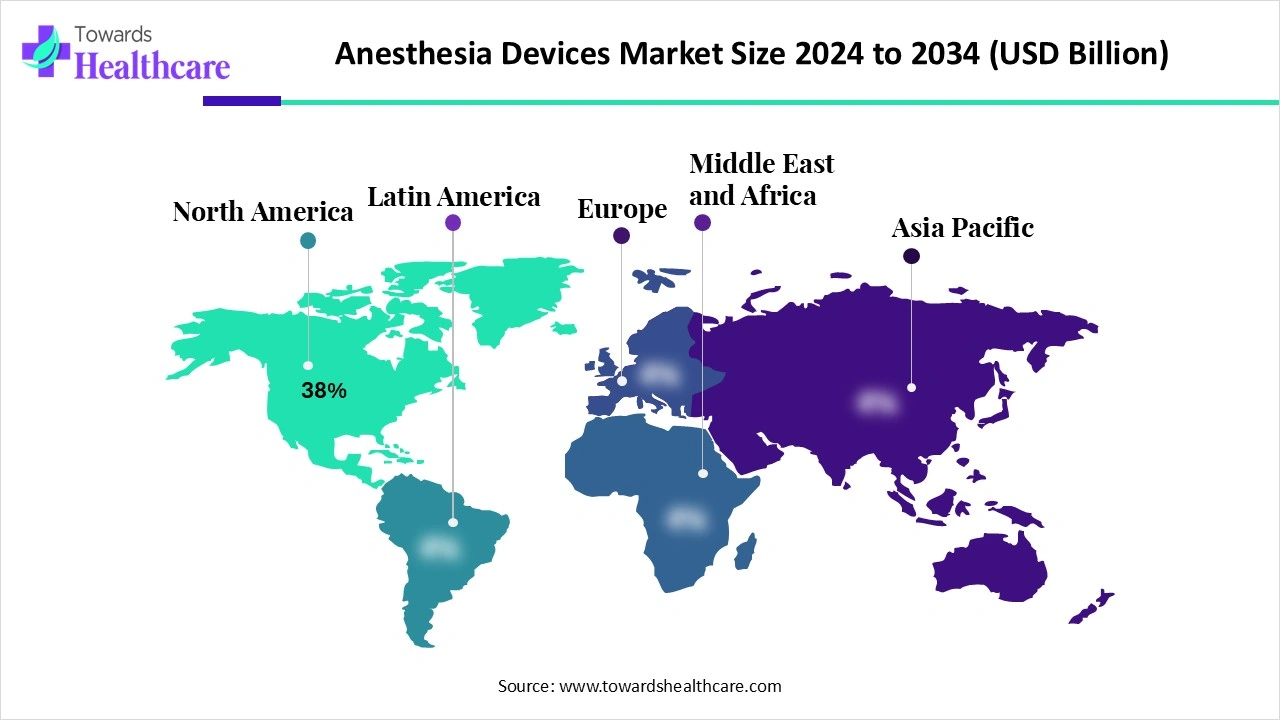

| Leading Region | North America by 38% |

| Market Segmentation | By Product Type, By Modality, By Application, By End-User, By Region |

| Top Key Players | GE HealthCare, Medtronic plc, Draegerwerk AG & Co. KGaA, Mindray Medical International, Philips Healthcare, Smiths Medical (ICU Medical), Fisher & Paykel Healthcare, B. Braun Melsungen AG, BD (Becton, Dickinson and Company), Teleflex Incorporated, Ambu A/S, Penlon Ltd., Nidek Medical Products, Heyer Medical AG, Löwenstein Medical Technology, Beijing Aeonmed Co. Ltd., Spacelabs Healthcare, Hamilton Medical AG, Intersurgical Ltd., Nihon Kohden Corporation |

The anesthesia devices market includes medical equipment used to deliver anesthetic agents, monitor patients, and ensure safe and effective anesthesia administration during surgical and diagnostic procedures. These devices encompass anesthesia machines, monitors, disposables, and accessories. Market growth is driven by the rising number of surgeries (elective, emergency, and outpatient), increasing prevalence of chronic diseases, technological advancements in anesthesia delivery (closed-loop systems, integrated monitoring), and the growing shift toward outpatient surgical centers.

Expanding Geographical Presence: International companies launch their products in foreign markets to reach a larger patient population.

Increasing Collaboration: Companies collaborate to access advanced technologies and expand their product pipeline, providing enhanced care to patients.

AI plays a vital role in anesthesia devices by introducing automation and optimizing the delivery of anesthetic agents. AI and machine learning (ML) algorithms can analyze vast amounts of data and suggest anesthesia dosing based on patients’ conditions and surgical requirements. They can continuously monitor patients and predict the risk of post-operative outcomes, such as respiratory failure and delirium. This enables anesthesiologists to make proactive clinical decisions. Thus, AI and ML enhance the efficiency and precision of anesthesia devices and reduce manual errors.

Increasing Number of Surgeries

The major growth factor for the anesthesia devices market is the increasing number of surgeries. Surgeries are conducted due to the growing burden of chronic disorders and the rising geriatric population. The increasing road accidents and sports injuries also necessitate surgeries. General or local anesthesia is used depending on the type of surgery. Helsinki University Hospital (HUS) is Finland’s largest university hospital. It conducted a total of 91,572 surgeries in 2024, representing an increase of 4% from 2023. Additionally, 4.4 million Americans were treated in emergency departments for injuries involving sports and recreational equipment in 2024.

Supply Chain Disruption

Anesthesia devices are facing supply chain disruption due to their growing demand, geopolitical issues, and evolving regulatory landscape. Shortages result in delays and cancellations of care, impacting patient safety and care.

What is the Future of the Anesthesia Devices Market?

The market future is promising, driven by the growing demand for environmental sustainability. Regulatory agencies impose stringent regulations on the sustainability of anesthesia devices. Conventional devices carry a risk of anesthesia leakage due to their volatile nature. This may significantly impact the environment. This encourages researchers to develop novel devices that are more sustainable and safe. Several studies have demonstrated that introducing automation into anesthesia devices has proven to be beneficial.

By product type, the anesthesia delivery machines segment held a dominant presence in the market in 2024. This is due to the need for precise delivery of anesthetics and the growing demand for personalized care. Anesthesia delivery systems offer tailored anesthesia solutions to enhance clinical workflow and support optimal patient safety. This enables surgeons and anesthesiologists to meet their specific operational needs. The availability of automated devices further streamlines the delivery of anesthetics.

By product type, the anesthesia monitors segment is expected to grow at the fastest CAGR in the market during the forecast period. Patient monitoring is essential during and after anesthesia delivery. This is because anesthesia can cause rapid changes in the vital functions of patients, such as temperature, respiration rate, and pulse rate. Anesthesia monitors titrate the administration of anesthesia and detect physiologic perturbations. They enable anesthesiologists to intervene before the patient suffers harm.

By modality, the standalone anesthesia systems segment held the largest revenue share of the market in 2024. This segment dominated because standalone systems are widely used in hospitals and surgical centers. They are fixed at a place and can monitor different functionalities of a patient. Standalone systems perform a wide range of functions that are not possible through portable systems. Hospitals and surgery centers have specialized infrastructure to install standalone systems.

By modality, the portable anesthesia devices segment is expected to grow with the highest CAGR in the market during the studied years. Portable devices are primarily used in ambulatory surgery centers and in resource-limited settings. They eliminate the need for a specialized infrastructure to install anesthesia devices. They are more cost-effective compared to standalone systems. They are designed to function effectively in difficult situations where conventional anesthesia machines may not be feasible.

By application, the general anesthesia segment contributed the biggest revenue share of the market in 2024. The segmental growth is attributed to the increasing number of major surgeries, as general anesthesia requires unconsciousness and controlled ventilation. A recent study by IIT Madras found that the prevalence of C-sections across India rose from 17.2% to 21.5% in five years.General anesthesia provides complete patient comfort irrespective of the surgical duration. It also eliminates waiting for the block to set up.

By application, the regional anesthesia segment is expected to expand rapidly in the market in the coming years. The growing demand for minimally invasive surgeries, such as spinal, epidural, and nerve blocks, potentiates the need for regional anesthetics. Regional anesthetics are increasingly used in outpatient procedures. A recent study reported that a total of 30,485 spinal surgeries were performed in New York City.

By end-user, the hospitals segment led the market in 2024. Hospitals have favorable infrastructure and suitable capital investments to adopt advanced anesthesia devices. They conduct the highest number of surgeries with the presence of advanced ICU and operating rooms. Patients prefer hospitals for surgeries due to favorable reimbursement policies and the presence of skilled professionals. Skilled professionals provide multidisciplinary expertise to patients.

By end-user, the ambulatory surgical centers (ASCs) segment is expected to witness the fastest growth in the market over the forecast period. ASCs conduct minor surgeries and provide outpatient services. The availability of portable anesthesia devices propels the segment’s growth. ASCs possess specialized equipment and provide personalized care to patients.

North America dominated the global market share by 38% in 2024. The availability of a robust healthcare infrastructure, the presence of key players, and the rising adoption of advanced technologies are the major growth factors for the market in North America. Favorable reimbursement policies by government and private organizations, and a strong surgical infrastructure, augment the market. Regulatory agencies promote the development of innovative anesthesia devices.

The U.S. is at the forefront of developing and evaluating innovative anesthesia devices. Of the total 1,529 clinical trials, about 305 studies related to anesthesia devices are registered in the U.S. as of September 18, 2025. Key players, such as GE Healthcare, Smiths Medical, Inc., and Abbott Laboratories, are the major contributors to the market.

Companies like BOMImed, Medline Canada, and GE Healthcare provide advanced anesthesia devices in Canadian hospitals and surgical centers. In 2023-24, there were approximately 3.05 million acute inpatient hospitalizations in Canada, compared to 2.96 million in 2022-23. As of September 18, 2025, 63 clinical trials were registered on the clinicaltrials.gov website related to anesthesia devices in Canada.

Asia-Pacific is expected to grow at the fastest CAGR in the market during the forecast period. The rising prevalence of chronic disorders and the increasing surgical procedures boost the market. The rapidly expanding healthcare infrastructure and growing demand for cost-effective devices bolster market growth. The increasing number of medical device startups and venture capital investments contributes to the growth of the market. The presence of a large patient population base and favorable regulatory policies encourages foreign companies to launch their products in the Asia-Pacific countries.

Researchers develop novel anesthesia devices that incorporate physiological monitoring systems, a ventilator, and automated dose delivery.

Key Players: GE Healthcare, Mindray Medical International Limited, and Teleflex, Inc.

Anesthesia devices undergo clinical trials to determine their safety and efficacy profile. These devices are then approved by regulatory agencies to be used in healthcare settings.

Key Players: Recens Medical, Inc., MCRA, LLC, and Philips Healthcare

After an anesthesia device gets market authorization, it is distributed to different hospitals, ASCs, specialty clinics, and surgical centers.

Anesthesia devices provide patient support & services by streamlining tasks, such as pre-operative assessments, intraoperative monitoring, and post-operative monitoring.

Philip Silberg, CEO of Senzime, commented that the initiative to drive the next wave of clinical transformation in anesthesia care aligns with Senzime as it continues to strengthen its role as a device innovator and scientific and educational partner. The company’s new Medical Affairs team and educational platform reflect the commitment to partnering with providers to implement evidence-based practices that elevate patient outcomes.

By Product Type

By Modality

By Application

By End-User

By Region

February 2026

February 2026

February 2026

February 2026