January 2026

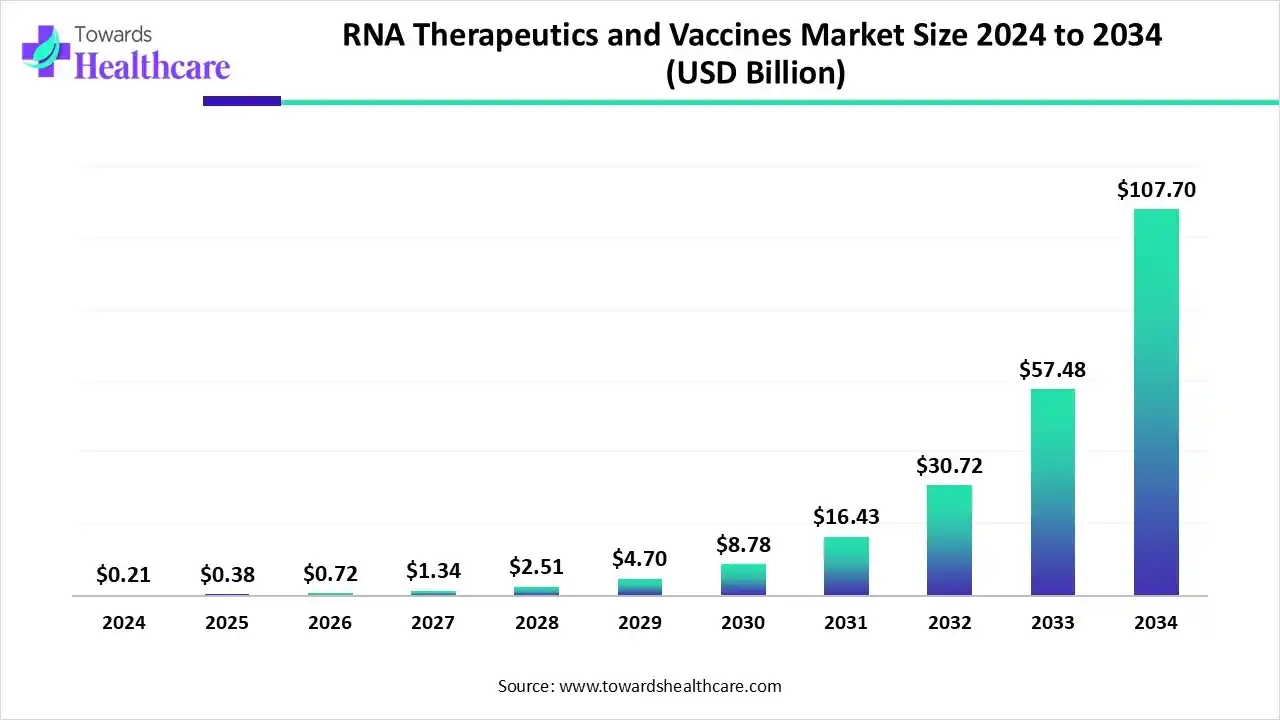

The global RNA therapeutics and vaccines market size is estimated at US$ 0.21 billion in 2024, is projected to grow to US$ 0.38 billion in 2025, and is expected to reach around US$ 107.7 billion by 2034. The market is projected to expand at a CAGR of 87% between 2025 and 2034.

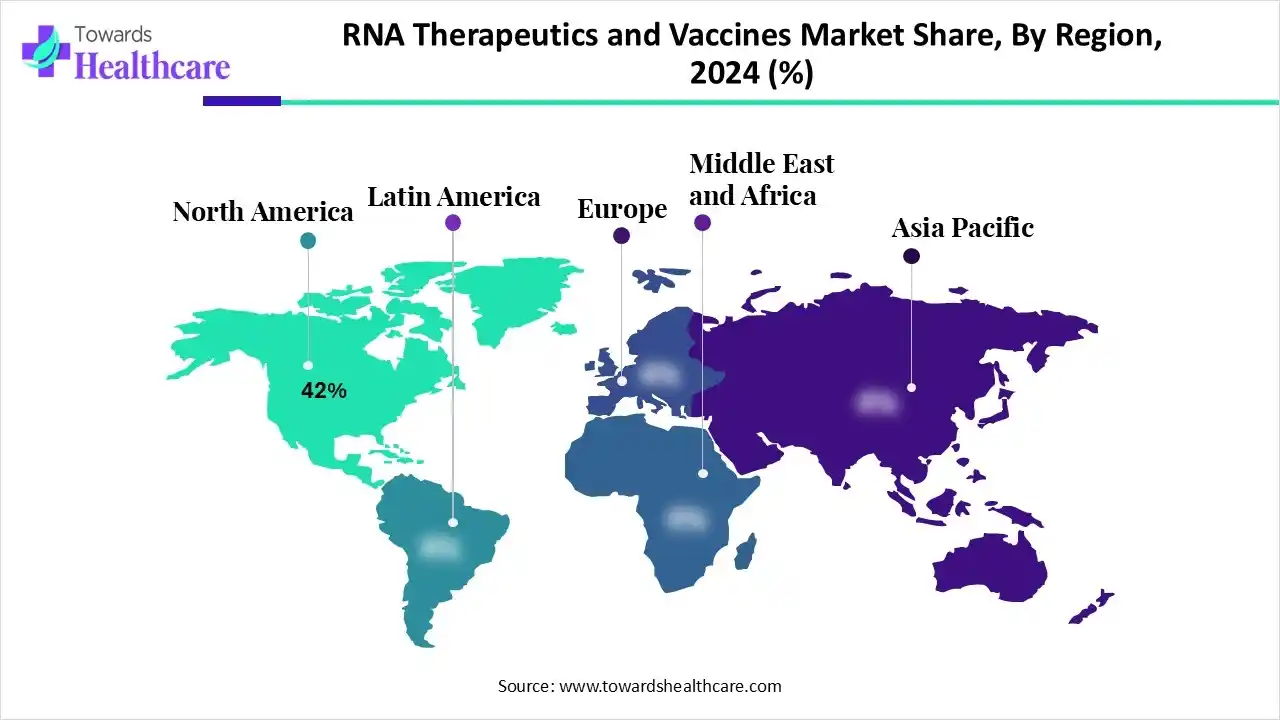

The RNA therapeutics and vaccines market is growing because of increasing R and D in genetic, infectious, and oncology diseases. Improvement in delivery technology and advanced intellectual characteristics. North America is dominant in the market due to a strong R&D infrastructure and innovation ecosystem, while the Asia Pacific is fastest fastest-growing market due to a supportive regulatory environment and high-level funding.

| Table | Scope |

| Market Size in 2025 | USD 0.38 Billion |

| Projected Market Size in 2034 | USD 107.7 Billion |

| CAGR (2025 - 2034) | 87% |

| Leading Region | North America by 42% |

| Market Segmentation | By Modality / Product Type, By Therapeutic Area / Indication, By Product / Offering Type, By Delivery & Enabling Technology, By End User, By Region |

| Top Key Players | Moderna, Inc., BioNTech SE, Pfizer Inc., Sanofi (including Translate Bio), CureVac N.V., Alnylam Pharmaceuticals, Inc., Ionis Pharmaceuticals, Inc., Sarepta Therapeutics, Inc., Arrowhead Pharmaceuticals, Inc., Beam Therapeutics Inc., Intellia Therapeutics, Inc., Editas Medicine, Inc., Lonza Group Ltd., Catalent, Inc., Acuitas Therapeutics, Inc., Precision NanoSystems, Inc., Thermo Fisher Scientific, Inc., Merck KGaA (MilliporeSigma), Arcturus Therapeutics Holdings Inc., Gritstone Bio, Inc. |

The RNA therapeutics and vaccines market includes the discovery, development, manufacture, and commercialization of therapeutic and prophylactic products that utilize RNA as their primary active component. This encompasses mRNA vaccines and therapeutics, small interfering RNA (siRNA), antisense oligonucleotides (ASOs), self-amplifying RNA (saRNA), microRNA-based therapies, RNA aptamers, and RNA-based gene-editing tools.

The RNA therapeutics and vaccines market also comprises RNA delivery systems (like lipid nanoparticles or LNPs), GMP-grade reagents, oligonucleotide synthesis platforms, and contract manufacturing services (CDMOs). Growth is driven by the proven success of COVID-19 mRNA vaccines, expansion into oncology and rare genetic diseases, advancements in RNA delivery chemistry, and rising manufacturing scalability globally.

The integration of artificial intelligence into RNA therapeutics and vaccines is driving market growth, as AI-driven technologies are a disruptive force transforming cancer analysis and therapies by interpreting concealed signatures in RNA biomarker data. This technology, particularly machine learning and deep learning, has revolutionized the analysis of complex biological data, enabling the identification of nuanced yet healthcare-significant RNA expression patterns that predictive statistical techniques fail to capture.

By leveraging AI-driven technology, scientists analyze large-scale transcriptomic databases to identify novel RNA biomarkers, predict disease progression, and improve treatment strategies. AI-driven technique enhances the identification of RNA biomarkers from liquid biopsies, providing a non-invasive and tremendously sensitive process for early screening of diseases.

By modality/product type, the mRNA vaccines & therapeutics segment led the RNA therapeutics and vaccines market with approximately 38% share, as mRNA vaccines offered more advantages than traditional vaccines, with the ease of their production, simple scalability, and rapid development. Like other vaccines, mRNA vaccine drug products also undergo three steps in their production, which are upstream production, downstream purification, and lastly formulation of the mRNA drug products. mRNA vaccines generate a higher immune response than DNA vaccines, as they must go through an added step of penetrating the cell nucleus to be efficient.

On the other hand, the self-amplifying RNA (saRNA) & replicons segment is projected to experience the fastest CAGR from 2025 to 2034, as self-amplifying RNA (saRNA) technology is an evolving platform for vaccine manufacturing, providing important advantages over conventional mRNA vaccines. It is an artificial nucleic acid engineered to replicate in cells without generating viral particles. saRNA delivers a hopeful substitute to predictable mRNA vaccines, improving antigen expression while needing lower doses.

By therapeutic area/indication, the infectious diseases & vaccines segment is dominant in the RNA therapeutics and vaccines market in 2024, with approximately 36% share, as RNA-based molecules to modulate biological pathways to cure a specific antibody, can be used as effective vaccines in inhibition and management of numerous human and animal infectious health condition, like Zika virus, influenza virus, SARS-CoV-2, human immunodeficiency virus, and respiratory syncytial virus. mRNA vaccines train the immune system to identify and attack cancer cells, providing a targeted strategy to cancer immunotherapy.

The rare and genetic diseases segment is expected to experience the fastest growth from 2025 to 2034, as RNA therapeutics are significant devices for the treatment of many severe diseases, particularly genetically mutated diseases such as cancer and metabolic disorders. RNA vaccines provide advantages in efficacy, safety, affordability, speed, and simplicity of manufacturing. RNA therapy has significant capability to induce an immune response, which has been harnessed for vaccine manufacturing. It was investigated for cancer, genetic disorders, and immunotherapy.

By product/offering type, the finished drug products segment led the RNA therapeutics and vaccines market in 2024, with approximately 40% share, as RNA-driven drugs are known to exhibit a broad diversity of advantageous traits, making them standard ingredients for the development of different new therapeutic strategies. RNA therapeutics creates the opportunity for the realization of targeted medicine that is cheaper, safer, to accessible, and easier to manufacture.

The CDMO & contract development services segment is projected to experience the fastest CAGR from 2025 to 2034, as CDMOs service experts experienced in nucleic acid synthesis, modification, and purification. This expertise is significant for navigating the difficulties of RNA progress, such as managing the instability of RNA molecules. CDMOs provide inclusive services, from expansion to large-scale manufacturing. CDMOs rapidly and effectively scale up production from preclinical batches to large-scale manufacturing.

By delivery and enabling technology, the lipid nanoparticles (LNPs) & ionizable lipids segment led the RNA therapeutics and vaccines market in 2024, with approximately 34% share, as these helper lipids not only offer mechanical stability of the nanoparticle, which enhances the biodistribution of LNPs and improves the delivery efficiency by encouraging cytosolic entry and intracellular uptake.

The novel lipid chemistries segment is projected to experience the fastest CAGR from 2025 to 2034, as it progresses RNA therapeutics by predominantly enhancing the delivery and effectiveness of RNA molecules in the body. Novel lipids are a significant component of lipid nanoparticles (LNPs), which act as non-viral delivery vectors for RNA medicine by protecting them from degradation and allowing their access into cells.

By end user, the arge pharmaceutical & biotechnology companies segment led the RNA therapeutics and vaccines market in 2024 with approximately 48% share, as pharma and biotech to capitalizing on RNA therapeutics to expedite R&D worldwide. These drugs are affordability, relatively simple to manufacture, and target previously undruggable ways. It rapidly develops novel and targeted RNA theories.

The CDMOs/contract manufacturers segment is projected to experience the fastest CAGR from 2025 to 2034, as CDMOs providing include the complete RNA therapeutic advancement chain from plasmid manufacturing and mRNA synthesis to LNP encapsulation and aseptic filling. CDMO collaborating with integrated strength in process development, quality assurance, and government expertise. CDMOs maintain state-of-the-art services and advanced tools needed for RNA synthesis.

North America is dominant in the RNA therapeutics and vaccines market share by 42% in 2024, due to this region is a hub of a high concentration of leading medical and biotechnology organizations, research institutions, and academic centers. Increasing investment from both public and private sectors in biotechnology research. Strong presence of supportive regulatory framework, for instance, as of April 2024, at least 21 RNA-based therapies have been approved by the FDA, including ten ASOs, six siRNAs, and five mRNA-based vaccines, which contributes to the growth of the market.

In the U.S., a vigorous startup environment, maintained by a booming venture capital sector, permits early-stage organizations such as Moderna to develop new technologies. The presence of world-class academic institutions conducting advanced genomic research and hosting dedicated centers for RNA science, like the University of Rochester Center for RNA Biology and Therapeutics.

For instance,

Asia Pacific is the fastest-growing region in the RNA therapeutics and vaccines market in the forecast period, as Governments in this region are massively funding the biotechnology and pharmaceutical sectors. Also strong presence of intended platforms such as Singapore's Nucleic Acid Therapeutics Initiative (NATi), maintained by the Agency for Science, Technology and Research, which drives the growth of the market.

The Chinese government is predominantly growing funding for biotechnology and pharmaceutical innovation, with billions of dollars owed to mRNA research. China has quickly expanded its research infrastructure to become a home for RNA therapy innovation. Chinese scientists are expanding the application of RNA technology to various areas, including chronic conditions and oncology. Growing medical care policy, for instance, in July 2025, China’s NMPA and NHSA unveiled the Measures to Support High-Quality Development of Innovative Drugs, a game-changer for the biopharma industry! This policy streamlines R&D, market access, clinical trials, and reimbursement to fast-track novel drug development.

Europe is a notably growing region in the market due to this region has a strong presence of academic foundation in the life sciences, with widespread expertise in gene editing and genomics research. A supportive government and economic environment has enhanced development and clinical trials for RNA therapies in Europe, for instance, in May 2025, Ethris GmbH, a clinical-stage biotechnology company pioneering next-generation RNA therapeutics and vaccines, announced that it was awarded a €10 million grant from EU4Health, the EU’s largest health programme committed to a healthier European Union.

Germany claims a modern biotech sector with advanced research infrastructure and a dedicated biopharmaceutical novelty and targeted medicine. This translates into massive spending in RNA research and development. The German government has actively supported the biotechnology field with investment programs, initiatives, and grants goal of hastening research, development, and manufacturing capacity, particularly for vaccines and RNA-driven therapeutics.

In October 2025, the European Investment Bank (EIB) and the European Commission (EC) are teaming up with BioNTech to help advance a messenger RNA (mRNA) vaccine manufacturing facility in Kigali, Rwanda. To support this project, BioNTech has been awarded a blended financing option of up to €95 million: a €35 million Commission grant, and the possibility to take out a loan of up to €60 million from the EIB.

The research and development (R&D) processes for RNA therapeutics and vaccines significantly include fundamental research into RNA biology and design, from production, clinical trials, and commercialization.

Key Players: Alnylam Pharmaceuticals and Ionis Pharmaceuticals

Clinical trial process for RNA therapeutics and vaccines is an extremely structured and regulated pathway that shifted from initial laboratory research to large-scale human testing and post-market monitoring.

Key Players: Pfizer Inc. and CureVac

Major companies often provide programs to support patients with the high expenses associated with these modern therapies. Organizations connect patients and families dealing with rare or genetic conditions, such as those that are targets for RNA therapies.

Key Players: Moderna and BioNTech

By Modality / Product Type

By Therapeutic Area / Indication

By Product / Offering Type

By Delivery & Enabling Technology

By End User

By Region

January 2026

January 2026

January 2026

January 2026