February 2026

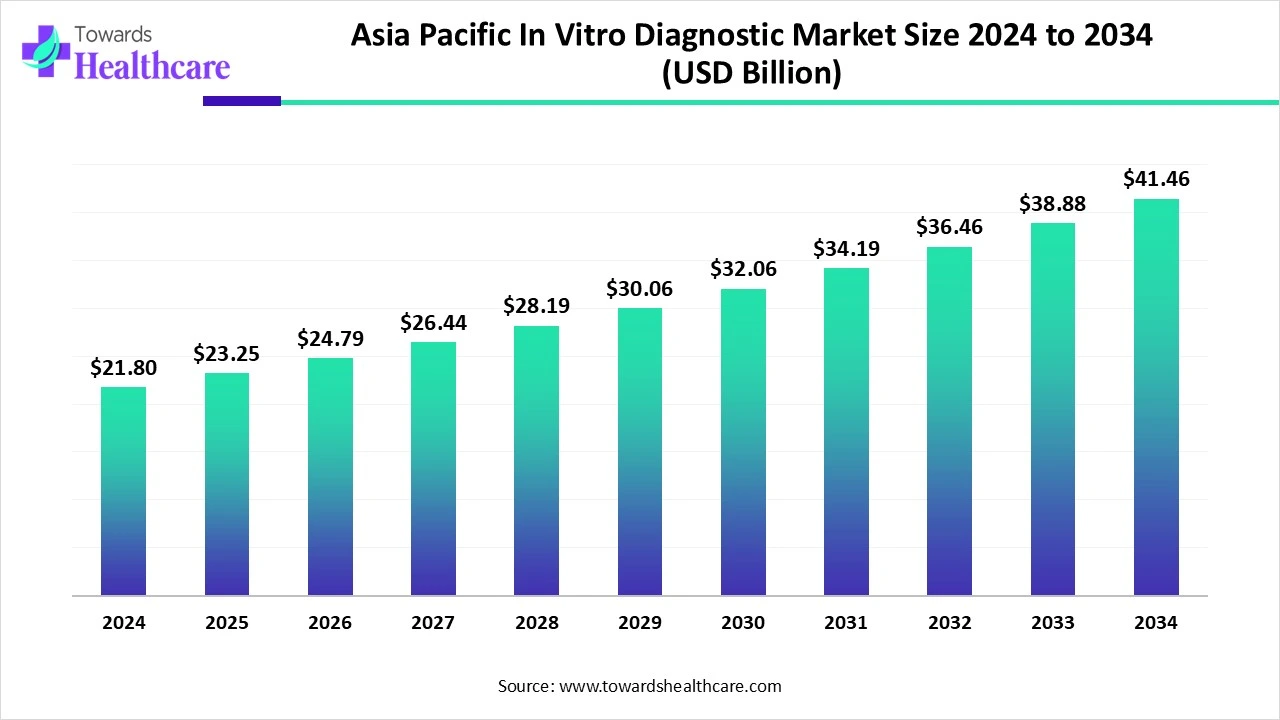

The Asia Pacific in vitro diagnostic market size is calculated at USD 21.8 billion in 2024, grows to USD 23.25 billion in 2025, and is projected to reach around USD 41.46 billion by 2034. The market is expanding at a CAGR of 6.64% between 2025 and 2034.

| Metric | Details |

| Market Size in 2025 | USD 23.25 Billion |

| Projected Market Size in 2034 | USD 41.46 billion |

| CAGR (2025 - 2034) | 6.64% |

| Market Segmentation | By Product, By Technology, By Application, By End-use, By Regions |

| Top Key Players | Abbott, bioMérieux SA, QuidelOrtho Corporation, Siemens Healthineers AG, Bio-Rad Laboratories, Inc., Qiagen, Sysmex Corporation, Charles River Laboratories, Quest Diagnostics Incorporated, Agilent Technologies, Inc., Danaher Corporation, BD, F. Hoffmann-La Roche Ltd. |

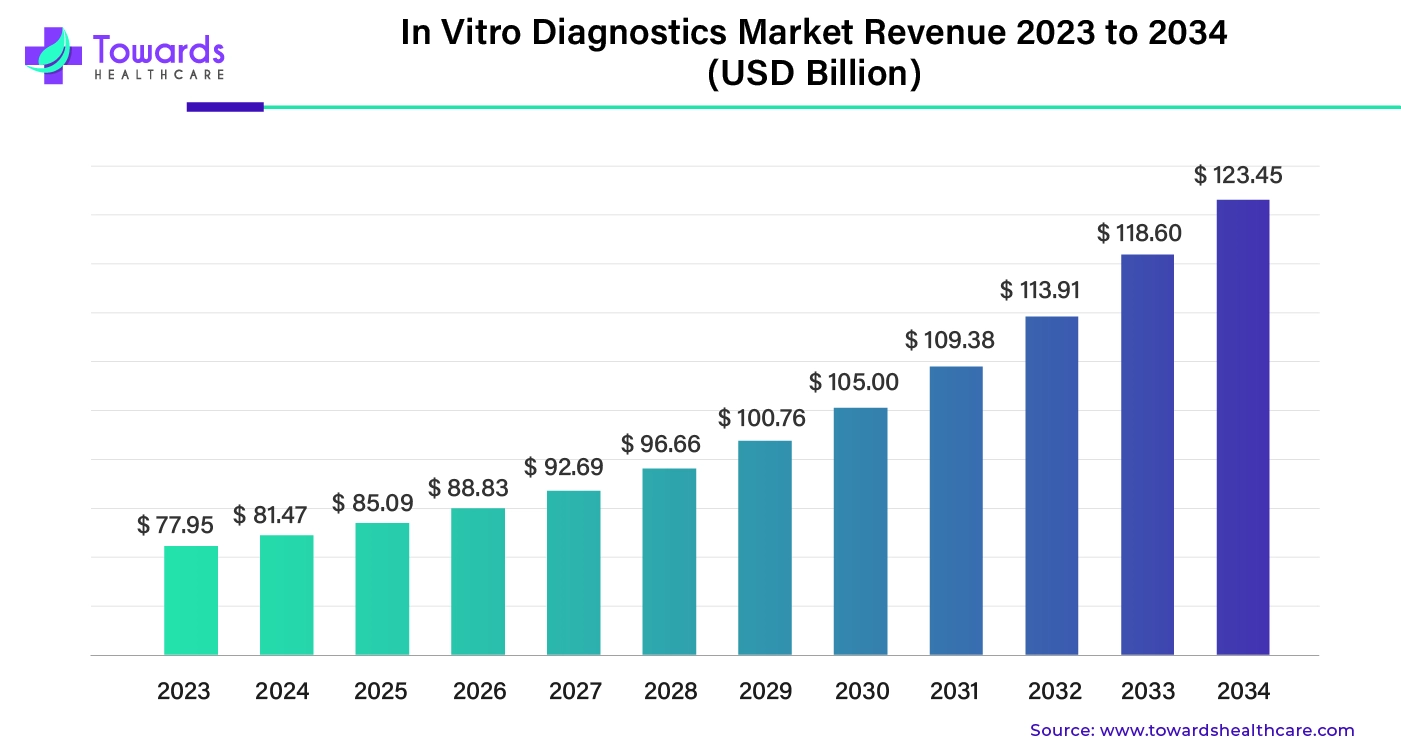

The global in vitro diagnostics market was worth about $77.95 billion in 2023. It’s expected to keep growing steadily and could reach around $123.45 billion by 2034. On average, the market is projected to grow by about 4.45% each year from 2024 to 2034.

The in vitro diagnostics market refers to the industry focused on diagnostic tests performed outside the body on samples like blood or urine, using instruments and reagents to detect diseases, monitor health, and guide treatment decisions. The market is growing due to the rising incidence of chronic diseases such as diabetes and cancer, increasing health awareness, and a rapidly aging population. Technological advancements, particularly in molecular diagnostics and point-of-care testing, are improving access and accuracy. Additionally, government initiatives to strengthen healthcare infrastructure and expand diagnostic services in emerging economies like India and China are fueling demand, making the region a key focus for IVD development adoption.

Artificial intelligence (AI) is significantly transforming the market. By enhancing diagnostic accuracy and efficiency, AI enables rapid disease detection and personalized treatment plans. Its integration into point-of-care testing and molecular diagnostics is particularly beneficial in remote and underserved regions, improving healthcare accessibility. Countries like China and India are leading this shift, leveraging AI to address healthcare challenges and expand diagnostic capabilities. As AI-driven solutions become more prevalent, the Asia-Pacific IVD market is poised for substantial growth and innovation.

Increasing Chronic Disease Prevalence

The rising prevalence of chronic diseases in the Asia-Pacific region is a major driver for Asia Pacific in vitro diagnostic market growth. Conditions like Diabetes, cancer, and cardiovascular diseases require early detection and continuous monitoring, increasing the demand for accurate diagnostic tools. According to the World Health Organization (WHO), chronic diseases are rapidly increasing in the region, with diabetes being a major concern. It is estimated that by 2030, around 522 million people could be affected by diabetes, emphasizing the urgent need for better diagnostic and healthcare solutions. Aging populations, urbanization, and lifestyle changes further contribute to this trend. Additionally, government health initiatives and technological advancements in diagnostics are improving access and efficiency, accelerating the adoption of IVD solutions to manage chronic diseases effectively.

High Costs of Advanced Diagnostic Technologies

Regional companies are increasingly investing in affordable yet high-quality diagnostics to meet local healthcare needs. This encourages domestic innovation and partnership, boosting market growth. Additionally, medical tourism and rising healthcare infrastructure investment in countries like India and China create opportunities for affordable IVD solutions, positioning the region competitively in the global Asia Pacific in vitro diagnostic market.

How Point of Care Creates Growth Opportunity?

Point-of-care testing creates a significant opportunity in the market due to its ability to deliver rapid, accurate results in decentralized settings. This is especially valuable in rural and underserved areas with limited access to centralized laboratories. The growing prevalence of chronic and infectious diseases, coupled with increasing healthcare awareness and government initiatives, further fuels demand for POC solutions. Additionally, technological advancements and the need for cost-effective, real-time diagnostics support POC adoption, driving robust market expansion across the region.

For Instance,

By product, the reagents segment held a dominant presence in the Asia Pacific in vitro diagnostic market in 2024, due to the high frequency of diagnostic testing, which requires repeated use of reagents. Reagents are essential consumables in most IVD procedures, including immunoassays, molecular diagnostics, and clinical chemistry. Additionally, the growing prevalence of chronic diseases, increasing demand for rapid and accurate testing, and advancements in diagnostics technologies significantly contribute to the increased consumption and revenue generation of regents across the region.

By product, the instruments segment is anticipated to grow at the fastest CAGR in the market during the studied years. The rapid expansion is driven by rising demand for advanced diagnostic technologies, growing healthcare awareness, and increased government investment in healthcare infrastructure. Technological innovation and focus on early disease detection are also boosting the adoption of diagnostic instruments. Additionally, the region's expanding population and increasing prevalence of chronic diseases contribute significantly to the growing need for reliable and efficient diagnostic solutions.

By technology, the immunoassay segment accounted largest share in the market in 2024, due to its wide application in detecting infectious diseases, cancer, and chronic conditions. This technology offers high sensitivity, specificity, and rapid results, making it essential for both clinical and laboratory settings. Additionally, the growing demand for early disease detection and the rising prevalence of lifestyle-related illnesses have boosted the adoption of immunoassay-based diagnostics across the region, further driving the Asia Pacific in vitro diagnostic market.

By technology, the molecular diagnostics segment is expected to grow at the fastest rate in the market during the forecast period due to its ability to provide accurate and early detection of a wide range of diseases, including cancer and genetic disorders. Its high sensitivity, specificity, and potential for personalized treatment support its growing use in clinical decision-making. The rising focus on precision medicine and the increasing availability of advanced molecular testing technologies are key factors driving this segment's rapid growth in the region.

By application, the infectious diseases segment was dominant in the market in 2024 because of the high prevalence of infections such as tuberculosis, hepatitis, HIV, and dengue across the region. The need for early, accurate, and rapid diagnostic solutions to control disease spread has driven the demand for reliable testing methods. Additionally, growing public health awareness, government initiatives to combat infectious diseases, and improved access to diagnostic services have significantly contributed to the segment's strong presence and continued growth in the Asia Pacific in vitro diagnostic market.

By application, the autoimmune diseases segment is predicted to grow at the fastest CAGR in the market, due to the rising incidence of autoimmune disorders such as rheumatoid arthritis, lupus, and thyroid diseases. Increased awareness, better diagnostic capabilities, and a growing elderly population contributed to higher testing demand. Advancements in diagnostics technologies and a stronger focus on early and accurate detection are also supporting the segment's rapid growth as healthcare systems prioritize the timely management of these chronic conditions.

By end-use, the hospital segment held the highest share of the market in 2024. The increased number of hospitals and clinics in the region has led to greater utilization of diagnostic products. Hospitals often serve as referral centers for complex diagnostic procedures requiring sophisticated technologies and specialized expertise. The integration of advanced IVD technologies in hospitals' laboratories, such as automated analyzers and molecular diagnostics tools, has further enhanced the efficiency and accuracy of diagnostic services. Additionally, the growing adoption of advanced diagnostics technologies in hospitals is contributing to the Asia Pacific in vitro diagnostic market growth.

By end-use, the laboratory segment is projected to grow at the fastest rate in the market during the studied years due to rising investment in healthcare infrastructure, especially in emerging economies. The increasing burden of chronic and infectious diseases is driving demand for accurate and efficient diagnostic solutions, which are primarily conducted in laboratories. Moreover, advancements in laboratory automation, growing awareness of early disease detection, and the consolidation of diagnostics services are further accelerating the adoption and expansion of laboratory-based testing in the region.

China dominated the Asia Pacific in vitro diagnostic market in 2024. A large aging population led to a higher demand for diagnostic solutions, especially for chronic and lifestyle-related diseases. The Chinese government's consistent efforts to improve healthcare access and infrastructure further supported the growth of the IVD sector. Additionally, China strong base in biotechnology and the distribution of diagnostic tools. Increased healthcare awareness and routine health checkups are also contributing to robust domestic market growth.

Japan is anticipated to grow at a significant rate in the market during the forecast period, due to its aging population, increasing chronic disease burden, and strong focus on preventive healthcare. The country’s advanced medical technology sector, supported by innovations in AI and automation, enhances diagnostic efficiency and accuracy. Government initiatives, such as healthcare digitization and funding for early disease detection, further boost market expansion. Additionally, strategic partnerships and investments in research continue to foster innovation, solidifying Japan’s position as a key growth driver in the regional IVD market.

In March 2025, the NIHR HealthTech Research Centre in In Vitro Diagnostics (HRC IVD), launched by Imperial College and funded by NIHR, aims to advance diagnostic development and adoption. It focuses on cancer, infectious and respiratory diseases, critical care, and primary/social care, offering expertise in regulation, real-world evidence, health economics, and adoption challenges. (Source - IMPERIAL)

By Product

By Technology

By Application

By End-use

By Regions

February 2026

February 2026

February 2026

February 2026