January 2026

The global behavioral health EHR market is on an upward trajectory, poised to generate substantial revenue growth, potentially climbing into the hundreds of millions over the forecast years from 2025 to 2034. This surge is attributed to evolving consumer preferences and technological advancements reshaping the industry.

The behavioral health EHR market is driven by the potential of advanced tools and techniques to keep track of patients’ health information and maintain the confidentiality of patients’ data. The electronic health records encompass features such as telehealth, robust security, and EHR software. These advanced technologies maintain compliance with the latest government regulations. They enable fast and efficient electronic prescriptions and laboratory orders. The advanced features provide access to patient files in real-time and keep track of data files, forms, and documentation.

The behavioral health electronic health record (EHR) market refers to digital platforms designed for recording, managing, and analyzing patient information specific to mental health and substance use care. These systems streamline documentation, treatment planning, e-prescriptions, telepsychiatry integration, patient engagement, and compliance with regulatory standards such as HIPAA and HITECH. Tailored for psychiatrists, psychologists, therapists, and counselors, behavioral health EHRs address the unique workflows of outpatient clinics, rehabilitation centers, and community health organizations. Demand is driven by the rising prevalence of mental health conditions, the adoption of value-based care, government incentives for digital health adoption, and the growing preference for integrated EHR solutions that combine behavioral and general healthcare data. Cloud-based platforms and mobile access are further accelerating growth.

AI is a valuable tool to optimize patient care. AI supports clinicians, and AI capabilities reflect clinicians’ mindset. AI contributes to streamlining and automating clinical documentation. AI is the most useful tool for therapists. AI solutions can be integrated into workflows such as behavioral health, generic healthcare, inpatient and outpatient services, diagnosis, and group treatments.

What are the Major Drifts in the Behavioral Health EHR Market?

MedTech and the Internet of Medical Things (IoMT) are the key drivers of value-based patient care. Some of the applications of AI in healthcare include virtual health assistants, personalized treatment plans, and predictive analytics. There is a data-driven, holistic approach to behavioral, social, and mental health. Accurate healthcare data, incentives, and proactive care drive the prevention of diseases.

What are the Potential Challenges in the Behavioral Health EHR Market?

Certain challenges are associated with the implementation of EHR, which requires assessment, planning, vendor selection, system customization, staff training, and optimization. Moreover, the other challenges include high costs, data migration, interoperability, security concerns, user training, technical infrastructure, patient engagement, and resistance to change.

What is the Future of the Behavioral Health EHR Market?

The future of electronic health record systems in healthcare is driven by certain technological advancements. Patient engagement software can be used to always communicate with patients. It encourages follow-up appointments and optimizes the calibre of healthcare professionals’ work. It assesses patients for social dangers and clinical requirements. It is capable of getting immediate and direct patient feedback. It notifies the patient population about healthcare announcements. It keeps an eye on the interactions between patients and healthcare professionals.

The software segment dominated the market in 2024, owing to the improved clinical efficiency, enhanced practice engagement, improved quality of care, and increased patient engagement. The software supports telehealth, streamlines billing, and delivers coordinated and integrated care. The software reduces administrative burden and achieves regulatory compliance.

The services segment is expected to grow at the fastest CAGR in the market during the forecast period due to increased efficiency and improved practice management. The various healthcare services enable improved medication management and deliver reduced operational costs. They also deliver enhanced care coordination and enable better-informed decision-making.

The cloud-based segment dominated the market in 2024. The cloud-based segment is expected to sustain its position in the market during the forecast period. This segmental growth is driven by improved practice efficiency, enhanced data security, and compliance. The cloud-based platforms offer secure remote monitoring of patients and scalability. They allow telehealth integration and enhanced patient engagement. They reduce IT burden and streamline documentation processes.

The clinical functionality segment dominated the market in 2024, owing to the improved treatment planning and support for diverse workflows. It allows robust data security and compliance with regulations. It serves numerous benefits for patient care, clinical workflows, security, and compliance.

Under the clinical functionality segment, the clinical decision support (CDS) sub-segment is expected to grow at the fastest CAGR in the market during the forecast period due to its major role in improving clinical decisions and patient outcomes. It is beneficial to streamline workflow and practice efficiency. It enables efficient monitoring and reporting of healthcare.

The hospitals segment dominated the market in 2024, owing to their key role in improving diagnostic accuracy and delivering better coordinated care. They help to streamline administrative tasks and ensure advanced data security. They support enhanced communication and patient access to information.

The behavioral health clinics segment is expected to grow at the fastest CAGR in the market during the forecast period due to enhanced treatment planning and supportive integrated care. It improves billing and revenue cycle management. It enables remote access to patient records.

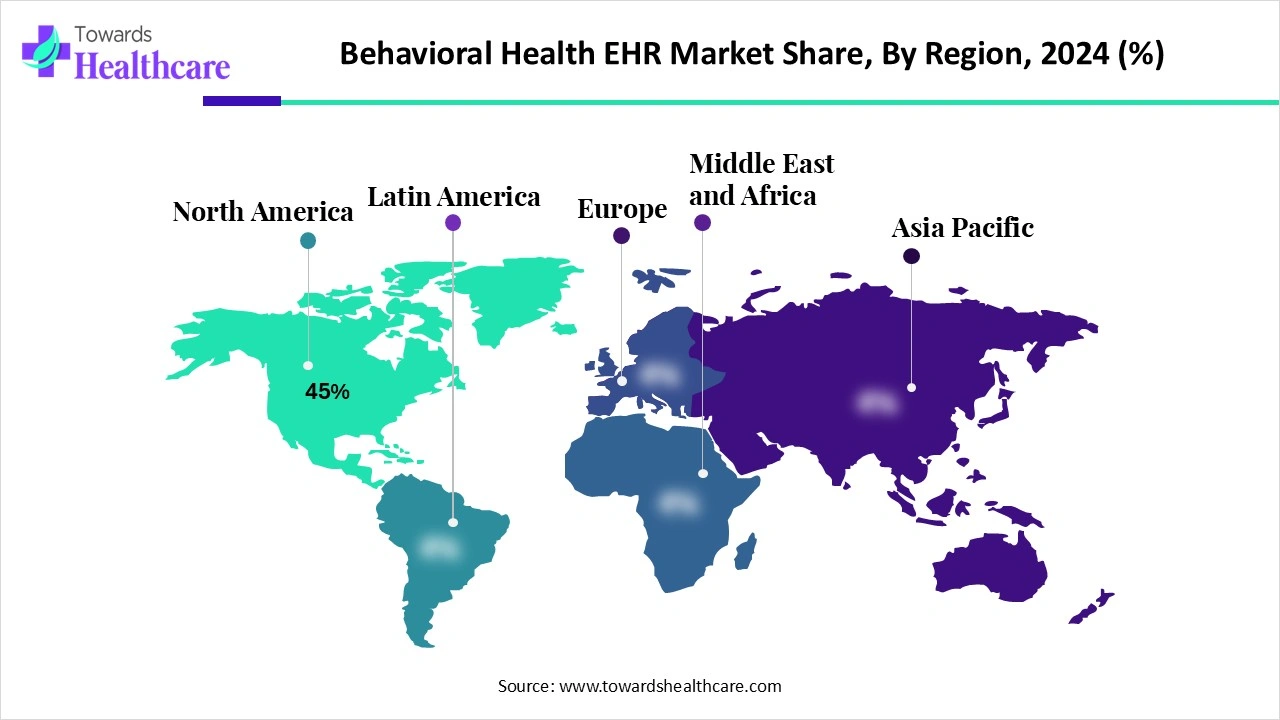

North America dominated the market share 45% in 2024, led by modernization in electronic health records. The National Human Genome Research Institute introduced the electronic medical records and genomics network (eMERGE), which is dedicated to combining electronic medical record systems for genomic discovery. The eMERGE network is funded and organized by the National Institutes of Health (NIH) and U.S. medical research institutions, according to the national electronic health records survey conducted in December 2024 to measure the progress of U.S. physicians and their offices in adopting EHRs.

The Centers for Medicare and Medicaid Services (CMS) reported that EHR can improve patient care by reducing medical errors and improving the accuracy of medical records, and the CMS promotes interoperability programs. In March 2025, the U.S. Government Accountability Office reported on the ongoing struggle of the Veterans Affairs to modernize its electronic health record system.

The U.S. Food and Drug Administration (FDA) introduced the digital health center of excellence, which aims to connect and establish partnerships, share knowledge, and discover regulatory approaches.

In June 2024, the Government of Canada introduced the Connected Care for Canadians Act.

The government of Canada focuses on transforming its healthcare system through the investment of $200 billion over 10 years through the Working Together to Improve Health Care for Canadians Plan.

It also serves to enable secure and timely access to personal health information for improving and saving the lives of Canadians.

Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast period due to increased mental health awareness and supportive government policies. Hospitals in the Asia Pacific region have highly adopted EHRs. The regional growth is also driven by increased workflow optimization, enhanced workforce efficiency, and enhanced patient engagement. EHR vendors are utilizing AI/ML capabilities, which are essential to support clinicians and improve diagnostic accuracy. The innovations are introduced by next-generation EHR providers.

There are country-specific regulations that ensure seamless data sharing with national health systems, such as the Privacy Act of Australia, the Personal Data Protection Act (PDPA) of Singapore, and the Digital Personal Data Protection Act of India. The government of India has taken measures to improve mental healthcare. India expanded the national tele-mental health program.

According to the National Medical Products Administration, China planned to strengthen medical, healthcare reform in 2024. It focuses on tackling high medical expenses and optimizing hospital services. In July 2025, China adopted its strategy to advance high-end medical devices.

Europe is expected to grow at a notable rate in the market in 2024. This regional growth is attributed to the increasing demand for mental health solutions and operational efficiency. In February 2025, the World Health Organization (WHO) focused on strengthening mental health in the WHO European region.

The European Commission introduced various projects that support the European Health Data Space Regulation (EHDS). There was a launch of the EHDS implementation initiative named MyHealth@MyHands, which aims to support patients in accessing their health data.

France is experiencing the rise of teleconsultation companies, which is a stabilized, legal, and ethical framework in 2025. These services transformed healthcare delivery in France. They ensure ethics, interoperability, and security in the healthcare sector.

Germany adopted new strategies to expand healthcare services across the country. It has adopted e-health services such as electronic health records and e-prescriptions. The overall growth of this country is driven by several benefits, such as less paperwork, reduced mismedication, early recognition of complications, and many other rationales.

In March 2025, Seth Howard, Epic’s executive vice president of research and development, said that the company is focusing on the establishment of its enterprise resource planning tool that is used in healthcare as well as many other industries.

By Component

By Delivery Mode

By Functionality

By End User

By Region

January 2026

January 2026

January 2026

January 2026