December 2025

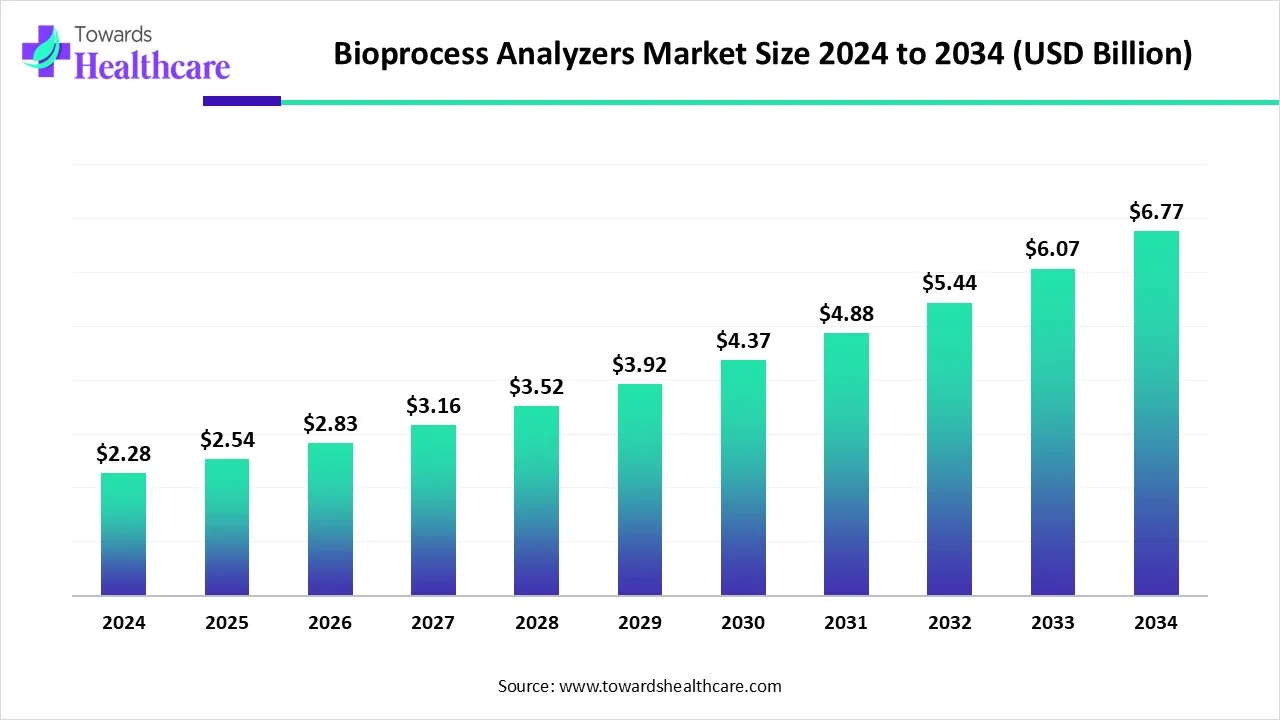

The global bioprocess analyzers market size is calculated at US$ 2.28 in 2024, grew to US$ 2.54 billion in 2025, and is projected to reach around US$ 6.77 billion by 2034. The market is expanding at a CAGR of 11.54% between 2025 and 2034.

| Metric | Details |

| Market Size in 2025 | USD 2.54 Billion |

| Projected Market Size in 2034 | USD 6.77 Billion |

| CAGR (2025 - 2034) | 11.54% |

| Leading Region | North America |

| Market Segmentation | By Product, By Analysis Type, By Application, By End Use, By Region |

| Top Key Players | Merck KGaA, Sartorius, Danaher, Eppendorf AG, Thermo Fisher Scientific, Applikon Biotechnology B.V., Corning, Lonza Group AG, AGC Biologics, Univercells Technologies S.A. |

Bioprocess Analyzers are instruments utilized to track and control numerous parameters in bioprocesses such as cell growth, substrate levels, and metabolite concentration. Nowadays, rising occurrences of chronic diseases and enhanced use of biologics (like monoclonal antibodies, vaccines, and hormones) are acting as a vital factor in the bioprocess analyzers market growth. Advancements in bioprocessing techniques, involving recombinant protein production and scalable bioreactors, are elevating the efficiency and quality of biologics. As well as rigorous regulations and raised targets on quality control of products in the biopharmaceutical industry, demand for bioprocess analyzers.

AI has significance in the bioprocess analyzer market, as it assists in rising efficiency, minimizing expenses, and optimizing the quality and consistency of bioproduction. Additionally, it provides instantaneous monitoring (parameters pH, temperature, and nutrient levels, allowing timely adjustments), data analysis, and predictive modelling to upgrade the process, increase output, and reduce waste. AI-aided systems support task automation, lessen manual mistakes, and enhance drug discovery and development.

Growing demand for biopharmaceuticals and R&D expenditure

Globally, in the bioprocess analyzers market, products like vaccines, antibiotics, and insulin, in biopharmaceuticals, have a wide range of demand, which is increasing because of accelerating geriatric populations, the occurrence of chronic diseases, and technological advancements in the healthcare sector. Also, the escalation in R&D department expenditure in biotechnology areas is impacting on need for advanced tools like bioprocess analyzers, which are significant in monitoring parameters like cell growth, pH, and product yield during biopharmaceutical production.

Prolonged bioprocessing and downstream processing difficulties

In bioprocessing, it has a longer period than chemical processing, resulting in a hindrance to product development and market arrival. This is a major barrier for various companies trying to commercialize rapidly in emerging biopharmaceutical markets. One more rising difficulty in bioprocessing is about complicated and expensive isolation and purification processes in downstream processing are generating challenges in the bioprocess analyzers market.

Boosting biopharmaceutical demand and rising advancements in R&D

In biopharmaceuticals, bioprocess analyzers act as a major tool as there is growing demand for numerous products like vaccines, antibiotics, and insulin, due to the rising geriatric population, chronic diseases, and advancements in healthcare. These kinds of tools assist in increasing product yield, optimizing quality, and efficiency by precise measurement and analysis of factors such as cell growth, substrate levels, and metabolite concentrations. Along with this, in biopharmaceuticals, developing innovative advances in the R&D sector is also playing a vital role in the bioprocess analyzers market.

By product, the consumables & accessories segment held the largest share in 2024 and is expected to grow at a significant CAGR in the projected period. Usually, this segment includes reagents, sensors, calibration kits, culture media, and filters, which are required for the performance and maintenance of bioprocess analyzer instruments. Prospectively, these consumables and accessories are widely used in culturing cells in bioreactors, for monitoring pH and dissolved oxygen levels, and filtration & purification of bioprocess samples.

By analysis type, the concentration detection segment led the market in 2024 and is expected to grow significantly during the projected timeframe. This segment is driven by the demand for more accurate monitoring of different parameters such as dissolved oxygen, proteins, pH levels, and cell densities within the biopharmaceutical production, which is impelling the growth of the bioprocess analyzers market. Also, used in the detection of concentration of specific metabolites, including glucose, lactate, and glutamine, involved in cell metabolism, and improving bioprocesses.

By application, the antibiotics segment held the largest share and is expected to grow significantly in the upcoming years. In the production of antibiotics, particularly monoclonal antibodies, a bioprocess analyzer plays a crucial role in monitoring and managing complex fermentation processes, which ensures ideal conditions for cell growth and product yield.

By end use, the biopharmaceutical companies segment dominated the market in 2024 and is predicted to grow at a significant CAGR in the projected period. As a rising geriatric population with increasing instances of chronic diseases is demanding advanced medicine and biologics like vaccines, and biopharmaceuticals are driving the growth of this segment in the market. Moreover, vaccine production and advances in drug delivery systems are fueling the growth of the bioprocess analyzers market.

North America dominated the market with the largest share in 2024. In North America, it has boosted a robust biopharmaceutical industry with various companies emerging in research and development. These emerging companies are investing incredibly in R&D, which is influencing revolution and the demand for technological advancements in bioprocess analyzers.

In the U.S., a significant driver of market growth is the growing demand for biopharmaceuticals, including vaccines, antibiotics, and insulin. And further, this is impelled by factors like a rising aging population, chronic disease instances, and escalating advances in bioprocessing to develop more firm, mobile, and robust bioprocess analyzers, impacting the market growth.

In Canada, the bioprocessing industries are perceiving the new technological developments, having advanced sensors, software, and analytical tools, which are boosting the quality and effectiveness of bioprocesses, promoting demand for bioprocess analyzers.

Asia Pacific is expected to grow fastest in the market during the forecast period. Mainly, substantiating government policies and reimbursement strategy for healthcare in the areas to initiate the acquisition of advanced bioprocessing technologies. Also, the extension of bioproduction, particularly in countries like China, India, influences the demand for bioprocess analyzers to monitor and improve production operations.

Asia Pacific is anticipated to grow fastest in the market in the project period, comprising countries such as India and Japan, announced the new startups in biotechnology sector, as the bioprocess analyzers market is driven by rising innovations in biotechnology, demand for vaccines and insulin in biopharmaceuticals, and these are impacted mainly by growing geriatric populations in respective countries.

In China, an increasing number of biopharmaceutical and bioprocessing companies are demanding tools possessing ideal process efficiency and product quality, like bioprocess analyzers. Also, the increasing need for reasonable and robust quality biosimilars is propelling the demand for bioprocess analyzers to keep adherence with regulatory considerations and consistency in product quality.

For instance,

In Japan, cell culture technologies play a major role in the development of novel drugs and therapeutic agents, and bioprocess analyzers are needed for maintaining and improving these operations. Moreover, regulatory authorities are highly pointing up the significance of quality control and continuity in bioprocessing, which leads to the acquisition of bioprocess analyzers to confirm compliance and regulate product quality.

For instance,

Europe is predicted to grow significantly in the upcoming years. Primarily, the expansion of the biotechnology industry in Europe is a vital factor contributing to the market growth, including countries such as Germany, France, and the UK. These areas possess highly sophisticated biotechnology sectors; additionally, they are involved in the rising expenses in R&D, which are majorly impacting the growth of the market.

In Germany, the growing prevalence of chronic diseases that require highly precise biologics is fueling the growth of the market. Along with this, Japan has innovative bioprocessing technologies, like Process Analytical Technologies (PAT) and actual release testing, are provide highly effective and reliable monitoring and maintenance of bioprocess.

In February 2024, Takeda opened a €74 million plant in Singen, Germany, in expectation of demand for its latest approved dengue vaccine, Qdenga. (Source- Bioprocess International)

In the UK, the rising expansion of healthcare infrastructure, aided by government initiatives in the promotion of pharmaceutical and biopharmaceutical areas, is propelling the growth of the market. Besides this, sophisticated bioprocess analyzers are being developed by emerging technological advancements.

In October 2024, Thermo Fisher Scientific announced the registration of an MoU with the Government of Telangana to initiate a Bioprocess Design Center (BDC) in Genome Valley, Hyderabad. Sridhar Babu, Minister for Information Technology, Department of Electronics & Communications (ITE&C), commented that Telangana has persistently played a major role in its commitment to accelerate innovation and nourishing a world-class ecosystem for biotech and life sciences industries. (Source: Healthcare Radius)

By Product

By Analysis Type

By Application

By End Use

By Region

December 2025

November 2025

January 2026

November 2025