January 2026

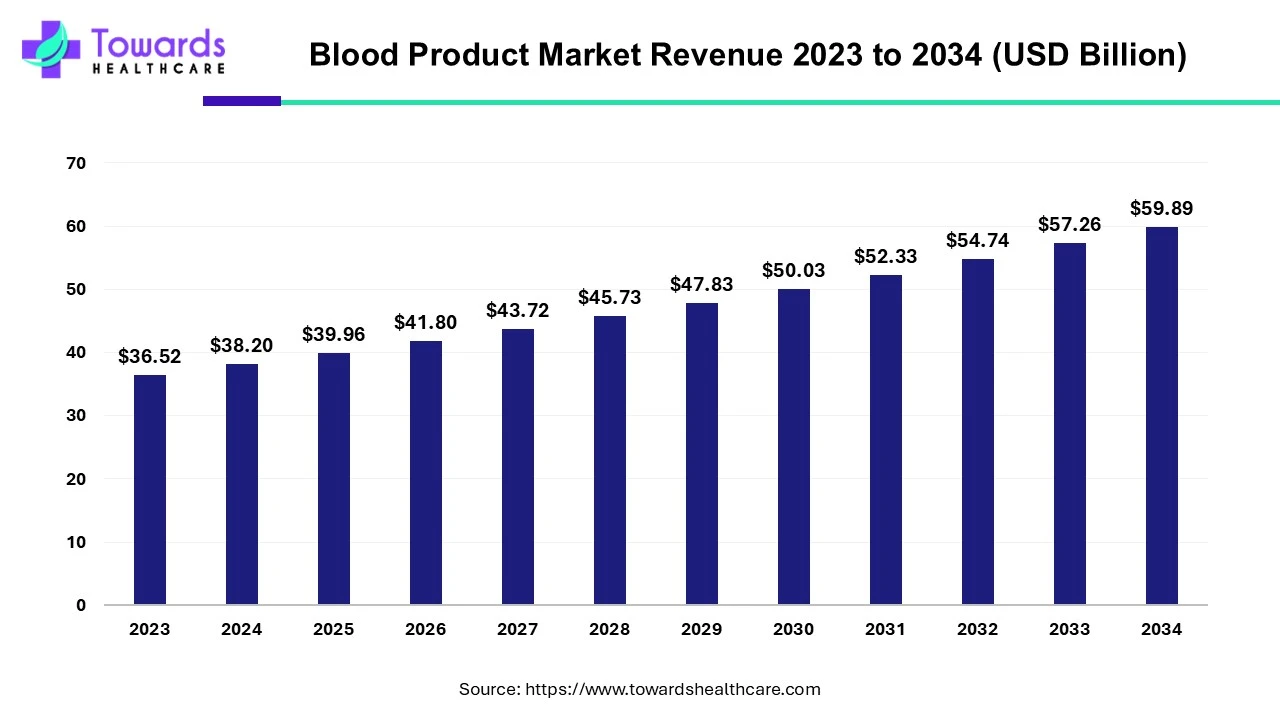

The global blood product market was estimated at US$ 41.8 billion in 2026 and is projected to grow to US$ 62.65 billion by 2035, rising at a compound annual growth rate (CAGR) of 4.6% from 2026 to 2035. The demand for blood and blood products is high due to their usage during surgeries, emergency situations, blood-related health issues, and many more health problems.

| Key Elements | Scope |

| Market Size in 2025 | USD 39.96 Billion |

| Projected Market Size in 2035 | USD 62.65 Billion |

| CAGR (2025 - 2035) | 4.6% |

| Leading Region | North America |

| Market Segmentation | By Product Type, By End-use, By Region |

| Top Key Players | KM Biologics, Nanyue Bio, Nordisk, Weiguang Bio, Yuanda Shuyang, Boya Bio, F. Hoffmann-La Roche Ltd., Shuanglin Bio, Bio-Rad Laboratories Inc., Tiantan Bio, Hualan Bio, CBPO, LFB Group, Merck & Co, Inc., RAAS, Biotest, Octapharma, Haemonetics Corporation, Grifols, Kedrion, CSL, Ortho Clinical Diagnostics, Takeda, BPL |

The blood product market is responsible for collecting, separating, storing, and distributing various blood products. These include whole blood, RBCs, WBCs, plasma, and platelets. The market is growing strongly because whole blood or components derived from blood are used during surgery, accidents, blood loss, blood cancer, or any particular health condition. Red blood cells are used for anemia, platelets for cancer treatment, plasma for trauma, shock, and burn, cryo for preventing and controlling bleeding, and WBCs for immunity.

Since millions of new cases of cancer are identified each year, cancer is becoming a bigger global problem. According to research on 29 diseases in 204 nations, the total cost of cancer to the world economy is predicted to exceed 25.2 trillion international dollars between 2020 and 2050. About half of it will be spent on five different forms of cancer. Because platelet counts drastically decline after cancer therapy and platelets are transfused to minimize bleeding issues, platelet transfusion is an essential and frequently required part of cancer management.

Blood donations are usually made via free campaigns, and many people are not willing to donate blood, which becomes a growth barrier for the blood product market. The number of donors is reduced even more when people are unable to donate blood due to health issues like HIV, cancer, sickle cell, anemia, or any other disease. Apart from this, many people, especially in rural areas, are not aware of such practices or refrain from donating blood due to different beliefs.

The market future is promising, driven by the development of artificial blood and lab-grown RBCs. These products are grown in labs using advanced engineered technologies. They replicate essential functions of human blood and oxygen delivery. These products are free from immune reactions, eliminating the need for blood type matching. They can withstand ambient temperatures and do not rely on blood donations from healthy individuals. Additionally, artificial blood products could be stored for years and transported across different geographical locations without a refrigerator.

Many factors contribute to the growth of the market in North America. People often participate in blood donation campaigns; there is a huge presence of blood donation centers, and governments make continuous efforts to create awareness and develop better facilities for blood donation, component separation, and storage.

The U.S. dominated the blood product market in North America due to continuous efforts taken by the government, NGPs, public & private organizations, and other key stakeholders.

For instance,

Every year, around 16 million blood components are transfused in the United States. There are 90,000 to 100,000 cases of sickle cell disease in the United States. The condition affects about 1,000 newborns annually. People with sickle cell disease may need blood transfusions for the rest of their lives. In 2023, about 1.9 million individuals are anticipated to receive a cancer diagnosis, according to the American Cancer Society. During their chemotherapy treatment, many patients may require blood transfusions on a regular basis.

The blood product market is growing strongly in Asia Pacific, mainly due to the growing population. A large population increases the number of people in need of blood or blood products. In addition, governments are also making efforts to increase blood donation and increase awareness about blood donation.

Every two seconds, there is a need for blood transfusions in India. An average of 14.6 million transfusions of blood are required annually. There were 4153 authorized blood banks (also known as blood centers) in the nation as of November 30, 2023; 1266 of them were government-affiliated, while the remaining 2887 were private. 5,897,452 blood units have been collected by the MoHFW as of October 2024, and 5,899,116 donors have signed up on the website.

Europe is considered to be a significantly growing area in the blood product market, due to the rising prevalence of blood disorders and increasing awareness of blood donations. Government and private organizations launch initiatives to raise awareness about blood donations. They also support research activities by providing funding to develop novel blood-based therapeutics. The increasing collaborations among researchers and industry professionals contribute to market growth.

The European Blood Alliance (EBA) contributes to the safety and security of the blood supply for Europeans by developing and maintaining a network of European blood services. It is estimated that 60,000 to 70,000 units of blood are required daily in the EU. The Medicines and Healthcare products Regulatory Agency (MHRA) regulates the approval of blood products in the UK. The Ministry of Health in Spain encouraged people to donate blood, reminding people of the importance of such donations for multiple treatments and surgical interventions. Approximately 2 million blood products are transfused annually in Spain.

UK Market Trends

The NHS England encouraged 1 million people in England to donate blood and help create the nation’s largest volunteering force to stabilize the nation’s blood supply. The UK requires more than 5,000 donations every day, accounting for 1.8 million donations every year.

The Middle East & Africa are considered to be a significantly growing area, due to the rising prevalence of hematological disorders and the growing demand for blood products. The burgeoning healthcare and biotech sectors and favorable regulatory policies contribute to market growth. Government organizations launch initiatives and campaigns to encourage people to donate blood. They also make constant efforts to strengthen the storage infrastructure of blood products.

UAE Market Trends

The increasing collaboration among key players helps strengthen blood products development and storage in the region. In October 2024, Hemanext, Inc. announced a collaboration with Hemara Bio in Dubai, UAE, to bolster the sales of Hemanext ONE RBC Processing and Storage System across the GCC countries, strengthening its relationships with key blood centers and clinicians in the region.

By product type, the red blood cells (RBCs) segment dominated the market and is estimated to grow at the fastest rate during the forecast period. This segment dominated because the blood component that is transfused most frequently is red blood cells. Individuals who suffer from acute blood loss due to trauma or chronic anemia brought on by renal failure or gastrointestinal bleeding benefit the most from obtaining red blood cells.

By end-use, the blood station segment held the largest share of the market. The segment is dominating due to the growing number of blood stations worldwide. These stations have made blood collection, storage, and transfer easy. A large population visits blood stations for donation, and the collected blood is further transferred to hospitals, ambulatory centers, and clinics.

The hospital segment is estimated to grow rapidly in the blood product market during the forecast period. Hospitals are the major users of blood and blood products for treating anemia, cancer, or any other health issue requiring blood transfusion. Apart from this, blood transfusion is used during severe blood loss due to accidents, childbirth, and surgeries. All of these things also happen in hospitals, which is why a continuous high demand for blood occurs.

Ash Toye, Professor in the School of Biochemistry at the University of Bristol, England, commented that the launch of a new clinical trial in Japan using artificial blood derived from human hemoglobin marks a potentially exciting step forward in transfusion medicine. The trial is conducted to demonstrate that artificial blood is safe and can replicate donor blood in a range of clinical conditions. (Source: Newsseek)

By Product Type

By End-use

By Region

January 2026

January 2026

December 2025

December 2025